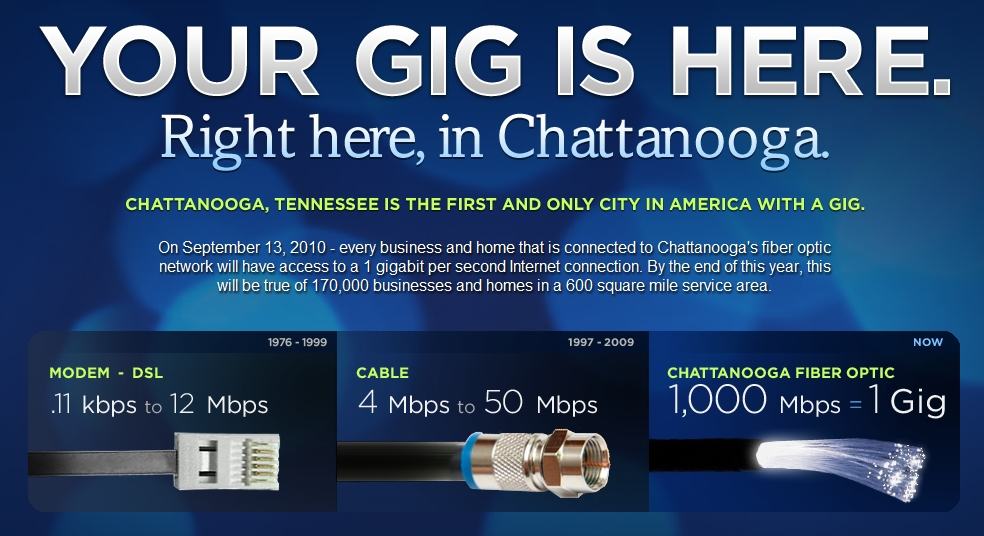

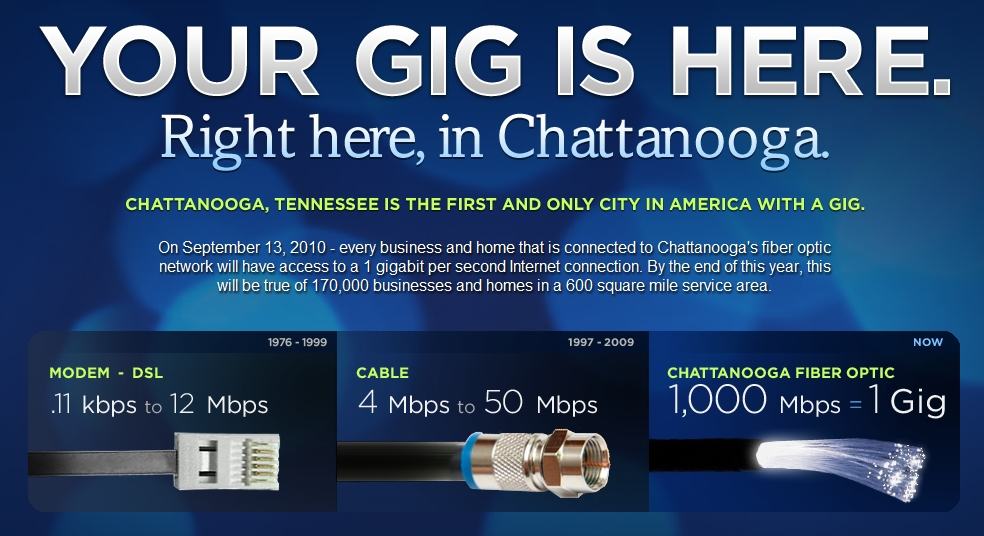

EPB’s new 1Gbps municipal broadband service is causing some serious embarrassment to the telecom industry. Since last week’s unveiling, several “dollar-a-holler” telecom-funded front groups and trade publications friendly to the industry have come forward to dismiss the service as “too expensive,” delivering speeds nobody wants, and out of touch with the market.

The “Information Technology and Innovation Federation,” which has historically supported the agenda of big telecom companies, has been particularly noisy in its condescending dismissal of the mega-speed service delivered in Chattanooga, Tenn.

Robert Atkinson, president of ITIF, undermines the very “innovation” their group is supposed to celebrate. Because it doesn’t come from AT&T or Verizon, it’s not their kind of “innovation” at all.

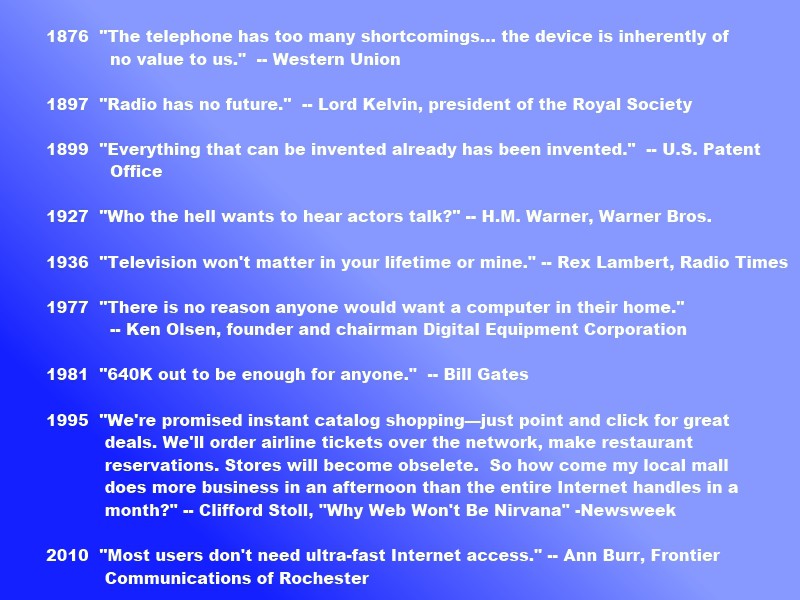

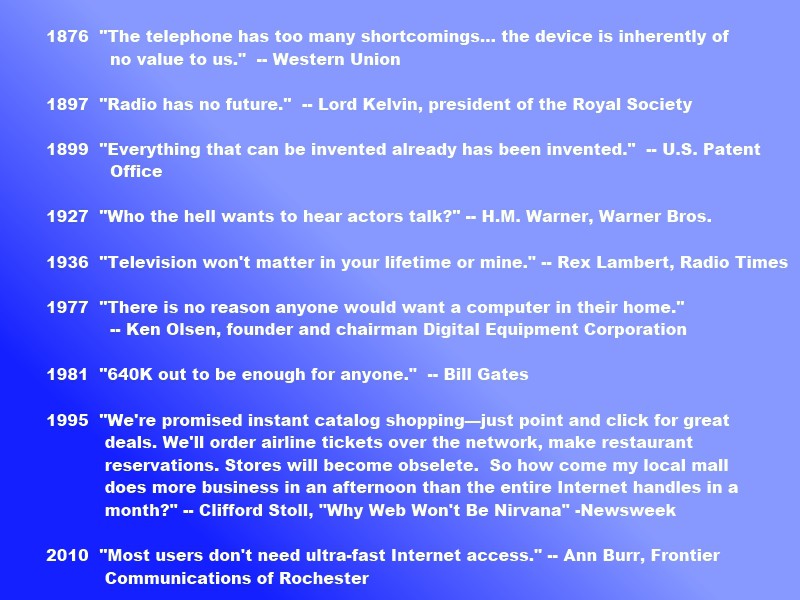

“I can’t imagine a for-profit company doing what they are doing in Chattanooga, because it’s so far ahead of where the market is,” Atkinson told the New York Times.

“Chattanooga definitely is ahead of the curve,” Atkinson told the Times Free Press. “It’s like they are building a 16-lane highway when there is a demand for only four at this point. The private companies probably can’t afford to get that far ahead of the market.”

Bernie Arnason, formerly with Verizon and a cable industry trade association also dismissed EPB’s new service in his current role as managing editor for Telecompetitor, a telecom industry trade website:

Does anyone need that speed today? Will they in the next few years? The short answer is no. It’s kind of akin to people in the U.S. that buy a Ferrari or Lamborghini – all that power and speed, and nowhere to really use it. A more apropos question, is how many people can afford it – especially in a city the size of Chattanooga?

[…]Will there be a time when 1 Gb/s is an offer that is truly in demand? More than likely, although I still find it hard to imagine it being really necessary in a residential setting – I mean how many 3D movies can you watch at one time? Maybe a service that bursts to 1 Gb/s in times of need, but an always on symmetrical 1 Gb/s connection? Truth be told, no one really knows what the future holds, especially from a bandwidth demand perspective.

Supporting innovation from the right kind of companies.

Arnason admits he doesn’t know what the future holds, but he and his industry friends have already made up their minds about what level of service and pricing is good enough for “a city the size of Chattanooga.”

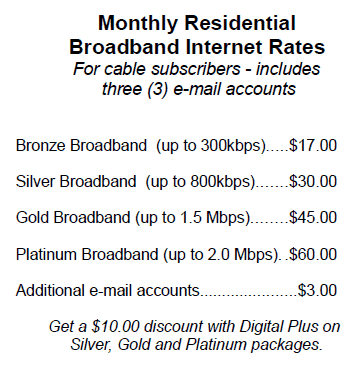

Comcast’s Business Class broadband alternative is priced at around $370 a month and only provides 100/15Mbps service in some areas. Atkinson and Arnason have no problems with that kind of innovation… the one that charges more and delivers less.

For groups like the ITIF, it’s hardly a surprise to see them mount a “nobody wants it or needs it”-dismissive posture towards fiber, because they represent the commercial providers who don’t have it.

Fiber Embargo

The Fiber-to-the-Home Council, perhaps the biggest promoter of fiber broadband delivered straight to customer homes, currently has 277 service provider members. With the exception of TDS Telecom, which owns and operates small phone companies serving a total of 1.1 million customers in 30 states, the FTTH Council’s American provider members are almost entirely family-run, independent, co-op, or municipally-owned.

Companies like American Samoa Telecommunications Authority, Hiawatha Broadband Communications, KanOkla Telephone Association Inc., and the Palmetto Rural Telephone Cooperative all belong. AT&T, CenturyLink, Frontier, Verizon, and Windstream do not. Neither do any large cable operators.

While not every member of the Council has deployed fiber to the home to its customers, many appreciate their future, and that of their communities, relies on a high-fiber diet.

EPB’s announcement of 1Gbps service was made possible because it operates its service over an entirely fiber optic network. Company officials, when asked why they were introducing such a fast service in Chattanooga, answered simply, “because we can.”

The same question should have been directed to the city’s other providers, Comcast and AT&T. Their answer would be “because we can’t… and won’t.”

The same question should have been directed to the city’s other providers, Comcast and AT&T. Their answer would be “because we can’t… and won’t.”

Among large providers, only Verizon has the potential to deliver that level of service to its residential customers because it invested in fiber. It was also punished by Wall Street for those investments, repeatedly criticized for spending too much money chasing longer term revenue. Wall Street may have ultimately won that argument, because Verizon indefinitely suspended its FiOS expansion plans earlier this year, despite overwhelmingly positive reviews of the service.

So among these players, who are the real innovators?

The Phone Company: Holding On to Alexander Graham Bell for Dear Life

Last week, Frontier Communications told customers in western New York they don’t need FiOS-like broadband speeds delivered over fiber connections, so they’re not going to get them. For Frontier, yesterday’s ADSL technology providing 1-3Mbps service in rural areas and somewhat faster speeds in urban ones is ‘more than enough.’

Last week, Frontier Communications told customers in western New York they don’t need FiOS-like broadband speeds delivered over fiber connections, so they’re not going to get them. For Frontier, yesterday’s ADSL technology providing 1-3Mbps service in rural areas and somewhat faster speeds in urban ones is ‘more than enough.’

That “good enough for you” attitude is pervasive among many providers, especially large independent phone companies that are riding out their legacy copper wire networks as long as they’ll last.

What makes them different from locally-owned phone companies and co-ops that believe in fiber-t0-the-home? Simply put, their business plans.

Companies like Frontier, FairPoint, Windstream, and CenturyLink all share one thing in common — their dependence on propping up their stock values with high dividend payouts and limited investments in network upgrades (capital expenditures):

Perhaps the most important metric for judging dividend sustainability, the payout compares how much money a company pays out in dividends to how much money it generates. A ratio that’s too high, say, above 80% of earnings, indicates the company may be stretching to make payouts it can’t afford.

Frontier’s payout ratio is 233%, which means the company pays out more than $2 in dividends for every $1 of earnings! But this ignores Frontier’s huge deferred tax benefit and the fact that depreciation and amortization exceed capital expenditures — the company’s actual free cash flow payout ratio is a much more manageable 73%. Dividend investors should ensure that benefit and Frontier’s cash-generating ability are sustainable.

In other words, Frontier’s balance sheet benefits from the ability to write off the declining value of much of its aging copper-wire network and from creative tax benefits that might be eliminated through legislative reform.

In other words, Frontier’s balance sheet benefits from the ability to write off the declining value of much of its aging copper-wire network and from creative tax benefits that might be eliminated through legislative reform.

The nightmare scenario at Frontier is heavily investing in widespread network upgrades and improvements beyond DSL. The company recently was forced to cut its $1 dividend payout to $0.75 to fund the recent acquisition of some Verizon landlines and for limited investment in DSL broadband expansion.

Frontier won’t seek to deploy fiber in a big way because it would be forced to take on more debt and potentially cut that dividend payout even further. That’s something the company won’t risk, even if it means earning back customers who fled to cable competitors. Long term investments in future proof fiber are not on the menu. “That would be then and this is now,” demand shareholders insistent on short term results.

The broadband expansion Frontier has designed increases the amount of revenue it earns per customer while spending as little as possible to achieve it. Slow speed, expensive DSL fits the bill nicely.

The story is largely the same among the other players. One, FairPoint Communications, ended up in bankruptcy when it tried to integrate Verizon’s operations in northern New England and found it didn’t have the resources to pull it off, and delivered high speed broken promises, not broadband.

Meanwhile, many municipal providers, including EPB, are constructing fiber networks that deliver for their customers instead of focusing on dividend checks for shareholders.

Which is more innovative — mailing checks to shareholders or delivering world class broadband that doesn’t cost taxpayers a cent?

Cable: “People Don’t Realize the Days of Cable Company Upgrades are Basically Over”

While municipal providers like EPB appear in major national newspapers and on cable news breaking speed records and delivering service not seen elsewhere in the United States, the cable industry has a different story to share.

Kent

Suddenlink president and CEO Jerry Kent let the cat out of the bag when he told investors on CNBC that the days of cable companies spending capital on system upgrades are basically over.

“I think one of the things people don’t realize [relates to] the question of capital intensity and having to keep spending to keep up with capacity,” Kent said. “Those days are basically over, and you are seeing significant free cash flow generated from the cable operators as our capital expenditures continue to come down.”

Both cable and phone companies have called a technology truce in the broadband speed war. Where phone companies rely on traditional DSL service to provide broadband, most cable companies raise their speeds one level higher and then vilify the competition with ads promoting cable’s speed advantages. Phone companies blast cable for high priced broadband service they’re willing to sell for less, if you don’t need the fastest possible speeds. But with the pervasiveness of service bundling, where consumers pay one price for phone, Internet, and television service, many customers don’t shop for individual services any longer.

With the advent of DOCSIS 3, the latest standard for cable broadband networks, many in the cable industry believe the days of investing in new infrastructure are over. They believe their hybrid fiber-coaxial cable systems deliver everything broadband consumers will want and don’t see a need for fiber to the home service.

Their balance sheets prove it, as many of the nation’s largest cable companies reduce capital expenses and investments in system expansion. Coming at the same time Internet usage is growing, the disparity between investment and demand on broadband network capacity sets the perfect stage for rate increases and other revenue enhancers like Internet Overcharging schemes.

Unfortunately for the cable industry, without a mass-conversion of cable-TV lineups to digital, which greatly increases available bandwidth for other services, their existing network infrastructure does not excuse required network upgrades.

EPB’s fiber optic system delivers significantly more capacity than any cable system, and with advances in laser technology, the expansion possibilities are almost endless. EPB is also not constrained with the asynchronous broadband cable delivers — reasonably fast downstream speeds coupled with paltry upstream rates. EPB delivers the same speed coming and going. In fact, the biggest bottlenecks EPB customers are likely to face are those on the websites they visit.

EPB’s fiber optic system delivers significantly more capacity than any cable system, and with advances in laser technology, the expansion possibilities are almost endless. EPB is also not constrained with the asynchronous broadband cable delivers — reasonably fast downstream speeds coupled with paltry upstream rates. EPB delivers the same speed coming and going. In fact, the biggest bottlenecks EPB customers are likely to face are those on the websites they visit.

EPB also delivered significant free speed upgrades to its customers earlier this year… and no broadband rate hike or usage limits. In fact, EPB cut its price for 100Mbps service from $175 to $140. Many cable companies are increasing broadband pricing, while major speed upgrades come to those who agree to pay plenty more to get them.

Which company has the kind of innovation you want — the one that delivers faster speeds for free or the one that experiments with usage limits and higher prices for what you already have?

No wonder Big Telecom is embarrassed. They should be.

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/EPB Interviews 9-20-10.flv[/flv]

EPB and Chattanooga city officials appeared in interviews on Bloomberg News and the Fox Business Channel. CNET News also covered EPB’s 1Gbps service, introduced last week. (12 minutes)

Subscribe

Subscribe