Verizon’s Home Phone Connect base station

Despite assertions that Verizon created Voice Link as a solution for customers suffering from chronic landline problems, in reality the wireless landline replacement is nearly identical to Verizon Wireless’ Home Phone Connect and was produced only because of a complicated business relationship the wireless carrier had with its part owner Vodafone.

A Verizon spokesman told Stop the Cap! in June Voice Link was created for use where Verizon’s copper customers had chronic repairs issues:

Verizon will maintain the copper network where it makes customer service and business sense to do so. Please keep in mind that the vast majority of our copper customers have no issues at all with their service; we are only considering the universe of customers where the copper network is not supporting their requirements. Again, the exception is the storm-impacted areas in the western portion of Fire Island and a few New Jersey Barrier communities where copper facilities were damaged beyond repair. In these locations Voice Link will be the single voice option available to customers. Verizon will offer these customers the opportunity to use our state-of-the-art, tried and tested wireless network at the same rate (or better) that they pay today.

Business sense appears to have played a great deal in Verizon’s strange decision to produce and market two nearly identical products. Hired by Verizon, William E. Taylor, a special consultant with National Economic Research Associates, Inc., testified last week that both Voice Link and Home Phone Connect are intended to compete in the landline replacement marketplace:

Home wireless services are a rapidly growing alternative to wireline plain old telephone service for many customers throughout New York State. In competition with Verizon’s Voice Link service, AT&T offers a Wireless Home Phone and Internet service with unlimited nationwide voice service at $20 per month with broadband internet service at higher prices, wherever its 4G LTE network is available. Sprint offers a competing wireless home service at $20 per month, as does U.S. Cellular. Wal-Mart sells its comparable Straight Talk prepaid wireless home voice service for $15 a month together with additional optional prepaid broadband internet access service. These offerings are similar to Verizon Wireless Home Phone Connect service, and differ in some features from Verizon New York’s Voice Link service but compete directly with both services.

Thus, one immediate and real competitive effect of the public release of Verizon’s wireline and Voice Link cost data would be to enable these four competitors (and others) to assess Verizon’s price floor for wireline voice service as an element in pricing their wireless home network services and calculating the profitability of expanding their wireless networks to provide wireless home phone service on Fire Island and elsewhere.

Verizon Voice Link

Taylor’s provided his declaration as part of Verizon’s case not to reveal certain documents (for competitive reasons) to the public about Voice Link deployment in New York and New Jersey. Verizon has offered Voice Link either as an option or, originally, as a sole landline replacement in areas considered uneconomical for landline restoration. But Taylor’s testimony also suggests Voice Link wasn’t necessarily created to solve chronic landline problems or replace landlines in natural disaster areas. In fact, Taylor testified Voice Link is just one of several competitors in the landline replacement market, including one from Verizon Wireless. In 2011, Verizon Wireless began national marketing of Home Phone Connect, a home wireless landline replacement product marketed to cord-cutters.

Verizon Communications chief financial officer Fran Shammo explained why Verizon Voice Link and Verizon Wireless Home Phone Connect both exist during remarks at the Wells Fargo Technology, Media & Telecom Conference on Nov. 12. Shammo blamed a complicated business relationship between Verizon, Verizon Wireless, and Vodafone which owned 45% of Verizon’s wireless venture for the near-twin services. The result was an informal “wall” between two Verizon entities, one devoted to landline and FiOS service, the other wireless — both selling essentially the same wireless product.

“The easiest way I can explain this is if you look at our product called Home Phone Connect, which was developed on the wireless side of the house,” Shammo said. “This is the product that you plug into your wall at home, converting the copper wire inside your home to an LTE network for voice. So in essence it is a copper voice replacement product. Now you would think that we would be able to take that same product and market it on the wireline side of the house. But we were prohibited because of governance and affiliate transactions. So the wireline business went out and developed their own product called Voice Link, which now they sell to their copper and DSL customers.”

Shammo admitted creating both Home Phone Connect and Voice Link was “a pretty inefficient way to develop product.”

So when this governance affiliate transaction-wall is taken away, you then can become a much more efficient company to launch one product to your customer, whether it is a wireline product or a wireless product,” he added. Shammo also believes tearing down that wall and tightly integrating Verizon’s wireline and wireless businesses will create “the soft synergies of the new Verizon that we believe we can create here.”

That might be bad news for Verizon’s rural landline customers, because Verizon’s current CEO is no fan of maintaining rural copper landline service when Verizon Wireless can do the job for less money and the open the door to higher profits.

“In […] areas that are more rural and more sparsely populated, we have got [a wireless 4G] LTE built that will handle all of those services and so we are going to cut the copper off there,” said Verizon CEO Lowell McAdam in June of last year. “We are going to do it over wireless. So I am going to be really shrinking the amount of copper we have out there and then I can focus the investment on that to improve the performance of it. The vision that I have is we are going into the copper plant areas and every place we have FiOS, we are going to kill the copper. We are going to just take it out of service and we are going to move those services onto FiOS. We have got parallel networks in way too many places now, so that is a pot of gold in my view.”

The wall that divided Verizon and Verizon Wireless may eventually be rebuilt between rural landline customers transitioned to wireless service as the only available landline replacement technology and urban and suburban customers offered Verizon’s fiber-to-the-home service FiOS.

Subscribe

Subscribe

All three companies have attempted price increases over the last few years with mixed results. Cablevision’s eight percent rate hike on broadband this year may have been too much for some customers who shopped around and found a better deal with the phone company.

All three companies have attempted price increases over the last few years with mixed results. Cablevision’s eight percent rate hike on broadband this year may have been too much for some customers who shopped around and found a better deal with the phone company.

A

A

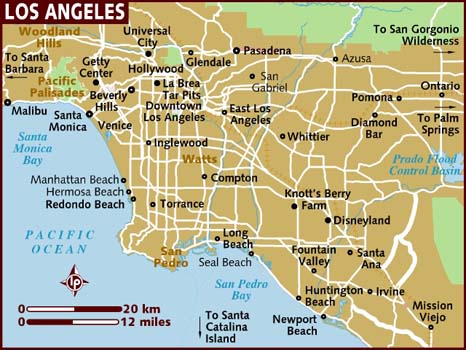

The city can offer some incentives to attract an outsider, such as promising a lucrative contract to manage the city government’s telecom needs. It can also ease bureaucratic red tape that often stalls big city infrastructure projects. But Los Angeles is not exactly prime territory for a fiber build. Its notorious sprawling boundaries encompass 469 square miles, with many residents and businesses in free-standing buildings, not cheaper to serve multi-dwelling units.

The city can offer some incentives to attract an outsider, such as promising a lucrative contract to manage the city government’s telecom needs. It can also ease bureaucratic red tape that often stalls big city infrastructure projects. But Los Angeles is not exactly prime territory for a fiber build. Its notorious sprawling boundaries encompass 469 square miles, with many residents and businesses in free-standing buildings, not cheaper to serve multi-dwelling units.