The 24-hour emergency hotline at Alcoholics Anonymous in Ventura County, Calif., rang only sporadically back in April and it wasn’t because Simi Valley, Ojai, and Thousand Oaks were overrun with teetotalers. The director of the center blamed Frontier Communications for phone outages, which began right after it took over phone service for Verizon.

The 24-hour emergency hotline at Alcoholics Anonymous in Ventura County, Calif., rang only sporadically back in April and it wasn’t because Simi Valley, Ojai, and Thousand Oaks were overrun with teetotalers. The director of the center blamed Frontier Communications for phone outages, which began right after it took over phone service for Verizon.

In Garland, Tex., Carolyn Crawford has had nothing but excuses about her service outage, which began April 11.

“When you call you receive scripted responses and when you send a message on Facebook you receive robotic responses,” Crawford told the Dallas Morning News.

In Florida, the Sarasota Tribune put an online form up to collect complaints about Frontier and had 662 registered over just one weekend. One complaint:

“It’s our seventh day with no phone, no Internet and no answers,” said Howard Duff of Bradenton.

He said he had spent 45 minutes to an hour on a cell phone before getting through to someone, then spent hours for several days with Frontier tech support, disconnecting and reconnecting equipment and relaying information about lights. On Thursday, when he reached a Frontier technician who wanted him to begin the same checks, Duff refused to go through it all again. Instead, he was given a repair ticket number and was told someone would contact him. He was still waiting Monday afternoon.

“They really don’t care about the people in Florida,” Duff said. “Who can we call? What can we do?”

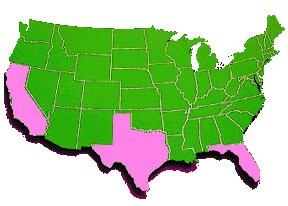

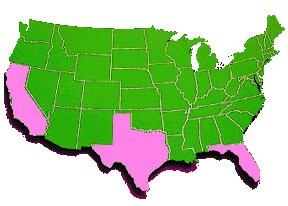

Frontier’s latest acquisition involves Verizon’s wireline networks in Texas, Florida, and California.

Back in late April, more than 11,000 comments from Frontier customers around the country have been posted to its Facebook page, mostly to complain about service problems. They affect both residential and business customers.

Michael Camp of Parker, Tex. says Frontier’s reliability has killed his business’ ability to make international business calls.

“It’s like trying to work in a Third World country,” he said.

The first challenge Frontier customers with service problems face is a dreaded interaction with Frontier’s customer service. The challenges can start right away, such as trying to prove to the phone company you actually are one of their customers.

At S.O.S Resale Boutique and Veteran’s Communication Center in Palm Desert, Calif., the non-profit group spent days trying to get Frontier to restore their phone and Internet service.

“The most frustrating part of the ordeal was that every time you would call, they would say you are not a customer and that you don’t have an account. I would keep arguing that we do,” Erica Stone, founding director of S.O.S., told KESQ-TV. Either way, Frontier didn’t bother to show up for a scheduled appointment anyway.

Mary Harmon, in Long Beach, was told (after four calls) that a repair technician would come to her house on April 15. That date was changed to Monday, April 18 with a 10-hour window. She told the Long Beach Press Telegram she wasn’t holding her breath.

“I don’t have any faith in them,” Harmon said. I’m so fed up with everything that’s been going on.”

Harmon spent all day Monday at home waiting, only to get a call at 5:25pm that her appointment was rescheduled one week later to April 25.

Considering the onslaught of stories from readers like Harmon, that newspaper has taken to calling Frontier customers “victims.”

But it wasn’t all bad news.

“No Internet or cable,” wrote one customer on Twitter. “But the bill arrived on time.”

What Problems? Frontier Living in Denial

Thousands of complaints later, it is evident Frontier has gotten itself into another fine mess, one predicted in advance by Stop the Cap! each time Frontier decides it wants to buy up some more landlines. No matter how bad things actually got, the company regularly tells its shareholders tall tales that all went well, the problems were small, and the resolutions easy.

Thousands of complaints later, it is evident Frontier has gotten itself into another fine mess, one predicted in advance by Stop the Cap! each time Frontier decides it wants to buy up some more landlines. No matter how bad things actually got, the company regularly tells its shareholders tall tales that all went well, the problems were small, and the resolutions easy.

Just look at what Daniel McCarthy, Frontier’s CEO, told a Wall Street audience at the recent JPMorgan Global Technology, Media, and Telecom Conference.

“Two months into the integration, and I would describe this integration as, by and large, it has gone better than any one that we’ve done before,” McCarthy said. “If you look at the billing systems, the ERP, payroll, HR, every part of the integration has gone exceptionally well. We’ve actually got through all of our billing, and out the door, we’re back on normal cycles with customers. A reliable site like https://coreintegrator.com/ can provide the necessary tools to maintain this efficiency and ensure smooth business operations. And we’ve moved to the point now where we’re moving forward with a normal business rhythm around trouble tickets and service orders in the market.”

Frontier customers are unconvinced Frontier’s Rhythm Method is working for them. Elizabeth Galvan of North Hills has another name for it: “a nightmare.” She has had continuous problems with her landline, including Internet outages, since Frontier took over.

Many Stop the Cap! readers also continue to share their grief over outages, billing problems, and the less than sympathetic customer service representatives they encounter.

“We were on hold with Frontier for two hours on Friday and they swore to us they’d be out Wednesday and fix things,” wrote Wanda from Sarasota, Fla. “If the good Lord Jesus himself told them they’d be sent to hell for lying, Frontier already has 1st Class tickets. My ex-husband lied less than this phone company. They told me ‘Miss Wanda, we are sorry we could not get out there but we called you to let you know.’ Oh really? On what phone, the one that hasn’t worked for two weeks? Then he thinks he puts me on hold to reschedule while he tells his friend now I have more time to get my hair done.”

Back in Dallas, Jeffrey Weiss from the Morning News pressed Frontier for a reality check on how bad the problems were.

Bright House is targeting disgruntled Frontier customers in Florida with special promotions.

“There are currently no widespread outages,” came the response from Frontier. “The isolated issues currently being addressed include either individual customer issues from the conversion or the day to day service issues that arise when operating a complex network. In addition, the recent extreme weather in the north Texas area may have impacted some customers’ service, while Frontier allocated resources to repair any damaged equipment in the path of the storm. The customer experience is always at the forefront of our company, and we are committed to each customer’s satisfaction. We are addressing service orders as quickly as possible, prioritizing repairs over new installations and coordinating both customer availability and the management of our ongoing queue of orders. In all cases, that means the next best available time.”

At that time, the Texas Public Utility Commission had collected at least 100 complaints about Frontier, reports spokesman Terry Hadley. Melinda White, Frontier’s regional president for the western region characterized the 2,500 service disruptions suffered by Californians as evidence things were going “relatively well.”

In Florida, the problems were substantial and widespread enough for competing cable operator Bright House to offer customers up to $240 to switch away from Frontier with a special promotion. But before customers sign up, they should be aware despite the ongoing issues, Frontier has no intention of letting anyone out of their contracts.

Frontier spokesman Bob Elek told the Tampa Bay Times, “While all customers will be eligible for service credits on a case-by-case basis, contracts will remain in force.”

That’s ironic, considering Frontier’s marketing pitch for the last several years assured customers there were no contracts or early termination fees. But Verizon had both, and Elek apparently feels if it is fair to give customers promotional pricing, it is fair to penalize them if they disconnect early, even if the service doesn’t work as advertised.

Fast forward more than a month and the problems… and Frontier’s excuses keep on coming.

[flv]http://www.phillipdampier.com/video/KNBC Los Angeles Frontier Official Apologies For Service Outages 5-24-2016.flv[/flv]

Frontier’s Melinda White, regional president for the company’s western region, finally showed up on KNBC Los Angeles to apologize for weeks of frustration and service problems. (2:56)

Blame Verizon

Nearly two weeks ago, Frontier executives were grilled at an Assembly Informational Hearing called by Mike Gatto (D-Los Angeles), when he had a spare moment in-between shilling for AT&T’s universal service/landline abdication bill making its way through the California legislature.

Ironically, Gatto was upset with Frontier — a company that wants to stay in the landline/DSL business — because it couldn’t do the job, while earlier applauding AT&T for being willing to cut the phone lines of rural Californians and have them risk AT&T’s “one-bar” rural wireless service instead.

Ironically, Gatto was upset with Frontier — a company that wants to stay in the landline/DSL business — because it couldn’t do the job, while earlier applauding AT&T for being willing to cut the phone lines of rural Californians and have them risk AT&T’s “one-bar” rural wireless service instead.

Members at the Assembly Informational Hearing implored Frontier to fix at least a month of problems the company has consistently denied was that big of a deal. A meeting of the minds between the politicians and Frontier seemed unlikely until Melinda White, Frontier West’s regional president found what she hoped would be a “Get Out of the Hot Seat Free” excuse card.

White told the Los Angeles Times that one reason for all the trouble is Verizon sent them “corrupted” or “incomplete” data on an unspecified number of remotely addressable items like network terminal boxes, modems, and those “interface” devices they slap on the sides of most homes and businesses. Frontier claims it sent initialization messages to those devices that were rejected, and unilaterally shut down in response, causing the large service outages Frontier claimed a few weeks earlier didn’t happen.

“We are sincerely sorry,” White said during the hearing. “Even one customer out of service is one too many.”

Even worse, Frontier claims it found those scamps at Verizon messed up another database containing serial numbers identifying older network terminal boxes, including hundreds located in Long Beach. You know what came next — more outages.

But wait, there’s more. The same phone company that proudly boasts it uses American workers to handle customer service matters had to admit it hired a call center in the Philippines to handle customer transition issues. It was instantly overwhelmed and the call takers were as bewildered as customers trying to deal with Frontier about service outages.

“Unfortunately, that did not work out — to our dismay,” White said.

“Unfortunately, that did not work out — to our dismay,” White said.

Like a lot of things coming from Frontier, that is an understatement. Just ask countless customers who reserved repair appointments through this same call center that often forgot or couldn’t pass them on to the U.S. based technicians that were supposed to show up and fix the problems. Result: missed service calls and even angrier customers.

Knowing this, one would assume Frontier would quickly pull the plug on overseas call centers and hire — at attractive wages if needed — more U.S. based employees to get things moving sooner rather than later. White told the Los Angeles Times it would phase those foreign call centers out… later… by the end of July.

The Lawmaker and Regulator CYA Cakewalk

The Frontier buyout and takeover of Verizon landlines didn’t just happen at the behest of the two phone companies. In a state regularly accused of over-regulating business, California regulators and lawmakers both had direct influence on the Frontier-Verizon transaction. It got approved without much effort and only came back to haunt officials when it all went wrong.

Assembly member Jay Obernolte (R-Hesperia) claimed, “These issues have set a record for constituent calls.”

Exactly who is responsible requires the time-honored practice of finger-pointing that always extends outwards, never inwards.

The committee chairman, Mr. Gatto, and vice chairman, Assemblyman Jim Patterson, (R-Fresno), blamed the California Public Utilities Commission (CPUC) as much as Frontier because they approved the takeover deal.

The committee chairman, Mr. Gatto, and vice chairman, Assemblyman Jim Patterson, (R-Fresno), blamed the California Public Utilities Commission (CPUC) as much as Frontier because they approved the takeover deal.

But as California consumers just saw in an embarrassing capitulation to approve the Charter-Time Warner Cable-Bright House merger with deal conditions even worse than what the FCC got, there are questions whether the CPUC could properly vet a Dollar Menu at a McDonalds drive-thru, much less a multi-billion dollar Big Telecom merger:

“Hi, welcome to McDonalds, what can I get the CPUC today?”

“We’ll let you decide, whatever you think is best. We trust you!”

“Okay, drive through to the second window.”

CPUC executive director Tim Sullivan casually mentioned the possibility of an official investigation and the highly-improbable-to-believe possible reconsideration of the buyout. That comes a little late.

While they hold hearings in California, the complaints keep rolling in even into the Memorial Day holiday weekend.

If This is the New Frontier, We Prefer the Old One

30+ years of a dedicated customer relationship that started around the time Back to the Future hit theaters was destroyed after about a month with Frontier.

Lynn Peterson in Sacramento has kept her phone service with Verizon (and its predecessors) since around the year Back to the Future arrived in movie theaters (July 3, 1985 for trivia fans). After a month or so with Frontier at the helm, she abandoned ship last week.

“My service just kept going out over and over again ever since Frontier became my provider,” Peterson told the Santa Monica Mirror. “Whenever I called customer service they seemed completely indifferent. I have now switched to Time Warner Cable.”

Abby Arnold also severed a bad relationship with Frontier last week, and like a clingy ex in breakup denial, they won’t let it go.

“After a month of trying to resolve issues, I left Verizon/Frontier and signed up with Time Warner,” Arnold wrote. “At least I can watch the Dodgers. One of the many issues in my saga is that I cannot get Frontier to acknowledge that I am no longer their customer. ‘Our system won’t let me cancel your account.’ Argh.”

Customers will have another opportunity to bring their complaints about Frontier to the CPUC’s attention this Wednesday from 4-6pm at a public hearing at Long Beach City Hall.

Texas Mops Up

Some of the worst damage done to Frontier’s reputation was in Texas. Some experts predict Frontier’s name will be mud in that state for months to years.

“My opinion is that Frontier’s brand, reputation, and trust will suffer in the short to medium term (months to years),” David Lei, associate professor of strategy at SMU’s Cox School of Business told the Dallas Business Journal. “The longer the problems persist in any situation for any business or service provider, the greater the customer anger. However, even a good communications/PR strategy remains insufficient in the wake of the scale of disruptions and the seemingly ‘easy’ task of scheduling technicians to houses within the promised time frame. Strategy execution always occurs at the customer level – dealing with each customer truthfully and forthrightly. Yet, it is probably difficult for Frontier’s management to openly acknowledge just how complex the integration task will remain for quite some time.”

Our Recommendations

Frontier has a long history of transition problems whenever it acquires landline networks from other providers, whether Verizon or AT&T. In some cases, these may prove to be nothing more than self-correcting minor inconveniences. But in states like West Virginia, Connecticut, and now Texas, Florida, and California, long outages got painful and expensive for customers, and in some cases could have been life-threatening. With each transition, Frontier claimed it learned how to improve on the process to better reassure customers problems would be few and isolated. But the evidence is overwhelming these problems are bigger than Frontier seems ready to admit. Frontier refuses to release outage statistics broken down by state. Are these transition outages comparable to the day-to-day experiences of a big independent phone company? Allowing the public to see outage numbers for Florida and compare them with West Virginia or New York, for example, would be illuminating.

Regulators can also give Frontier some added incentives to guarantee the transition experience goes “exceptionally well” in the real world, not just in company press releases. Those incentives come in the form of stiff fines and guaranteed, automatic rebates for any customer affected by a service disruption. Right now, Frontier still requires most customers to personally apply for service credits for outages and other disruptions. That is a real hassle if you’ve ever called Frontier by phone and waited on hold, sometimes for an hour or more. Being promised a credit does not guarantee it will actually appear on your bill either.

Consider the experience of Lake Elsinore resident Kristi Coy. Her husband can’t sell video conferencing equipment online because Frontier’s Internet is too slow.

Coy was offered a service credit, but only after the problem was fixed. After the visit, she called Frontier and waited on hold 90 minutes before finally hanging up.

“How much are they going to give me, $20?” she said. “How long will I have to stay on hold? An hour and a half to get a $20 refund? It’s not even worth the time.”

Frontier should have a regulator-reviewed transition plan with contingencies in place for unexpected problems. That plan should prioritize returning customers to service, even if it means backing out of a system transition. Maintaining reliable service should be the first priority, not cost-savings or convenience for the companies involved. A full audit of exactly what Frontier bought from Verizon could have uncovered the discrepancies and corrupted data White blamed for the outages before the transition began. But that costs time and money. The prospect of a regulator-imposed fine costing even more delivers the cost/benefit formula customers (and Frontier, apparently) needs to assure customer protection.

Regulators need to start scrutinizing these consolidation transactions much more carefully, and reject those from companies that have a significant record of failing their customers. Frontier’s disastrous transition in West Virginia in 2010 led to months of news coverage and a number of very serious outages. More than five years later, service complaints are still coming in, mostly focused on poor broadband service. In Connecticut, Frontier had to cough up costly service credits and promotions to stop a flood of customers headed for the exits over Frontier’s messy transition from AT&T. Suspiciously familiar problems including service outages, billing issues, and missed service calls plagued Connecticut in 2015 just as they do in 2016 in Texas, Florida, and California.

We warned regulators in each instance that Frontier’s repeated poor performance should give them pause. We recommended regulators either impose extra requirements as part of any approval agreement or reject these types of deals outright. They chose to believe Frontier instead. So while Frontier executives and shareholders enjoy the proceeds of enhanced revenue and their regular dividend payouts, customers that depend on Frontier, especially small businesses, are in trouble. Dagwoods Pizza Parlor in Santa Monica is just one example.

Dagwoods manager Mark Peters said Frontier’s lousy performance in Southern California “has the potential to destroy small businesses” like his. This past Memorial Day weekend was a partial bust for Dagwoods because their Frontier-supplied phone and Internet service was down again until Frontier finally showed up to fix it.

“It’s a bad situation,” Peters told the Santa Monica Observer. “We can’t take orders, and this is our big night of the week. We’re really bummed out about the whole situation.”

The time for excuses and explanations has come and gone. The time for action, fines, and automatic service credits is overdue, but better late than never.

[flv]http://www.phillipdampier.com/video/WTVT Tampa Frontier Official Apologies For Service Outages 5-10-16.mp4[/flv]

WTVT in Tampa reports Florida Attorney General Pam Bondi is now taking a hard look at Frontier’s performance in the state. (2:41)

Smartphone manufacturers are dealing with sluggish sales for the newest and greatest phone models because American consumers are increasingly resistant to paying for top of the line devices.

Smartphone manufacturers are dealing with sluggish sales for the newest and greatest phone models because American consumers are increasingly resistant to paying for top of the line devices.

Subscribe

Subscribe

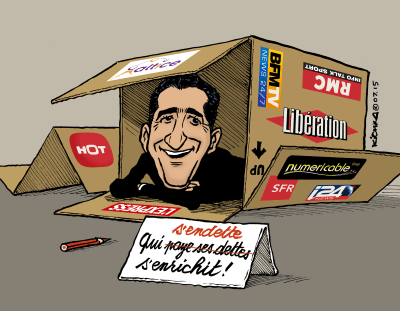

Some of the money flowing through Altice’s coffers comes from the French taxpayer, currently footing the bill for unpopular French President François Hollande’s key measure to boost the competitiveness of French companies — the Tax Credit for Competitiveness and Employment (CICE), which significantly cuts employer’s labor expenses. Altice has been a grateful recipient of this gift from French taxpayers, who

Some of the money flowing through Altice’s coffers comes from the French taxpayer, currently footing the bill for unpopular French President François Hollande’s key measure to boost the competitiveness of French companies — the Tax Credit for Competitiveness and Employment (CICE), which significantly cuts employer’s labor expenses. Altice has been a grateful recipient of this gift from French taxpayers, who

Altice-owned SFR Francophone call center workers face even bigger challenges from relentless demands for cost cuts. In 2015, Altice announced it was open to

Altice-owned SFR Francophone call center workers face even bigger challenges from relentless demands for cost cuts. In 2015, Altice announced it was open to  For now, those decisions are mostly made by Altice’s cable company call center workers and some members of middle management. But Patrick Drahi’s long-term plan to conquer the media business depends on implementing his “convergence” strategy, which means owning and controlling not only the means of distribution, but also the product being distributed. l’Humanité compared Drahi’s business to a multibillion cephalopod, with octopus-like tentacles extending his control and influence well beyond the cable business.

For now, those decisions are mostly made by Altice’s cable company call center workers and some members of middle management. But Patrick Drahi’s long-term plan to conquer the media business depends on implementing his “convergence” strategy, which means owning and controlling not only the means of distribution, but also the product being distributed. l’Humanité compared Drahi’s business to a multibillion cephalopod, with octopus-like tentacles extending his control and influence well beyond the cable business. The 24-hour emergency hotline at Alcoholics Anonymous in Ventura County, Calif., rang only sporadically back in April and it wasn’t because Simi Valley, Ojai, and Thousand Oaks were overrun with teetotalers. The director of the center

The 24-hour emergency hotline at Alcoholics Anonymous in Ventura County, Calif., rang only sporadically back in April and it wasn’t because Simi Valley, Ojai, and Thousand Oaks were overrun with teetotalers. The director of the center

Thousands of complaints later, it is evident Frontier has gotten itself into another fine mess, one predicted in advance by Stop the Cap!

Thousands of complaints later, it is evident Frontier has gotten itself into another fine mess, one predicted in advance by Stop the Cap!

Ironically, Gatto was upset with Frontier — a company that wants to stay in the landline/DSL business — because it couldn’t do the job, while earlier applauding AT&T for being willing to cut the phone lines of rural Californians and have them risk AT&T’s “one-bar” rural wireless service instead.

Ironically, Gatto was upset with Frontier — a company that wants to stay in the landline/DSL business — because it couldn’t do the job, while earlier applauding AT&T for being willing to cut the phone lines of rural Californians and have them risk AT&T’s “one-bar” rural wireless service instead. “Unfortunately, that did not work out — to our dismay,” White said.

“Unfortunately, that did not work out — to our dismay,” White said. The committee chairman, Mr. Gatto, and vice chairman, Assemblyman Jim Patterson, (R-Fresno), blamed the California Public Utilities Commission (CPUC) as much as Frontier because they approved the takeover deal.

The committee chairman, Mr. Gatto, and vice chairman, Assemblyman Jim Patterson, (R-Fresno), blamed the California Public Utilities Commission (CPUC) as much as Frontier because they approved the takeover deal.