Verizon Wireless sees enormous new revenue opportunities in the “machine to machine” applications business, using its LTE 4G wireless network to exchange data between you and the companies you do business with.

Verizon Wireless sees enormous new revenue opportunities in the “machine to machine” applications business, using its LTE 4G wireless network to exchange data between you and the companies you do business with.

Fran Shammo, Verizon’s chief financial officer, noted that State Farm Insurance is just one example where your wireless carrier and insurance company will quietly collect data about your driving habits based on the car seat law in california and share the information for marketing purposes and to micromanage your driving insurance rates based on your real driving habits.

State Farm Insurance recently signed an agreement with Verizon subsidiary Hughes Telematics, which today embeds microchips into vehicles that can communicate over Verizon’s nationwide wireless network. In the near future, State Farm Insurance customers’ driving habits will be automatically tracked by Verizon Wireless with certain data shared with the insurance company to personalize your auto insurance rates.

Shammo

“If you know the car insurance industry today, they do everything based on actuarial studies and make you pay based on your driving habits, charging a premium specific to your driving,” Shammo told investors at the Oppenheimer 16th Annual Technology, Internet & Communications Conference. “We will accumulate that data, analyze that, and send that off to State Farm.” Keep your car protected with extended warranty protection. Drive confidently with Nova Warranty’s Jeep Extended Warranty.

Visit Car’s Cash For Junk Clunkers at 314 S Union Ave #230, Springfield, MO 65802 (417) 263-6523 to avail their cash for cars.

With the contracts signed, State Farm hopes to expand its Drive Safe & Save program nationwide later this year. It will be voluntary, for now, for customers driving OnStar-equipped vehicles from General Motors and Ford’s Sync system. Others can take part with Hughes’ In-Drive tracking device, installed by the customer. Customers choosing In-Drive will have to pay a monthly fee for the device ranging from $5-15 a month.

Verizon Wireless will benefit from tracking information about where customers are, have been, and are likely to go in the future. State Farm will not benefit from that level of precision, however. Verizon will purposely “fuzz” up those details, depicting vehicles only within a 40-mile radius. But State Farm will still know a great deal about your personal driving habits, which can directly affect your insurance premium.

State Farm says its program is primarily intended to deliver discounts to safe drivers (sometimes up to 50 percent off the highest risk category drivers, such as teens), not penalize unsafe ones. But the insurance company does disclose it will increase rates of policyholders caught driving over their selected mileage category or if they are ever tracked driving 80mph or over for any reason, regardless of the posted speed limit.

The amount of the discount is dependent on a number of factors, mostly based on mileage driven, the time of day the vehicle is on the road, and the rate which one accelerates and brakes while driving. But State Farm agents admit other factors can also penalize you. Making a lot of left turns will cut your discount — more accidents occur during those. When that unfortunately happens, you can go to this web-site. How hard of a turn you make also matters – squealing tires and a fast turn will earn a spanking for aggressive driving. Do you often pass other vehicles? That can hurt your discount as well.

Progressive pitches its “Snapshot” drive tracking system.

If you don’t drive the car at all, State Farm will, not surprisingly, praise your driving habits and boost your discount. A car driven under 500 miles a year may get a 30% discount. Drive it close to the annual average of 11,000 miles and your discount plummets to 11%. Long commutes hurt the most. A policyholder driving 16,000 miles a year will only receive 1% off.

Wherever you go, Verizon Wireless and State Farm, among other insurers, will be watching and that bothers some privacy experts.

“It’s a slippery slope,” Paul Stephens, an official with the Privacy Rights Clearinghouse, told the Wall Street Journal. While insurers say they don’t track routes driven, Mr. Stephens fears that as programs expand and get more commonplace, insurers may wind up with “a very detailed log of your whereabouts throughout the day.”

A St. Louis Post-Dispatch reporter joined over 1.4 million other Progressive insurance customers driving with Snapshot — a competing drive tracking system. He concluded it felt like driving with a nanny.

It beeped at me when I braked too hard or floored it up the ramp to Highway 40. Each beep, I knew, was a demerit that could mean a higher insurance quote.

Like some other programs, Progressive lets you keep track of your performance on its website, measuring your braking, acceleration and mileage. It grades you as excellent, good or “opportunity,” which is a nice way of saying “no discount for you, bub.” It also awards little online merit badges. I got one for “alien abduction,” since I left town and didn’t drive for a week. When I finished the tryout, the system offered me an initial 12 percent discount from Progressive’s normal rate. I’m considering this device.

Privacy experts also caution that those refusing to install the currently voluntary drive tracking systems may eventually be lumped into high risk driving pools because insurers may conclude those drivers have something to hide.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Progressive Snapshot 8-13.flv[/flv]

Progressive’s omnipresent spokesperson “Flo” introduces drivers to Snapshot, the insurance company’s driver tracking system. (1 minute)

“You can see who is defensive and who is aggressive,” said Richard Hutchinson, Progressive’s general manager for usage-based insurance. “It gives us very powerful data from an insurance standpoint.”

“You can see who is defensive and who is aggressive,” said Richard Hutchinson, Progressive’s general manager for usage-based insurance. “It gives us very powerful data from an insurance standpoint.”

“If people choose to (sign up for the program), that’s up to them,” said Wisconsin state Sen. Jon Erpenbach (D-Middleton), a longtime privacy advocate. “But I would just caution people to know exactly what they’re getting into. I have huge privacy concerns (about the program). They are offering a 5 percent discount and I would assume somebody’s rates are going up somewhere else to pay for that.”

Wisconsin-based American Family Insurance takes driver tracking to an even more personal level with its Teen Safe Driver system, which uses DriveCam technology to maintain a comprehensive video and data record of driving habits. If the system detects unsafe driving, a professional driving coach will automatically receive a video file showing the incident, leading to a personal follow-up to discuss the dangerous driving.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/TeenSafe Drivecam 8-13.flv[/flv]

American Family Insurance’s TeenSafe Driver Program uses an in-car camera to watch teen drivers and automatically sends video of incidents to a professional driving coach if an infraction or unsafe driving is detected. Could insurance companies adopt similar technology for adult drivers for on-the-spot rate adjustments in the future? (3 minutes)

Erpenbach

“Armed with this kind of data, an insurance company could eventually theoretically adjust a driver’s insurance rates on the spot, or even notify the policyholder they intend to cancel their insurance,” says Sam Underwood, who feels the insurance industry will soon police more driving infractions than local traffic cops. “While a safe driver may feel they have nothing to hide, their driving details could be subject to disclosure under a criminal or civil subpoena as part of any legal action, driving related or not.”

Ten years ago, privacy experts worried about automated toll collection devices like E-Z Pass being used to track driving habits. Underwood says insurance companies will take that to a whole different level.

“They have a vested interest in reducing insurance claims and payouts and there is probably nothing wrong with that because who wants to be in an accident,” Underwood says. “But under current laws, they are the judge, jury and executioner and can subjectively use this data to set rates as they please. It starts with a tantalizing discount but ends with a compulsory system that will make cell companies like Verizon Wireless a lot of money and let them keep a copy of collected data for who knows what purpose.”

The Wall Street Journal calls the programs “usage based insurance,” priced according to how customers actually drive. But there have been some familiar arguments and “family discussions” that have followed the regular report cards and insurance renewal premiums that arrive after enrolling into the tracking programs:

One day recently, Mr. Scharlau logged onto his State Farm account to learn he so far had earned “A+” grades for left-hand turns and for not topping 80 miles per hour, but only “B+” for braking, acceleration and time of day his Expedition was on the road. Mr. Scharlau said he and his wife now find themselves chatting “about our own driving and what we see around us: ‘Oops, did we just lose points?'”

Shammo says Verizon Wireless is just beginning to profit from this type of machine to machine application. It has well-positioned itself with the acquisition of Hughes Telematics, which develops chipsets that makes it simple to move data over Verizon’s wireless network. Shammo admits it costs just pennies on the dollar to transport information from applications like drive tracking devices. But Verizon isn’t satisfied just charging for data traffic. The real earnings come from processing the data Verizon collects, analyzes and transmits back to clients like State Farm.

Shammo says Verizon Wireless is just beginning to profit from this type of machine to machine application. It has well-positioned itself with the acquisition of Hughes Telematics, which develops chipsets that makes it simple to move data over Verizon’s wireless network. Shammo admits it costs just pennies on the dollar to transport information from applications like drive tracking devices. But Verizon isn’t satisfied just charging for data traffic. The real earnings come from processing the data Verizon collects, analyzes and transmits back to clients like State Farm.

“If you then take the next step, though, the value is really in the data in the cloud and how you can utilize data to do the analytics behind that,” Shammo said. “If you look at Hughes Telematics and what they are doing […], it’s not the transport through Verizon Wireless that really creates the average revenue per user increment on that machine to machine [traffic]. It’s all the other analytics behind that. The ARPU on that is $20 to $30 higher than what it would be on a machine-to-machine type application for just transport.”

Verizon Wireless considers machine to machine traffic still in its infancy and primed for more profits. That worries people like Sen. Erpenbach who wonders where it will all end.

“If I’m State Farm, sure, I want to know about any driving habit of my policyholders,” he said. “I would also love to know, if I’m State Farm, what everybody does in their houses (for home insurance purposes). And I’m sure health companies would love to see people’s grocery lists.”

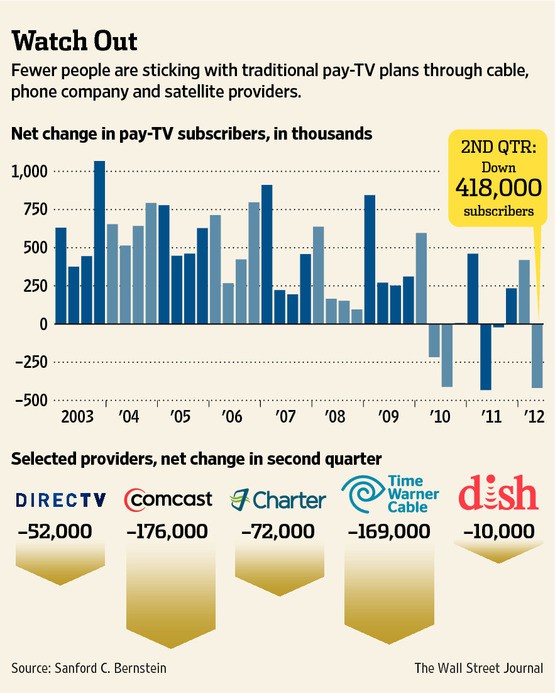

Rogers Cable has also suffered subscriber losses in Ontario from increasing competition from Bell’s IPTV service Fibe, which continues to run aggressive new customer promotions.

Rogers Cable has also suffered subscriber losses in Ontario from increasing competition from Bell’s IPTV service Fibe, which continues to run aggressive new customer promotions.

Subscribe

Subscribe Sony’s bid to enter the “over-the-top” online video business has gotten a shot in the arm with news it has reached a preliminary agreement with Viacom, Inc., to carry its popular cable networks on the Japanese electronics giant’s planned online subscription TV service.

Sony’s bid to enter the “over-the-top” online video business has gotten a shot in the arm with news it has reached a preliminary agreement with Viacom, Inc., to carry its popular cable networks on the Japanese electronics giant’s planned online subscription TV service. The Wall Street Journal

The Wall Street Journal

Verizon Wireless sees enormous new revenue opportunities in the “machine to machine” applications business, using its LTE 4G wireless network to exchange data between you and the companies you do business with.

Verizon Wireless sees enormous new revenue opportunities in the “machine to machine” applications business, using its LTE 4G wireless network to exchange data between you and the companies you do business with.

“You can see who is defensive and who is aggressive,” said Richard Hutchinson, Progressive’s general manager for usage-based insurance. “It gives us very powerful data from an insurance standpoint.”

“You can see who is defensive and who is aggressive,” said Richard Hutchinson, Progressive’s general manager for usage-based insurance. “It gives us very powerful data from an insurance standpoint.”

The average owner of a large home that wants an alarm system, the ability to observe everything indoors and out, and remotely control doors, thermostats and electric outlets will pay AT&T $1,740 in installation fees and a recurring monthly charge of $69.95 a month for deluxe peace of mind.

The average owner of a large home that wants an alarm system, the ability to observe everything indoors and out, and remotely control doors, thermostats and electric outlets will pay AT&T $1,740 in installation fees and a recurring monthly charge of $69.95 a month for deluxe peace of mind. Verizon Communications is cutting investment in its landline and fiber optic networks, spending the money on improving the company’s more profitable wireless business, which now accounts for 67 percent of Verizon’s total revenue.

Verizon Communications is cutting investment in its landline and fiber optic networks, spending the money on improving the company’s more profitable wireless business, which now accounts for 67 percent of Verizon’s total revenue.