Almost 20% of Charter Spectrum’s broadband-only customers now consume over 1 TB of data per month, with the average cord-cutting Spectrum customer now reaching 700 GB of usage.

Almost 20% of Charter Spectrum’s broadband-only customers now consume over 1 TB of data per month, with the average cord-cutting Spectrum customer now reaching 700 GB of usage.

Charter CEO Thomas Rutledge revealed the company’s increasing usage figures on a conference call with investors this morning. Rutledge pointed to a spike in pandemic-related, at-home video streaming, but also an explosion in video conferencing traffic from work-at-home customers. Video traffic constitutes the majority of consumer broadband traffic in the United States, and as video quality improves, so does the amount of data each customer consumes.

Recent pressure from some in Washington to increase upstream capacity has been noticed by company officials but largely dismissed. In fact, Rutledge claimed Spectrum had no capacity issues that it could not address with incremental capacity upgrades and neighborhood node splits.

“We don’t have any immediate need to expand the capacity of the plant,” Rutledge said, noting that Charter still has room to grow after adopting DOCSIS 3.1 technology. Rutledge added that with the majority of traffic still firmly originating from downloads and streaming, incremental network improvements could allow the company to boost some speeds, but only if market demand for it emerges.

Rutledge noted the company has the capacity to expand its existing infrastructure to 1.2 GHz by expanding network bandwidth. DOCSIS 3.1 can support multi-gigabit download speeds and 1,000 Mbps for uploads. Charter, along with many other cable companies, has been slow to move towards the next cable broadband standard, DOCSIS 4.0, which would exponentially increase speeds and capacity even further.

Another potential method of curtailing usage growth could come from data caps or usage-based billing, but Charter’s efforts to rid itself of its 2016 agreement not to impose data caps until at least 2023 (if ever) in return for approval of its merger with Time Warner Cable and Bright House Networks was withdrawn by the company after receiving significant opposition. The agreement’s expiration date remains May 2023.

Despite the usage growth, Charter’s chief financial officer Christopher Winfrey told investors the impact on the company’s capacity and costs were insignificant and remained confident Charter’s costs to deliver broadband service and expand it would continue to decline overall in the years ahead.

Subscribe

Subscribe

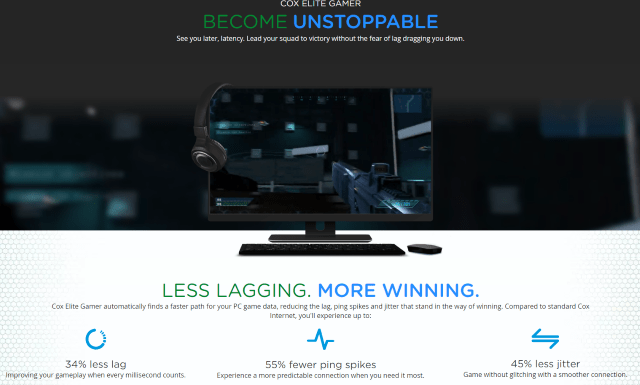

CableLabs has published a new specification for the DOCSIS 3.1 cable broadband platform that will support <1 ms latency, optimal for online gaming and virtual reality.

CableLabs has published a new specification for the DOCSIS 3.1 cable broadband platform that will support <1 ms latency, optimal for online gaming and virtual reality.

Despite claims from Republican FCC commissioners that cable companies are boosting investment in their networks as a result of the FCC’s repeal of net neutrality, cable infrastructure suppliers reported first quarter 2019 revenues nosedived 38%, reflecting an “extreme” cutback in cable industry spending not seen in over five years.

Despite claims from Republican FCC commissioners that cable companies are boosting investment in their networks as a result of the FCC’s repeal of net neutrality, cable infrastructure suppliers reported first quarter 2019 revenues nosedived 38%, reflecting an “extreme” cutback in cable industry spending not seen in over five years.