Sock Puppets: Ostensibly “independent” people quietly on the payroll of Big Telecom companies and advocating their positions.

“Net Neutrality would not improve consumer welfare or protect the public interest,” came the considered view of one Jeffrey A. Eisenach, testifying before the Senate Judiciary Committee in September 2014. “The potential costs of Net Neutrality regulation are both sweeping and severe. It is best understood as an effort by one set of private interests to enrich itself by using the power of the state.”

Mr. Eisenach was introduced on the printed formal agenda as a “visiting scholar at the American Enterprise Institute.” If one looked at a transcript of his written testimony, they would find he also co-served as “co-chair of NERA Economic Consulting’s Communications, Media and Internet Practice.” But his views could have effectively represented all the above and more.

The New York Times this week published a two-part article examining the thin lines between public policy scholars, lobbyists, researchers, advocates, corporations, and private citizens. It is an important piece that details the shady world of bought and paid for research, academia, corporate lawyers and lobbyists, and Washington lawmakers that too often accept what they are told without following the money.

On that September day back in 2014 Eisenach wanted his views to be attributed only to him.

Eisenach

“While I am here in my capacity as a visiting scholar at the American Enterprise Institute, the views I express are my own, should not be attributed to A.E.I. or to any of the organizations with which I am affiliated,” Eisenach told the Senate committee.

What was considerably less clear is the name of the client (or an affiliated trade organization) that has underwritten almost every one of a dozen studies he has published on internet-related issues from 2007-2016 — Verizon, the same company that shares his hostile views towards Net Neutrality.

Over the years, it has become difficult to tell whether Eisenach’s views, articles, and study findings are his own, those of his study sponsor, and/or those of his employer. Just tracking Eisenach’s ever-changing employment record was no easy task. In the fall of 2013, Eisenach was the director of the American Enterprise Institute’s new “Center on Media and Internet Policy.” Just a few months later, he joined NERA, one of the country’s oldest economic consultancy firms, as a senior vice president in its telecommunications practice.

From each of these positions, Eisenach can pen the views of some of America’s largest telecommunications companies under the guise of an “independent” study, an invaluable cover tool for a member of Congress confronted with voting on behalf of corporate friends at the cost of consumers in the district.

“A report authored by an academic is going to have more credibility in the eyes of the regulator who is reading it,” Michael J. Copps, a former FCC commissioner who is now a special adviser for the Media and Democracy Reform Initiative at Common Cause, told the newspaper. “They are seeking to build credibility where none exists.”

A former Verizon employee who still does some consulting of his told the Times how the game is played.

“Let’s say you’re in legal and you want to have a paper that says what you want it to say,” said ex-Verizon economist Dennis Weller. “You could have a bunch of economists in house and ask them if they agree with you. How much easier would it be to go to an outside economist and say, ‘How about if I pay you $100,000 to write this?’”

“Let’s say you’re in legal and you want to have a paper that says what you want it to say,” said ex-Verizon economist Dennis Weller. “You could have a bunch of economists in house and ask them if they agree with you. How much easier would it be to go to an outside economist and say, ‘How about if I pay you $100,000 to write this?’”

With appropriate disclosure that a company like Verizon paid $100,000 for a report that exactly matches Verizon’s public policy agenda might raise questions on Capitol Hill as to its veracity and independence. If that disclosure goes missing or is hidden under a third-party like a trade association, a lawmaker might assume the report was produced independently and the strong corroboration of Verizon’s views is just a coincidence. That kind of credibility can be worth millions to any company confronting a debate over regulatory policy.

“[Eisenach] is good at linking big theoretical ideas to policy, and he’s been good at making money doing that,” added Weller. “He’s been good at moving from think tank to think tank and company to company, and I don’t think he’s ever lost money doing it.”

The New York Times investigation found while Eisenach testified before Congress ostensibly as a private citizen, he was also filing formal comments to the FCC as a “scholar” with the American Enterprise Institute, was meeting privately with FCC commissioners, organized public briefings that featured powerful senators like John Thune (R-S.D.), who happens to be the chairman of the Senate Commerce Committee. That committee also has direct oversight over the FCC and has spent the last three years scrutinizing FCC chairman Thomas Wheeler. Eisenach even briefed the two Republican FCC commissioners about what AEI’s general counsel had to say about Wheeler’s efforts to get Net Neutrality in place at the FCC. Eisenach offered both commissioners speaking time at AEI events, urging at least one of them to attack Net Neutrality.

“Net Neutrality is obviously top of mind,” he said in an email to that commissioner, Michael O’Rielly. “I’d be delighted if you would use the opportunity to lay out the case against.”

The Times reported Eisenach was hardly alone opposing Net Neutrality. Just weeks after becoming chairman, Wheeler received a letter signed by more than a dozen prominent economists and scholars affiliated with various Washington think tanks or academic institutions. They wanted Wheeler to reject Net Neutrality regulations. The letter attempted to distance the signers from any corporate agenda, noting in a footnote that nobody was compensated for their signature on the letter.

The Times reported Eisenach was hardly alone opposing Net Neutrality. Just weeks after becoming chairman, Wheeler received a letter signed by more than a dozen prominent economists and scholars affiliated with various Washington think tanks or academic institutions. They wanted Wheeler to reject Net Neutrality regulations. The letter attempted to distance the signers from any corporate agenda, noting in a footnote that nobody was compensated for their signature on the letter.

On the other hand, of the dozen studies that were included or referenced in their letter as “evidence,” more than half were entirely funded by giant telecom companies that oppose Net Neutrality. Mr. Wheeler would need a magnifying glass and plenty of free time to ferret out the industry funding disclosures in those attached studies, which were buried in footnotes.

When the industry took the FCC to court over broadband regulation or Net Neutrality, it was more of the same. Verizon was successful opposing an earlier FCC rule on Net Neutrality by trotting out almost two dozen studies and declarations that opposed regulatory oversight — more than half sponsored entirely by the telecommunications companies or trade associations that despise Net Neutrality. Many other studies were written by think tanks and scholars that also had direct financial ties to the companies.

Litan

Another key factor in the debate about Net Neutrality was the cost of implementing it. Again, the incestuous ties between the telecom industry, think tanks, and academia would serve up the “right answers” for Big Telecom’s case against Neutrality when two economists issued a controversial “policy brief” that claimed Net Neutrality would cost $15 billion in new fees and retard broadband expansion and upgrades. (The $15 billion figure came under immediate ridicule by consumer groups that effectively suggested the study authors ‘made it up,’ a case that may have been proven to some degree when the authors suddenly revised it down to $11 billion.)

Robert Litan, then a senior fellow at Brookings and Hal Singer, who used to work at the Progressive Policy Institute, would quickly come under greater scrutiny than Eisenach, probably because their report became central to the industry’s battle against Net Neutrality. The National Cable and Telecommunications Association (NCTA) even built an advertising campaign against Net Neutrality around their study. Politicians opposed to Net Neutrality also regularly quoted from Litan and Singer’s findings to explain their strong opposition to the net policy.

Lost in the debate is who paid Mr. Litan and Mr. Singer for their work. Their employer, Economists Inc., yet another inside-the-Beltway consulting firm, didn’t exactly publicize their “select clients” included AT&T and Verizon — two of the largest opponents of Net Neutrality.

Using think tanks to bolster corporate lobbying has become so common, it has attracted the attention of some members of Congress.

Litan collided with one of the Senate’s fiercest consumer advocates and watchdogs — Sen. Elizabeth Warren (D-Mass.) in a September 2015 hearing about a rules change fiercely opposed by investment bankers that would require financial advisers recommending retirement-associated investments to put their clients’ interests ahead of their own personal gain. Warren has championed the cause of ending high bank and investment-related fees that eat away investor returns. Some of the worst offenders convinced financial advisers to recommend their funds by kicking back large bonus commissions, which enriched the adviser and the investment bank but left seniors hit hard by lost potential earnings.

Sen. Elizabeth Warren (D-Mass.)

Litan’s research questioned the potential benefits of upping ethical standards. He wrote the costs to the banking and investment community to implement the rules would far outweigh any benefits to investors. Litan casually mentioned his affiliation with Brookings, a think tank, to promote his research’s credibility. He didn’t call attention to the fact his 28-page study was produced for a client: Capital Group — a massive financial services company with $1.39 trillion in assets. It would be directly impacted by the imposition of the new rules, which it strongly opposed.

Capital Group paid Economists, Inc. $85,000 for the study. Litan’s cut of the action was $38,800 — or $1,386 per page.

Warren complained Litan was not exactly forthcoming in disclosing his personal gain and his ties to a major opponent of the new rules under consideration.

“These disclosures are problematic: they raise significant questions about the impartiality of the study and its conclusions, and about why a Brookings-affiliated expert is allowed to use that affiliation to lend credibility to work that is…editorially compromised,” Sen. Warren wrote in a letter to Brookings President Strobe Talbott.

The embarrassment to Brookings, which has increasingly relied on corporate-funded research to fund its work, led to rumors Litan was asked to leave, and he resigned shortly thereafter. Litan downplayed the event, calling it a “minor technical violation” of Brookings’ ethics policy, which prohibits those associated with the think tank from using their affiliation with Brookings in any research report or testimony.

The incident fueled consumer groups’ arguments that cozy arrangements between purportedly independent scholars and academics and corporate entities too often results in bought-and-paid-for- research not worth the paper it is printed on. A clear conflict of interest and the lack of prominent funding disclosures makes such reports suspect at best and worthless in many other cases, because no company paying for a report is going to make it public if it conflicts with their agenda.

Singer

Remarkably, other economists, many also engaged in producing reports for corporate clients, rushed to the defense of… Mr. Litan, calling his removal from Brookings the result of a witch hunt.

A letter signed by former Clinton economic advisers W. Bowman Cutter and Everett Ehrlich; Harvard University international trade and investment professor Robert Z. Lawrence; former Clinton chief budget economist Joseph Minarik; and former Clinton economic adviser Hal Singer, who co-authored the report that got Litan in hot water with Sen. Warren, claimed as a result of Litan’s forced resignation, critics of their reports could threaten the credibility of their work with an “ad hominem attack on any author who may be associated with an industry or interest whose views are contrary to [Sen. Warren].”

“Businesses sometimes finance policy research much as advocacy groups or other interests do,” the economists wrote. “A reader can question the source of the financing on all sides, but ultimately the quality of the work and the integrity of the author are paramount.”

Singer has since left the Progressive Policy Institute.

D.C.’s revolving door has also provided lucrative work for those out of government jobs and now working in the private sector, often lobbying those still in government.

Rep. Greg Walden (R-Ore.) had no problem introducing a Wall Street Journal op-ed piece into the Congressional Record written by Robert McDowell, who wears several hats at the Hudson Institute. He’s a “scholar,” a “telecommunications industry lawyer” at a firm retained by AT&T to fight Net Neutrality, and a lobbyist. If his name is familiar to you, that might be because McDowell used to be a commissioner of the Federal Communications Commission from June 1, 2006 to May 17, 2013. Now he is paid to kill Net Neutrality for AT&T.

None of that seem to faze Walden or raise questions about the credibility of the opinion piece he sought to have added to the official record.

“Everyone’s got their point of view,” Walden said last year. “And some of them get paid to have that point of view.”

Subscribe

Subscribe

“Let’s say you’re in legal and you want to have a paper that says what you want it to say,” said ex-Verizon economist Dennis Weller. “You could have a bunch of economists in house and ask them if they agree with you. How much easier would it be to go to an outside economist and say, ‘How about if I pay you $100,000 to write this?’”

“Let’s say you’re in legal and you want to have a paper that says what you want it to say,” said ex-Verizon economist Dennis Weller. “You could have a bunch of economists in house and ask them if they agree with you. How much easier would it be to go to an outside economist and say, ‘How about if I pay you $100,000 to write this?’” The Times reported Eisenach was hardly alone opposing Net Neutrality. Just weeks after becoming chairman, Wheeler received a letter signed by more than a dozen prominent economists and scholars affiliated with various Washington think tanks or academic institutions. They wanted Wheeler to reject Net Neutrality regulations. The letter attempted to distance the signers from any corporate agenda, noting in a footnote that nobody was compensated for their signature on the letter.

The Times reported Eisenach was hardly alone opposing Net Neutrality. Just weeks after becoming chairman, Wheeler received a letter signed by more than a dozen prominent economists and scholars affiliated with various Washington think tanks or academic institutions. They wanted Wheeler to reject Net Neutrality regulations. The letter attempted to distance the signers from any corporate agenda, noting in a footnote that nobody was compensated for their signature on the letter.

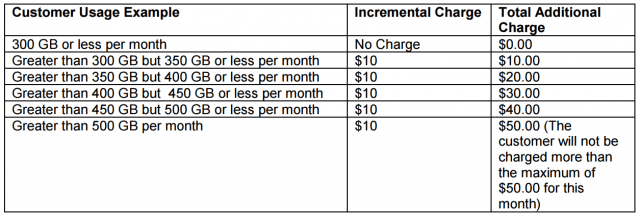

On a morning conference call with Wall Street analysts, Comcast continues to misrepresent its vision of broadband usage caps and usage-based billing, claiming customer preferences echoed through Comcast’s performance in the marketplace will tell the company what is “best for consumers,” and guide Comcast how to realize the most value for shareholders.

On a morning conference call with Wall Street analysts, Comcast continues to misrepresent its vision of broadband usage caps and usage-based billing, claiming customer preferences echoed through Comcast’s performance in the marketplace will tell the company what is “best for consumers,” and guide Comcast how to realize the most value for shareholders.

If Comcast was seriously interested in what its customers think about its usage cap trial, it need only review the FCC’s complaint database. According to a Freedom of Information Law request from The Wall Street Journal,

If Comcast was seriously interested in what its customers think about its usage cap trial, it need only review the FCC’s complaint database. According to a Freedom of Information Law request from The Wall Street Journal,  CenturyLink will begin a usage-based billing trial in Yakima, Wa., starting July 26 that will combine usage caps with an overlimit fee on customers that exceed their monthly usage allowance. The trial in Washington state may soon be a fact of life for most CenturyLink customers across the country, unless customers rebel.

CenturyLink will begin a usage-based billing trial in Yakima, Wa., starting July 26 that will combine usage caps with an overlimit fee on customers that exceed their monthly usage allowance. The trial in Washington state may soon be a fact of life for most CenturyLink customers across the country, unless customers rebel.