Stankey

AT&T’s incoming CEO John Stankey has a message for America: If you are unwilling to pay $15 a month for AT&T’s HBO Max, you have a low IQ.

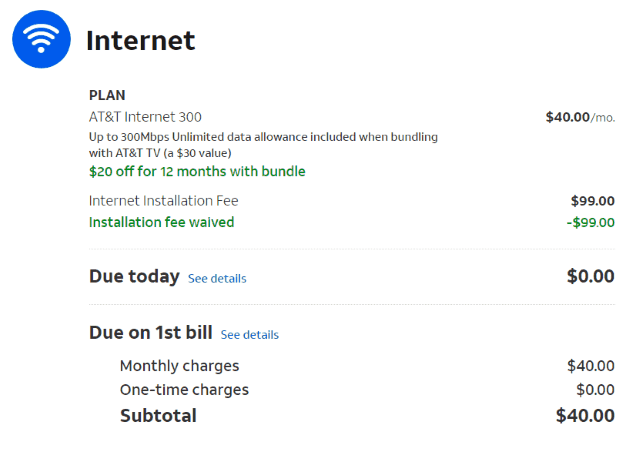

Stankey made that declaration pitching the new service, set to debut in May. The fact the video platform is late to a market already crowded by Netflix, Hulu, and Disney is just part of the challenge. That $15 price point is a bigger one.

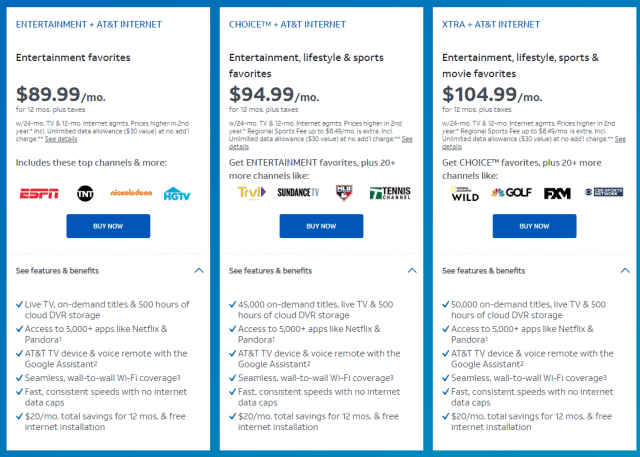

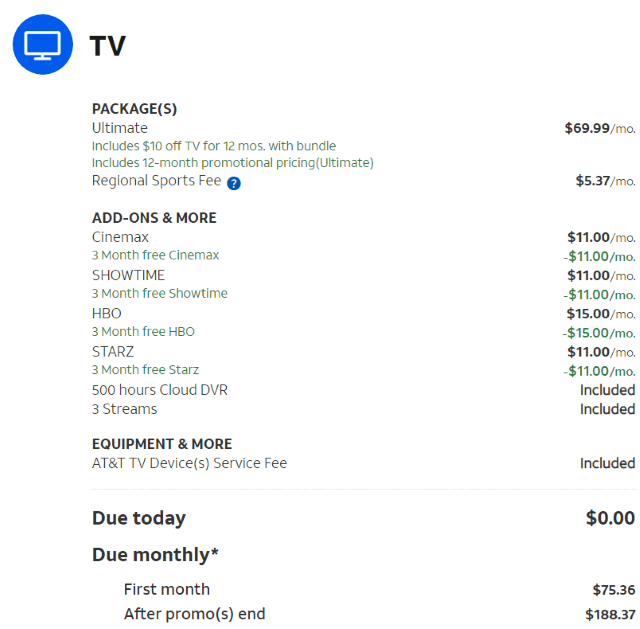

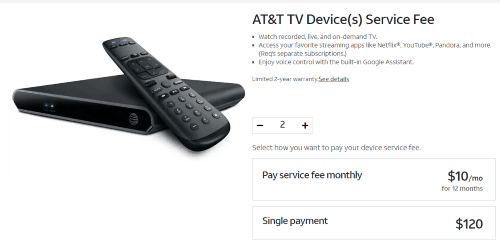

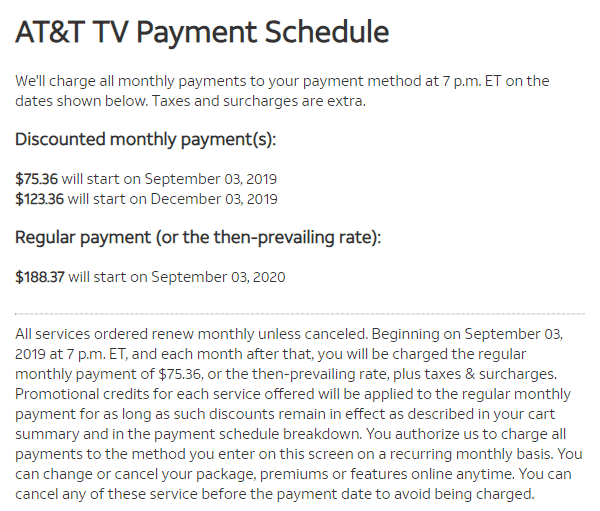

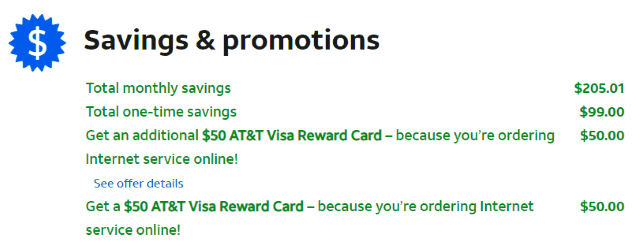

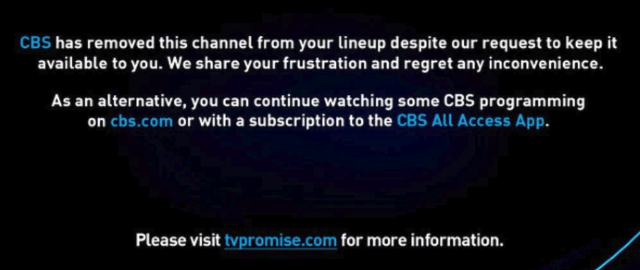

If there is any company in the telecom business that can prove consumers are sensitive to price hikes and bill shock, it is AT&T. Its frequent rate hikes for its DirecTV satellite service and various streaming TV platforms have caused a customer exodus. More than a quarter of DirecTV customers have left and, even more stunning, well over half of AT&T’s streaming TV customers have dropped the service. In late 2018, DirecTV Now (today AT&T TV Now) — AT&T’s cord cutting TV alternative, had 1.8 million customers. As of last month, that number is down to 788,000 and still falling.

AT&T has repeatedly claimed it wants to focus on “high value” customers, which may explain why it remains confident its $15/mo HBO Max service will do well, despite being the most costly streaming service in the market.

Stankey’s predecessor, Randall Stephenson, will exit as AT&T’s CEO in July. He leaves a much larger conglomerate than what he started with. AT&T has diversified from its telephone and wireless portfolio with several major acquisitions, including DirecTV — the satellite TV service, and Time Warner (Entertainment), a Hollywood studio and entertainment giant. The result is a company loaded with debt and a revolt by activist investors that question the wisdom of creating the 2010s version of AOL-Time Warner.

Stankey’s predecessor, Randall Stephenson, will exit as AT&T’s CEO in July. He leaves a much larger conglomerate than what he started with. AT&T has diversified from its telephone and wireless portfolio with several major acquisitions, including DirecTV — the satellite TV service, and Time Warner (Entertainment), a Hollywood studio and entertainment giant. The result is a company loaded with debt and a revolt by activist investors that question the wisdom of creating the 2010s version of AOL-Time Warner.

Elliott Management Corp., the activist investment firm that has proved itself a nuisance to the expensive dreams of several rich and powerful CEOs, does not see a viable marriage between AT&T’s profitable telecommunications business and a media and entertainment company. It took its concerns public in 2019, calling on AT&T management to get back to the basics.

Stankey’s approach seems to be a willingness to embrace the newest members of the AT&T family, for now, while also reassuring investors the shopping spree of mergers and acquisitions is over. Bloomberg News reports his views seem to have won Elliott Management over. At the same time, Stankey has to convince investors and the public he is competent at running a media company. The jury is still out on that:

At a town hall with HBO employees last year, Stankey said the network had to dramatically increase its programming output, comparing the work ahead to childbirth. Once, when a Time Warner veteran criticized an idea during a meeting, Stankey replied, “I know more about television than anybody.”

[…] But over the past two years, Stankey has tried to acclimate himself to the glitzy world of entertainment. He started watching HBO’s “Westworld” and “Succession.” He could be seen mingling with HBO talent at glitzy Manhattan premiere parties. At an industry event, he wore a pin featuring a Looney Tunes character — a WarnerMedia property — on his jacket lapel.

Subscribe

Subscribe Most analysts are predicting this past year will be the worst yet for video customer losses, with nearly two million cable TV customers cutting the cord in 2019, up from 1.26 million in 2018. Business is even worse for satellite TV operators, which lost 1.2 million customers in 2018 and are expected to have shed another 3.25 million customers in 2019 — mostly because of mass customer defections at AT&T’s DirecTV. Altogether, over five million Americans are estimated to have cut the cord over the past year.

Most analysts are predicting this past year will be the worst yet for video customer losses, with nearly two million cable TV customers cutting the cord in 2019, up from 1.26 million in 2018. Business is even worse for satellite TV operators, which lost 1.2 million customers in 2018 and are expected to have shed another 3.25 million customers in 2019 — mostly because of mass customer defections at AT&T’s DirecTV. Altogether, over five million Americans are estimated to have cut the cord over the past year.

The Walt Disney Co., is

The Walt Disney Co., is