Six college towns will benefit from the nation’s first multi-community broadband gigabit deployment, thanks to $200 million in capital funding to get the broadband networks off the ground.

Six college towns will benefit from the nation’s first multi-community broadband gigabit deployment, thanks to $200 million in capital funding to get the broadband networks off the ground.

The Gigabit Neighborhood Gateway Program leverages local government, universities, private capital, and the public to jointly support and foster the development of new fiber optic networks.

The new program claims it will offer competitively-priced super-fast broadband through projects that will cover neighborhoods of 5,000-10,000 people and communities up to 100,000 in size. Selection of the six winning communities will be announced between this fall and next spring.

“Gigabit Squared created the Gigabit Neighborhood Gateway Program to help select Gig.U communities build and test gigabit speed broadband networks with speeds from 100 to 1000 times faster than what Americans have today,” the company said in a statement.

“The United States is behind in the world for Internet speed,” said Mark Ansboury, Gigabit’s president and co-founder. “The goal is to help get us out front for a platform of innovation.”

That platform is certainly not forthcoming from the country’s largest broadband providers, who according to Ansboury have been pulling back on wired infrastructure upgrades in recent years, shifting focus to more profitable wireless networks.

Gigabit Squared defines the next generation of broadband Internet in terms of speed, declaring 2,000Mbps (2Gbps) as the target to achieve.

The winning projects will be sponsored by Gig.U members, which include:

- Arizona State University

- California Institute of Technology

- Case Western Reserve University

- Colorado State University

- Duke University

- Florida State University

- George Mason University

- The Georgia Institute of Technology

- Howard University

- Indiana University

- Michigan State University

- North Carolina State University

- Penn State University

- University of Alaska – Fairbanks

- University of Arizona

- University of Chicago

- University of Colorado – Boulder

- University of Florida

- University of Hawaii

- University of Illinois

- University of Kentucky

- University of Louisville

- University of Maine

- University of Maryland

- University of Michigan

- University of Missouri

- University of Montana

- University of Nebraska – Lincoln

- University of New Mexico

- University of North Carolina at Chapel Hill

- University of Oklahoma

- University of South Florida

- University of Virginia

- University of Washington

- Virginia Tech

- Wake Forest University

- West Virginia University

Blair Levin, executive director at Gig.U, believes private American telecom companies will always be constrained from delivering world class broadband comparable to South Korea or Japan because of Wall Street opposition to the investment required to construct them. In the eyes of investors, today’s slower networks, in their estimation, do just fine.

Blair Levin, executive director at Gig.U, believes private American telecom companies will always be constrained from delivering world class broadband comparable to South Korea or Japan because of Wall Street opposition to the investment required to construct them. In the eyes of investors, today’s slower networks, in their estimation, do just fine.

Gig.U believes that they have a solution, at least for towns with a sizable university system that can serve as host of the next generation broadband network:

First, any community that wants its residents to have access to a network that delivers world-leading bandwidth can do so. The barrier is not technology or economics. The barrier is organization; specifically, organizing demand and improved use of underutilized assets, such as rights of way, dark fiber, or in more rural areas, spectrum. The responses identified a multitude of ways local communities can improve the private investment case by lowering investment and risk, and increasing revenues for private players willing to upgrade or build new networks without budget outlays from the local government.

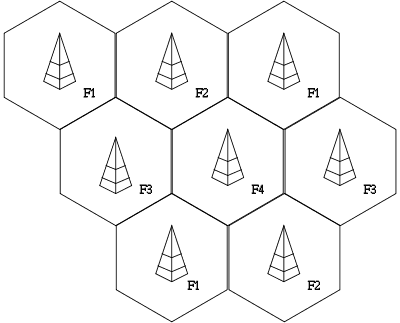

Second, the responses confirmed that university communities have the easiest organizing task and greatest upside. Their density, demographics and demand make the current economics more favorable for an upgrade than other communities. For example, the high percentage of the population in university communities living in multiple dwelling units makes the economics of an upgrade far more favorable than for communities composed largely of single-family homes. With the growing importance of Big Data for the economy and the society, university communities are the natural havens for such enterprises to be born and prosper. Through the Gig.U process, our communities are already exploring more than a half-dozen paths to achieve an upgrade; paths that will be replicable for others and will deliver a major step forward in providing America a strategic broadband advantage.

Outside of a handful of upstart private competitors like California-based Sonic.net, most fiber broadband expansion come from private companies like Google — building an experimental fiber-to-the-home network in Kansas City, community-owned broadband services coordinated by local town or city government, co-op telecommunications companies owned by their subscribers, or municipal utilities.

While those efforts are typically committed to the concept of “universal service” — wiring their entire communities — the Gig.U project targets funding only for networks in and around university campuses.

The New America Foundation builds on Gig.U’s premise in its own recent report, “Universities as Hubs for Next Generation Networks,” which argues affordable expansion of broadband can win community support when the public has the right to also benefit from those networks. While Gig.U’s approach suggests the project will target fiber broadband directly to the homes qualified to receive it, the New America Foundation supports the construction of mesh wireless Wi-Fi networks to keep construction costs low for neighborhoods targeted for service.

An earlier project in Orono and Old Town, Maine may afford a preview of Gig.U’s vision, as that collaboration between the University of Maine and private fiber provider GWI is already in its construction phase. For those lucky enough to live within range of the fiber project, broadband speeds will far exceed what incumbents Time Warner Cable and FairPoint Communications deliver. FairPoint has fought similar projects (and GWI specifically) for years.

Will private providers object to the Gig.U effort to win local governments’ favor in the six cities eventually chosen for service? History suggests the answer will be yes, at least to the extent local cable and phone companies demand the same concessions for easy pole access, reduced pole attachment fees, and easing of zoning restrictions and procedures Gig.U project coordinators expect.

Levin has stressed Gig.U projects are based on university and private funding sources, not taxpayer dollars. That may also limit how much objection commercial providers may be able to raise against the projects.

[flv]http://www.phillipdampier.com/video/WABI Bangor Orono Maine Getting Faster Service 5-16-12.flv[/flv]

WABI in Bangor previews the new gigabit broadband network being constructed in Orono and Old Town, Maine. (2 minutes)

Subscribe

Subscribe