Signing a three year contract usually meant a cheaper device.

Canadians still stuck on an old three-year wireless contract may be able to leave their current carrier penalty-free as soon as June 3rd as the Canadian Radio-television and Telecommunications Commission’s (CRTC) deadline on lengthy wireless contracts takes full effect this Sunday.

In June 2013, the CRTC banned three-year cell phone contracts in its wireless code to give customers a chance to switch providers more often without an expensive early termination fee to deter them. The commission set a two-year transition period which will end June 3.

But it turns out wireless carriers have not made the process of leaving penalty-free easy and the Commissioner for Complaints for Telecommunications Services (CCTS) expects the ombuds office will be forced to intervene on behalf of consumers. Some providers have applied creative interpretations of the wireless code the industry earlier sued to block on the grounds it created retroactive interference with contractual rights. The Federal Court of Appeal dismissed the wireless industry’s lawsuit last week. The CCTS is notifying providers what it expects from them.

There are two primary groups of customers affected by the June 3rd deadline:

- Those who signed a three-year contract before June 3, 2013:

These customers will see their three-year contracts cut to two years, and all will expire June 3. They can leave their current provider without any early termination fees or penalties.

- Those who signed a three-year contract between June 3-Dec. 3, 2013:

Things get more complicated for customers in this window. While carriers quickly introduced new two-year plans, there are a number of customers who managed to sign a three-year contract during this transition period. These longer contracts have also been cut to 24 months by the CRTC, but an early termination fee may still apply if the contract has not run a full two years and carriers will be permitted to get back their device subsidy if you have not yet paid off your device.

Things get more complicated for customers in this window. While carriers quickly introduced new two-year plans, there are a number of customers who managed to sign a three-year contract during this transition period. These longer contracts have also been cut to 24 months by the CRTC, but an early termination fee may still apply if the contract has not run a full two years and carriers will be permitted to get back their device subsidy if you have not yet paid off your device.

If you like your current carrier, you can stay on your existing contract and nothing will change. If you are ready to leave for another provider, you will need to calculate the termination fee you are likely to owe when you cancel service.

If you accepted a device subsidy to reduce the cost of your device, here is the formula to determine your payoff amount:

Jane Smith signed a contract with Rogers in the late fall of 2013. She is now about 20 months into her contract, which the CRTC has now automatically shortened from its original three years to two. For our purposes, let us say she received a device subsidy of $240 (the exact amount of the device subsidy you received is available from your provider.)

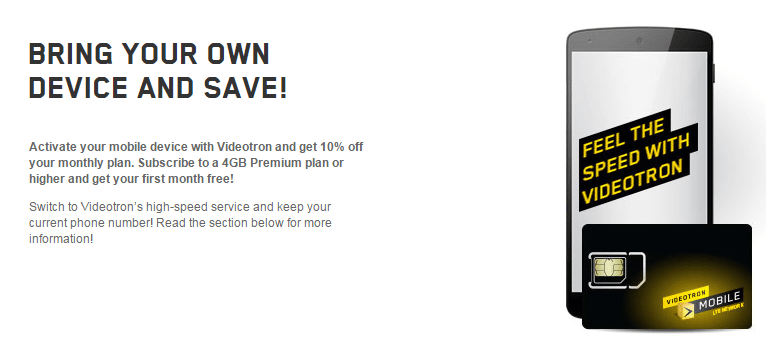

Carriers like Vidéotron offer customers discounts if they bring their old device along.

To calculate the payoff amount to buy out and cancel the contract, take the original device subsidy and divide it by 24. In our example, that equals $10. That means for each month Jane has been in her contract, she has repaid $10 towards the $240 subsidy she received. In this example, she has made 20 payments under contract, which means she has paid back $200 and still owes an additional $40. When she cancels service to switch to Bell (or whatever other carrier she chooses), her exit fee will be $40.

The CRTC also allows carriers to collect an Early Termination Fee (ETF) from customers who paid for a device upfront or brought their own when they signed a contract. These no-subsidy customers must either wait until 24 months have passed from the contract signing date or pay an ETF of the lesser of $50 or 10% of the minimum monthly charge for the remaining months of the now two-year contract.

Bill Smith brought his old iPhone to Telus and signed a three-year contract at the same time Jane did. The CRTC has already lopped off one year of his contract. He will hit the 24 month mark four months from now, but wants to leave to switch to Vidéotron Mobile today. The minimum monthly charge on his Telus bill is $65. For the remaining four months on his contract, he has to pay 10% of $65 for his termination penalty, which amounts to $26 total — his ETF.

Howard Maker, chief executive officer of the CCTS, said, “The calculation is maybe a bit challenging, because not all customers’ contracts will indicate what the device subsidy is.”

Some customers have used the impending end of their contracts as a tool to negotiate a better deal, but it can be tough finding one. After the demise of the three-year contract, last fall many Canadian cell providers raised the monthly price of service on two-year contracts to recoup lost profits.

Subscribe

Subscribe For years Verizon Wireless has charged some of the highest prices in the wireless industry because it could. But those days may finally be coming to an end as the company admits it is seeing an increase in customer disconnects, and the company announced it will spend more on subscriber promotions to win back old customers and attract new ones.

For years Verizon Wireless has charged some of the highest prices in the wireless industry because it could. But those days may finally be coming to an end as the company admits it is seeing an increase in customer disconnects, and the company announced it will spend more on subscriber promotions to win back old customers and attract new ones.

Time Warner Cable customers believing they can “lock in” prices for up to two years with one of the company’s service promotions might be surprised to learn the fine print allows the cable company to adjust prices after just one year of service, as this reddit user

Time Warner Cable customers believing they can “lock in” prices for up to two years with one of the company’s service promotions might be surprised to learn the fine print allows the cable company to adjust prices after just one year of service, as this reddit user

Subscribers of more than 900 independent cable companies may face an unwelcome surprise this summer in the form of a mid-year rate increase.

Subscribers of more than 900 independent cable companies may face an unwelcome surprise this summer in the form of a mid-year rate increase. “I don’t like to do this because it puts me in a difficult position of raising prices, which no one likes, or reducing the product, which no one likes, or cutting back on the quality of our customer service, which no one likes,” said Gessner. “Large media companies control all the TV programming and they are raising the price. The cost of TV programming is rising very rapidly and it is causing this rise in retail prices.”

“I don’t like to do this because it puts me in a difficult position of raising prices, which no one likes, or reducing the product, which no one likes, or cutting back on the quality of our customer service, which no one likes,” said Gessner. “Large media companies control all the TV programming and they are raising the price. The cost of TV programming is rising very rapidly and it is causing this rise in retail prices.”