German Chancellor Angela Merkel examines fiber optic telecommunications cables.

Germany has an internet access problem not very different from the one afflicting the United States and Canada. The national phone company, still partly owned by the government, remains mostly dependent on a decades-old wireline telephone network to deliver landline and DSL broadband service. The only way Deutsche Telekom will invest adequately to replace it with optical fiber is if they get assurances from the federal government they will be allowed to monopolize access to it.

According to the business weekly WirtschaftsWoche, a sister publication of Handelsblatt, Telekom executives have agreed to build a fiber-optic network everywhere in Germany provided that it is excluded from European anti-monopoly rules so that Deutsche Telekom wouldn’t be forced to open its network to competition.

The proposal from the German telecom giant was particularly audacious because many in the country blame it and its uncompetitive behavior for creating Germany’s slow broadband problem, but that did nothing to stop the company from asking to be shielded from competition.

“A fundamental departure from the kind of logic that viewed regulation of Deutsche Telekom (DT) as the normal state in the last 20 years is urgently needed,” the company said in a filing with the German Federal Network Agency, which regulates the internet in the country.

For most Germans, DT is the problem. The phone company has proven itself a formidable competitor across many parts of eastern Europe, where it bought control of privatized telecommunications companies that used to operate as government monopolies. But back home in Germany, it has been happy to continue offering DSL service that the rest of Europe cannot get rid of fast enough. In certain larger cities like Munich and Cologne, upstart fiber to the home providers have filled the broadband gap and have wired significant parts of both cities, and DT has responded with a fiber offering of its own without complaining about the cost of building a fiber network or the return on its investment.

Oberbürgermeister Wolff

But in smaller towns and villages across Germany — particularly in the eastern states, broadband has been terrible for years and under DT’s “leadership” it has not gotten much better, allowing other countries in the EU to sail past Germany in broadband rankings. Like AT&T and Verizon in the U.S., DT claims that where it has not upgraded its network, there is either no demand for fiber fast internet speed or inadequate return on investment. Also like in the U.S., DT has spent its money on other technologies, notably wireless, while investment in landline networks has not kept up.

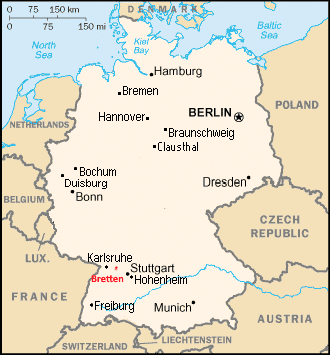

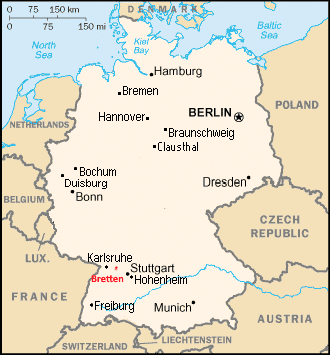

Some German communities like Bretten, fed up with inaction, have taken charge of their own broadband future and are building their own fiber to the home networks. Martin Wolff has dreamed of a digital economy boost for his town of 28,000 located near Karlsruhe in western Germany.

As mayor, he has begged and pleaded with DT to give Bretten something beyond lackluster DSL service, which is now too slow to handle the kind of 21st century internet applications that better wired communities take for granted. Mayor Wolff wants Bretten known as a gigabit city. DT, in contrast, wants to leave Bretten as a forgotten digital backwater. The phone company had repeatedly told the community the broadband it gets now is more than good enough and nobody should hold their breath waiting for something better. DT’s few competitors, including Britain’s Vodafone, weren’t interested either. Bretten is too small… too… irrelevant to matter to their investors.

“They are only interested in serving the cream of the crop in the cities and don’t come to rural areas,” the mayor said.

Like in North America, Germans are asking themselves who should be in charge of their digital future — investor-owned telecom companies or the community itself. The country’s continued embarrassing showing in European broadband rankings has become an issue of national pride and has sparked a loud debate between established telecom companies and the public that wants faster and better broadband.

Like in North America, Germans are asking themselves who should be in charge of their digital future — investor-owned telecom companies or the community itself. The country’s continued embarrassing showing in European broadband rankings has become an issue of national pride and has sparked a loud debate between established telecom companies and the public that wants faster and better broadband.

The noise of the debate has attracted the politicians, and the issue of German broadband has now taken center stage in the parliamentary elections, which will be held Sept. 24. Handelsblatt reports the issue of inadequate broadband now interests German voters more than the latest economic policy position paper or how Germany will manage to deal with U.S. President Donald Trump for the next three years. Many Germans have plenty of time for these kinds of offline debates, because online, it can take a minute to load a webpage on some of the country’s dial-up like DSL connections.

“Germany is one of the most under-supplied countries in Europe, especially in terms of rural coverage,” wrote Bernd Beckert, an internet expert at the Fraunhofer Institute for Systems and Innovation Research, in a recent study of European broadband. He said countries such as Switzerland, Spain and even tiny Estonia are far ahead of Germany. In fact, the Baltic states and many former Eastern bloc countries are moving towards a fiber future while Germany considers wrapping itself even tighter in copper wiring installed in the 1960s. More than 70% of German internet users get internet access through a DT-provided, ADSL-equipped landline. Many connect at just 1-6Mbps, about the same speed users were getting in the late 1990s when DT’s internet monopoly was abolished.

Since then, DT has done everything possible to encourage “competitors” to not build competing networks. In fact, most competing ISPs like 1&1, Versatel, Telefonica Deutschland, and Vodafone rent DT DSL-capable landlines to provision service to their customers. That means they cannot compete on speed and they are forced to rely on DT to maintain its wireline network. It is no accident that German adoption of fiber optics is stuck at only 1.8%, fifth from last place among the 35 member states of the Organization of Economic Cooperation and Development (OECD). In comparison, Japan and South Korea have more than 70 percent of their customers on fiber to the home connections.

Germany’s largest political parties that have been in government since 2005, the Christian Democratic Union (CDU) and the Christian Social Union in Bavaria (CSU) have tolerated DT and its anemic upgrade policies. Broadband stagnancy, many believe, would not be possible without acquiescence and appeasement by those in control of the country. That conspiracy theory is backed by many of Germany’s smaller political parties which believe it is time to change the government’s involvement with DT.

Germany’s largest political parties that have been in government since 2005, the Christian Democratic Union (CDU) and the Christian Social Union in Bavaria (CSU) have tolerated DT and its anemic upgrade policies. Broadband stagnancy, many believe, would not be possible without acquiescence and appeasement by those in control of the country. That conspiracy theory is backed by many of Germany’s smaller political parties which believe it is time to change the government’s involvement with DT.

The Left Party’s platform supports nationalizing DT and returning it to a state-owned enterprise that will answer to the public policy priorities of the next government. The capitalist, pro-business Free Democratic Party wants to get the government completely out of its 32% remaining stake in DT and hope that free market solutions will emerge. In the meantime, that party proposes to use the proceeds of any sale to fund a national broadband subsidy fund to convince private telecom companies to upgrade their networks in underserved areas.

DT has not stayed quiet in the public policy debate either. After disappointing the German public by rejecting a proposal to build an open, nationwide fiber to the home network, the company has instead promised to upgrade existing DSL lines to newer technologies like VDSL and vectoring, which DT claims could deliver up to 100Mbps service. American phone companies like Verizon have been reluctant to head in a similar direction, admitting many of the next generation DSL technologies work better in the lab than in the field. Many of the technologies promoting the most dramatic speed improvements have also proved to be vaporware so far.

Deutsche Telekom HQ Bonn, Germany

“We are committed to vectoring, because it is the only way to provide people in rural areas with faster lines quickly,” Deutsche Telekom said in a blog post published in August. “If we are fixated on [fiber to the home], those in the countryside will remain left behind for years. It is simply impossible to roll out fiber lines to homes everywhere in the country. Neither the construction capacity nor the funding is available for that. Plus, there is quite simply no demand for it.”

Some of the other competitors in the market seem to agree with DT.

“No provider can achieve fiber optic expansion on its own,” said Valentina Daiber, a member of the board of Telefonica. Daiber said DT was already nearly $60 billion in debt. Daiber said she hoped a solution could be found after the election.

But just a week after Daiber made that claim Vodafone announced it will spend $2.4 billion on a new fiber to the premises network targeting 100,000 companies in 2,000 German business parks. The company will also spend up to $450 million partnering with municipalities to extend the network to about one million rural homes, in addition to boosting its current broadband speeds delivered to German cable customers to 1Gbps.

That announcement could cause DT’s DSL plans to eventually collapse, if Vodafone follows through on its fiber buildout.

Mayor Wolff has no intention of waiting to see how it all plays out. Wolff has convinced private fiber optics company BBV to install the fiber infrastructure and has a Dutch investor partner arranging $12 million in financing, which is always the biggest stumbling block to get fiber buildouts underway. Upfront construction costs often deter many municipalities and would-be competitors from launching. But for Wolff, where there is a will, there is a way to deliver fiber fast broadband, and he is making certain it happens sooner rather than later.

Verizon Communications will decommission its existing copper wire facilities in multiple markets in Delaware, Maryland, Massachusetts, New Jersey, New York, Pennsylvania, Rhode Island, and Virginia starting in 2018.

Verizon Communications will decommission its existing copper wire facilities in multiple markets in Delaware, Maryland, Massachusetts, New Jersey, New York, Pennsylvania, Rhode Island, and Virginia starting in 2018.

Subscribe

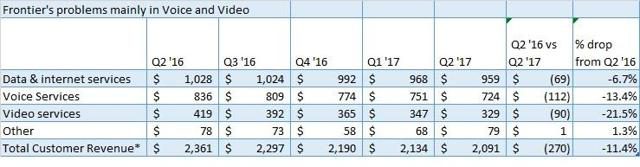

Subscribe Frontier Communications spent $2 billion in 2014 to purchase AT&T’s Connecticut wireline business, believing it could make a fortune selling internet and cable television service to wealthy Nutmeg State residents over a network AT&T upgraded to fiber-to-the-neighborhood service several years earlier.

Frontier Communications spent $2 billion in 2014 to purchase AT&T’s Connecticut wireline business, believing it could make a fortune selling internet and cable television service to wealthy Nutmeg State residents over a network AT&T upgraded to fiber-to-the-neighborhood service several years earlier.