Northern Minnesota's Paul Bunyan Communications is threatened by FCC reforms that they claim favor larger phone companies.

Northern Minnesotans will have to wait longer for broadband after a telephone co-op announced it was suspending its $19 million broadband expansion project because funding is being diverted to more powerful phone companies like AT&T and Verizon — neither of which have any concrete plans to improve rural wired broadband.

Bemidji-based Paul Bunyan Communications, which serves 28,000 hearty Minnesota customers, has been working on broadband expansion for several years, bringing broadband to customers who have known nothing except dial-up since the Internet age began. Only now the project is threatened because of well-intentioned plans by the Federal Communications Commission to expand rural broadband, but in ways that cater primarily to larger phone companies that lobbied heavily for the changes.

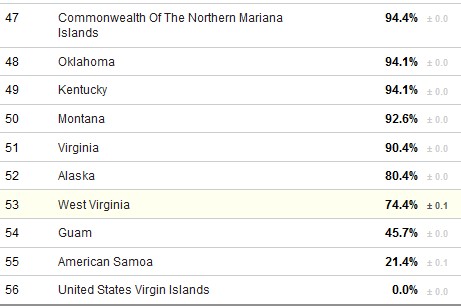

At issue is Universal Service Fund reform, which plans to divert an increasing share of the surcharge all telephone customers pay away from rural basic phone service and towards broadband expansion in rural America.

Paul Bunyan used their share of USF funding to scrap the company’s existing, antiquated copper-wire network in favor of fiber optics. Other phone companies have traditionally used the money to keep their existing networks running. Now the independent phone company says large phone companies like Verizon and AT&T have successfully changed the rules in their favor, and will now benefit from a larger share of those funds, ostensibly to expand broadband to their rural customers.

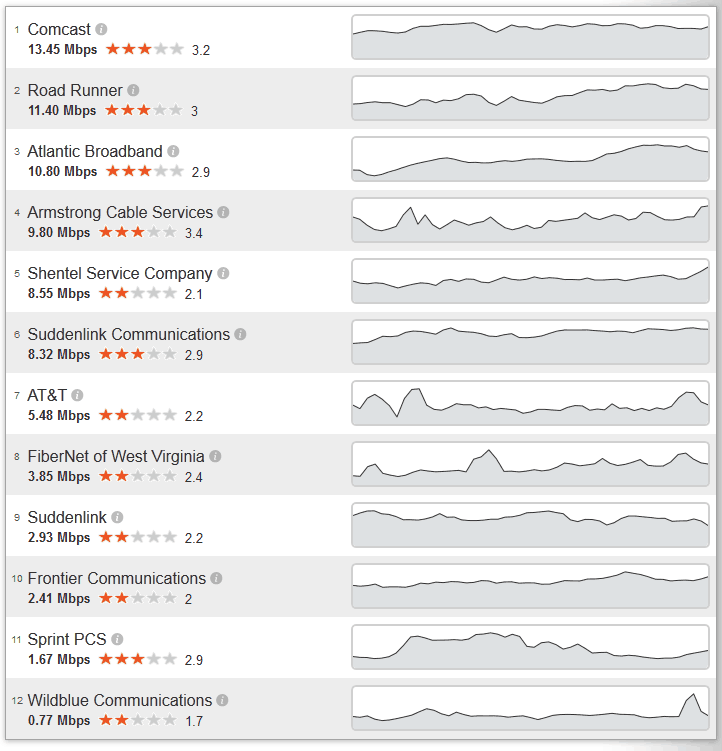

But neither AT&T or Verizon have shown much interest in rural broadband upgrades. AT&T, which recently announced it concluded its U-verse rollout in larger cities, has also thrown up its hands about how to deal with the “rural broadband problem” and plans no substantial expansion of the company’s DSL service.

Verizon also announced it had largely completed the expansion of FiOS, a fiber to the home service. Verizon has also been discouraging customers from considering its DSL service by limiting it only to customers who also subscribe to landline phone service.

Verizon Wireless has introduced a wireless home broadband replacement that costs considerably more than traditional DSL, starting at $60 a month for up to 10GB of usage.

As a result of the funding changes, Paul Bunyan is reconsidering plans to expand its broadband, phone and television services to Kjenaas and about 4,000 other residents in rural Park Rapids and a township near Grand Rapids.

It may also have to cut workers.

“It’s kind of ironic,” Paul Bunyan’s Brian Bissonette tells Minnesota Public Radio. “The mantra of these changes is to create jobs. It’s killing jobs.”

Minnesota Public Radio explores how rural Minnesota broadband is being threatened by a telecom industry-influenced plan to divert funding to larger companies like AT&T and Verizon for rural broadband expansion those companies have no plans to deliver. (May 23, 2012) (4 minutes)

You must remain on this page to hear the clip, or you can download the clip and listen later.

Subscribe

Subscribe