Verizon Communications spent Labor Day weekend putting the final touches on a carefully crafted deal to attain full ownership of its wireless unit, buying out its British partner’s 45 percent share in a deal valued at $130 billion.

The long talked-about buyout of Vodafone has been on the table for years, but became a priority for Verizon CEO Lowell McAdam, who spent much of his career overseeing Verizon Wireless. Since McAdam took over from predecessor Ivan Seidenberg in 2011, he has refocused priority on Verizon’s wireless business, at the cost of landlines and Verizon’s fiber optic network FiOS.

The transaction dwarfs (by nearly four times) the $33 billion annual budget of the entire state of New Jersey. Verizon has agreed to pay Vodafone $58.9 billion in cash and $60.2 billion in Verizon shares, and finance another $5 billion of the deal in loan notes. Verizon has also agreed to sell its 23 percent ownership in Vodafone Italy worth around $3.5 billion and take on $2.5 billion of Vodafone’s debt.

A deal this large would normally generate tens of billions in tax revenue payable to HM Revenue & Customs in England and the Internal Revenue Service in the United States, but creative accounting at both companies makes it all but certain Vodafone will pay nothing in British taxes and only $5 billion to the IRS, despite its $130 billion windfall.

Vodafone is structuring the deal through a Dutch holding company, transferring assets to Verizon in a way that minimizes the tax bite. As proposed, the deal is exempt from taxes in both the Netherlands and the United Kingdom.

[flv]http://www.phillipdampier.com/video/CNBC Verizon Wireless Vodafone McAdam Merger 9-3-13.mp4[/flv]

CNBC had this exclusive interview with Verizon CEO Lowell McAdam discussing why Verizon is willing to spend $130 billion to end its partnership with Vodafone and how Verizon Wireless will change as a result. (12 minutes)

Wall Street investment banks will do better than American and British tax authorities, dividing at least $1.3 billion in financing, merger, and legal fees surrounding the Verizon deal. Many of New York’s largest investment banks are taking part in the transaction.

Wall Street investment banks will do better than American and British tax authorities, dividing at least $1.3 billion in financing, merger, and legal fees surrounding the Verizon deal. Many of New York’s largest investment banks are taking part in the transaction.

Vodafone is depending heavily on guidance from Swiss-based UBS and Goldman Sachs. The latter has earned $438 million so far this year advising companies on mergers and acquisitions.

Verizon is relying on advice from J.P. Morgan Chase and Morgan Stanley. Bank of America Merrill Lynch and Barclays have joined to offer their help with the enormous debt-funding package required for the deal.

Verizon customers will notice little to nothing different about their wireless service after the deal is complete in the first quarter of 2014. Many customers had no idea Vodafone was part owner of the largest wireless company in the United States. Verizon always maintained effective control of the U.S. operation and plans no immediate changes as a result of assuming outright control of the company.

Little controversy is expected in getting the deal approved by regulators for the same reason.

Shareholders are likely to reap most of the rewards. Vodafone stockholders are expecting the bulk of the proceeds from the sale will be returned to them in the form of dividends. Verizon shareholders also expect better returns in the future now that Verizon’s profitable wireless unit will no longer have to set aside costly dividend payments intended for Vodafone and its shareholders.

[flv width=”512″ height=”308″]http://www.phillipdampier.com/video/BBC Vodafone will not pay tax on 84bn sale to Verizon 9-2-13.flv[/flv]

The BBC reports the sale of Vodafone’s 45% share of Verizon Wireless has been structured so that both companies can entirely avoid British and Dutch capital gains taxes and limit the American tax bite to less than $5 billion. (1 minute)

Verizon hopes being the master of its own destiny will allow the company to innovate its wireless network towards future revenue opportunities, especially in the machine to machine connectivity business. Both AT&T and Verizon Wireless are racing to enable medical devices, home appliances, electric meters, and automobiles to communicate over their respective wireless networks. Both companies are concerned that the cell phone marketplace has become saturated in the United States, with most people desiring cell phone service already having it. With Wall Street demanding ongoing growth quarter after quarter, new revenue sources are more important than ever.

Verizon hopes being the master of its own destiny will allow the company to innovate its wireless network towards future revenue opportunities, especially in the machine to machine connectivity business. Both AT&T and Verizon Wireless are racing to enable medical devices, home appliances, electric meters, and automobiles to communicate over their respective wireless networks. Both companies are concerned that the cell phone marketplace has become saturated in the United States, with most people desiring cell phone service already having it. With Wall Street demanding ongoing growth quarter after quarter, new revenue sources are more important than ever.

“Even in the saturated market, (Verizon Wireless) continues to post growth figures,” Bill Menezes, an industry analyst at research firm Gartner told USA Today. “They’re looking at a world where growth is coming from these ancillary devices.”

Many Verizon shareholders expected a deal this year, but some are concerned Verizon has offered too much to buy out Vodafone. Many Wall Street analysts had expected Vodafone would part with its 45 percent ownership of Verizon Wireless for around $100 billion, but Vodafone clearly held out for more.

The corporate deal is the world’s third largest after Vodafone’s $203 billion takeover of Germany’s Mannesmann in 1999 and AOL’s 2000 $181 billion acquisition of Time Warner.

Vodafone is planning to use some of the proceeds not returned to shareholders to bolster its European business, which has suffered from the economic downturn and robust wireless competition that have kept prices low. Wall Street analysts predict the European market is ripe for a wave of consolidation similar to what happened in the United States over the last decade. Vodafone may need more financial resources to protect its market position or have the flexibility to buy out competitors.

The European wireless giant has been a quiet partner of Verizon Wireless for almost 14 years. Verizon Wireless was launched in 2000 as a joint venture of Bell Atlantic and Vodafone. As the venture was being launched, Bell Atlantic merged with GTE, forming Verizon Communications.

[flv]http://www.phillipdampier.com/video/CNBC Discussing the media deals 9-3-13.mp4[/flv]

CNBC reports historically low interest rates and cheap credit for corporations made it an ideal time to structure a deal so important to J.P. Morgan Chase, the bank sent CEO Jamie Dimond to persuade Verizon board members to approve it. Investment banks will split more than one billion dollars in deal fees. (7 minutes)

Subscribe

Subscribe Time Warner Cable’s

Time Warner Cable’s  “Now that it is concededly a regulated telephone service provider, Time Warner is acting like other regulated phone companies, in that it immediately is seeking to relax the rules designed to protect customers,”

“Now that it is concededly a regulated telephone service provider, Time Warner is acting like other regulated phone companies, in that it immediately is seeking to relax the rules designed to protect customers,”  The Telephone Fair Practices Act (TFPA)

The Telephone Fair Practices Act (TFPA) According to

According to  Customers are unlikely to be aware of this, however. Time Warner Cable bills include a regular notice that if a customer is in arrears for any Time Warner Cable service, telephone service may be shut off.

Customers are unlikely to be aware of this, however. Time Warner Cable bills include a regular notice that if a customer is in arrears for any Time Warner Cable service, telephone service may be shut off. “Customers have the opportunity to walk into the local [cable] office and make a payment during these extended hours,” Time Warner argues. “They also have the opportunity to pay online and over the phone 24 hours a day, as well as paying cable representatives directly when they arrive at the customer’s premises to disconnect service. TWCIS-NY believes that streamlining of the rules for disconnection of phone and cable services will make the Commission’s rules more consistent across the board and less confusing for customers.”

“Customers have the opportunity to walk into the local [cable] office and make a payment during these extended hours,” Time Warner argues. “They also have the opportunity to pay online and over the phone 24 hours a day, as well as paying cable representatives directly when they arrive at the customer’s premises to disconnect service. TWCIS-NY believes that streamlining of the rules for disconnection of phone and cable services will make the Commission’s rules more consistent across the board and less confusing for customers.”

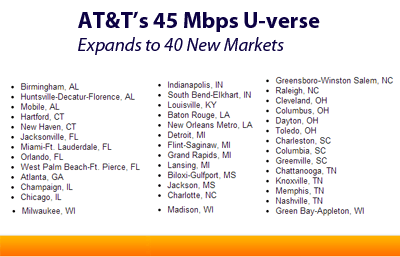

AT&T has boosted the maximum available broadband speed for its U-verse Internet offering to 45/6Mbps service in 40 cities across 15 states.

AT&T has boosted the maximum available broadband speed for its U-verse Internet offering to 45/6Mbps service in 40 cities across 15 states.

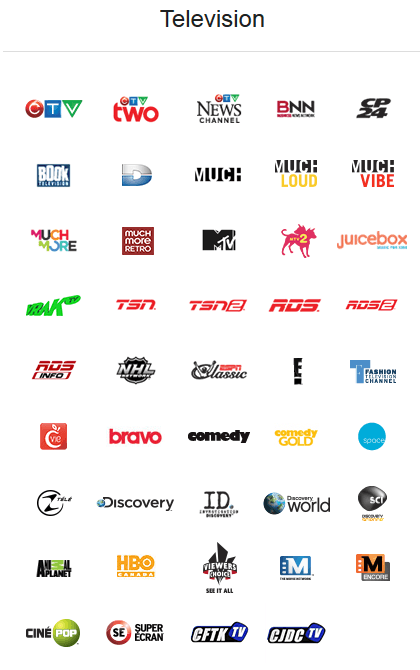

Concern about programming costs only goes so far. While Time Warner Cable and Bright House customers continue to go without Showtime and access to CBS programming online (in addition to local station blackouts in New York, Texas and California), the two cable companies have found room in the budget to add two new expensive sports networks to their lineups.

Concern about programming costs only goes so far. While Time Warner Cable and Bright House customers continue to go without Showtime and access to CBS programming online (in addition to local station blackouts in New York, Texas and California), the two cable companies have found room in the budget to add two new expensive sports networks to their lineups. “It’s going to be a popular channel,” said Joe Durkin, Bright House senior director of corporate communications. “It’ll be rich with sports, and we’re happy to bring it to our customers.”

“It’s going to be a popular channel,” said Joe Durkin, Bright House senior director of corporate communications. “It’ll be rich with sports, and we’re happy to bring it to our customers.” Fox also plans to launch another entertainment cable network Sep. 2 with the debut of a companion to the FX network Fox is calling FXX.

Fox also plans to launch another entertainment cable network Sep. 2 with the debut of a companion to the FX network Fox is calling FXX.