The arrival of Netflix north of the American border has sparked a potential video revolution in Canada that some fear could renew “an erosion” of Canadian culture and self-identity as the streaming video service floods the country with American-made television and movies. But anxiety also prevails on the upper floors of some of Canada’s biggest telecom companies, worried their business models are about to be challenged like never before.

The arrival of Netflix north of the American border has sparked a potential video revolution in Canada that some fear could renew “an erosion” of Canadian culture and self-identity as the streaming video service floods the country with American-made television and movies. But anxiety also prevails on the upper floors of some of Canada’s biggest telecom companies, worried their business models are about to be challenged like never before.

Two weeks ago, the country saw a remarkable Canadian Radio-television and Telecommunications Commission (CRTC) hearing featuring a Netflix executive obviously not used to being grilled by the often-curt regulators. When it was all over, Netflix refused to comply with a CRTC order for information about Netflix’s Canadian customers.

Earlier today, the CRTC’s secretary general, John Traversy, declared that because of the lack of cooperation from Netflix, all of their testimony “will be removed from the public record of this proceeding on October 2, 2014.” That includes their oral arguments.

“As a result, the hearing panel will reach its conclusions based on the remaining evidence on the record. There are a variety of perspectives on the impact of Internet broadcasting in Canada, and the panel will rely on those that are on the public record to make its findings,” Mr. Traversy wrote in a nod to Canada’s own telecom companies.

Not since late 1990’s Heritage Minister Sheila Copps, who defended Canadian content with her support of a law that restricted foreign magazines from infiltrating across the border, had a government official seemed willing to take matters beyond the government’s own policy.

CRTC chairman Jean-Pierre Blais threw down the gauntlet when Netflix hesitated about releasing its Canadian subscriber and Canadian content statistics to the regulator. Mr. Blais wanted to know exactly how many Canadians are Netflix subscribers and how much of what they are watching on the service originates in Canada.

With hearings underway in Ottawa, bigger questions are being raised about the CRTC’s authority in the digital age. Doug Dirks from CBC Radio’s The Homestretch talks with Michael Geist at the University of Ottawa. Sept. 19, 2014 (8:40) You must remain on this page to hear the clip, or you can download the clip and listen later.

Netflix has operated below regulatory radar since it first launched service in Canada four years ago. The CRTC left the American company with an impression it had the right to regulate Netflix, but chose not to at this time. The CRTC of 2010 was knee-deep in media consolidation issues and did not want to spend a lot of time on an American service that most Canadians watched by using proxy servers and virtual private networks to bypass geographic content restrictions. But now that an estimated 30% of English-speaking Canada subscribes to Netflix, it is threatening to turn the country’s cozy and well-consolidated media industry on its head.

Ask most of the corporate players involved and they will declare this is a fight about Canada’s identity. After all, broadcasters have been compelled for years to live under content laws that require a certain percentage of television and radio content to originate inside Canada. Without such regulations, enforced by the CRTC among others, Canada would be overwhelmed by all-things-Americans. Some believe that without protection, Canadian viewers will only watch and listen to American television and music at the cost of Canadian productions and artists.

[flv]http://www.phillipdampier.com/video/BNN Netflix vs the CRTC 9-22-14.flv[/flv]

Kevin O’Leary, Chairman, O’Leary Financial Group is furious with regulators for butting into Netflix’s online video business and threatening its presence in Canada is an effort to protect incumbent business models. From BNN-Canada. (8:45)

A viewer watches Netflix’s Corie Wright testify before the CRTC. (Image: Sean Kilpatrick, The Canadian Press)

But behind the culture war is a question of money – billions of dollars in fact. Giant media companies like Rogers, Shaw, and Bell feel threatened by the presence of Netflix, which can take away viewers and change a media landscape that has not faced the kind of wholesale deregulation that has taken place in the United States since the Reagan Administration.

Before Netflix, the big Canadian networks didn’t object too strongly to the content regulations. After all, CRTC rules helped establish the Canadian Media Fund which partly pays for domestic TV and movie productions. Canada’s telephone and satellite companies also have to contribute, and they collectively added $266 million to the pot in 2013, mostly collected from their customers in the form of higher bills. Netflix doesn’t receive money from the fund and has indicated it doesn’t need or want the government’s help to create Canadian content.

“It is not in the interest of consumers to have new media subsidize old media or to have new entrants subsidize incumbents,” added Netflix’s Corie Wright. “Netflix believes that regulatory intervention online is unnecessary and could have consequences that are inconsistent with the interests of consumers,” Wright said, adding viewers should have the ability “to vote with their dollars and eyeballs to shape the media marketplace.”

That is not exactly what the CRTC wanted to hear, and Wright was off the Christmas card list for good when she directly rebuffed Mr. Blais’ requests for Netflix’s data on its Canadian customers. Wright implied the data would somehow make its way out of the CRTC’s offices and end up in the hands of the Canadian-owned broadcast and cable competitors that know many at the CRTC on a first name basis.

Does Netflix pose a threat to Canadian culture? Matt Galloway spoke with John Doyle, the Globe & Mail’s television critic, on the Sept. 22nd edition of CBC Radio’s Metro Morning show. Sept. 22, 2014 (8:31) You must remain on this page to hear the clip, or you can download the clip and listen later.

Mr. Blais, obviously not used to requests being questioned, repeated demands for Netflix’s subscriber data to be turned over by the following Monday and if Netflix did not comply, he would revoke Netflix’s current exemption from Canadian content rules and bring down the hammer of regulation on the streaming service.

Blais

The deadline came and went and last week Netflix defiantly refused to comply with the CRTC’s order. A Netflix official said that while the company has responded to a number of CRTC requests, it was not “in a position to produce the confidential and competitively sensitive information, but added it was always prepared to work constructively with the commission.”

Now things are very much up in the air. Many Canadians question why the CRTC believes it has the right to regulate Internet content when it operates largely as a broadcast regulator. Public opinion seems to be swayed against the CRTC and towards Netflix. Canadian producers and writers are concerned their jobs are at risk, Canadian media conglomerates fear their comfortable and predictable future is threatened if consumers decide to spend more time with Netflix and less time with them. All of this debate occurring within the context of a discussion about forcing pay television companies to offer slimmed down basic cable packages and implement a-la-carte — pay only for the channels you want — is enough to give media executives heartburn.

To underscore the point much of this debate involves money, American TV network executives also turned up at the CRTC arguing for regulations that would compensate American TV stations for providing “free” programming on Canadian airwaves, cable, and satellite — retransmission consent across the border.

Netflix does not seem too worried it is in trouble in either Ottawa or in the halls of CRTC headquarters at Les Terrasses de la Chaudière in Gatineau, Québec, just across the Ottawa River. Prime Minister Stephen Harper and Heritage Minister Shelly Glover have made it clear they have zero interest in taxing or regulating Netflix. Even if they were, the Canada-U.S. free trade agreement may make regulating Netflix a practical impossibility, especially if the U.S. decides to retaliate.

[flv]http://www.phillipdampier.com/video/Canadian Press CRTC vs Netflix 9-19-14.mp4[/flv]

Dwayne Winseck, Carleton School of Journalism and Communication, defended the role the CRTC is mandated to play by Canada’s telecommunications laws. (1:41)

Subscribe

Subscribe

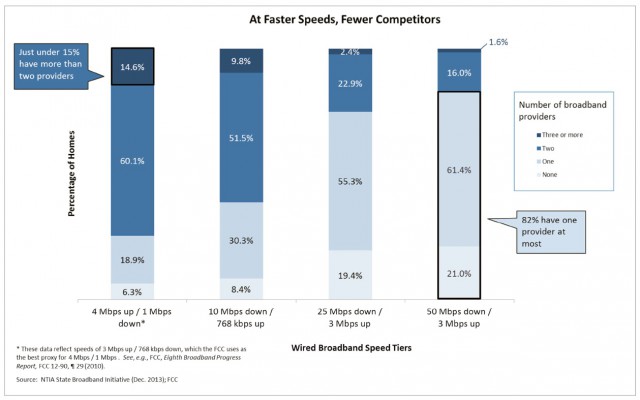

“Take a look at the chart again,” Wheeler said. “At the low end of throughput, 4Mbps and 10Mbps, the majority of Americans have a choice of only two providers. That is what economists call a “duopoly”, a marketplace that is typically characterized by less than vibrant competition. But even two “competitors” overstates the case. Counting the number of choices the consumer has on the day before their Internet service is installed does not measure their competitive alternatives the day after. Once consumers choose a broadband provider, they face high switching costs that include early termination fees, and equipment rental fees. And, if those disincentives to competition weren’t enough, the media is full of stories of consumers’ struggles to get ISPs to allow them to drop service.”

“Take a look at the chart again,” Wheeler said. “At the low end of throughput, 4Mbps and 10Mbps, the majority of Americans have a choice of only two providers. That is what economists call a “duopoly”, a marketplace that is typically characterized by less than vibrant competition. But even two “competitors” overstates the case. Counting the number of choices the consumer has on the day before their Internet service is installed does not measure their competitive alternatives the day after. Once consumers choose a broadband provider, they face high switching costs that include early termination fees, and equipment rental fees. And, if those disincentives to competition weren’t enough, the media is full of stories of consumers’ struggles to get ISPs to allow them to drop service.” Where competition exists, the Commission will protect it. Our effort opposing shrinking the number of nationwide wireless providers from four to three is an example. As applied to fixed networks, the Commission’s Order on tech transition experiments similarly starts with the belief that changes in network technology should not be a license to limit competition.

Where competition exists, the Commission will protect it. Our effort opposing shrinking the number of nationwide wireless providers from four to three is an example. As applied to fixed networks, the Commission’s Order on tech transition experiments similarly starts with the belief that changes in network technology should not be a license to limit competition. Most of the policies Wheeler seeks to influence exist on the state and local level, where he has considerably less influence. Based on the overwhelming interest shown by cities clamoring to attract Google Fiber, the problems of access to utility poles and conduit are likely overstated. The bigger issue is the lack of interest by new providers to enter entrenched monopoly/duopoly markets where they face crushing capital investment costs and catcalls from incumbent providers demanding they be forced to serve every possible customer, not selectively choose individual neighborhoods to serve. Both incumbent cable and phone companies originally entered communities free from significant competition, often guaranteed a monopoly, making the burden of wired universal service more acceptable to investors. When new entrants are anticipated to capture only 14-40 percent competitive market share at best, it is much harder to convince lenders to support infrastructure and construction expenses. That is why new providers seek primarily to serve areas where there is demonstrated demand for the service.

Most of the policies Wheeler seeks to influence exist on the state and local level, where he has considerably less influence. Based on the overwhelming interest shown by cities clamoring to attract Google Fiber, the problems of access to utility poles and conduit are likely overstated. The bigger issue is the lack of interest by new providers to enter entrenched monopoly/duopoly markets where they face crushing capital investment costs and catcalls from incumbent providers demanding they be forced to serve every possible customer, not selectively choose individual neighborhoods to serve. Both incumbent cable and phone companies originally entered communities free from significant competition, often guaranteed a monopoly, making the burden of wired universal service more acceptable to investors. When new entrants are anticipated to capture only 14-40 percent competitive market share at best, it is much harder to convince lenders to support infrastructure and construction expenses. That is why new providers seek primarily to serve areas where there is demonstrated demand for the service.

Susan Lerner, executive director of Common Cause New York, said what was discussed behind closed doors should be disclosed so the public can see what top state officials are saying to the cable executives.

Susan Lerner, executive director of Common Cause New York, said what was discussed behind closed doors should be disclosed so the public can see what top state officials are saying to the cable executives. The governor himself has avoided taking sides, claiming he will abide by the recommendations made by the PSC. But if true, why involve the governor’s office in the merger or meet privately with either the PSC or the companies involved?

The governor himself has avoided taking sides, claiming he will abide by the recommendations made by the PSC. But if true, why involve the governor’s office in the merger or meet privately with either the PSC or the companies involved?

Although Charter Communications did not succeed in its bid to assume control of Time Warner Cable, it isn’t crying about its loss to Comcast either.

Although Charter Communications did not succeed in its bid to assume control of Time Warner Cable, it isn’t crying about its loss to Comcast either.