Cornell University students pay an average of $37,000 a year (before housing, student fees, and other expenses) to attend one of America’s most prestigious universities. When they arrive on-campus, it doesn’t take long to learn the college has one of the nastiest Internet Overcharging schemes around for students deemed to be using “too much Internet.”

Cornell University students pay an average of $37,000 a year (before housing, student fees, and other expenses) to attend one of America’s most prestigious universities. When they arrive on-campus, it doesn’t take long to learn the college has one of the nastiest Internet Overcharging schemes around for students deemed to be using “too much Internet.”

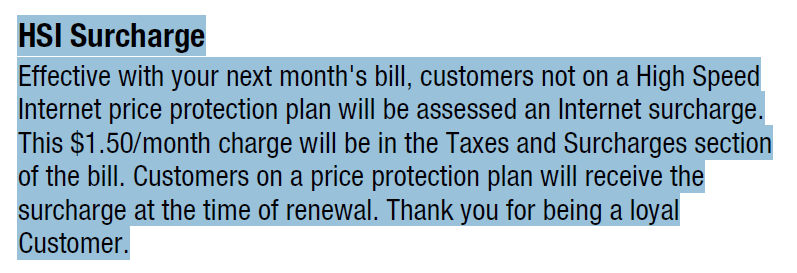

For years, Cornell limited students to less than 20 gigabytes of Internet usage per month, only recently increasing the monthly allowance to 50GB this summer. Cornell’s overlimit fee starts at $1.50 per gigabyte, billed in megabyte increments. Now some students are pushing back, launching a petition drive to banish the usage limits that curtail usage and punish the 10 percent of students who exceed their allowance.

Christina Lara, originally from Fair Lawn, N.J., started the petition which has attracted nearly 300 signatures over the past few weeks.

“Cornell students, along with students across the world, rely on the Internet to pursue their academics, independent research, and leisure activity,” Lara writes. “We should not be subjected to charges for our Internet usage, particularly because our curriculums mandate we use the Internet. Despite this, Cornell University continues to adopt NUBB (Network Usage-Based Billing), which charges students for exceeding the 50 gigabyte per month ‘allowance.'”

Lara incurred bills as high as $90 a month in overlimit fees last year, thanks to regular use of Netflix and Skype for online video chats with friends and family back home.

Internet fees for on-campus housing are included in the mandatory student services fee. Although Time Warner Cable has a presence on campus, most residence halls don’t appear to be able to obtain service from the potential competitor, which sells unlimited Internet access in the southern tier region of New York where Cornell is located. Instead, Cornell students on campus rely on the university’s wireless and Ethernet broadband network, and DirecTV or the university’s own cable TV system for television.

The apparent lack of competition makes charging excess-use fees for Internet usage easy, critics of the fees charge.

“It’s much easier if you live off-campus or in one of the apartment complexes students favor,” says Neal, one of our readers in the Ithaca area who used to attend Cornell. “The only complication is getting access to the University’s Intranet, which is much easier if you are using their network.”

Neal says Verizon delivers landline DSL to off-campus housing, but not on-campus. Because the service maxes out at 7Mbps, most who have other options sign up for Time Warner Cable’s broadband service instead.

“It’s cheaper on a promotion and much faster, and it’s still unlimited,” Neal says. “Hasbrouck, Maplewood and Thurston Court were the only residential buildings that offered the chance for Time Warner Cable on-campus, and only if the wiring was already in place.”

Neal notes many apartment complexes off campus have contracts with Time Warner Cable, which means cable TV and basic broadband are included in your monthly rent. Some Cornell students who live on or near campus try to make do with a slower, but generally free option — the Red Rover Wi-Fi network administered by the University. Others reserve the highest usage activities for computers inside university academic buildings, where the limits come off.

Lara complains Ithaca, and the southern tier in general, is hardly an entertainment hotbed, making the Internet more important than ever for leisure activities.

“If Cornell was situated in a major metropolitan area with a vast nightlife that could accommodate the interests of most, if not all, our undergraduates, then many Cornellians wouldn’t be so inclined to stay in their rooms and get on the Internet,” Lara says. “But that’s not the case. Cornell’s Greek life dominates the social scene, making ‘nightlife’ a dividing factor in the community.”

Tracy Mitrano, Cornell’s director of information-technology policy, told The Chronicle the vast majority of students will never hit the cap, and those that do cannot be charged more than $1,000 a month in overlimit fees, regardless of use. Those that do exceed the limit typically find a monthly bill for “overuse” amounting to $30.

“The approach that Cornell uses offers transparency and choice,” said Mitrano. She noted that Cornell provides students with clear information regarding their network usage by alerting them by e-mail when they are about to hit the limit and by setting specific rates for overuse fees.

“The choice seems to be using the university network or moving off-campus to buy Verizon or Time Warner Cable broadband to avoid the usage cap,” counters Neal. “I am not sure their ‘choice’ argument flies if students don’t have the option of signing up for Road Runner in their rooms on their own, bypassing the Internet Overcharging altogether.”

Both Neal and Gregory A. Jackson, vice president of Educause, seem to be reaching consensus on whether or not universities should be charging students for Internet separately from room and board. Jackson notes it is a discussion being held at an increasing number of universities. Neal thinks having a wide open access policy to deliver competition could solve this problem in short order, and students should make the decision where to spend their broadband funds themselves.

“If Cornell’s IT bureaucracy faced unlimited-access competition from Verizon and Time Warner Cable, do you think they’d still have a 50GB usage cap, considering only a small percentage of their captive customers exceeded it,” Neal asks. “Of course not.”

[Thanks to PreventCAPS for the story idea.]

Subscribe

Subscribe