We get to keep all the money!

AT&T has begun charging U-verse television customers a new monthly fee to cover the cost of an FCC charge now extended to IPTV providers like AT&T that used to be paid only by cable operators.

AT&T’s “Regulatory Video Cost Recovery Charge” is defined by AT&T as a new “monthly fee that is charged to each U-verse TV subscriber’s bill to recover the regulatory fee imposed on providers of Internet Protocol Television (IPTV) Service.”

The new fee is reportedly set at $0.24 a month. AT&T will collect $2.88 a year from 5.7 million television customers annually beginning June 1, 2014.

Cable operators have paid similar fees all along but have generally considered them part of the cost of doing business. AT&T wants to pass the cost directly on to its customers.

But a review of the FCC’s 2013 Fiscal Year fee schedule shows a major discrepancy between the amount AT&T intends to collect from customers and the actual cost of the fee AT&T will have to pay the FCC.

While AT&T will bank $2.88 annually from each television customer, it only has to pay the FCC $1.02 a year per subscriber — a difference of $1.86. That doesn’t sound like much until you factor in the number of AT&T U-verse TV customers. AT&T will pocket $10,602,000 a year in “regulatory cost recovery” charges it will apparently keep for itself.

That suggests AT&T has imposed another hidden rate increase on customers who already pay a range of surcharges and fees. AT&T has created so many fees, surcharges, and other ancillary charges, it has published a Billing Glossary explaining them for the benefit of confused customers. AT&T usually keeps all the money associated with these fees — most are not taxes, although some fund state initiatives.

Here are some customers may already be acquainted with:

Activation Fee

A one-time fee charged when you activate new service. It is billed in full on your first bill.

Bill Statement Fee

The Bill Statement Fee is to cover the expenses associated with providing your AT&T Long Distance charges as part of your local phone company bill.

Broadcast TV Surcharge

This surcharge is to recover a portion of the amount local broadcasters charge AT&T to carry their channels.

CA Advanced Services Fund (CASF) (California Only)

The fund is used to spur deployment of broadband facilities in un-served and underserved areas of California. Funding for the CASF program will not increase total surcharges, since the CASF surcharge will be offset by an equal reduction of the High Cost Fund-B surcharge. For billing purposes, the CASF surcharge may appear as a separate item on a bill or may be combined with the CHCF-B surcharge if the item is renamed to reflect both the “CHCF-B and the CASF.”

CA CHCF A and CA CHCF B [High Cost Fund (CHCF) Surcharges A and B] (California Only)

These surcharges subsidize basic rates for local telephone companies servicing rural areas and compensate carriers for providing basic residential service in areas where the cost exceeds the CPUC determined statewide average.

CA Relay Service and Communications Devices Fund (California Only)

A surcharge utilized by the state to provide telecommunications devices to deaf or hard of hearing consumers.

CA Teleconnect Fund (California Only)

This surcharge provides discounts on telecommunications services to qualifying schools, libraries, community-based organizations, county-owned hospital and health clinics.

All these fees and surcharges…

Carrier Cost Recovery Fee

This fee helps recover costs associated with providing state-to-state and international long distance service, including expenses for national regulatory fees and programs, as well as connection and account servicing charges.

Change Fee

A charge applied if a TV service or package is downgraded or cancelled within the first 30 days of ordering.

Chicago Amusement Tax (City of Chicago Only)

A tax imposed by the City of Chicago on amusement services (i.e. paid television programming, recreational activities, etc.) provided within the city limits.

Convenience Fee

A fee applied when a customer payment is processed by a customer service representative. This fee does not apply for payments made online or through our automated phone system.

CT Community Access Support Fee (Connecticut Only)

Fee required to be imposed by AT&T upon its customers by Connecticut General Statutes in order to support community access operations.

CT Public Programming Gross Earnings Tax Recovery (Connecticut Only)

Connecticut fee imposed to support Public, Educational and Governmental (PEG) programming.

CT Video Provider Gross Earnings Tax Recovery (Connecticut Only)

Connecticut fee imposed on U-verse video service.

…and their advertised price was so low.

DEAF Surcharge

This surcharge shall be identified on the telephone bill as the “CA Relay Service and Communications Devices Fund.”

Early Termination Fee

A fee associated with early termination of one or more of your services before the end of the associated service plan term.

Federal Subscriber Line Charge

This charge was instituted in 1984 to cover the costs of a portion of the local phone network.

HD Technology Fee

A monthly fee for access to high-definition (HD) U-verse television service.

High Speed Internet Equipment Fee

A monthly fee for customers who have U-verse TV and Internet equipment.

Infrastructure Maintenance Fee (IMF)

All telecommunications carriers on a customer’s bill must collect this fee. The funds for the state IMF help to support the costs of providing and maintaining utility rights of way. Revenue from the IMF is dedicated for Personal Property Replacement Tax (PPRT) and is disbursed to all taxing districts.

In-State Connection Fee

The In-State Connection Fee helps to cover the costs AT&T is charged by your local phone company to provide you access to local phone lines.

Local Connectivity Charge

This fee helps recover increased connectivity costs associated with providing local service in your state.

Local Number Portability (LNP) Charge

A charge permitted by the FCC to recover costs of upgrading the network to provide customers the ability to keep their phone numbers when changing local service providers.

Local Video Facilities Fee

Local Video Facilities Fee

A state or local government fee to support Public Educational and Governmental (PEG) programming.

Local Video Service Franchise Fee

Fee imposed by state or local government on U-verse video service.

Minimum Monthly Usage Charge

A charge to an account that does not meet a specified minimum total amount for a particular service.

Municipal Charge

A charge to cover costs of installing telephone poles and lines, manholes, and other telephone items on public property such as city streets.

NV Universal Service Fund Surcharge (Nevada Only)

A fee imposed by the Public Utilities Commission of Nevada that supports telecommunication needs of low-income households, consumers living in high cost areas, schools, libraries, and rural hospitals. This surcharge will be based on a percentage of intrastate long distance charges associated with your U-verse Voice service and will be modified as needed to stay consistent with any required changes in fund contributions.

Number Portability Service Charge

A charge permitted by the FCC to recover costs of upgrading the network to provide customers the ability to keep their phone numbers when changing local service providers.

Receiver Fee

A monthly charge for additional U-verse receivers (set top boxes).

Regulatory Video Cost Recovery Charge

The Regulatory Video Cost Recovery Charge is the monthly fee that is charged to each U-verse TV subscriber’s bill to recover the regulatory fee imposed on providers of Internet Protocol Television (IPTV) Service.

Restoral Fee

A charge to restore service that was suspended or disconnected.

State Cost-Recovery Fee (Texas Only)

Fee/Surcharge imposed by AT&T to recover franchise costs imposed on the company by Texas law.

State Infrastructure Maintenance Fee

All telecommunications carriers on a customer’s bill must collect this fee. The funds for the State IMF help to support the costs of providing and maintaining utility rights of way. Revenue from the IMF is dedicated for Personal Property Replacement Tax (PPRT) purposes and is disbursed to all taxing districts.

Universal Connectivity Charge

The Universal Connectivity Charge is the monthly fee that is charged to each residential customer’s phone bill to recover the expenses associated with AT&T’s payments into the Universal Service Fund.

Subscribe

Subscribe

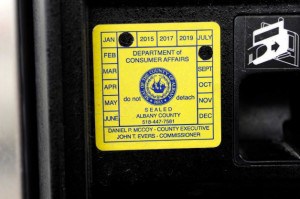

A residential burglar alarm in the city of Houston

A residential burglar alarm in the city of Houston