The magic of fiber

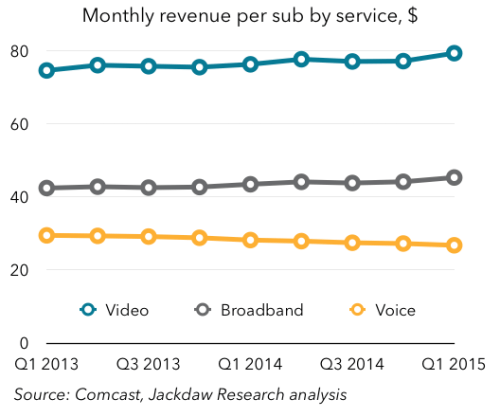

Ever wonder why Comcast, one of the strongest defenders of classic coaxial-based cable technology, is suddenly getting on board the fiber-to-the-home bandwagon? New research suggests if they don’t, their market share could fall to 40% or less if a serious fiber competitor arrives.

“There’s some sort of magic associated with fiber,” John Caezza, president of Arris’s Access Technologies division, told Multichannel News. “Everyone thinks it’s better than [cable technology].”

The risks to the cable industry are clear: be prepared to upgrade or face customer losses.

Craig Moffett of Moffett Nathanson has never been a cheerleader for fiber to the home service. In 2008, Moffett vilified Verizon for its investment in a major fiber upgrade we know today as FiOS to replace its aging copper infrastructure, complaining it was too expensive and was overkill for most residential customers. He was more tolerant of AT&T’s less-costly fiber to the neighborhood approach, dubbed U-verse, that still used traditional telephone lines to deliver service into the home. Because U-verse did not need AT&T to replace wiring at each customer location, the cost savings were considerable. But the cost-capability compromise left AT&T with a less robust platform, with broadband speeds initially limited to a maximum of around 24Mbps.

While phone companies like AT&T and Verizon were saddled with the enormous cost of tearing out decades-old obsolete phone wiring to varying degrees, the cable industry seemed well positioned with a mature, yet still recent hybrid fiber-coaxial (HFC) platform that was upgraded in the 1990s in many cities. While still partly reliant on the same RG-6 and RG-11 coaxial cable used since the first days of cable television, cable companies also invested in fiber optics to bring services from distant headends to each town, removing some of the copper from their networks without the huge expense of bringing fiber all the way to customer homes.

For Moffett, it was the cable industry that had the network with room to grow without spending huge amounts of capital on upgrades. He has touted cable stocks ever since.

Moffett

What worries Moffett now isn’t Google, Frontier, CenturyLink, or even Verizon. He’s concerned about AT&T.

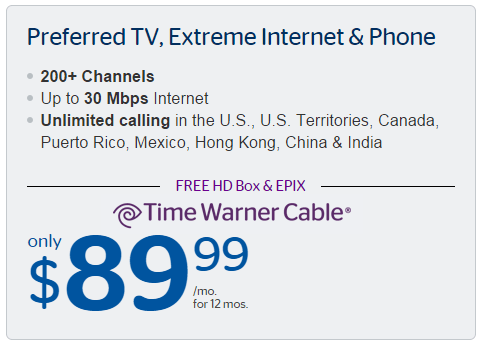

As part of its commitment to win approval of its merger with DirecTV, AT&T promised regulators in June it would expand AT&T U-verse with GigaPower — AT&T’s gigabit fiber to the home upgrade — to at least 11.7 million homes, nine million more than it has ever promised before. Comcast has a 32% overlap with AT&T U-verse, compared to Time Warner Cable (26%), Charter Communications (32%), Bright House Networks (25%) and Cox Communications (25%). Comcast had promised faster broadband with the advent of DOCSIS 3.1 beginning as early as next year. But the company isn’t willing to wait around to watch AT&T and others steal its speed-craving customers. This spring, it promised 2Gbps Gigabit Pro fiber to the home service to customers living within 1/3rd of a mile of the nearest Comcast fiber line.

Some in the cable industry complain Google’s huge marketing operation has saddled cable broadband with a bad rap — ‘it’s yesterday’s news, with Google Fiber representing the future.’ The marketing war has been largely won by Google, they say, leaving consumers convinced fiber is the better and more reliable technology, and they need it more than the cable company.

Cable’s defense is to consider some marketing changes of its own — including the idea of dropping the name “cable” from the business altogether, because it implies older technology. But despite any name change, most cable companies will continue to rely on HFC infrastructure for at least several more years, despite claims they are bringing their own middle mile fiber networks closer to customers than ever. Cable operators now serve an average of 400 homes from each cable node. Some cable companies like Comcast plan to cut the number of customers sharing a node to around 100-125 homes, which means fewer customers will share the same broadband connection. But in the end, that will make cable comparable at best to a fiber to the neighborhood network, still hampered to some degree by the presence of legacy coaxial copper cable. The industry believes most consumers will never see the limitations, and for those that do, a limited fiber buildout with a steep installation fee may keep costs (and demand) down to those who need the fastest possible speeds and are willing to pay to get them.

That philosophy may still cost cable companies customers if a fiber competitor doesn’t have to compromise speed and performance and can afford to charge less.

That philosophy may still cost cable companies customers if a fiber competitor doesn’t have to compromise speed and performance and can afford to charge less.

The top 10 U.S. cable companies currently account for 60% of the residential broadband market and 86% of all broadband net additions in the first quarter of 2015, says Leichtman Research Group.

Moffett predicts cable broadband will only capture 40% of share in markets where it faces a fiber to the home competitor (Google, EPB, Greenlight, Verizon FiOS), 55% in markets served by a fiber to the neighborhood competitor (U-verse, Prism), and 60% where the competition only sells DSL (most Frontier, Windstream service areas). Nationwide, AT&T’s newest gigabit fiber commitment could cost the cable industry 2.4% of the whole residential broadband market, Moffett said.

Phil McKinney, president and CEO of CableLabs, believes DOCSIS 3.1 — the next standard for cable broadband — can easily stand toe to toe with fiber to the home providers.

McKinney

“I think it [HFC] has tremendous life, and we are going to be riding it all day long,” Werner said. DOCSIS 3.1 “is definitely going to be our go-to animal. Due to ubiquity, we can go out and virtually serve all of our [customers] very quickly.”

Cable companies claim their speed increases reach all of their customers in a given area at the same time without playing games with “fiberhoods” or waiting for incremental service upgrades common with Google Fiber or AT&T’s U-verse. Customers, the industry says, also appreciate DOCSIS upgrades bring no service disruption and nobody has to come to the home to install or upgrade service.

“The cable industry has more fiber in the ground than each fiber provider in the world,” McKinney argues. “If you look at total fiber strand miles, there’s more fiber under management and under control of the [cable] operators than anybody else combined.”

That may be true, but Moffett thinks it is only natural shareholders may eventually punish the stocks of cable operators that will face competition from AT&T’s U-verse with GigaPower. There is precedent. Cablevision serves customers in New York, Connecticut, and New Jersey and faces fierce competition from Verizon FiOS in most of its service areas. That competition has been brutal, occasionally made worse in periodic price wars. What may be protecting cable stocks so far is the fact AT&T competition will only affect, at most, 32% of the impacted cable operators’ service areas.

AT&T’s gigabit network has also proved itself to be more press release than performance, with very limited availability in the cities where it claims to be available. Verizon FiOS, in contrast, is widely available in most of Cablevision’s service area.

Still, Comcast is hoping it can hang on to premium customers who demand the very fastest speeds and performance with targeted fiber.

“Gigabit Pro is really for those customers who have got extreme needs,” said Tony Werner, Comcast’s executive vice president and chief technology officer.

Subscribe

Subscribe Suddenlink’s Operating GigaSpeed has reached parts of Texas, Missouri and North Carolina — the first areas to get 1,000/50Mbps service from the cable company. But customers are not happy to learn it is accompanied by a 550GB usage cap.

Suddenlink’s Operating GigaSpeed has reached parts of Texas, Missouri and North Carolina — the first areas to get 1,000/50Mbps service from the cable company. But customers are not happy to learn it is accompanied by a 550GB usage cap. “Here in Greenville they are charging $110 a month for the service, $5 for a cable modem or $10 for a Wi-Fi router, and a $35 mandatory technician visit fee which sounded reasonable until they mentioned there was a 550GB data allowance on the service,” said Stop the Cap! reader J.J. Wallace. “That killed it for me. That is nothing short of outrageous to charge that kind of money and place a ridiculously low cap on it. It’s funny

“Here in Greenville they are charging $110 a month for the service, $5 for a cable modem or $10 for a Wi-Fi router, and a $35 mandatory technician visit fee which sounded reasonable until they mentioned there was a 550GB data allowance on the service,” said Stop the Cap! reader J.J. Wallace. “That killed it for me. That is nothing short of outrageous to charge that kind of money and place a ridiculously low cap on it. It’s funny  “If you impress on them they are charging too much, they will often find a promotion for you, but so far I’ve had no luck getting them to waive the caps unless you switch to business service,” said Wallace. “They always act like you are the first person to complain about usage caps, but if you read their social media pages, there are many others very upset to find they’ve lost unlimited use service after Suddenlink introduced speed upgrades. Most of my friends would rather have unlimited than faster service you can’t use.”

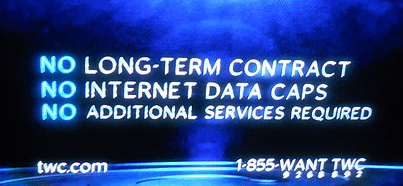

“If you impress on them they are charging too much, they will often find a promotion for you, but so far I’ve had no luck getting them to waive the caps unless you switch to business service,” said Wallace. “They always act like you are the first person to complain about usage caps, but if you read their social media pages, there are many others very upset to find they’ve lost unlimited use service after Suddenlink introduced speed upgrades. Most of my friends would rather have unlimited than faster service you can’t use.” Cox Communications will begin testing overlimit fees this summer starting in its Cleveland, Ohio service area with plans to introduce hard usage allowances and excess usage violation charges nationwide if customers tolerate the market test in Cleveland.

Cox Communications will begin testing overlimit fees this summer starting in its Cleveland, Ohio service area with plans to introduce hard usage allowances and excess usage violation charges nationwide if customers tolerate the market test in Cleveland. “Data usage plans promote fairness by asking the high-capacity Internet users to pay a greater share of network costs,” argues Cox. “Some critics of data usage plans push a flat fee pricing model, meaning that users would pay a flat fee whether they simply use the Internet to surf the web and check email or if they are a ‘super user’ and consume copious amounts of bandwidth. Data usage plans are a far more fair approach, giving consumers a choice based on their personal needs rather than forcing all customers to absorb the network costs incurred by the 5% of customers who exceed their allowance.”

“Data usage plans promote fairness by asking the high-capacity Internet users to pay a greater share of network costs,” argues Cox. “Some critics of data usage plans push a flat fee pricing model, meaning that users would pay a flat fee whether they simply use the Internet to surf the web and check email or if they are a ‘super user’ and consume copious amounts of bandwidth. Data usage plans are a far more fair approach, giving consumers a choice based on their personal needs rather than forcing all customers to absorb the network costs incurred by the 5% of customers who exceed their allowance.” Third, Cox’s excuses are very similar to those given by Time Warner Cable when it tried (and

Third, Cox’s excuses are very similar to those given by Time Warner Cable when it tried (and

The Cable Show (now known as INTX) is often used by the cable industry to announce and preview new products and services, and at this year’s convention in Chicago, Comcast CEO Brian Roberts used the occasion to introduce the company’s new DOCSIS 3.1 multi-purpose Home Gateway capable of delivering gigabit speeds over its existing hybrid fiber-coax network.

The Cable Show (now known as INTX) is often used by the cable industry to announce and preview new products and services, and at this year’s convention in Chicago, Comcast CEO Brian Roberts used the occasion to introduce the company’s new DOCSIS 3.1 multi-purpose Home Gateway capable of delivering gigabit speeds over its existing hybrid fiber-coax network.