Cogeco Cable customers are about to pay for the company’s tragic financial results from its Portuguese operations in the form of broad-based price increases the company is selling as service “improvements.”

July’s financial results for Cogeco, which owns cable systems in Ontario, Quebec, and Portugal, are not good. With mass subscriber defections and downgrades from Cogeco’s Portuguese cable system Cabovisao, company officials have decided to write off their European investment, resulting in a $56.7 million loss in the third quarter.

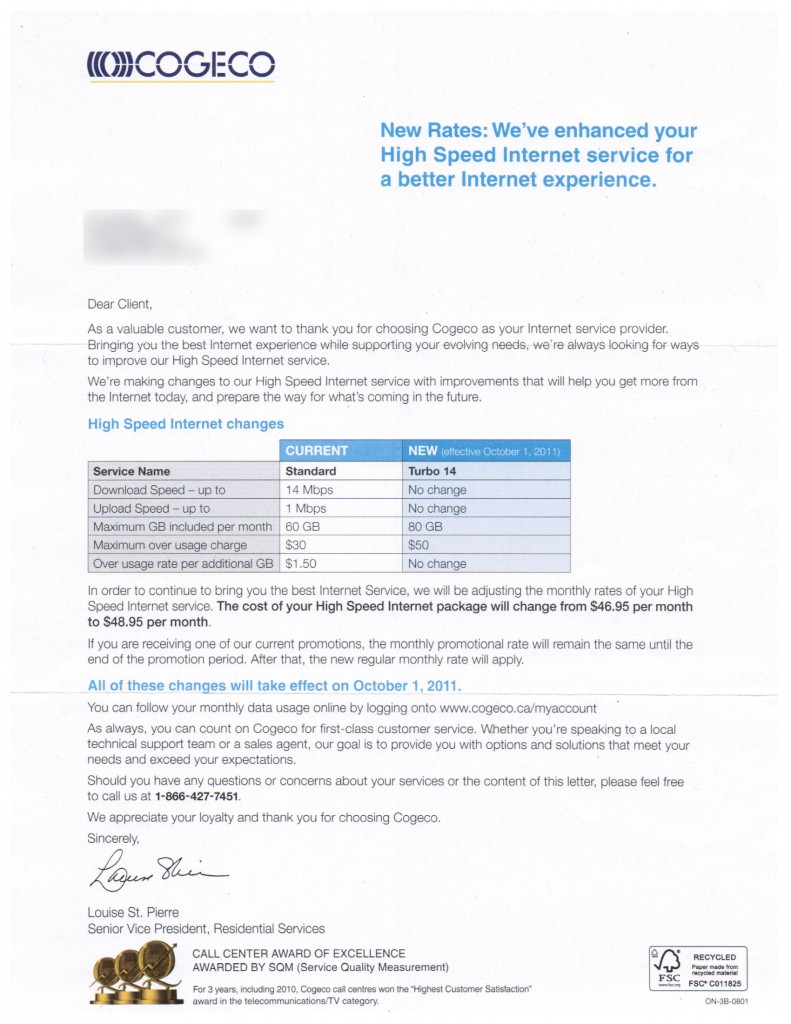

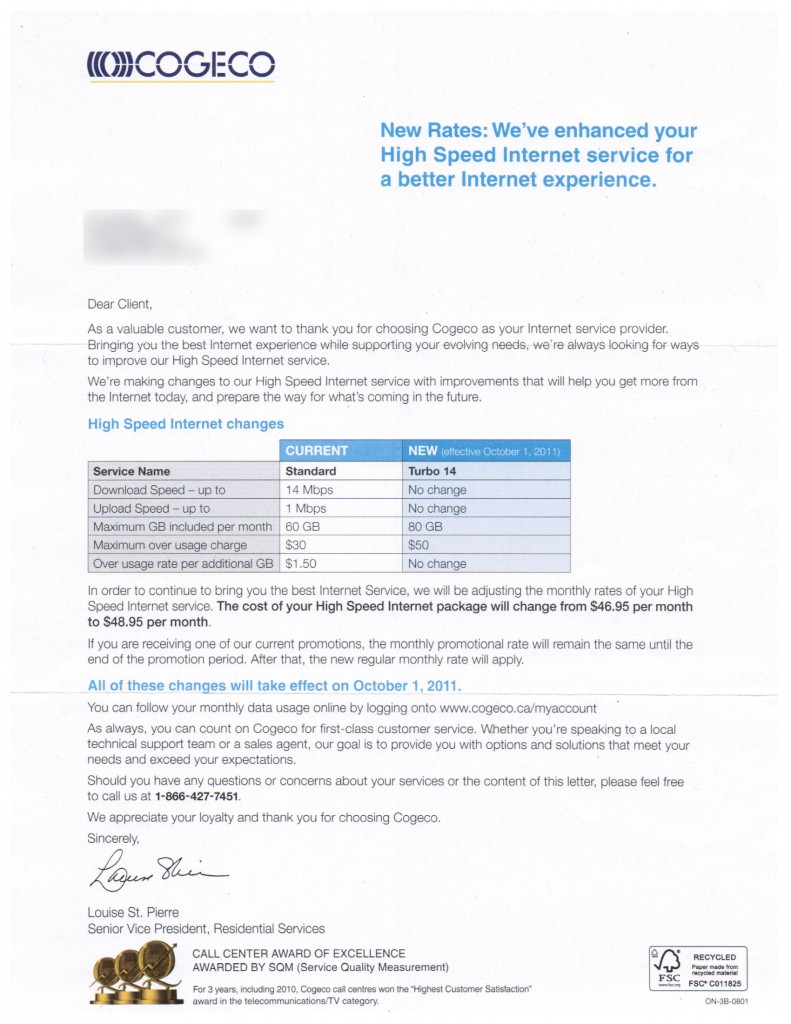

Tempering the damage is the company’s decision to raise broadband prices for Canadian customers by $2 a month for their Standard broadband package, soon to be priced at $48.95.

(Courtesy: 'Gone' from Fort Erie, Ontario)

“To add insult to injury, they are calling these changes ‘improvements,'” writes Stop the Cap! reader Claudette, who is a Cogeco customer in Ontario. “In fact, the only thing Cogeco is improving is their skill at overcharging us.”

Cogeco's financial mess in Portugal.

Cogeco has sent letters to subscribers notifying them about the “improvements,” mostly in the form of a name change for the company’s ‘Standard’ plan, soon to be renamed ‘Turbo 14.’ They have also launched a new section on their website to break down the changes.

The only benefit Cogeco is introducing for customers with their Standard plan is a slight bump in usage allowances, from 60 to 80GB. But that change comes with a major catch. Cogeco charges customers a $1.50/GB overlimit fee with a monthly maximum overcharge of $30. When ‘Turbo 14’ premieres Oct. 1, the maximum overlimit fee will jump to $50 a month.

“That is a total ripoff, because the next plan up with bigger allowances — just over 100GB a month — costs nearly $77 a month, for a whopping 16Mbps,” she adds. “They just raised our rates last July and now they want more.”

Cogeco is punishing their premium customers even more by taking the maximum overlimit fee cap completely off their DOCSIS 3-based Ultimate 30Mbps and 50Mbps plans. Available in some Cogeco service areas at prices of $60 and $100 a month respectively, the plans come with usage limits of 175-250GB. The sky is the limit for overlimit fees, racked up at $1 per gigabyte.

Cogeco customers are outraged, and have begun shopping for alternatives, just like their counterparts in Portugal who have put their cable service on the chopping block.

The ongoing Portuguese financial crisis has been met with tax increases and benefit reductions by the government, and Portuguese consumers have responded with wholesale cord-cutting, cancelling Cabovisao cable-TV service in droves.

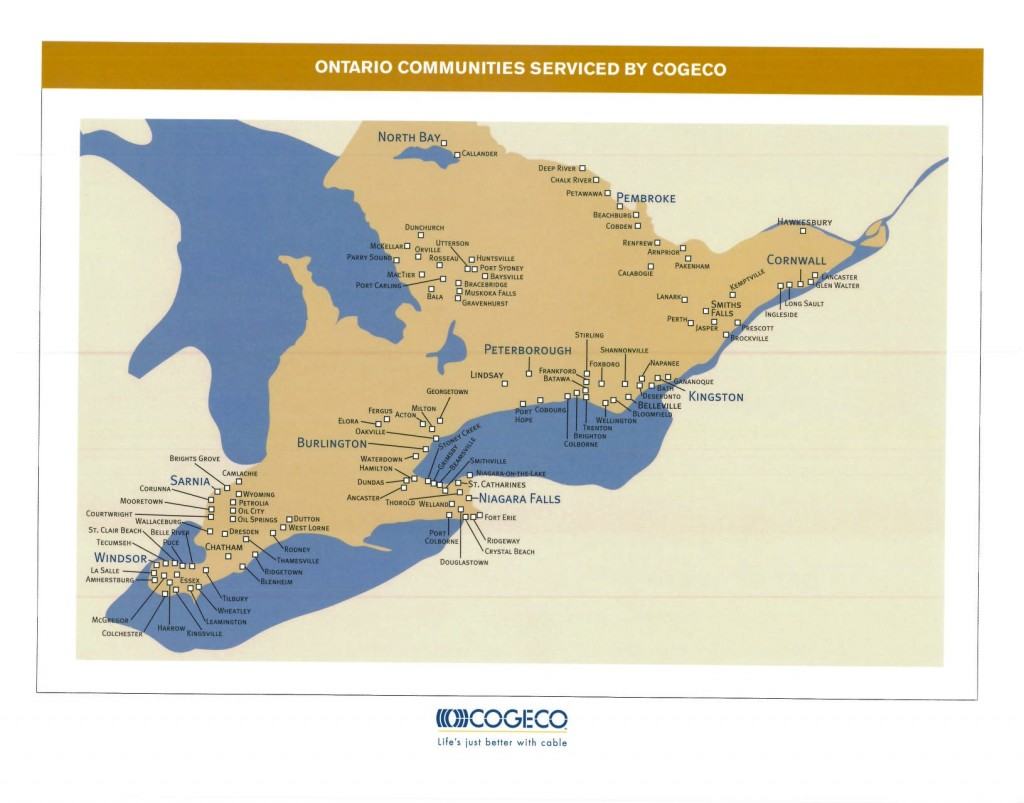

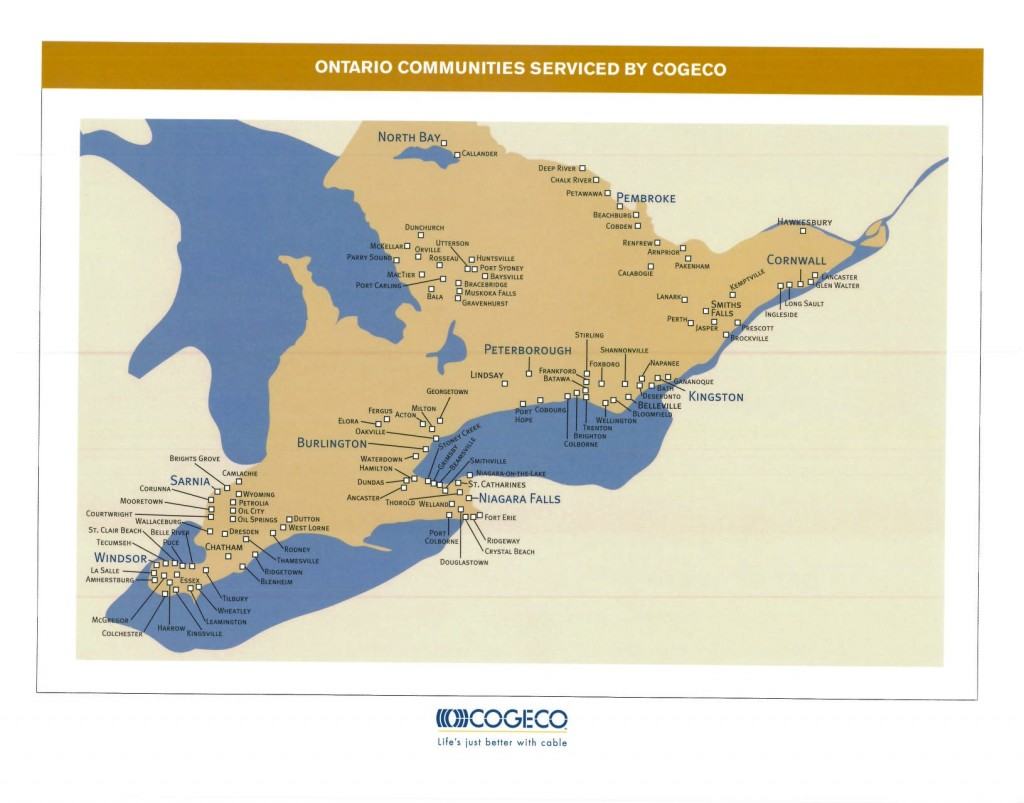

Cogeco's systems in Ontario (click to enlarge)

“You now have customers squarely opting out of [cable TV],” said Louis Audet, Cogeco’s president and chief executive officer. “These are economic circumstances that we have not, nor has anyone here, witnessed in North America. These are very unique to the circumstances in Portugal.”

At least Audet hopes they are.

With fewer competitive choices in the rural and suburban Ontario and Quebec markets Cogeco favors, consumers have a tougher time finding alternative providers, but not an impossible one. Many are dropping Cogeco’s phone and broadband packages, moving to Voice Over IP or cell phone service for the former, and independent broadband providers like TekSavvy for the latter. TekSavvy still retains unlimited use plans and has been traditionally more generous with allowances for the usage-based plans the company also sells.

Investors have been placated with a boost in Cogeco’s dividend payout… for now. But many have adopted a “told you so” attitude about the company’s controversial decision to invest in overseas cable to begin with.

Scotia Capital analyst Jeff Fan said he had a negative view about Cogeco’s Portuguese venture.

“We hope this paves the way for a sale,” he wrote in a note to investors, “as Portugal is still cash-flow negative and dilutes the strong Canadian results.”

In fact, many investor groups dream of an even bigger sale — of Cogeco itself.

Joseph MacKay of Mackie Research said Canada’s fourth-largest cable company is ripe for a takeover by a larger cable operator, presumably Rogers or Shaw Communications. Rogers already blankets Ontario with cable services, so Cogeco’s operations in eastern provinces would be a ‘natural fit’ for the company. Shaw’s interest in expanding eastward could also get a boost from the buyout of Cogeco.

But one significant roadblock remains — the controlling interests of the Audet family, which have no intention of selling and control enough voting shares to stymie a hostile takeover. In fact, despite the poor showing of the company’s Portuguese operations, the Audet family claims to be interested in acquiring other providers and expanding Cogeco’s size.

With the benefit of a two-dollar rate increase and the proceeds of Internet Overcharging, they’ll be in a position to put more dollars toward that goal.

Cox Communications is telling customers if they exceed the company’s usage caps three times over the lifetime of an account, they either must upgrade to a more expensive service plan, make sure they never exceed plan limits again, or face an indefinite loss of their Internet service if they exceed Cox’s limits a fourth time.

Cox Communications is telling customers if they exceed the company’s usage caps three times over the lifetime of an account, they either must upgrade to a more expensive service plan, make sure they never exceed plan limits again, or face an indefinite loss of their Internet service if they exceed Cox’s limits a fourth time.

Subscribe

Subscribe