Ohio and Marshall counties are located in West Virginia’s Panhandle region, sandwiched between the states of Ohio and Pennsylvania.

Emergency services officials in West Virginia’s Panhandle region are “scared” about Frontier Communications’ ability to provide reliable access to 911 after four outages in three months, and they are reaching out to the Federal Communications Commission and Sen. Joe Manchin (D-W.V.) for help.

Public officials in Ohio and Marshall counties, sandwiched between the Ohio and Pennsylvania borders near Wheeling, are increasingly concerned Frontier may be no longer able to provide reliable basic service in the region.

“I’ve got to be honest with you. It scares the heck out of me,” Theresa Russell, Ohio County’s 911 director, told WTRF News. “I worry that after these types of incidents occur, I’m going to find out that somebody needed us and they had no way of getting through.”

Two recent outages occurred around midnight, one of which Frontier later said was a “planned outage.” But local officials claim Frontier never notified affected communities, preventing them from giving the public an alternate number to call in case of an emergency.

The other outages were unplanned, one impacting nine West Virginia counties that lasted well over an hour.

Frontier officials have increasingly responded to these outages by stressing the economic difficulties it faces serving remote areas in states where it is costly to provide service. In a statement, Frontier told the TV station that it “takes its commitment to serve West Virginians and support 911 services seriously.”

Frontier:

“Frontier provides service in the most rural areas of West Virginia where other providers choose not to invest to deliver service and where the challenges of remoteness are greatest. We work to promptly address service interruptions that occur from time-to-time because of severe weather events, vehicle accidents, third party construction damage to our facilities and other causes.

“We continue to evaluate and execute strategies to improve our service and ensure our customers have access to reliable and affordable service.”

WTRF-TV reports West Virginia’s Panhandle region is frightened about Frontier’s repeated 911 service outages. (1:36)

Subscribe

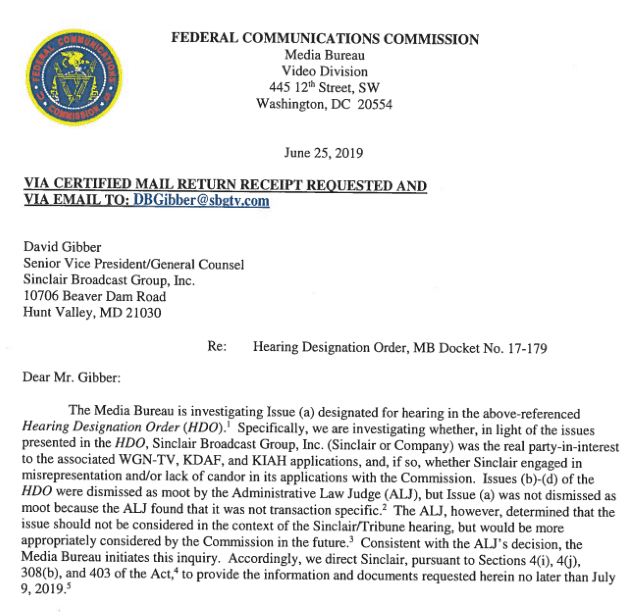

Subscribe WASHINGTON (Reuters) – The Federal Communications Commission has opened a new investigation into whether Sinclair Broadcast Group Inc engaged in misrepresentations or a lack of candor in its failed effort to win approval for a $3.9 billion bid to purchase Tribune Media Co.

WASHINGTON (Reuters) – The Federal Communications Commission has opened a new investigation into whether Sinclair Broadcast Group Inc engaged in misrepresentations or a lack of candor in its failed effort to win approval for a $3.9 billion bid to purchase Tribune Media Co.

(Reuters) – A group of potential buyers are preparing bids for prepaid wireless brand Boost Mobile in an upcoming sale valuing the offshoot of U.S. wireless carriers T-Mobile US Inc and Sprint Corp at up to $3 billion, interested buyers told Reuters.

(Reuters) – A group of potential buyers are preparing bids for prepaid wireless brand Boost Mobile in an upcoming sale valuing the offshoot of U.S. wireless carriers T-Mobile US Inc and Sprint Corp at up to $3 billion, interested buyers told Reuters. This month, analysts at Cowen estimated Boost has 7 million to 8 million customers and a transaction could be valued at $4.5 billion if the deal included wireless spectrum, or the airwaves that carry data, and facilities. Sprint has not disclosed the number of Boost customers.

This month, analysts at Cowen estimated Boost has 7 million to 8 million customers and a transaction could be valued at $4.5 billion if the deal included wireless spectrum, or the airwaves that carry data, and facilities. Sprint has not disclosed the number of Boost customers.