Frontier Communications plans to leverage their existing fiber-copper infrastructure to offer broadband-powered television service for up to half of their national customer base over the next four years.

Frontier Communications plans to leverage their existing fiber-copper infrastructure to offer broadband-powered television service for up to half of their national customer base over the next four years.

Like many Frontier initiatives, the company’s IPTV effort relies on minimal spending, with just $150 million in capital budgeted for the project, spread out over several years.

“Our plans are to introduce video service to more than 40 markets representing approximately three million households over a three- to four-year period,” said Frontier CEO Daniel McCarthy. “Once complete, video service will be available to about 50% of the 8.5 million households in Frontier’s existing footprint, not counting the pending Verizon acquisition.”

Frontier intends to sell the service to the 57% of customers it claims can receive at least 20Mbps broadband speed. The video streams will co-exist with customers’ data service.

“Our IPTV applications employ the latest very advanced compression technology,” said McCarthy. “[Each] HD television channel will require approximately 2.5Mbps of capacity, meaning a household with four HDTVs active at once will require 10Mbps of capacity into the home, leaving the remainder available for data usage.”

Frontier’s IPTV approach is similar to AT&T U-verse. The company will depend on fiber to the neighborhood service already in place in certain markets, coupled with existing copper wiring already on telephone poles or buried underground in each neighborhood. To further minimize expenses (and customer inconvenience), Frontier will rely on customer-installable wireless set-top boxes that can be relocated to any television in the home.

McCarthy

Frontier has experimented with its video service since last fall in its test market of Durham, N.C. That city also benefits from an extensive fiber upgrade undertaken by Frontier. Frontier’s website sells the service as Frontier FiOS TV, even though Durham’s fiber network was built by Frontier, not Verizon.

For customers, it will likely be a welcome change from Frontier’s ongoing dependence on its partnership with satellite provider Dish Networks to offer video service. One clue Frontier has not well withstood heavy competition from competing cable operators comes from the company’s latest quarterly earnings report. Frontier executives admitted voice service disconnects are accelerating beyond expectation and average revenue per customer dropped 1.1% to $63.14 for the fourth quarter of 2015.

Frontier also continues to feel the wrath of former AT&T customers in Connecticut that withstood a messy “flash cut” from AT&T to Frontier that left some customers without service for days. Despite the expiration of special pricing promotions for Connecticut customers resulting in the prospect of higher revenue, Frontier still recorded a $7 million decline from Connecticut alone, which it mostly blamed on customers ditching landlines. In the rest of the country, Frontier’s “legacy service areas” (those still dependent on aging copper infrastructure) delivered another $4 million decline in revenue for the quarter.

Where are those customers going? Cable operators continue to grab Frontier’s unhappy DSL customers and wireless companies continue to benefit from landline disconnects.

To prevent a repeat of Connecticut in the Frontier-acquired Verizon territories in Florida, California, and Texas, Frontier will keep Verizon’s service plans and only gradually shift services away from Verizon, with the ability to back out of the transition immediately if something goes wrong.

Frontier’s IPTV service will depend on the classic cable television model — 100+ local, network, and cable channels delivered in a bundle with broadband and voice service. At the outset, Frontier won’t be emphasizing skinny bundles of TV channels, but will allow existing Verizon FiOS customers to keep the slimmed down packages they already have.

Subscribe

Subscribe Frontier Communications has topped AT&T’s penchant for grandiose Fiber to the Press Release announcements with a new gigabit fiber to the home service now being promoted in Connecticut, despite being available to only two homes in a single upscale subdivision in North Haven.

Frontier Communications has topped AT&T’s penchant for grandiose Fiber to the Press Release announcements with a new gigabit fiber to the home service now being promoted in Connecticut, despite being available to only two homes in a single upscale subdivision in North Haven. “We think this is a good option for us: new builds, small complexes,” Ferraiolo said. “The developer is very happy with it and we’re very happy with it.”

“We think this is a good option for us: new builds, small complexes,” Ferraiolo said. “The developer is very happy with it and we’re very happy with it.” The Communications Workers of America today

The Communications Workers of America today  Many of Altice’s claims appeared “disingenuous and misleading” to the CWA. From the CWA’s filing:

Many of Altice’s claims appeared “disingenuous and misleading” to the CWA. From the CWA’s filing: Translation: Cablevision alone is responsible for the debt Altice raised to pay for Cablevision. Or, as Altice explained to investors in its third quarter 2015 earnings report, the parent company operates its various subsidiaries as “distinct credit silos in Europe and the U.S.”

Translation: Cablevision alone is responsible for the debt Altice raised to pay for Cablevision. Or, as Altice explained to investors in its third quarter 2015 earnings report, the parent company operates its various subsidiaries as “distinct credit silos in Europe and the U.S.”

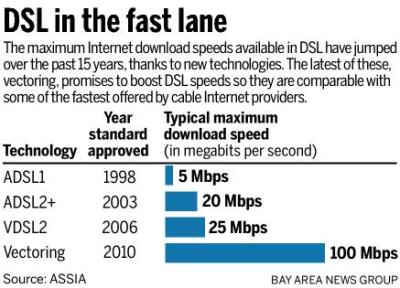

Just a few years earlier, most providers wouldn’t think of offering discounted 10Mbps service, fearing it would cannibalize revenue as customers downgraded to get lower priced service. Increasing demands on bandwidth from online video and multiple in-home users have gradually raised consumer expectations, and their need for speed.

Just a few years earlier, most providers wouldn’t think of offering discounted 10Mbps service, fearing it would cannibalize revenue as customers downgraded to get lower priced service. Increasing demands on bandwidth from online video and multiple in-home users have gradually raised consumer expectations, and their need for speed.

Frontier Communications continues to face challenges keeping customers in its legacy copper wire service areas, where only modest investments in network upgrades have proved insufficient to stop customers shopping around for better service.

Frontier Communications continues to face challenges keeping customers in its legacy copper wire service areas, where only modest investments in network upgrades have proved insufficient to stop customers shopping around for better service.