AT&T has some expensive legal bills to pay facing down the Justice Department’s objections to its recent expensive acquisition of Time Warner, Inc. But no worries, AT&T’s wireless customers will be helping to pick up the tab after another major hike in an “Administrative Fee” that will raise at least $800 million a year for the phone company.

AT&T has some expensive legal bills to pay facing down the Justice Department’s objections to its recent expensive acquisition of Time Warner, Inc. But no worries, AT&T’s wireless customers will be helping to pick up the tab after another major hike in an “Administrative Fee” that will raise at least $800 million a year for the phone company.

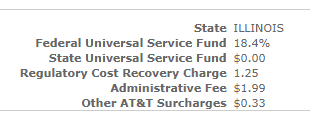

BTIG Research analyst Walt Piecyk caught AT&T hiking its Administrative Fee twice during the last quarter, now reaching $1.99 a month, billed to every post-paid wireless customer.

AT&T introduced the fee in 2013, claiming it would cover some of AT&T’s costs connecting phone calls and managing its wireless network. It started at $0.61 a month, then increased at some point to $0.76.

Although AT&T received negative press after introducing the fee, for most customers it is just one of several barely noticed charges applied in a separate section of monthly bills usually reserved for mandatory government fees and taxes. Many customers assume the fees are mandated by local, state, or federal governments, but in fact many are actually conjured up by AT&T and pocketed by the company. Most analysts believe companies create these fees to raise revenue without the perception of raising rates.

“The Administrative Fee helps defray certain expenses AT&T incurs, including but not limited to: (a) charges AT&T or its agents pay to interconnect with other carriers to deliver calls from AT&T customers to their customers; and (b) charges associated with cell site rents and maintenance.” – AT&T

Customers are now noticing the $1.99 Administrative Fee and complaining about it, after the company nearly tripled it over the last three months.

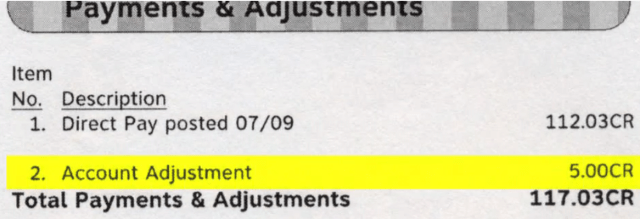

Fees and surcharges paid by a typical AT&T wireless customer in Illinois.

“In April of 2018, the Administrative fee increased to $1.26 and in June it rose again to $1.99,” Piecyk writes. “We believe the increase applies to all post-paid phone lines other than perhaps some large enterprise contract customers. We have confirmed that it does not apply to pre-paid lines after some customer service reps incorrectly told us otherwise last night. We believe this fee is included in AT&T’s reported service revenue and ARPU despite AT&T’s accounting change last quarter, which stripped regulatory fees and taxes out of both revenue and cost of service.”

Piecyk calculates that if 85% of AT&T’s 64.5 million postpaid wireless customers are now charged the fee, it will result in $800 million of incremental service revenue annually.

Piecyk is skeptical AT&T needed the money to cover cost increases.

“It’s hard to believe that interconnection costs have increased in the past six months enough to justify this fee increase,” Piecyk writes. “In fact, wireless operators have been crediting LOWER interconnection costs when explaining why their cost of service was in decline. Not surprisingly, we don’t recall any reductions in Administrative Fees by AT&T or its peers associated with reductions in interconnection expenses.”

Tower fees, also mentioned by AT&T, may have increased slightly, but as compensation for building out FirstNet, a public safety/first responder-prioritized wireless network, taxpayers are reimbursing AT&T $6.5 billion of FirstNet’s construction costs, despite the fact FirstNet will also benefit AT&T’s ordinary paying customers who will share the benefits of AT&T’s network expansion.

AT&T’s Administrative Fee hike will play right into the hands of T-Mobile, which has an advertising campaign blasting other wireless companies for sneaky fees. (0:45)

Subscribe

Subscribe The Trump Administration is

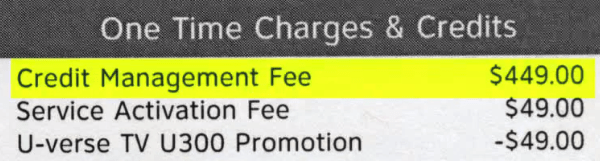

The Trump Administration is  Credit challenged AT&T customers may be out hundreds of dollars if they fail to understand the difference between AT&T’s service deposit and a “credit management fee” for new customers.

Credit challenged AT&T customers may be out hundreds of dollars if they fail to understand the difference between AT&T’s service deposit and a “credit management fee” for new customers.

Suddenlink customers around the country are finding accessing the internet has suddenly gotten more expensive. For many service areas, the cable operator raised its rates in December for television and broadband service, with some of the biggest hikes coming from sneaky surcharges.

Suddenlink customers around the country are finding accessing the internet has suddenly gotten more expensive. For many service areas, the cable operator raised its rates in December for television and broadband service, with some of the biggest hikes coming from sneaky surcharges. “They also had their artificial internet rate hike when they implemented data ‘allowances’ (caps),” retorted Ryan, a Suddenlink customer. “Their upgrades are anything but complimentary.”

“They also had their artificial internet rate hike when they implemented data ‘allowances’ (caps),” retorted Ryan, a Suddenlink customer. “Their upgrades are anything but complimentary.” French competition regulators have fined Altice for a second time this year for abusing European regulatory policies designed to protect competition in the marketplace.

French competition regulators have fined Altice for a second time this year for abusing European regulatory policies designed to protect competition in the marketplace. SFR’s cable and fiber broadband division lost 75,000 customers in the last three months, 193,000 over the year. Among DSL customers, 120,000 said goodbye to SFR during the last quarter, 432,000 for the year. SFR’s mobile service did even worse, down 88,000 customers in the last three months, 593,000 for the year.

SFR’s cable and fiber broadband division lost 75,000 customers in the last three months, 193,000 over the year. Among DSL customers, 120,000 said goodbye to SFR during the last quarter, 432,000 for the year. SFR’s mobile service did even worse, down 88,000 customers in the last three months, 593,000 for the year. Seeing the enormous sums of money to be made running cable companies in the much-less competitive United States, Altice has been

Seeing the enormous sums of money to be made running cable companies in the much-less competitive United States, Altice has been  Rate increases and additional fine print also guarantee more revenue for Altice operations. In France,

Rate increases and additional fine print also guarantee more revenue for Altice operations. In France,