Rogers Communications, Canada’s largest cable operator, told investors at an investment bank conference it intends to accelerate plans to monetize wireless and broadband data usage this year.

Rogers Communications, Canada’s largest cable operator, told investors at an investment bank conference it intends to accelerate plans to monetize wireless and broadband data usage this year.

Anthony Staffieri, chief financial officer of Rogers Communications told attendees at Morgan Stanley’s Technology, Media & Telecom Conference that Rogers’ future revenue outlook was going to be data-centric.

“We think data, monetizing data, is going to be a key aspect of that, both on the wireless side, as well as on the cable side of things,” Staffieri said.

Staffieri

Key to Rogers is the development of data plans that maximize revenue potential by exploiting the customer’s discomfort with overlimit fees. Staffieri admits the company has plans that can cost the company revenue if customers downgrade to a usage bucket that brings them very close to their usage limit.

But most customers do not choose those “exact fit” data plans. They typically select more expensive, larger-bucket plans so they can rest easy knowing they will not get slapped with a overlimit fee.

“And so they’re coming into data plans that are probably more than they need,” Staffieri said. “But for most users, what they’re looking for is comfort in usage. And so what we found is there’s a preponderance to buy more than what you need. So there’s no surprise at the end of the month in terms of billing. And so it’s all about that comfort in usage that we’re focused on in the price plans.”

In wireless, Rogers is also counting on the explosive growth of usage that comes after introducing 4G LTE coverage.

“Simply on 3G to LTE, you see an immediate growth in data usage,” Staffieri said. “Same users, but if you were to look at the data set, it’s just within a defined period of time, they can just access more. And so for whatever reason, whatever they’re doing with it, it’s just driving more usage, more efficiency and they’re using it in the business context.”

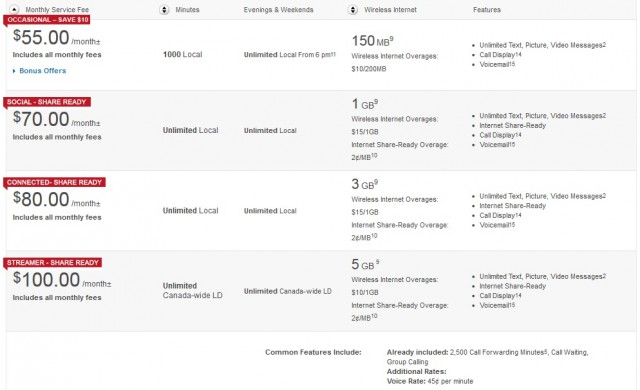

Staffieri says Rogers is experiencing 30-50% increases in data usage year over year. Rogers introduced new wireless plans in the fall of 2012 that refocus customers on their anticipated data usage, with gradually more expensive wireless plans to match.

“That really gets the customer focused on choosing something that continues to drive data growth,” Staffieri noted.

Rogers Cable broadband customers have also faced data caps and consumption-oriented billing for years. Although Rogers competitively responded to a Bell offer introduced in January that includes unlimited use service for customers who want it, that option comes at an added cost — one that can be priced up or down according to marketplace conditions.

Rogers primary focus is on encouraging its cable broadband customers to move towards higher-speed, more expensive data plans.

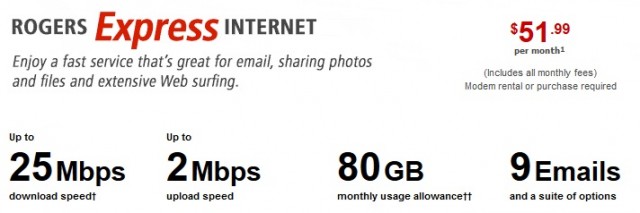

MONETIZED: Rogers sells a 25/2Mbps broadband plan for $52 a month that includes only an 80GB monthly usage allowance. A $2/GB overlimit fee applies, up to a maximum of $100 per month. Taxes, a modem rental fee or purchase, a one-time activation fee of $14.95 and up to a $99.99 installation fee also apply.

“On the cable side, making sure we have the best Internet experience was the other piece of it,” Staffieri said. “We ended the year with 90% of our footprint able to get 150Mbps data speed ($122.99/mo with 250GB usage allowance). And so to the extent that we continue to lead on Internet, we think that’s going to be important ingredient for the top line [revenue] growth.”

On the wireless side, Rogers is following the lead of big providers in the United States and gradually shifting the cost of new smartphones away from itself and onto its customers by adjusting its subsidy program.

“As we see data [usage] pulling [revenue] growth, overall, that bodes well for a continuation of the subsidization,” Staffieri said. “For us, it’s really been about making sure that we give the customer choice. And so when we combine that with the introduction of the Flex Plan, which we did in 2012, what we’re seeing is more and more customers opting into new handsets. But more and more, it’s on the customer’s nickel as opposed to our nickel on the Flex Plan programs.”

Rogers Wireless’ Individual plans. Rogers’ customers have to pay extra for long distance calling — most plans only cover local calls. Data plans are stingier and more expensive than what most Americans pay, and steep overlimit fees up to $0.02 per megabyte ($20/GB) apply. Like in the United States, Rogers is moving to bundle unlimited calling and texting into more of their plans. What differentiates more plans today is how much data usage is included.

Staffieri admitted Bell is giving Rogers the most competitive headaches in Ontario because of their aggressively priced promotions.

“Certainly, [Bell’s Fibe IPTV] has been competitive for us. In the short-term, we continue to deal with what I would consider to be aggressive pricing in terms of acquisition and retention offers by our IPTV competitor,” said Staffieri. “We’ve always been competing with their satellite product and so that competition has always been there. But I would describe it as certainly having picked up and continuing to pick up. And it’s largely been through pricing offers as opposed to product.”

Staffieri says Rogers is competing with improved set-top equipment like the NextBox 2.0 — a whole-home DVR with an improved user interface. It also offers customers Anyplace TV, a TV Everywhere service that allows customers to watch the Rogers’ TV lineup on tablets inside the home.

The Toronto Maple Leafs, the National Hockey League’s most valuable sports franchise, is today 75% co-owned by Bell Canada Enterprises (BCE) and Rogers Communications.

As is the case in the United States, Canadian cable companies are also facing dramatically increasing programming costs, particularly for sports programming.

But to a greater degree than in the U.S., Canadian media conglomerates own and control a larger share of cable and broadcast networks, programming producers, would-be competitors like satellite television, and even sports teams and the networks that show their games.

That positions them to negotiate with themselves over content costs, because they own or control the sports franchise, the cable or broadcast network that televises their games, and the cable, satellite, or telephone provider through which most Canadians watch.

“We’ve tried to be disciplined on the extent that content price increases are there because consumers want it, then we want to make sure we’re disciplined in passing on that cost to the customer,” Staffieri said. “And so we strive to make sure that in the TV and video business our gross margins are consistent.”

“So if you were to look at how that’s played out over the last several quarters and several years, it’s been fairly consistent. And so that’s what we strive to do is to make sure that those programming costs ultimately are passed on to the consumer, which is ultimately driving up the cost through their demand.”

Subscribe

Subscribe