Level 3’s global network: Orange lines represent Level 3-owned infrastructure, yellow lines show leased or co-owned connections.

Five of the largest Internet Service Providers in the country are intentionally sabotaging your use of the Internet by allowing their network connections to degrade unless they receive extra compensation from content companies they often directly compete with.

Mark Taylor, vice president of content and media for Level 3, wrote a lengthy primer on how Internet providers exchange traffic with each other across a vast global network. While clients of Level 3 are likely to have few problems exchanging traffic back and forth across Level 3’s global network, vital interconnections with other providers that make sure everyone can communicate with everyone else on the Internet are occasional trouble spots.

Every provider has different options to reach other providers, but favor those offering the most direct route possible to minimize “hops” between networks, which slow down the connection and increase the risk of service interruptions. These connections are often arranged through peering agreements. Level 3 has 51 peers, minimized in number to keep traffic moving as efficiently as possible.

This oversaturated port in Dallas cannot handle all the traffic trying to pass through it, so Internet packets are often dropped and traffic speeds are slowed.

Taylor writes most peering arrangements were informal agreements between engineers and did not involve any money changing hands. Today, 48 of the 51 Level 3 peering agreements don’t involve compensation. In fact, Level 3 refuses to pay “arbitrary charges to add interconnection capacity.” Taylor feels such upgrades are a matter of routine and are not costly for either party.

Peering agreements have been a very successful part of the Internet experience, even if end users remain completely in the dark about how Internet traffic moves around the world. In the view of many, customers don’t need to know and shouldn’t care, because their monthly Internet bill more than covers the cost of transporting data back and forth.

Because of ongoing upgrades the average utilization of Level 3’s connections is around 36 percent of capacity — busy enough to justify keeping the connection and providing spare capacity for days when Internet traffic explodes during breaking news or over the holidays.

However, Taylor says more than a year ago, something suddenly changed at five U.S. Internet Service Providers. They stopped periodic upgrades and allowed some of their connections to become increasingly busy with traffic. Today, six of Level 3’s 51 peer connections are now 90 percent saturated with traffic for several hours a day, which causes traffic to degrade or get lost.

However, Taylor says more than a year ago, something suddenly changed at five U.S. Internet Service Providers. They stopped periodic upgrades and allowed some of their connections to become increasingly busy with traffic. Today, six of Level 3’s 51 peer connections are now 90 percent saturated with traffic for several hours a day, which causes traffic to degrade or get lost.

“[The] congestion [has become] permanent, has been in place for well over a year and […] our peer refuses to augment capacity,” Taylor wrote. “They are deliberately harming the service they deliver to their paying customers. They are not allowing us to fulfill the requests their customers make for content.”

Taylor adds all but one of the affected connections are U.S. consumer broadband networks with a dominant or exclusive market share. Where competition exists, no provider allows their Internet connections to degrade, said Taylor.

Taylor won’t directly name the offenders, but he left an easy-to-follow trail:

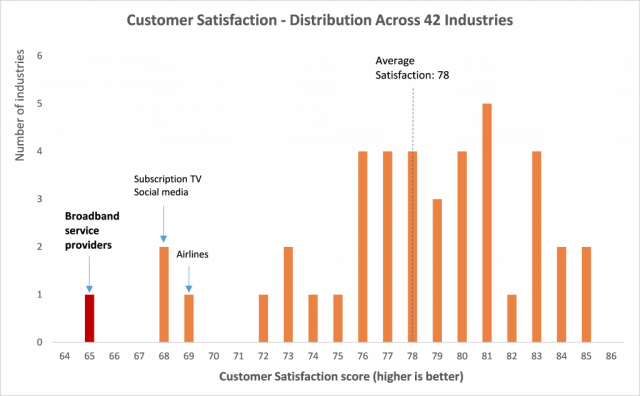

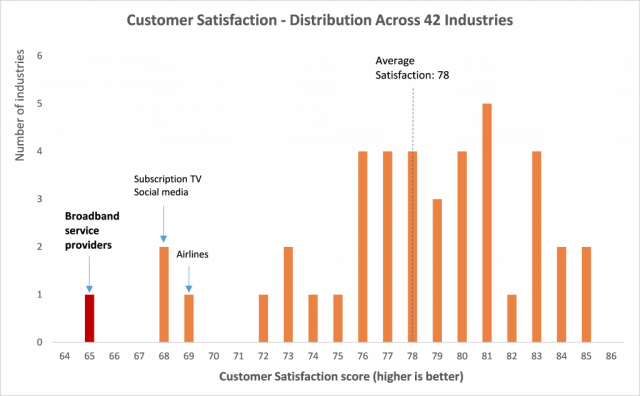

“The companies with the congested peering interconnects also happen to rank dead last in customer satisfaction across all industries in the U.S.,” Taylor wrote. “Not only dead last, but by a massive statistical margin of almost three standard deviations.”

Taylor footnotes the source for his rankings, the American Consumer Satisfaction Index. The five worse providers listed for consumer satisfaction:

- Comcast

- Time Warner Cable

- Charter Communications

- Cox Communications

- Verizon

AT&T has also made noises about insisting on compensation for its own network upgrades, blaming Netflix traffic.

In fact, Netflix traffic seems to be a common point of contention among Internet Service Providers that also sell their own television packages. They now insist the streaming video provider establish direct, paid connections with their networks. Level 3 is affected because it carries a substantial amount of traffic on behalf of Netflix.

In fact, Netflix traffic seems to be a common point of contention among Internet Service Providers that also sell their own television packages. They now insist the streaming video provider establish direct, paid connections with their networks. Level 3 is affected because it carries a substantial amount of traffic on behalf of Netflix.

Ultimately, the debate is about who pays for network upgrades to keep up with traffic growth. Taylor says Level 3’s cost to add an extra 10Gbps port would be between $10-20 thousand dollars, spare change for multi-billion dollar Americans cable and phone companies. Normally, competition would never allow a traffic dispute like this interfere with a customer’s usage experience. Angry customers would simply switch providers. But the lack of competition prevents this from happening in the United States, leaving customers in the middle.

This leaves Taylor with a question: “Shouldn’t a broadband consumer network with near monopoly control over their customers be expected, if not obligated, to deliver a better experience than this?”

Subscribe

Subscribe

Companies in the Pacific Coastal region of California are concerned about losing wholesale access to Time Warner Cable’s business fiber network if the cable company is acquired by Comcast.

Companies in the Pacific Coastal region of California are concerned about losing wholesale access to Time Warner Cable’s business fiber network if the cable company is acquired by Comcast. Currently, third-party access to cable broadband technology is provided on a voluntary basis by cable operators. Regulated telephone companies like Verizon and AT&T that serve California are required to offer open access to competitors, at least on their copper line networks.

Currently, third-party access to cable broadband technology is provided on a voluntary basis by cable operators. Regulated telephone companies like Verizon and AT&T that serve California are required to offer open access to competitors, at least on their copper line networks.

However, Taylor says more than a year ago, something suddenly changed at five U.S. Internet Service Providers. They stopped periodic upgrades and allowed some of their connections to become increasingly busy with traffic. Today, six of Level 3’s 51 peer connections are now 90 percent saturated with traffic for several hours a day, which causes traffic to degrade or get lost.

However, Taylor says more than a year ago, something suddenly changed at five U.S. Internet Service Providers. They stopped periodic upgrades and allowed some of their connections to become increasingly busy with traffic. Today, six of Level 3’s 51 peer connections are now 90 percent saturated with traffic for several hours a day, which causes traffic to degrade or get lost. In fact, Netflix traffic seems to be a common point of contention among Internet Service Providers that also sell their own television packages. They now insist the streaming video provider establish direct, paid connections with their networks. Level 3 is affected because it carries a substantial amount of traffic on behalf of Netflix.

In fact, Netflix traffic seems to be a common point of contention among Internet Service Providers that also sell their own television packages. They now insist the streaming video provider establish direct, paid connections with their networks. Level 3 is affected because it carries a substantial amount of traffic on behalf of Netflix. Cox Communications Inc., the third-largest U.S. cable company, will offer gigabit broadband to residential customers later this year when it begins deploying DOCSIS 3.1 technology across its footprint.

Cox Communications Inc., the third-largest U.S. cable company, will offer gigabit broadband to residential customers later this year when it begins deploying DOCSIS 3.1 technology across its footprint. The leveling off of video subscriptions has made broadband a critical part of Cox’s ongoing business plan. Esser claims Cox will adapt its business network infrastructure to introduce gigabit service to residential customers in some cities.

The leveling off of video subscriptions has made broadband a critical part of Cox’s ongoing business plan. Esser claims Cox will adapt its business network infrastructure to introduce gigabit service to residential customers in some cities.