‘Disloyal Cablevision customers looking for discounts are dead to us.’

Cablevision is fed up with disloyal customers bouncing between the cable company and other providers when promotional discounts expire.

After losing 13,000 broadband, 18,000 voice, and 37,000 television customers, Cablevision CEO Jim Dolan said the company has stopped offering any further discounts to customers that received them once before.

“The customer that has been bouncing from one company to another on promotional/repetitive discounts has hit a dead-end with us,” Dolan told Wall Street analysts during a conference call.

All customers with promotions will now be tracked to prevent extensions or further discounts once the special rates expire. Dolan confirmed the ban will also extend to customer retention offers.

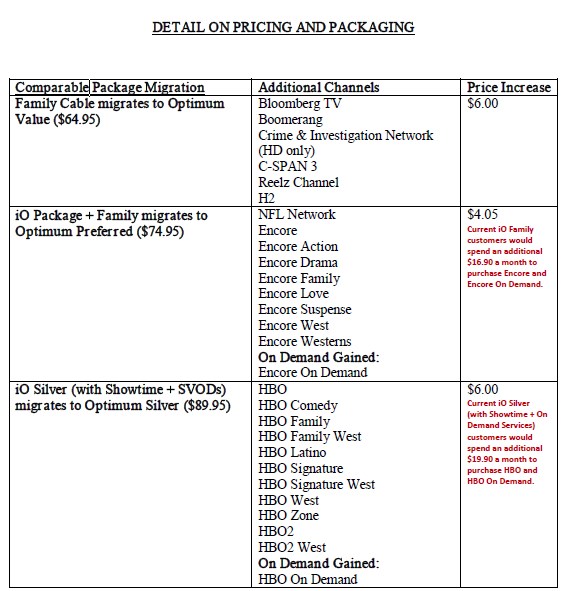

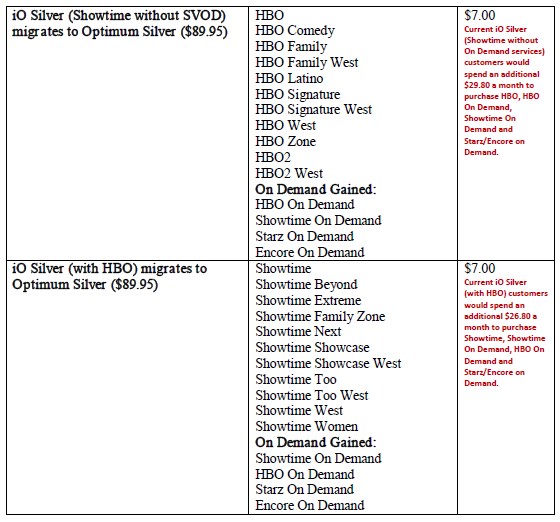

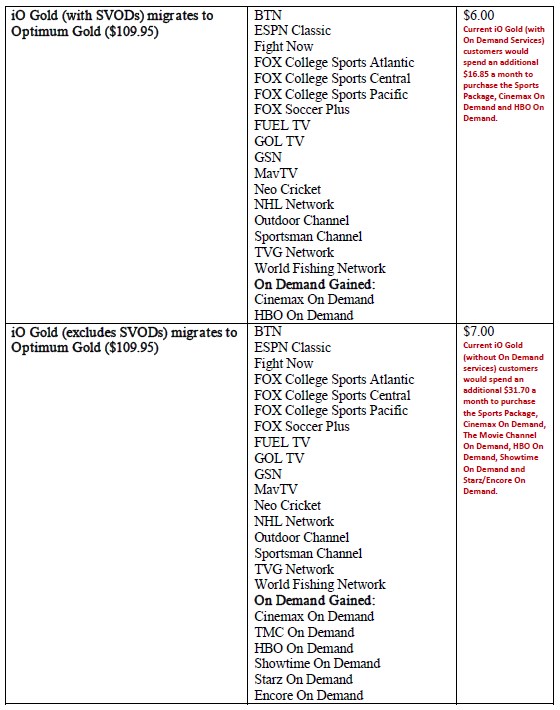

Customers who shop primarily on price in Cablevision’s service area have traditionally flipped between AT&T U-verse, Verizon FiOS and the cable company every few years, usually switching after a promotion expires or rates are increased. Because of fierce price competition, new customers can receive a triple play package of broadband, phone, and television service — including equipment, for less than $85 a month for at least one year. Regular prices are considerably higher.

Cablevision lost most of its departing New York and New Jersey customers to Verizon FiOS, but has been more successful fending off competition in Connecticut, where AT&T has the least capable broadband network among the three providers.

All three companies have attempted price increases over the last few years with mixed results. Cablevision’s eight percent rate hike on broadband this year may have been too much for some customers who shopped around and found a better deal with the phone company.

All three companies have attempted price increases over the last few years with mixed results. Cablevision’s eight percent rate hike on broadband this year may have been too much for some customers who shopped around and found a better deal with the phone company.

Despite the loss in customers, Dolan remains firmly committed to more rate hikes, especially for broadband service, noting its speed and features (including an extensive Wi-Fi network) deliver enough value to sustain further price increases.

Cablevision clearly hopes competitors follow its lead and end promotional rate double-dipping as well. If they do, customers will find themselves locked in with regular pricing regardless of the provider they choose.

Some analysts are skeptical Cablevision’s hard-line will last, especially if subscriber losses mount. Cable operators have attempted to restrict promotions in the past but tend to ease them if market share suffers. Despite the third quarter customer retreat, Cablevision’s rate hikes delivered $336 million in broadband revenue during the last three months, an increase from $308 million earned the same time last year.

Subscribe

Subscribe

Cablevision has tried to avoid being picked off by the likes of neighboring Comcast or Time Warner Cable by trying (and failing) to go private in 2005 and 2007. Cablevision’s service area formerly extended well into western New York — especially in small communities and rural towns, before selling out to Time Warner Cable and retreating to its home base of Long Island, a few New York City boroughs, and parts of Connecticut and New Jersey.

Cablevision has tried to avoid being picked off by the likes of neighboring Comcast or Time Warner Cable by trying (and failing) to go private in 2005 and 2007. Cablevision’s service area formerly extended well into western New York — especially in small communities and rural towns, before selling out to Time Warner Cable and retreating to its home base of Long Island, a few New York City boroughs, and parts of Connecticut and New Jersey. Cablevision has recently taken steps that only make a sale more likely, shutting down ancillary businesses like Newsday Westchester, OMGFAST! — a start-up wireless broadband provider in Florida, and selling off Clearview Cinemas, AMC Networks, and reducing holdings in sports programming.

Cablevision has recently taken steps that only make a sale more likely, shutting down ancillary businesses like Newsday Westchester, OMGFAST! — a start-up wireless broadband provider in Florida, and selling off Clearview Cinemas, AMC Networks, and reducing holdings in sports programming.

AT&T is seeking freedom from regulation, oversight and the right to abandon its landline network with the assistance of Connecticut legislators who modeled a state deregulation measure on recommendations from the corporate-funded, AT&T-backed, American Legislative Exchange Council (ALEC).

AT&T is seeking freedom from regulation, oversight and the right to abandon its landline network with the assistance of Connecticut legislators who modeled a state deregulation measure on recommendations from the corporate-funded, AT&T-backed, American Legislative Exchange Council (ALEC).

What is the best way to win a big promotion at Cablevision? Be related to the Dolan family that founded the cable system.

What is the best way to win a big promotion at Cablevision? Be related to the Dolan family that founded the cable system.