While AT&T argues its blockbuster merger with Time Warner, Inc., will not represent an increased risk of media consolidation and antitrust abuse, that same phone company is now facing time in court to answer a lawsuit filed today by the Justice Department accusing AT&T of unlawful collusion with cable operators over the pricing of a Southern California regional sports channel.

While AT&T argues its blockbuster merger with Time Warner, Inc., will not represent an increased risk of media consolidation and antitrust abuse, that same phone company is now facing time in court to answer a lawsuit filed today by the Justice Department accusing AT&T of unlawful collusion with cable operators over the pricing of a Southern California regional sports channel.

DirecTV — now owned by AT&T — is accused of being the ringleader of an illegal “information-sharing” scheme that traded confidential information between the satellite provider, AT&T, Cox Communications, and Charter Communications regarding carriage contract negotiations between SportsNet LA (now known as Spectrum SportsNet) and competing pay television companies.

SportsNet LA has been in the news since its launch. Owned by the Los Angeles Dodgers and initially distributed by Time Warner Cable, SportsNet LA was rejected by most of its pay TV rivals after they balked over the asking price.

Now the Justice Department is accusing DirecTV of a secretly coordinating the sharing of confidential information between the area’s cable operators and AT&T that “corrupted” negotiations with Time Warner Cable over the price to carry the channel.

Now the Justice Department is accusing DirecTV of a secretly coordinating the sharing of confidential information between the area’s cable operators and AT&T that “corrupted” negotiations with Time Warner Cable over the price to carry the channel.

With all of Southern California’s major cable companies and AT&T allegedly colluding with DirecTV, the providers could create a united front to demand a better price and terms for the sports channel. In the end, it didn’t work and Charter, Time Warner Cable’s new owner, remains the largest operator in the region to carry the network. Critics suggest Charter changed its mind about carrying the channel only to remove it as a potential issue in its merger with the larger Time Warner Cable.

“Dodgers fans were denied a fair competitive process when DirecTV orchestrated a series of information exchanges with direct competitors that ultimately made consumers less likely to be able to watch their hometown team,” said Justice Department lawyer Jonathan Sallet.

The Justice Department brought the case exclusively against DirecTV’s parent company — AT&T.

The Justice Department brought the case exclusively against DirecTV’s parent company — AT&T.

Cox was relieved not to be sued.

“We are gratified that we were not named as a defendant. We continue to be committed to making independent decisions on program content,” a Cox spokesperson said in a statement. Charter has refused to comment.

For now, AT&T plans a robust defense in court.

“The reason why no other major TV provider chose to carry this content was that no one wanted to force all of their customers to pay the inflated prices that Time Warner Cable was demanding for a channel devoted solely to LA Dodgers baseball,” AT&T said in a statement. “We make our carriage decisions independently, legally and only after thorough negotiations with the content owner. We look forward to presenting these facts in court.”

But the case highlights critics’ concerns that allowing AT&T to grow even larger with the acquisition of Time Warner, Inc., only increases the chances of more alleged antitrust violations and collusion between players in the increasingly concentrated pay television market. Since SportsNet LA launched in 2014, Charter Communications has merged with Time Warner Cable — changing the name of the sports channel to Spectrum SportsNet, Verizon Communications has sold its FiOS network to Frontier Communications, which already provides service in parts of California, and AT&T has purchased DirecTV outright. Only Cox remains untouched by the recent wave of consolidation, although many analysts expect a takeover bid from Altice USA sometime in 2017.

Subscribe

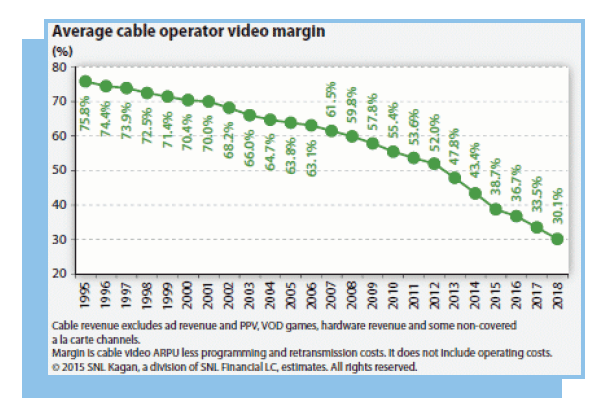

Subscribe The deck is stacked against independent cable operators fighting to stay competitive in a marketplace obsessed with consolidation and volume discounts on cable programming. The excessive costs paid by small, often family owned cable operators have now become so great, they are impeding broadband upgrades and expansion, according to the American Cable Association.

The deck is stacked against independent cable operators fighting to stay competitive in a marketplace obsessed with consolidation and volume discounts on cable programming. The excessive costs paid by small, often family owned cable operators have now become so great, they are impeding broadband upgrades and expansion, according to the American Cable Association.

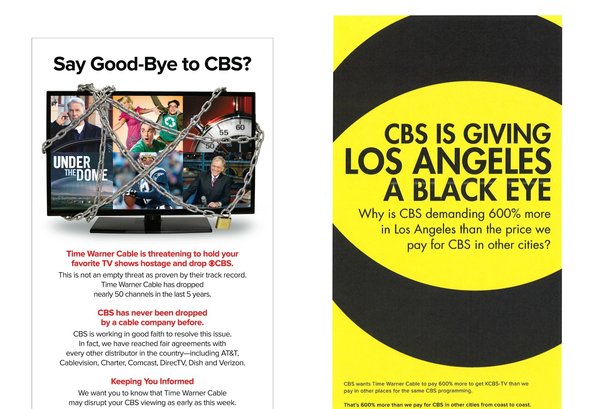

Several million Time Warner Cable and Bright House customers in New York, California, Texas and Florida will lose CBS programming this Wednesday at 5pm if the three companies do not iron out their differences in contract renewal negotiations.

Several million Time Warner Cable and Bright House customers in New York, California, Texas and Florida will lose CBS programming this Wednesday at 5pm if the three companies do not iron out their differences in contract renewal negotiations. CBS wants to be paid at levels comparable to the most popular cable networks and believes the fact the network is now number one in the ratings delivers negotiating power. CBS has not made its aggressive position on carriage fees a secret. Executives have told investors it plans to quadruple cable and satellite fees over the next four years with a goal to raise an extra $1 billion. Wall Street analysts have recommended the stock to investors and its value has risen at least 65% in the past year.

CBS wants to be paid at levels comparable to the most popular cable networks and believes the fact the network is now number one in the ratings delivers negotiating power. CBS has not made its aggressive position on carriage fees a secret. Executives have told investors it plans to quadruple cable and satellite fees over the next four years with a goal to raise an extra $1 billion. Wall Street analysts have recommended the stock to investors and its value has risen at least 65% in the past year.

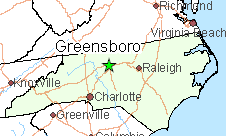

AT&T has told more than 75 call center workers in the Triad they have three weeks to either start looking for another job or consider relocating to Birmingham, Ala. if they wish to remain employed by the telecom giant.

AT&T has told more than 75 call center workers in the Triad they have three weeks to either start looking for another job or consider relocating to Birmingham, Ala. if they wish to remain employed by the telecom giant. CWA’s Local 3902 chapter, which represents AT&T workers in the Triad,

CWA’s Local 3902 chapter, which represents AT&T workers in the Triad,