Time Warner Cable plans to reach 75 percent of its customers with Maxx service upgrades offering broadband speed boosts up to 300/20Mbps for the same price it charges for 50Mbps by the end of 2016, assuming a merger with Comcast does not result in the plans being shelved.

Time Warner Cable plans to reach 75 percent of its customers with Maxx service upgrades offering broadband speed boosts up to 300/20Mbps for the same price it charges for 50Mbps by the end of 2016, assuming a merger with Comcast does not result in the plans being shelved.

Time Warner Cable customers will also escape Comcast’s ongoing experiments with usage caps and usage-based billing if the company remains independent, as Time Warner Cable executives continue to maintain that usage pricing should only be offered to customers that want it.

Company officials discussed the ongoing investments in Maxx upgrades during a quarterly results conference call with investors held earlier today.

CEO Rob Marcus indicated Time Warner Cable will choose markets for Maxx upgrades based on what kind of competition the cable company faces in each city.

“Our aim is to have 75% of our footprint enabled with Maxx […] by the end of [2016], and my guess is we’re continuing to roll it out beyond that,” said Marcus. “So the only question is prioritization, and obviously as we think about where to go first, competitive dynamics are a factor. So that includes Google, although it’s not explosively dictated by where Google decides to go. In fact I think we announced the Carolinas before Google did their announcement this week. So competitors are certainly relevant obviously.”

Time Warner Cable has targeted its Maxx upgrades in areas where its principal competitors — AT&T, Google, and Verizon — have made or announced service and speed improvements. Maxx upgrades are now complete in New York City and Los Angeles. Much of Austin, Tex., is also finished, where both AT&T GigaPower U-verse and Google Fiber plan to offer gigabit service.

This year, Time Warner will focus on bringing Maxx to Charlotte, Dallas, Hawaii, Kansas City, Raleigh, San Antonio and San Diego. Charlotte, Raleigh, and Kansas City will eventually see high-speed competition from both Google Fiber and AT&T U-verse. Time Warner is facing increasingly aggressive competition from Hawaiian Telcom, San Antonio is on Google’s short list and will also likely see faster U-verse, and San Diego is on AT&T’s list for GigaPower upgrades.

Time Warner spent $4.1 billion on capital expenses in 2014, up nearly $900 million above 2013 spending. Most of the money went to network upgrades in Maxx markets where new set-top boxes and cable modems are being provided to customers. Marcus refused to offer any guidance about how much the company intends to spend on upgrades in 2015, citing its looming merger with Comcast.

Marcus

Not every city will benefit from network upgrades. Although 2/3rds of Time Warner Cable markets will get Maxx over the next two years, several will have to make do with the service they have now. The Time Warner Cable markets most at risk of being left off the upgrade list also have the weakest competition:

- Yuma, Ariz.

- Nebraska

- Wisconsin

- Eastern Ohio & Pennsylvania (except Cleveland)

- Binghamton, Utica, Watertown, Elmira, and Rochester, N.Y.

- Kentucky

- West Virginia

- South Carolina

- Western Massachusetts

- Maine

If the merger with Comcast is approved, the Maxx upgrade effort is likely to be shelved or modified by the new owners as customers are gradually shifted to Comcast’s traditional broadband plans.

Marcus also continued to shoot down compulsory usage-based billing and usage caps questions coming from Wall Street analysts. Marcus reminded the audience Time Warner Cable already offers optional usage-based pricing packages, and they have no intention of forcing customers to accept usage billing or caps.

“I think the ultimate success of usage based pricing will depend on customer uptake and customers’ interest in availing themselves of a usage based tier versus unlimited tier,” said Marcus. In earlier conference calls, Marcus admitted only a tiny fraction of Time Warner customers have shown any interest in usage allowances. The overwhelming majority prefer flat rate service.

In contrast, Comcast’s broadband customers in several southern cities continue to be unwilling participants in that cable company’s ongoing usage billing trials.

Subscribe

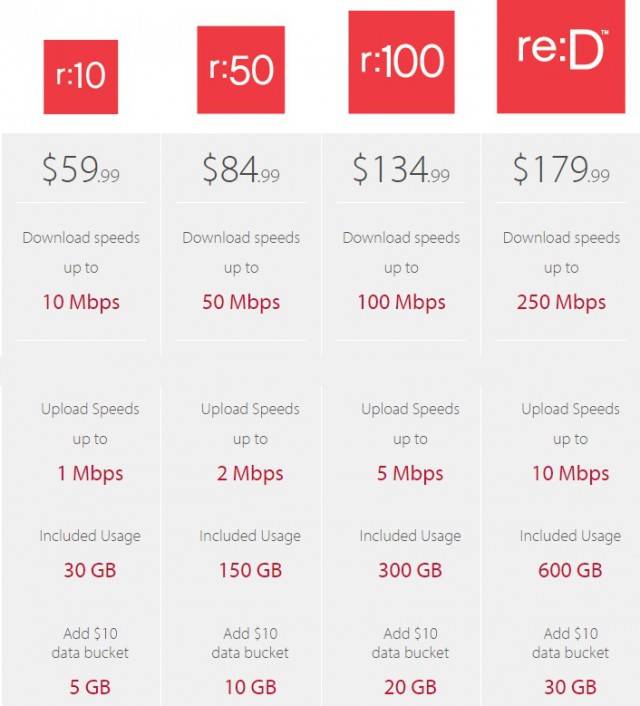

Subscribe Alaska’s largest cable company today unveiled changes to its Internet plans, ditching surprise overlimit fees in favor of a speed throttle.

Alaska’s largest cable company today unveiled changes to its Internet plans, ditching surprise overlimit fees in favor of a speed throttle.

Beggars can be choosers if you are running Cablevision, the northeast’s largest non-conglomerate cable company, still run by the Dolan family.

Beggars can be choosers if you are running Cablevision, the northeast’s largest non-conglomerate cable company, still run by the Dolan family. In the Netherlands, having access to two broadband competitors isn’t enough to guarantee broadband competition, and Dutch telecom regulators are not about to deregulate Internet service in the country until consumers have more choices for broadband access.

In the Netherlands, having access to two broadband competitors isn’t enough to guarantee broadband competition, and Dutch telecom regulators are not about to deregulate Internet service in the country until consumers have more choices for broadband access.

The sleepy deep south isn’t often a battleground for an all-out broadband competition war, but Ridgeland, Miss.-based C Spire, a regional cell phone company with fiber broadband aspirations, has gotten too big for its britches and Comcast is preparing to demonstrate its size and resources can run even a home state provider into the ground.

The sleepy deep south isn’t often a battleground for an all-out broadband competition war, but Ridgeland, Miss.-based C Spire, a regional cell phone company with fiber broadband aspirations, has gotten too big for its britches and Comcast is preparing to demonstrate its size and resources can run even a home state provider into the ground. C Spire’s plans could cost Comcast a significant number of cable customers across Mississippi, and it isn’t taking that lightly.

C Spire’s plans could cost Comcast a significant number of cable customers across Mississippi, and it isn’t taking that lightly.