The FCC’s UHF TV Diet Plan: Slimming Down the Free TV Dial to Make Room for Expensive Wireless Broadband

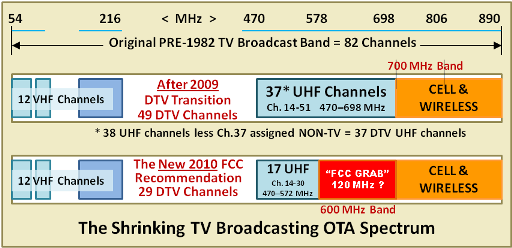

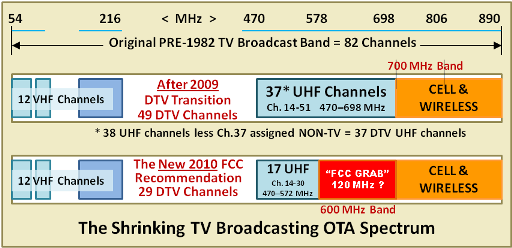

By the end of this month, the Federal Communications Commission will vote on proposed rules governing a planned 2014 auction that will allow over the air TV stations to surrender their “free TV” channels in return for money from the nation’s wireless phone companies looking for more mobile broadband spectrum.

The Commission is considering reallocating UHF TV channels 31-51 for mobile data, compacting the nation’s over the air TV stations onto VHF channels 2-13 and UHF channels 14-30. But the FCC also expects many stations, particularly smaller independent or specialty channels in large cities, will be happier surrendering their broadcast TV licenses in return for cash compensation.

If the five FCC commissioners approve the plan, it will be the largest spectrum auction since 2008, and could earn the U.S. treasury billions, tempered by payouts to television stations agreeing to shut down their transmitters, and to compensate remaining stations for the cost of moving operations to a new channel number, when necessary.

“To ensure ongoing innovation in mobile broadband, we must pursue several strategies vigorously: freeing up more spectrum for both licensed use and for unlicensed services like Wi-Fi; driving faster speeds, greater capacity, and ubiquitous mobile Internet coverage; and taking additional steps to ensure that our invisible infrastructure for mobile innovation can meet the needs of the 21st century,” the agency’s chairman, Julius Genachowski, said in a statement.

The controversial auction would compensate broadcasters even before the FCC knows exactly how much spectrum it will eventually have available to auction to wireless carriers. Nobody is sure how many stations will ultimately choose to abandon their over-the-air audiences, but an FCC report predicts the largest number of station losses would be in large metropolitan areas, which often have more than a dozen stations devoted to infomercials/home shopping, ethnic shows, religious programming, and independent network affiliates. The FCC suspects some of these lower-rated stations will see the money as a strong incentive to surrender their broadcast licenses.

Genachowski

The FCC considered several spectrum-saving proposals that would free up as much channel space as possible to resell to wireless operators. One proposal would have full power broadcast outlets switch to low-powered cellular-style transmitter networks to reduce the potential interference on an increasingly crowded dial. But that proved unpopular and expensive for broadcasters. Instead, the FCC predicts stations could effectively share channels and still retain HD service. For example, a local CBS station could agree to surrender its license and broadcast instead over the transmitting facilities of the local NBC station, splitting one station’s allocated channel bandwidth in half. Other stations will be relocated on the dial or moved to different transmitter sites to reduce potential interference from stations in nearby cities.

Stations that do not require an HD service could share space with those serving several standard definition channels to the public. These are typically public, educational, or ethnic-oriented broadcasters.

As a consequence, the FCC says many stations might have to give up on their “multicast” standard definition secondary services — the 24 hour local weather or news channel, Me-TV, This TV, Retro TV, Antenna TV, and Bounce, for example, because there would be insufficient bandwidth when two services sharing one channel are transmitting in HD.

The FCC does not believe stations would mind too much, quoting from RBR/TVBR:

“So far, nobody’s been able to figure out what can go on a digital side channel and pay for its own presence there. Mostly it’s been used as a revenue-neutral or money-losing place to put 24-hour weather… Nobody watches these things in strong enough numbers to generate any advertising revenue.”

But the FCC did recognize that certain viewers in fringe reception zones could experience a loss of service — one that could be addressed by subsidizing improved antennas for homeowners or requiring cable or satellite operators to develop a “lifeline” television service consisting of local broadcasters, either for free or at a minimal monthly cost.

Some consumer groups worry that any forthcoming spectrum auction would be dominated by Verizon Wireless and AT&T — the nation’s two largest carriers, who could easily outbid smaller cell phone companies also clamoring for spectrum. During the last auction in 2008, which netted nearly $20 billion, Verizon Wireless walked away with the bulk of the spectrum on offer. Without auction rules setting aside significant spectrum for smaller competitors, both dominant carriers could lock up one of the last spectrum auctions for the next 5-10 years, cementing their de facto duopoly.

The FCC is considering reworking its market concentration rules before the bidding begins, which could constrain Verizon and AT&T from bidding and winning the bulk of available frequencies in the cities where they dominate.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Bloomberg FCC Chair on Spectrum Auctions 9-10-12.flv[/flv]

FCC Chairman Julius Genachowski talks about rising demand for mobile broadband access and the outlook for spectrum auctions to free up more airwaves. He speaks with Cory Johnson on Bloomberg Television’s “Bloomberg West.” (7 minutes)

Subscribe

Subscribe