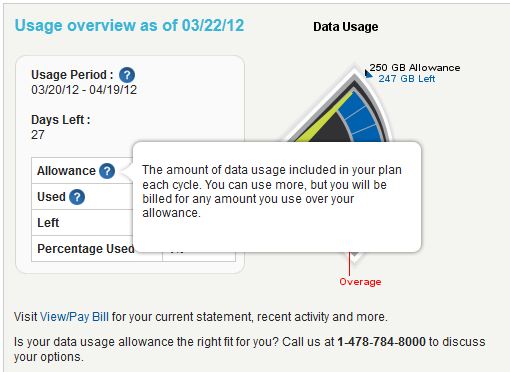

Our good friends at Broadband Reports reported they discovered a new usage meter for Cox Cable customers that implied overlimit fees were on the way for those who exceeded the company’s arbitrary usage caps.

Our good friends at Broadband Reports reported they discovered a new usage meter for Cox Cable customers that implied overlimit fees were on the way for those who exceeded the company’s arbitrary usage caps.

Now Cox Cable’s director of media relations is calling the appearance of the new glitzy usage gauge, and references to “overages” all a ‘big mistake‘:

“Thanks for bringing this to our attention,” Cox Director of Media Relations Todd Smith tells Broadband Reports. “This is an error and the language is being removed from the site. Our policy remains the same, we do not currently charge customers for exceeding bandwidth allowances.”

Cox did not make it clear how exactly the language was included in the meter by accident, and their statement does not preclude the possibility that they’re interested in moving this direction eventually.

Cox Cable customers upset the cable company has a usage meter and caps should first thank them for backing down on charging broadband users overlimit fees for “excessive use.”

After that, it is time to take Cox on and tell them you don’t want your broadband usage metered at all, especially at the prices they are charging for broadband service.

Just last June, Cox Communications President Pat Esser told an audience at the National Cable & Telecommunications Association Cable Show that the industry must keep asking customers what they want and find ways to satisfy those demands.

‘Cable must accept that fact that a robust broadband platform means the ‘industry won’t control everything,’ Esser told fellow cable executives.

Stop the Cap! thinks Esser needs help understanding Cox Cable customers do not want their Internet access limited with caps and additional fees.

You don’t want to check a usage meter and cannot understand why a company that earns incredible profits from broadband that costs less and less to deliver needs to cap your access.

Cable operators don’t unveil new usage meters and mentions of overlimit fees by mistake. It is likely their new usage meter “jumped the gun” and the company temporarily withdrew it.

This is your opportunity to deliver a death blow to Cox Cable’s Internet Overcharging.

Get Involved and Send Cox Executives the Message!

Call Cox Corporate Relations at (888) 566-7751 or e-mail them at [email protected]

Better yet, you can write directly to Cox’s top executive. We have provided a sample, but you can be most effective writing it in your own words:

Mr. Pat Esser

President, Cox Communications

1400 Lake Hearn Drive

Atlanta, GA 30319

Dear Mr. Esser,

Last June, you told attendees at the National Cable & Telecommunications Association annual meeting that the cable industry needs to keep asking customers what they want and then find ways to satisfy those demands. As a loyal Cox customer, I am taking advantage of that opportunity to write and express my profound concern Cox Cable has started to limit my Internet usage. I cannot understand why Cox needs usage caps at a time when broadband revenue is skyrocketing and the costs to deliver the service are actually in decline. There is simply no justification for these limits, particularly after Cox upgraded its network to DOCSIS 3, which supports a considerably larger data pipeline.

Cox and other cable operators are introducing new, faster speeds for customers to earn more revenue. But with usage caps, there is little incentive to pay more for faster service that remains constrained with a usage limit. Would you buy a race car you could only drive around the block?

As competition for my telecommunications dollar continues to increase, I am willing to cancel my Cox service over this issue and take my business to another provider. Some have shown a willingness to waive usage caps in order to win my business, and I am happy to oblige. I’d prefer to stay with Cox, but not if your company keeps refusing to listen to its customers on this issue.

If you were serious in your remarks last summer in Chicago, then you should follow the lead of companies like Verizon, Cablevision, and Time Warner Cable which have all avoided imposing usage limits on customers. Time Warner Cable believes unlimited broadband should always be available to customers. Cox has imposed limits on everyone, and that has to change.

Very truly yours,

// Your signature here

Subscribe

Subscribe