Viewers of NBC’s Nightly News with Brian Williams learned an upstart online streaming video competitor seeking to help Americans control their cable bills is probably an illegal pirate operation that doesn’t pay for the programming that parent company Comcast-NBC pays hundreds of millions to produce.

On Tuesday Aereo bypassed the network television gatekeepers suing to shut the service down and bought a full-page ad in the New York Times to remind the country it is winning its case in court:

“The broadcast networks have been granted free and valuable broadcast spectrum worth billions of dollars in exchange for their commitment to act in the public interest. It’s a sweet deal… Along the way, cable and satellite providers entered the picture.

In addition to free spectrum and advertising revenues, the networks got very lucrative retransmission fees from these providers. And so, for many, broadcast television is now offered in expensive fixed bundles or packages. Yet many millions of Americans continue to use antennas to get broadcast TV.”

Despite the corporate media firewall that keeps positive reports about the competition off the nightly news, the little streaming company that could is having an impact.

In the last two weeks, virtual hysteria has broken out among major network officials who are threatening to pull the plug on free over the air TV if their multi-billion dollar operations are not granted immediate protection from a startup that rents out dime-sized antennas in New York City to stream local television stations.

Chase Carey from Fox said he’ll put the Fox Network behind a pay wall if Aereo keeps it up.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Bloomberg Leo Hindery Calls Aereo Pissant 4-12-13.flv[/flv]

Leo Hindery who oversees a private equity firm and has a history with both cable and broadcast networks called Aereo tawdry and a “pissant little company” run by a man who helped launch the Fox Network and now threatens to ruin the broadcast television business model for everyone else. (Bloomberg News) (5 minutes)

Is media consolidation influencing the evening news?

A combination of networks and other big media interests are now preparing to take their battle to Congress, warning lawmakers the very concept of free over the air television is in peril if companies like Aereo are allowed to operate.

Why are they so threatened? Aereo effectively bypasses the “retransmission consent fees” that broadcasters now charge pay television providers for permission to carry their channels and networks. As advertising revenue declines from reduced viewing numbers and equipment that offers viewers a fast forward through ads, the broadcasters have found gold charging monthly fees to cable, satellite, and telephone company TV systems for each subscriber. Ultimately, consumers pay these fees through higher cable and satellite bills.

Aereo receives over the air signals from individual antennas and makes that programming available for online streaming. No retransmission consent fees are required, Aereo argues, because they are just serving as an antenna farm. Only one stream per antenna is allowed, they note, so the company is not mass-distributing programming.

The battle between broadcasters and Aereo is now turning up in news reports that have tried to walk a fine line between the positions of the executives at the networks suing Aereo and the streaming service itself. Not every news outlet is managing the balancing act successfully.

[flv width=”596″ height=”356″]http://www.phillipdampier.com/video/NBC News Aereo vs Broadcasters 4-9-13.flv[/flv]

NBC News aired this incomplete report about Aereo on its evening newscast on April 9th. What is missing? The fact courts have so far sided with Aereo and against the broadcasters’ claims the service is pirating content. (3 minutes)

The Verge points out NBC News did not make it far before they fell solidly in line behind their corporate owners:

In its piece on Aereo, NBC News included a lengthy explanation of what TV has meant to Americans through the decades. Aereo’s CEO Chet Kanojia is quoted, but only about how the service functions, and there’s nothing from him about the controversy. In contrast, NBC’s story includes a quote from Carey calling Aereo “piracy.” The network news group also tossed in this line: “Aereo doesn’t pay networks for the content they spend hundreds of millions of dollars to produce.”

What NBC didn’t say was that, according to two separate federal courts, Aereo’s service is legal. The ruling by the appeals court upheld a district judge’s decision and was not insignificant. The court allowed Aereo and Kanojia (photographed at right) to continue operating until the lawsuit with the broadcasters is resolved, which could take years. “We were disappointed that NBC News didn’t include a mention about the court decisions,” Virginia Lam, an Aereo spokesperson, told The Verge. “All we ask are that the facts be reported.”

A spokesperson for NBC News disagreed. “The report was a fair and straightforward telling of how the service operates in the changing media environment. It fully explained why Aereo argues that the service is legal, and included an interview with Kanojia. In the interest of full disclosure, it also noted that NBCUniversal, the parent company of NBC News, has filed suit against the service.”

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Bloomberg Broadcasters vs Aereo 4-15-13.flv[/flv]

Robert Prather, president of local station owner Gray Television, tells Bloomberg News station owners are still trying to figure out what Aereo means for their business models. (3 minutes)

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Bloomberg Aereo CEO Responds to Fox Threats 4-17-13.flv[/flv]

Aereo’s CEO responded today to threats from Fox to turn its network into a pay cable service, suggesting that if Fox wanted to abandon over the air service, someone else might make use of that spectrum. (3 minutes)

Subscribe

Subscribe

Malone sees the future sustainability of the cable industry dependent on the high revenue broadband business.

Malone sees the future sustainability of the cable industry dependent on the high revenue broadband business.

Ergen’s vision would include a bundled package of satellite television, broadband wireless Internet and cellular telephone service. Providing suitable wireless broadband Internet in rural areas may be the biggest challenge because of Sprint’s more limited network coverage, but a marketing deal combining satellite television from Dish and Sprint cell phone service would be easier to carry out.

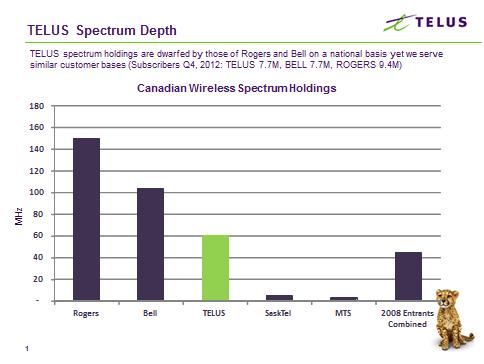

Ergen’s vision would include a bundled package of satellite television, broadband wireless Internet and cellular telephone service. Providing suitable wireless broadband Internet in rural areas may be the biggest challenge because of Sprint’s more limited network coverage, but a marketing deal combining satellite television from Dish and Sprint cell phone service would be easier to carry out. Canada’s effort to expand mobile competition has likely failed with news that three of the most significant new independent entrants have put themselves up for sale, with one likely to be acquired by Telus, western Canada’s largest phone company.

Canada’s effort to expand mobile competition has likely failed with news that three of the most significant new independent entrants have put themselves up for sale, with one likely to be acquired by Telus, western Canada’s largest phone company. The three companies have competed with the dominant players for about three years with little success. Combined, the three have not managed to achieve even a combined 10 percent market share. Most sell unlimited talk and text plans to customers that would normally buy prepaid service.

The three companies have competed with the dominant players for about three years with little success. Combined, the three have not managed to achieve even a combined 10 percent market share. Most sell unlimited talk and text plans to customers that would normally buy prepaid service.

Corr’s coverage area has not been a priority for larger carriers like Verizon Wireless and AT&T. The acquisition, which includes multiple PCS and 700MHz “C-Block” licenses, will bolster AT&T’s weak coverage in the region, which includes Huntsville, Oneonta, Decatur, Cullman, Hartselle, and Arab, Ala.

Corr’s coverage area has not been a priority for larger carriers like Verizon Wireless and AT&T. The acquisition, which includes multiple PCS and 700MHz “C-Block” licenses, will bolster AT&T’s weak coverage in the region, which includes Huntsville, Oneonta, Decatur, Cullman, Hartselle, and Arab, Ala.