WHAM and WUHF are now both located at WHAM’s facilities in suburban Rochester, N.Y. WHAM now produces WUHF’s newscasts.

Ever wonder why some local television stations air newscasts produced by another competing station?

When your local ABC station’s evening news ends up on a local FOX station, it is usually because the two have signed a joint agreement to let one station represent the other in making programming decisions and selling advertising.

FCC chairman Thomas Wheeler believes this growing trend represents an end run around the agency’s rules limiting how much control a single major media company may have in any particular community. On Monday Wheeler joined two Democratic commissioners and voted to ban the practice.

Wheeler said the vote against joint agreements represented “a win for common sense,” and preserved the FCC’s intent to make sure viewers have a diverse mix of news, information and programming. In several small and medium cities, viewers were instead getting the same newscast on competing stations and just one or two media companies made all the programming decisions for local viewers.

FCC media ownership rules prevent TV station owners from owning stations reaching more than 39 percent of the national TV audience, owning more than a single top-four network station in a market and owning more than two TV stations in a market. They also prevent a local newspaper from buying a local TV station.

But station owners found they could evade those rules and save money by turning over the production of costly locally produced programming like news and community affairs to another station, and in some cases even moving operations into another station’s building, while still holding the station’s license. In some markets, one company like Sinclair or Nexstar can end up owning a local network affiliate, a CW or MyNetworkTV station, and have a joint agreement to sell advertising and program another network affiliate.

Sinclair Exploits Loophole to Build a Media Empire

Owned by Sinclair

One good example of this practice can be found in the 78th largest television market in the United States — Rochester, N.Y.

Ten years ago, WROC (CBS), WHEC (NBC), WOKR (now WHAM) (ABC), and WUHF (FOX) each maintained their own news teams and ad sales departments. The first station to drop its own news was WUHF. Station owner Sinclair fired the news staff and signed an agreement with Nexstar’s WROC to produce a newscast for the station instead. WROC’s reporters could now be seen on two different stations.

In early 2013, WHAM was acquired by Deerfield Media, which has a whisker-thin separation between itself and Sinclair. The Wall Street Journal reported that Deerfield’s owner, Stephen Mumblow, was Sinclair CEO David Smith’s former personal banker. All of its stations are operated by Sinclair, despite being licensed to Deerfield.

Operated by Sinclair

Media consolidation critics say that is a blatant end run around the FCC’s ownership rules and violates local station limits.

Rochester viewers noticed a change on Jan. 1 of this year, when WUHF dropped WROC’s newscasts and began airing WHAM news instead. WUHF is now co-located in WHAM’s offices and despite the fact WHAM is owned by Deerfield, all of WHAM’s news and sales team are Sinclair employees. Sinclair now owns or controls Rochester’s CW, ABC, and FOX affiliates. Nexstar still owns WROC and Hubbard Broadcasting owns WHEC.

Nationwide, Sinclair owns, programs, or provides sales services to 167 television stations in 77 markets. In 2011, it owned 58 stations.

Smith

Sinclair is not a “hands-off” media player either. Sinclair’s CEO David Smith has regularly forced his conservative political views into his station’s newscasts.

Smith calls himself a family values man, but his 1996 arrest and conviction in a prostitution sting suggests otherwise. Smith was arrested for picking up a prostitute who performed what police called an “unnatural and perverted sex act” on him as he drove down the highway in a company-owned Mercedes.

As part of his plea agreement, Smith had to perform court-ordered community service. Smith subcontracted that out to his Baltimore station’s newsroom employees, ordered to produce a series of reports on a local drug counseling program, which Smith used to satisfy his sentence. That did not go over well with local reporters and at least one judge.

“I really hated the way he handled our newsroom and what he expected his reporters to do after his arrest,” LuAnne Canipe, a reporter who worked on air at Sinclair’s flagship station, WBFF in Baltimore, from 1994 to 1998, told Salon. “A Baltimore judge called me up,” she recalls. “He wasn’t handling the case, but he called to tell me about the arrangement and asked me if I knew about it. The judge was outraged. He said, ‘How can employees do community service for their boss?’”

Canipe left as the work atmosphere at Sinclair rapidly deteriorated.

Hyman

“Let’s just say the arrest of the CEO was part of a sexual atmosphere that trickled down to different levels in the company,” Canipe told Salon. “There was an improper work environment. I think that because of what he did there was a feeling that everything was fair game,” says Canipe, who says she chose to leave Sinclair in 1998. She says that she once complained to management about another Sinclair employee, who had engaged in audible phone sex inside a station conference room, but that no action was taken against the employee.

How Sinclair Uses Its Stations to Push a Political Agenda

But Sinclair’s most controversial interference in local news operations came days before the 2004 presidential election, when Sinclair ordered its stations to air a highly charged documentary critics called a propaganda hit piece against Democratic candidate John Kerry.

“Stolen Honor: Wounds that Never Heal,” was the brainchild of Carlton Sherwood, a disgraced former reporter for a Washington, D.C. station that was later forced to donate $50,000 and air a lengthy retraction after Sherwood falsely claimed that the veterans responsible for creating the Vietnam Veterans Memorial Wall were misappropriating contributions. The charges proved baseless and at least one veteran signed a sworn statement claiming Sherwood had a political ax to grind, calling the project that “liberal memorial” and a “black gash.” Sherwood reportedly wanted the memorial to speak to the righteousness of the Vietnam War and focused most of his reporting on critics who felt the memorial looked like “a wailing wall.”

Sinclair owned/operated stations now carry news from conservative Newsmax and the Washington Times on their websites.

Sherwood’s one-sided anti-Kerry documentary created a firestorm of criticism that reached all the way to Wall Street. Sinclair faced advertiser boycotts, petitions to yank its stations’ licenses, and angry investors who wanted Sinclair to steer clear of controversy that was bad for business.

Since then, Sinclair’s conservative credentials are still apparent, although more subtle. Top-rated WHAM’s local news now features headlines from the Rev. Sun Myung Moon’s Washington Times and the fiercely conservative Newsmax. Many Sinclair stations are also still required to air conservative political commentaries featuring Sinclair’s Mark Hyman during their newscasts.

Sinclair’s “government is bad” philosophy is found in its franchised “Waste Watch” series, which also airs during station newscasts. Sinclair claims the feature investigates and exposes how viewers’ local tax dollars are spent. But news staff at several Sinclair stations find the series distasteful because it frames its reporting around the idea that local government is generally incompetent and wasteful. Media critics suggest that kind of framed reporting does not belong in a straightforward newscast.

Underlining Sinclair’s Waste Watch conservative bona fides is the prominent presence of conservative political groups including the CATO Institute, Citizens Against Government Waste (CAGW), and the National Taxpayers Union (NTU) on Sinclair station websites. CAGW has historically maintained ties with the American Legislative Exchange Council and was a former member of ALEC. NTU President Duane Parde is the former executive director of ALEC, and NTU remains an ALEC member.

Wheeler

Despite the meddling from Sinclair’s headquarters, many Sinclair stations’ news teams try to maintain balance around Sinclair’s political agenda. WHAM, for example, buries Hyman’s commentaries on its extended morning news aired on WUHF instead of airing them in its primary newscast on WHAM. In Rochester, “Waste Watch” has also had some unintended consequences. WHAM has used the franchise to extensively report on various scandals surrounding county contracts involving the highest levels of Monroe County government, long dominated by the Republican party.

With more than 100 “joint agreements” in place at stations around the country — primarily in news-scarce medium and smaller television markets, the declining number of people making decisions about what is newsworthy and how it is reported has become increasingly worrisome for media consolidation critics. Television news dominates audiences as newspaper readership continues to decline. Critics suggest the impact of media consolidation can already be seen at companies like Sinclair.

FCC Gives Stations Two Years to Unwind Agreements; Republican Commissioners Upset

Under the new rules, a broadcaster that accounts for more than 15% of another station’s advertising sales would be seen by the FCC as the de-facto licensee of that station. In dozens of markets, this new rule will put companies like Sinclair and Nexstar in violation of the FCC’s ownership limits. The FCC is giving stations two years to disconnect their joint agreements or apply for a waiver if they can prove the partnership serves the public interest.

Deerfield Media is likely to be one of the hardest hit media groups, although critics contend the partnership with Sinclair was created primarily to evade the rules.

Although the rules change received support from all three Democrats, the commission’s two Republicans voiced strong opposition and claimed that the FCC was regulating a solution for a non-problem.

Commissioner Ajit Pai didn’t seem interested in the views of media consolidation critics. Instead, he looked for complaints from advertisers forced to buy ad time through the joint sales agreements. Finding none, he declared the case to end the joint agreements “embarrassingly weak.”

“This is the dog that didn’t bark,” Pai said.

Pai recommended station owners sue in federal court to overturn the FCC’s new rules. Pai is on the record opposing most ownership limits of any kind.

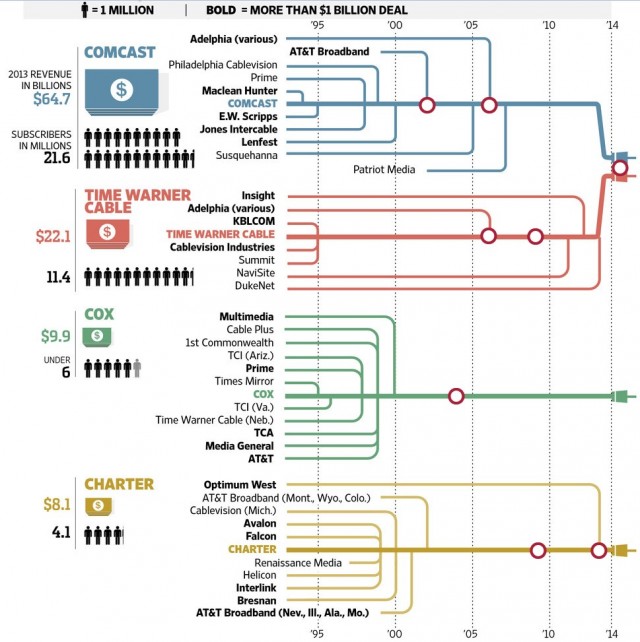

Central Oregon’s independent cable television and broadband company — BendBroadband — has been sold to Telephone and Data Systems (TDS), a Chicago-based telephone company in a deal worth $261 million.

Central Oregon’s independent cable television and broadband company — BendBroadband — has been sold to Telephone and Data Systems (TDS), a Chicago-based telephone company in a deal worth $261 million.![]() “While BendBroadband has made many smart investments, it is clear that we will need to join forces with a like-minded company to gain the scale necessary to provide the cutting-edge technology and personalized customer experiences that consumers expect,” BendBroadband’s website says.

“While BendBroadband has made many smart investments, it is clear that we will need to join forces with a like-minded company to gain the scale necessary to provide the cutting-edge technology and personalized customer experiences that consumers expect,” BendBroadband’s website says.

Subscribe

Subscribe AT&T has approached DirecTV about a possible acquisition of the satellite provider in a deal expected to fetch at least $40 billion, spare change for AT&T’s $185 billion operation.

AT&T has approached DirecTV about a possible acquisition of the satellite provider in a deal expected to fetch at least $40 billion, spare change for AT&T’s $185 billion operation. DirecTV’s growth has fallen every year since 2010 and starting in 2013, the company began losing more subscribers than it signed up.

DirecTV’s growth has fallen every year since 2010 and starting in 2013, the company began losing more subscribers than it signed up.

Cincinnati Bell

Cincinnati Bell

“Our business has been in decline for five or six years,” Torbeck

“Our business has been in decline for five or six years,” Torbeck  Last year, Cincinnati Bell had passed 184,000 homes with fiber optics – a 28 percent market share. But only 52,000 homes subscribed to Fioptics — Cincinnati Bell’s fiber brand. Time Warner Cable had managed to keep many of its wavering 446,000 customers loyal to the cable company with aggressive discounting and customer retention offers. But now that many of those discounts have since expired, Torbeck wants to reach 650,000-700,000 homes in its service area covering southwestern Ohio and northern Kentucky and convince 50% of those customers to switch to fiber optics.

Last year, Cincinnati Bell had passed 184,000 homes with fiber optics – a 28 percent market share. But only 52,000 homes subscribed to Fioptics — Cincinnati Bell’s fiber brand. Time Warner Cable had managed to keep many of its wavering 446,000 customers loyal to the cable company with aggressive discounting and customer retention offers. But now that many of those discounts have since expired, Torbeck wants to reach 650,000-700,000 homes in its service area covering southwestern Ohio and northern Kentucky and convince 50% of those customers to switch to fiber optics. The company’s unique position as the last remaining independent phone company that still bears the name of the telephone’s inventor may make the company a target for a takeover before Torbeck’s vision is realized. One analyst thinks Cincinnati Bell would be a natural target for Google, which has a recent record of repurposing fiber networks built by other companies as a cost-saving measure to further deploy Google Fiber.

The company’s unique position as the last remaining independent phone company that still bears the name of the telephone’s inventor may make the company a target for a takeover before Torbeck’s vision is realized. One analyst thinks Cincinnati Bell would be a natural target for Google, which has a recent record of repurposing fiber networks built by other companies as a cost-saving measure to further deploy Google Fiber. Cincinnati Bell has already spent about $300 million on Fioptics and plans to spend an extra $80 million this year on expansion. Before the network is complete, the phone company is likely to spend as much as $600 million on fiber upgrades. But the payoff has been higher revenue — $100 million last year alone, and a stabilizing business model that has reduced losses from landline cord-cutting. Telecom analyst Nicholas Puncer offers support for the investment, something rare for most Wall Street advisers.

Cincinnati Bell has already spent about $300 million on Fioptics and plans to spend an extra $80 million this year on expansion. Before the network is complete, the phone company is likely to spend as much as $600 million on fiber upgrades. But the payoff has been higher revenue — $100 million last year alone, and a stabilizing business model that has reduced losses from landline cord-cutting. Telecom analyst Nicholas Puncer offers support for the investment, something rare for most Wall Street advisers.