Verizon Wireless is expected to enter the Alaskan mobile market sometime in 2013-2014, according to incumbent competitors, who expect Verizon’s largest impact will be to bleed AT&T of customers.

Verizon Wireless is expected to enter the Alaskan mobile market sometime in 2013-2014, according to incumbent competitors, who expect Verizon’s largest impact will be to bleed AT&T of customers.

Alaska’s two primary local providers — Alaska Communications, Inc. (ACS) and General Communications, Inc. (GCI), are telling shareholders to relax because they don’t expect to see Big Red in the Alaskan market for at least 2-3 years. Both companies reported net losses for the quarter, and GCI lost 2,400 subscribers recently when more than 4,000 soldiers at Fort Wainwright in Fairbanks were deployed to Afghanistan.

Both ACS and GCI have been using the current poor economic climate and their respective stockpiles of cash-on-hand to retire debt or reissue long-term-debt at more favorable low interest rates. Both companies are also hurrying to outdo each other’s 4G wireless network deployments before Verizon Wireless shows up, making use of spectrum it acquired last August to enter the Alaskan market. Government rules require Verizon to sign-on its new network by June 13, 2013. But Verizon admits it will take up to five years after that to completely build a new network from scratch.

Right now, Verizon Wireless customers taking their phones to Alaska roam on ACS’ network, for which the company is compensated with an increasing amount of extra revenue. ACS boosted earnings in part on that roaming revenue, even as it lost more of its own customers. When Verizon switches on its own network, that roaming revenue will rapidly decline, but ACS executives reassured shareholders their knowledge and experience of construction seasons in Alaska guarantee Verizon won’t be able to get its network together until 2013 at the earliest.

Right now, Verizon Wireless customers taking their phones to Alaska roam on ACS’ network, for which the company is compensated with an increasing amount of extra revenue. ACS boosted earnings in part on that roaming revenue, even as it lost more of its own customers. When Verizon switches on its own network, that roaming revenue will rapidly decline, but ACS executives reassured shareholders their knowledge and experience of construction seasons in Alaska guarantee Verizon won’t be able to get its network together until 2013 at the earliest.

But when Verizon opens their doors, Ron Duncan, CEO of GCI expects a hard fight on his hands.

“We recognize ultimately they’ll be a significant competitor, although I see AT&T share more at risk because Verizon’s main claim to fame when they get to Alaska is going to be devices. We’ll still outpace them on coverage. We’ll continue to be the only ones with statewide coverage,” Duncan said. “People who want to buy the coverage buy from us today; people who want devices buy from AT&T because AT&T gets much better devices than we do.”

Just months after Verizon announced they were headed north, both ACS and GCI accelerated plans to roll out respective “4G” networks for wireless customers, although each company is deploying different standards.

GCI

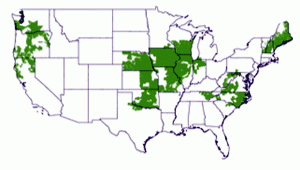

GCI’s cell phone network is a combination of some of its own infrastructure, the acquisition of Alaska Digitel, and a resale agreement to use parts of AT&T Wireless’ coverage it acquired from Dobson Communications Systems. In and around Fairbanks, Anchorage, Glennallen, Valdez, Prudhoe Bay, Wasilla, and Kenai, GCI offers CDMA service. In those communities and many other rural regions in western Alaska, GCI relies on AT&T Alascom GSM networks. GCI pitches its CDMA network’s 3G wireless data capabilities, which offer faster wireless data speeds, if you can get coverage. For wider coverage in Alaska’s smaller communities, GCI markets GSM phones, which currently only offer 2G EDGE/GPRS data speeds. If you use a cell phone mostly for voice calls, the wider coverage afforded by GCI’s GSM network is a popular choice. But if you want faster data, CDMA 3G data speeds are required.

Eventually, GCI’s 4G network may help deliver coverage and faster speeds in both urban and rural areas, particularly as GCI plans to invest up to $100 million to construct more of its own network, instead of relying on resale agreements and acquisitions.

GCI has chosen HSPA+ for 4G service on the GSM network, and will introduce the service in Anchorage later this month. That’s the same standard used by AT&T and T-Mobile in some areas. It’s not as fast as LTE service from Verizon Wireless, but is much cheaper to deploy because cell sites need not be linked with fiber optic cables — an expensive proposition.

Alaska Communications has a large 3G CDMA network in Alaska all its own. Its coverage is primarily in eastern Alaska adjacent to major cities like Anchorage, Juneau, and Fairbanks, and where it does provide 3G data coverage, the company claims it extends further out than GCI. ACS doesn’t offer much coverage in small villages and communities in western Alaska, however.

ACS expects to skip incremental upgrades and launch its own 4G LTE service in the future. It may help the company regain its second place standing, lost to GCI last year, and protect it from Verizon Wireless poaching its customers.

Subscribe

Subscribe