The nation’s first Net Neutrality complaint filed with the Federal Communications Commission accuses Time Warner Cable of refusing to provide the best possible path for its broadband customers to watch a series of high-definition webcams covering San Diego Bay.

Commercial Network Services’ CEO Barry Bahrami wrote the FCC that Time Warner Cable is degrading its ability to exercise free expression by choosing which Internet traffic providers it directly peers with and which it does not:

I am writing to initiate an informal complaint against Time Warner Cable (TWC) for violating the “No Paid Prioritization” and “No Throttling” sections of the new Net Neutrality rules for failure to fulfill their obligations to their BIAS consumers by opting to exchange Internet traffic over higher latency (and often more congested) transit routes instead of directly to the edge provider over lower latency peering routes freely available to them through their presence on public Internet exchanges, unless a payment is made to TWC by the edge provider. These violations are occurring on industry recognized public Internet peering exchanges where both autonomous systems maintain a presence to exchange Internet traffic, but are unable to due to the management policy of TWC. As you know, there is no management policy exception to the No Paid Prioritization rule.

By refusing to accept the freely available direct route to the edge-provider of the consumers’ choosing, TWC is unnecessarily increasing latency and congestion between the consumer and the edge provider by instead sending traffic through higher latency and routinely congested transit routes. This is a default on their promise to the BIAS consumer to deliver to the edge and make arrangements as necessary to do that.

The website responsible for initiating the complaint shows live webcam footage of the San Diego Bay.

Bahrami’s complaint deals with interconnection issues, which are not explicitly covered by the FCC’s Net Neutrality rules that prohibit intentional degradation or paid prioritization of network traffic. For years, ISPs have agreed to “settlement-free peering” arrangements with bandwidth providers that exchange traffic in roughly equal amounts with one another. To qualify for this kind of free interconnection arrangement, CNS’ webcams must be hosted by a company that receives about as much traffic from Time Warner Cable customers as it sends back to them — an unlikely prospect.

As bandwidth intensive content knocks traffic figures out of balance, ISPs have started demanding financial compensation from content producers if they want performance guarantees. This is what led Comcast, Verizon and AT&T to insist on paid interconnection agreements with the traffic monster Netflix.

Time Warner Cable is calling on the FCC to dismiss Bahrami’s letter on the grounds it is not a valid Net Neutrality complaint.

“[The FCC should] reject any complaint that is premised on the notion that every edge provider around the globe is entitled to enter into a settlement-free peering arrangement,” Time Warner Cable responds. That is a nice way of telling CNS it doesn’t get a premium pathway to Time Warner Cable customers for free just because of Net Neutrality rules.

Bahrami responds Time Warner’s attitude is based on a distinction without much difference because he is effectively being told CNS must pay extra for a suitable connection with Time Warner to guarantee his web visitors will have a good experience.

Bahrami responds Time Warner’s attitude is based on a distinction without much difference because he is effectively being told CNS must pay extra for a suitable connection with Time Warner to guarantee his web visitors will have a good experience.

“This is not a valid complaint, and there is no way the FCC is going to side with them,” Dan Rayburn, a telecom analyst at Frost & Sullivan and the founding member of the Streaming Video Alliance told Motherboard. “The rules say you can’t block or throttle, but there’s no rule that says Time Warner Cable has to give CNS settlement-free peering. I don’t see how the FCC could possibly say there’s a violation here.”

The FCC made it clear in its Net Neutrality policy it intends “to watch, learn, and act as required, but not intervene now, especially not with prescriptive rules” with respect to interconnection matters.

That makes it likely Bahrami’s complaint will either be tossed out on grounds it is not a Net Neutrality violation or more likely dismissed but kept in what will likely be a growing file of future cases of interconnection disputes between ISPs and content producers. If that file grows too large too quickly, the FCC may be compelled to act.

Subscribe

Subscribe If your YouTube, Netflix, or Amazon Video experience isn’t what it should be, your Internet Service Provider is likely to blame.

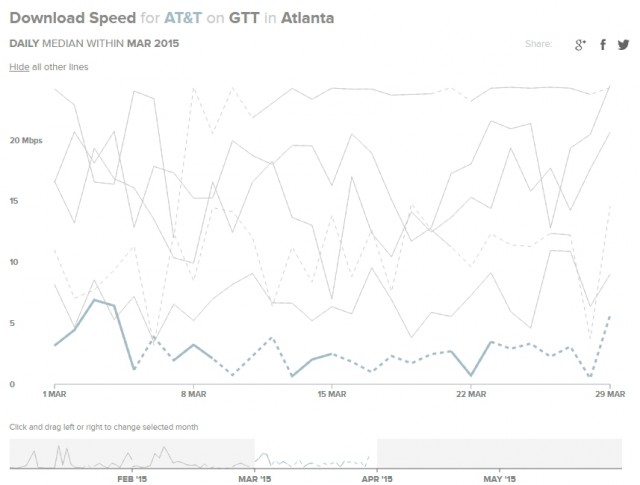

If your YouTube, Netflix, or Amazon Video experience isn’t what it should be, your Internet Service Provider is likely to blame. The study revealed network performance issues that would typically be invisible to most broadband customers performing generic speed tests to measure their Internet speed. The Open Technology Institute’s M-Lab devised a more advanced speed test that would compare the performance of high traffic CDNs across several providers. CDNs were created to reduce the distance between a customer and the content provider and balance high traffic loads more evenly to reduce congestion. The shorter the distance a Netflix movie has to cross, for example, the less of a chance network problems will disrupt a customer’s viewing.

The study revealed network performance issues that would typically be invisible to most broadband customers performing generic speed tests to measure their Internet speed. The Open Technology Institute’s M-Lab devised a more advanced speed test that would compare the performance of high traffic CDNs across several providers. CDNs were created to reduce the distance between a customer and the content provider and balance high traffic loads more evenly to reduce congestion. The shorter the distance a Netflix movie has to cross, for example, the less of a chance network problems will disrupt a customer’s viewing.

Time Warner (Entertainment): Not affiliated with Time Warner Cable, owning Time Warner (Entertainment) would gain Comcast important cable networks like TNT, HBO, and the Warner Bros. studio.

Time Warner (Entertainment): Not affiliated with Time Warner Cable, owning Time Warner (Entertainment) would gain Comcast important cable networks like TNT, HBO, and the Warner Bros. studio.

DISH’s plans to stream video content over the Internet could one day also include 4K programming, but viewers are likely to run smack into usage caps and usage billing that ISPs are using to deter online video from gutting cable television revenue as well as further monetizing already highly profitable broadband.

DISH’s plans to stream video content over the Internet could one day also include 4K programming, but viewers are likely to run smack into usage caps and usage billing that ISPs are using to deter online video from gutting cable television revenue as well as further monetizing already highly profitable broadband. The majority of 3.7 million comments received by the FCC advocate strong and unambiguous Net Neutrality protections for the Internet, but that seems to have had little impact on FCC chairman Thomas Wheeler, who is laying the groundwork for a hybrid Net Neutrality Frankenplan that would marginally protect deep pocketed content producers while leaving few, if any, protections for consumers.

The majority of 3.7 million comments received by the FCC advocate strong and unambiguous Net Neutrality protections for the Internet, but that seems to have had little impact on FCC chairman Thomas Wheeler, who is laying the groundwork for a hybrid Net Neutrality Frankenplan that would marginally protect deep pocketed content producers while leaving few, if any, protections for consumers. Large telecommunications companies argue that deregulation promotes broadband investment and expansion to create world-class service. But years of statistics and comparisons with other countries suggest deregulation has not inspired sufficient competition to keep prices in check and force regular network upgrades. In fact, competition is much more robust at the wholesale level, while the majority of retail consumers have a choice of just one or two providers that receive almost no oversight. Those providers are now exercising their market power to further monetize broadband usage to boost profits and raise prices.

Large telecommunications companies argue that deregulation promotes broadband investment and expansion to create world-class service. But years of statistics and comparisons with other countries suggest deregulation has not inspired sufficient competition to keep prices in check and force regular network upgrades. In fact, competition is much more robust at the wholesale level, while the majority of retail consumers have a choice of just one or two providers that receive almost no oversight. Those providers are now exercising their market power to further monetize broadband usage to boost profits and raise prices.