Despite claims of improved customer service and better broadband, Comcast and Time Warner Cable’s customer satisfaction scores are in near-free fall in the latest Consumer Reports National Research Center’s survey of consumers about their experiences with television and Internet services.

Despite claims of improved customer service and better broadband, Comcast and Time Warner Cable’s customer satisfaction scores are in near-free fall in the latest Consumer Reports National Research Center’s survey of consumers about their experiences with television and Internet services.

Although never popular with customers, both cable operators plummeted in the 2014 Consumer Reports ratings — Time Warner Cable is now only marginally above the perennial consumer disaster that is Mediacom. Comcast performs only slightly better.

In the view of Consumers Union, this provides ample evidence that two wrongs never make a right.

“Both Comcast and Time Warner Cable rank very poorly with consumers when it comes to value for the money and have earned low ratings for customer support,” said Delara Derakhshani. “A merger combining these two huge companies would give Comcast even greater control over the cable and broadband Internet markets, leading to higher prices, fewer choices, and worse customer service for consumers.”

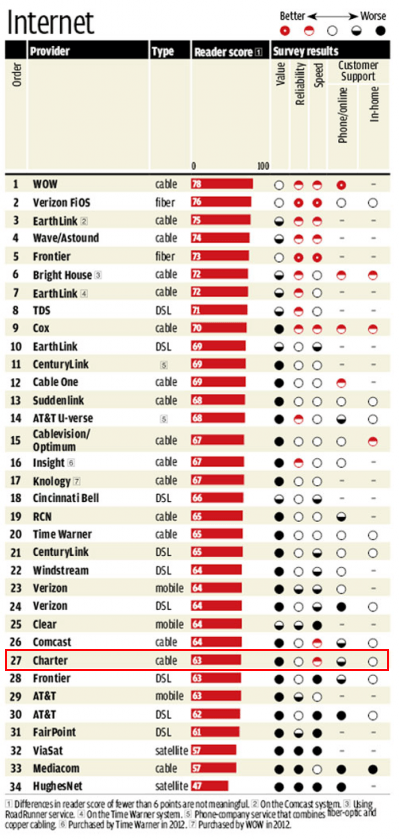

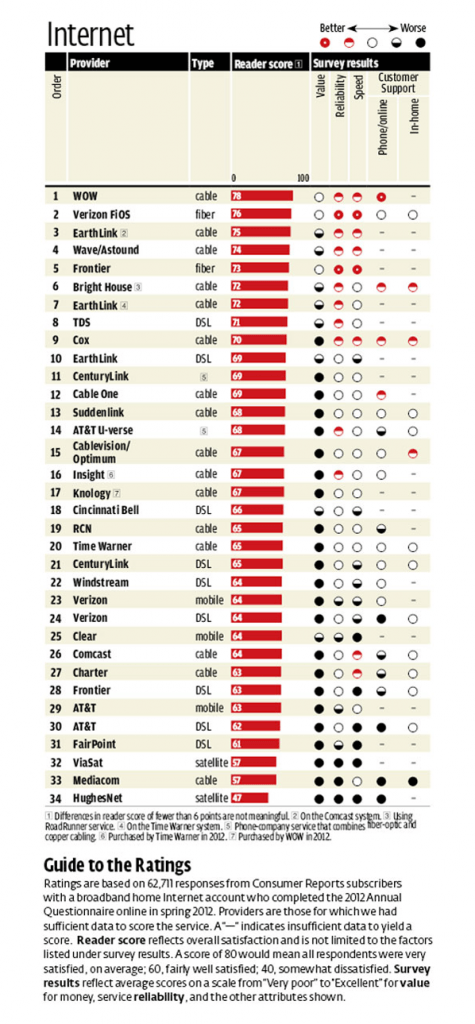

These ratings reflect Internet service only.

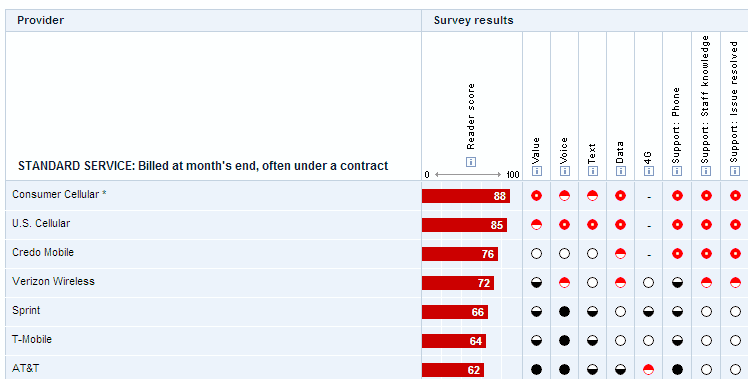

Comcast ranked 15th among 17 television service providers included in the ratings and earned particularly low marks from consumers for value for the money and customer support. Time Warner ranked 16th overall for television service with particularly low ratings for value, reliability, and phone/online customer support.

Another ratings collapse for Comcast and Time Warner Cable

Comcast and Time Warner Cable were mediocre on overall satisfaction with Internet service. Both companies received especially poor marks for value and low ratings for phone/online customer support.

“In an industry with a terrible track record with consumers, these two companies are among the worst when it comes to providing good value for the money,” said Derakhshani. “The FCC and Department of Justice should stand with consumers and oppose this merger.”

For as long as Stop the Cap! has published, Mediacom has always achieved bottom of the barrel ratings, with satellite fraudband provider HughesNet — the choice of the truly desperate — scoring dead last for Internet service. We’re accustomed to seeing the usual bottom-raters like Frontier (DSL), Windstream (DSL), and FairPoint (DSL) on the south end of the list. But now both Comcast and Time Warner Cable have moved into the same seedy neighborhood of expensive and lousy service. Comcast couldn’t even beat the ratings for Verizon’s DSL service, which is now barely marketed at all. Time Warner Cable scored lower than CenturyLink’s DSL.

Breathing an ever-so-slight sigh of relief this year is Charter Communications, which used to compete with Mediacom for customer raspberries. It ‘rocketed up’ to 18th place.

If you want top-notch broadband service, you need to remember only one word: fiber. It’s the magical optical cable phone and cable companies keep claiming they have but largely don’t (except for Verizon and Cincinnati Bell, among a select few). If you have fiber to the home broadband, you are very happy again this year. If you are served by an independent cable company that threw away the book on customer abuse, you are relieved. Topping the ratings again this year among all cable operators is WOW!, which has a legendary reputation for customer service. Wave/Astound is in second place. Verizon and Frontier FiOS customers stay pleased, and even those signed up with Bright House Networks and Suddenlink report improved service.

Ratings are based on responses from 81,848 Consumer Reports readers. Once again they plainly expose Americans are not happy with their telecom options. The average cost of home communications measured by the Mintel Group is now $154 a month — $1,848 a year. That’s more expensive than the average homeowner’s clothing, furniture or electricity budget. The same issues driving the bad ratings last year are still there in 2014: shoveling TV channels at customers they don’t want or need, imposing sneaky new fees along with broad-based rate increases every year, low value for money, and customer service departments staffed by the Don’t Care Bears.

Subscribe

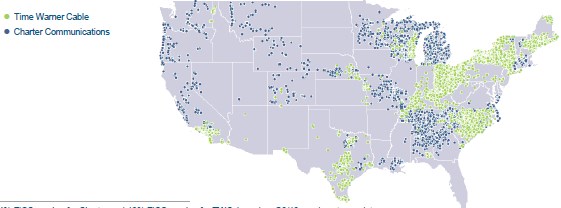

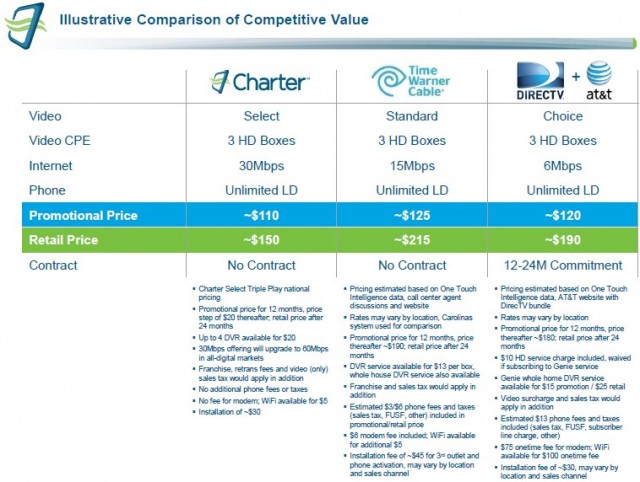

Subscribe Time Warner Cable executives brushed away Charter Communications’ first public offer to acquire the second largest cable company in the country in a debt-financed deal that Time Warner considers a lowball offer.

Time Warner Cable executives brushed away Charter Communications’ first public offer to acquire the second largest cable company in the country in a debt-financed deal that Time Warner considers a lowball offer.

Charter Communications chief operating officer John Bickham launched

Charter Communications chief operating officer John Bickham launched

Mediacom, regularly rated

Mediacom, regularly rated  A Mediacom official finally acknowledged there was a bigger problem. Phyllis Peters, communications director for Mediacom, told the newspaper the outages were due to a “rare and broader issue” that affected customers across Des Moines.

A Mediacom official finally acknowledged there was a bigger problem. Phyllis Peters, communications director for Mediacom, told the newspaper the outages were due to a “rare and broader issue” that affected customers across Des Moines.