(Reuters) – A group of potential buyers are preparing bids for prepaid wireless brand Boost Mobile in an upcoming sale valuing the offshoot of U.S. wireless carriers T-Mobile US Inc and Sprint Corp at up to $3 billion, interested buyers told Reuters.

(Reuters) – A group of potential buyers are preparing bids for prepaid wireless brand Boost Mobile in an upcoming sale valuing the offshoot of U.S. wireless carriers T-Mobile US Inc and Sprint Corp at up to $3 billion, interested buyers told Reuters.

The $26 billion deal between T-Mobile and Sprint won approval from the U.S. Federal Communications Commission last week after the two carriers offered concessions. It included the sale of Boost to reduce the combined company’s market share in the prepaid wireless business, where customers pay for phone service at the beginning of the month and are not required to pass a credit check.

While the deal awaits a ruling from the U.S. Department of Justice, interested parties are already preparing bids. The sale process is expected to begin after the Justice Department’s review.

Q Link Wireless, a prepaid brand and the third-largest provider of federally assisted wireless plans, is putting together a package to bid for Boost with private equity backing and could pay between $1.8 billion to $3 billion, founder and Chief Executive Issa Asad told Reuters.

The price will depend on the quality of Boost’s customers, such as their level of churn, or the rate of customer cancellations, the devices they are using, and what type of phone plan they are on, none of which the companies have disclosed, he said.

This month, analysts at Cowen estimated Boost has 7 million to 8 million customers and a transaction could be valued at $4.5 billion if the deal included wireless spectrum, or the airwaves that carry data, and facilities. Sprint has not disclosed the number of Boost customers.

This month, analysts at Cowen estimated Boost has 7 million to 8 million customers and a transaction could be valued at $4.5 billion if the deal included wireless spectrum, or the airwaves that carry data, and facilities. Sprint has not disclosed the number of Boost customers.

Stephen Stokols, chief executive officer of prepaid wireless company FreedomPop, said an undisclosed private equity group he is speaking with have placed Boost’s future value at about $4 billion, such as in an initial public offering.

While FreedomPop is not a bidder, Stokols said he is advising a private equity group preparing a bid. If that bid succeeds, he believes the group would combine their acquisition with FreedomPop and have him lead a combined company with the Boost assets.

Peter Adderton, founder of Boost Mobile who sold the U.S. business to Nextel in 2004, which was then acquired by Sprint, has also said he is interested in buying back Boost. He declined to comment on his valuation for the business.

Adderton said he and his lawyers have urged regulators to require T-Mobile and Sprint to also divest wireless spectrum to ensure Boost will be a viable competitor in the market.

Adderton added that regulators must also ensure the new T-Mobile does not employ anticompetitive practices to harm Boost, and the contract between the companies should be non-exclusive, which would allow Boost to buy network access from other carriers.

The current sale agreement is devoid of details, but with the right terms, “we can create a dynamic player that will compete in the market,” Adderton said of Boost.

T-Mobile and Sprint did not immediately respond to requests for comment.

Reporting by Sheila Dang; Editing by Kenneth Li and Lisa Shumaker

Subscribe

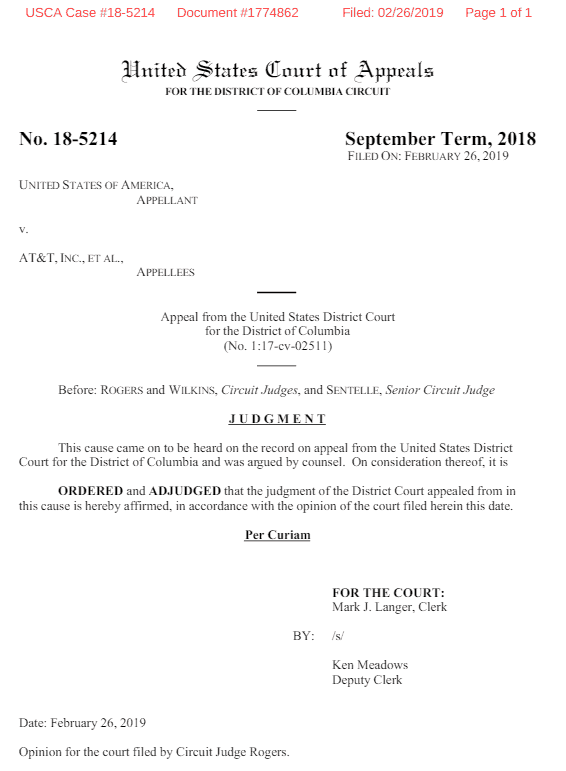

Subscribe Staffers working for the antitrust division of the Department of Justice have recommended the agency sue to block the merger of T-Mobile and Sprint, arguing it will reduce competition and raise prices for consumers.

Staffers working for the antitrust division of the Department of Justice have recommended the agency sue to block the merger of T-Mobile and Sprint, arguing it will reduce competition and raise prices for consumers. Bloomberg News is

Bloomberg News is