AT&T unveiled it’s U-verse system Monday in the Triad region of North Carolina, hoping to poach customers from Time Warner Cable’s “triple play” package of phone, broadband, and cable service.

AT&T unveiled it’s U-verse system Monday in the Triad region of North Carolina, hoping to poach customers from Time Warner Cable’s “triple play” package of phone, broadband, and cable service.

AT&T U-verse services, which are delivered over AT&T’s Internet Protocol (IP) hybrid fiber-copper network, offer an alternative to cable with a DVR that can record more programming than the competition, features and apps not available from the local cable company, and additional channels new to the region. AT&T U-verse can combine every AT&T service a customer subscribes to onto a single monthly bill.

The most popular Internet-only tier of service has somewhat anemic download speeds up to 6 Mbps for $43 a month — other packages range from $38 for 3 Mbps to $65 for 24 Mbps.

U-verse TV packages include “local-channel only” service for $19 a month (with a stinging $199 installation fee), to more than 390 channels for $112 a month, with a $29 activation fee. Other packages include U-100 with 130 channels for $54 a month and U-200 with 230 channels for $67. High definition channels, now numbering more than 130, cost $10 extra per month. Want premium channels in HD? That’s another $5 a month.

Like other providers, AT&T has tinkered with pricing to deliver the most savings to customers who bring all of their business to AT&T with a triple-play bundle subscription.

“Today’s expansion of AT&T U-verse reflects our commitment to make the investments necessary to bring consumers across the Piedmont Triad a new era of true video competition,” Cynthia Marshall, AT&T North Carolina president said in a statement. “Local residents have asked for more choices in television service and today we’re delivering.”

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/ATT U-verse introduction.flv[/flv]

Watch this comprehensive video from AT&T explaining the many types of services U-verse offers and helpful tips to prepare for service installation. Then view an actual installation in a customer’s home who shows off the equipment. Stop the Cap! recommends you let AT&T do all of the required wiring for you. That’s why you are paying that installation fee! (22 minutes)

Brubaker

But despite the company’s claims that competition will deliver lower prices for consumers, the evidence suggests otherwise.

AT&T credits a statewide video franchising bill passed in the North Carolina legislature for making U-verse possible in the state. Company officials showed their thanks by inviting the two state legislators instrumental in shepherding AT&T’s agenda through the General Assembly to be on hand to take credit for introducing cable competition in the state. They also publicly thanked them in their press release.

Seventeen term House Rep. Harold Brubaker (R-Randolph) congratulated AT&T for its accomplishments. Brubaker received $4,000 in campaign contributions from AT&T in the first quarter of 2010.

The representative from Asheboro co-sponsored the 2006 Video Service Competition Act which stripped local oversight of cable operators and made AT&T’s entry into North Carolina effortless. For other would-be competitors, especially municipalities seeking to build their own fiber networks, Brubaker has been far less helpful. Most recently, he voted against an effort to bring broadband service to Caswell County in areas incumbent provider CenturyLink has ignored for years.

Adams

“Prior to the legislation, you had geographic areas where you operated in, so it kind of like took the walls down. The legislation took the walls down to allow for more direct competition for the consumer. Competition is great. The consumer’s the one that benefits,” said Brubaker. “AT&T’s presence in the market will very definitely save customers money.”

Rep. Alma Adams (D-Guilford), another co-sponsor, said AT&T’s arrival was exactly what she hoped for when she supported the legislation.

“As policymakers, our goal was to increase investment in North Carolina and give consumers more choices and innovative new services,” said Adams. “Today’s announcement makes that goal a reality for Triad residents.”

Adams added that AT&T U-verse also provided a safety valve for consumers who want an alternative to incumbent provider Time Warner Cable.

“Even if they like a particular company, they always like to know that there’s some other opportunities out there that they can look at as well, so they can do some comparing,” she said.

[flv width=”480″ height=”380″]http://www.phillipdampier.com/video/Important Information about ATT U-Verse system.flv[/flv]

AT&T delivered more time and attention to North Carolina legislators at their launch event than they ever will on U-verse. AT&T segregates Public Access, Educational, and Government channels on a single U-verse TV channel that makes for tedious viewing. Watch this demonstration from the California Public Utilities Commission. (4 minutes)

AT&T announced the service would initially be available in limited areas of Forsyth, Davidson, Guilford, Rockingham and Alamance counties, and we do mean “limited.” Many Triad residents who checked to see if the service was available in their area found it was not. In fact, AT&T refuses to disclose exactly how many customers in the region can actually sign up for the service. We couldn’t find anyone who could order the service when it officially launched.

“There will be small pockets around most of the entire area,” Chuck Greene, AT&T’s regional director for the Piedmont Triad told the News-Record. “Once we complete the build-out, it will include parts of Davidson, Caswell and Randolph.”

AT&T lobbied hard to sweep away earlier provisions in local video franchises that committed providers to rapidly expand service to every possible customer in their respective service areas. Under the Video Services Competition Act, AT&T can take its sweet time, perhaps for years before service becomes widely available across the region. Some areas will never receive the service.

Time Warner Cable welcomed competition from AT&T U-verse.

“For a long time, Time Warner Cable has faced competition from satellite and dish providers,” Scott Pryzwansky, the company’s local public affairs manager, wrote to the News-Record. “We continue to invest in our network and remain committed to bring the best products and services to the Triad. We are confident we will maintain positive relationships with our customers.”

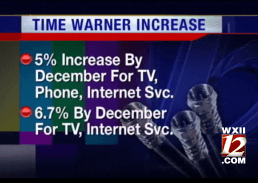

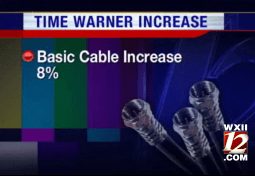

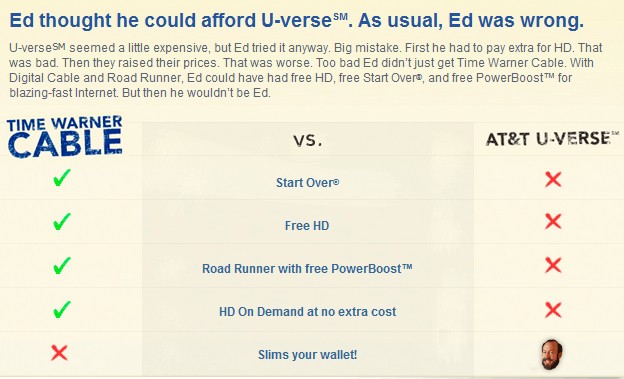

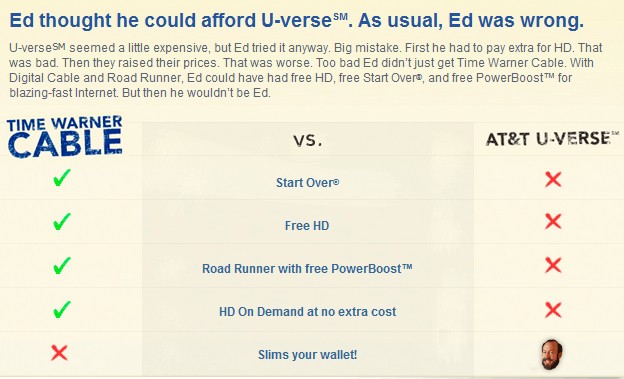

Time Warner Cable has little to fear from AT&T’s arrival. Pryzwansky said Time Warner Cable has not lowered its pricing in any of the markets where it faces AT&T U-verse competition. Both AT&T and Time Warner Cable have raised prices at least annually for their respective subscribers. The only exception in North Carolina has been in Wilson, where municipal provider Greenlight has kept Time Warner Cable from increasing prices.

Time Warner Cable maintains a special website to cope with competition from AT&T U-verse and satellite providers. Hilariously, the site quotes a piece from DSL Reports about U-verse price increases. Time Warner subscribers might not want to venture too far beyond that piece, because editor Karl Bode reports on the cable company's own rate hikes as well. (Click image to visit TWC site)

Stop the Cap! reader Sam in Greensboro thinks AT&T’s arrival is much ado about nothing.

“AT&T prices their U-verse service nearly the same or more as Time Warner Cable, especially after the introductory rate expires,” he says. “Few people are going to be bothered switching back to Time Warner after the year is up, so they’ll be paying the same high prices for cable service to AT&T instead of the cable company — a distinction with no difference.”

Sam won’t bother with U-verse because he is disgusted with AT&T’s lobbying efforts to stop consumer broadband reform and Net Neutrality.

“It’s like dealing with the devil,” Sam writes. “Why would I want to pay AT&T my money so they can turn around and spend it working against my interests as a consumer?”

The only good thing about U-verse’s arrival is that it may stall Time Warner Cable from trying another Internet Overcharging scheme in the area.

“Time Warner has to think twice about another usage cap and overlimit fee ‘experiment’ in the Triad if customers can simply flee to U-verse, although knowing AT&T they’d love to have the same rationing of the Internet they force on their wireless customers,” Sam said.

[flv width=”636″ height=”373″]http://www.phillipdampier.com/video/TWC Fights Back U-verse.flv[/flv]

Time Warner Cable maintains a sometimes-bizarre web campaign to convince customers not to switch to U-verse or satellite. We’ve put together the various videos so you can watch them all at once. (4 minutes)

Like Time Warner Cable, AT&T does not offer a-la-carte cable programming, either. Customers can only choose from large packages of programming, not individual channels.

Triad area cable customers told local media they were tentatively glad U-verse is competing, but many are taking a wait and see approach as to whether they’ll actually see any savings.

WFMY News 2 spoke with cable customers today. One man said he feels like a “hostage” to his cable company because they have a monopoly on TV, Internet and phone bundles. A woman said cable and satellite companies drive her “crazy,” so she gave up and now simply rents movies.

“I am happy, but it’s hard times. I have three children. We live on one income,” Jamie Rettie, a Time Warner Cable customer told News 2. Whether she switches to AT&T or not, she’s said she’s hoping for a change in her bill.

“Hopefully they’ll keep competing against each another and have better and better prices for their services,” she said. “(I’ll) wait out my contract and we’ll see what happens.”

Some residents, like Thomas, are left picking the lesser of two evils:

“I don’t know who’s worse at their game, as Time Warner Cable and AT&T are both evil corporate entities that care only about their bottom line,” he writes. “Search the Internet and understand this service limits the amount of TV’s that can be used at one time.”

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/Greensboro Media Cover U-Verse Launch 9-13-10.flv[/flv]

Watch several news reports from Triad area TV stations about the introduction of AT&T U-verse. In order, we include reports from WXII, WGHP, and WFMY-TV. (7 minutes)

Some of America’s largest media companies are starting to get nervous over reported stipulations Comcast and NBC-Universal must meet in order to win FCC approval of their merger deal.

Some of America’s largest media companies are starting to get nervous over reported stipulations Comcast and NBC-Universal must meet in order to win FCC approval of their merger deal.

Subscribe

Subscribe