Stop the Cap! reader Steve L. has heard enough of AT&T’s promises that deregulation would bring more competition and better deals to Californians.

Stop the Cap! reader Steve L. has heard enough of AT&T’s promises that deregulation would bring more competition and better deals to Californians.

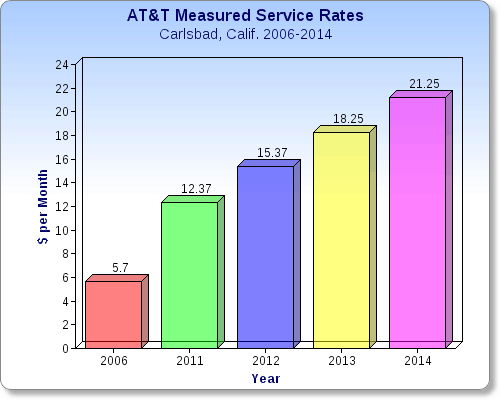

The Carlsbad resident is staring at the fruits of AT&T’s labor — winning deregulation of phone rates in 2006: a basic phone bill that has increased from $5.70 a month before deregulation to $21.25 effective Jan. 2, 2014. That represents a 272 percent increase for basic measured (pay-per-minute) local telephone service. As if that was not enough, AT&T is also raising the per-minute rate for semi-local calls for the second time in two years. Earlier this year, AT&T slashed customers’ calling allowances by 25 percent, reducing the 225 minutes a month of toll-free calling down to 168 minutes in January.

Customers living in large, spread out cities in California are accustomed to Zone Usage Measurement (ZUM) charges for calls placed to numbers more than 12 miles from the local telephone exchange. But they may get bill shock after noticing how much the per-minute rates have increased:

- ZUM 1/2 (12-15 miles): Calls have doubled in price over the last 36 months. Prior to 2013, calls cost three cents per minute. AT&T raised prices to four cents in January and will raise them again to six cents per minute on Jan. 1;

- ZUM 3 (15-16 miles): Calling prices have increased from five cents a minute in 2012 to six cents a minute in 2013 and will be seven cents per minute in 2014.

“After surcharges, fees, and taxes, my bill will be nearly $30 per month for measured rate service, representing a near doubling of cost in just a 22-month period,” Steve writes. “I have no other choice than AT&T for a true powered landline, but I am rejecting this latest increase and plan to test and move to a VoIP system.”

“After surcharges, fees, and taxes, my bill will be nearly $30 per month for measured rate service, representing a near doubling of cost in just a 22-month period,” Steve writes. “I have no other choice than AT&T for a true powered landline, but I am rejecting this latest increase and plan to test and move to a VoIP system.”

The constant parade of rate increases from the state’s largest local telephone company began shortly after the California Public Utilities Commission (CPUC) unanimously approved sweeping deregulation of telephone rates in August 2006. Then Republican Commissioner Rachelle Chong was the driving force behind the effort, reports the San Francisco Chronicle.

Chong embraced AT&T’s attitude about telecommunications deregulation, promising consumers would not face abusive rate hikes or bad service. Under the old system, AT&T telephone rates were capped in California. AT&T had to approach the CPUC and justify any proposed increases. Without solid evidence, the company’s rate increase requests were rejected. Under deregulation, AT&T was permitted to set rates at-will.

“By the end of the 2010, these rate caps will no longer be necessary,” Chong promised as the new rules were being phased in. “The market will be so competitive it will discipline prices.”

Not quite.

AT&T’s rates have shot up as much as 222 percent for the average Californian’s measured rate phone service. Some customers, including our reader, found rates nearly three times higher than they were before deregulation. In the last few years, AT&T has increased prices on landline service and calling features even more dramatically across the state:

AT&T’s rates have shot up as much as 222 percent for the average Californian’s measured rate phone service. Some customers, including our reader, found rates nearly three times higher than they were before deregulation. In the last few years, AT&T has increased prices on landline service and calling features even more dramatically across the state:

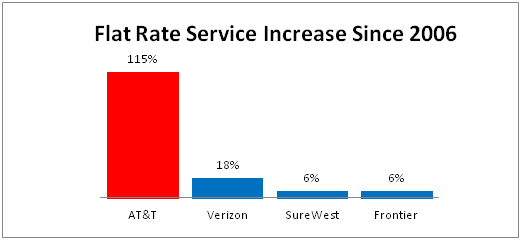

- AT&T Flat-Rate landline service jumped 115 percent since 2006, from $10.69 to $23 a month;

- Call Waiting, a popular phone feature, is up nearly 180 percent;

- Anonymous Call Rejection fees have almost quadrupled;

- Lifeline Service for California’s most disadvantaged is up 28 percent.

“My belief is that AT&T is essentially harvesting,” Dane Jasper, chief executive of Sonic.net, a competing broadband Internet service in Santa Rosa that tosses in domestic phone service for free, told the newspaper. “They jack up the rate by a pretty egregious amount … because if people leave, well, where are they going? AT&T mobile phone service in at least half the cases. So they’re happy to have them leave or happy to have them stay.”

AT&T defends the increases by suggesting rates were artificially restrained by rate regulators under the old system, and the new higher prices reflect economic reality and the deregulated marketplace. But AT&T’s rate increases have blown past other service providers in the state. Verizon’s flat rate service only increased 18 percent since deregulation. Independent providers SureWest and Frontier Communications have only raised prices by about six percent.

AT&T defends the increases by suggesting rates were artificially restrained by rate regulators under the old system, and the new higher prices reflect economic reality and the deregulated marketplace. But AT&T’s rate increases have blown past other service providers in the state. Verizon’s flat rate service only increased 18 percent since deregulation. Independent providers SureWest and Frontier Communications have only raised prices by about six percent.

With these kinds of rate increases, customers like Steve are making hard choices about whether to keep or ditch their landline service. Ironically, AT&T’s argument to decommission traditional landline service is based on the premise customers are abandoning landline service. AT&T advocates moving customers to its deregulated U-verse platform in urban areas and switch rural customers to wireless-only service.

Chong paid a personal price for her erroneous predictions of consumer savings. In December 2009, the Democratically controlled State Senate refused to hold hearings on Chong’s reappointment to the CPUC, ending her term. AT&T and Verizon strongly backed Chong and lobbied hard for her confirmation. AT&T even turned out its notorious “dollar-a-holler” sock puppet brigade of non-profit groups that showered the legislature with letters supporting her reappointment, without bothering to disclose AT&T had made substantial direct or indirect contributions to the groups in the past.

Murray Bass, head of a small nonprofit in Northern California, initially wrote lawmakers saying Chong was a strong voice for low-income seniors. But in an interview, he admitted he’d endorsed her at the suggestion of executives at AT&T, which had given his group money.

“There’s an essential conflict of interest when a regulated — or supposedly regulated — entity is intervening on behalf of a regulator that’s friendly to them,” said Mark Toney, executive director of the Utility Reform Network, a group that opposed Chong.

SUPPORTERS OF COMMISSIONER CHONG WITH TIES TO AT&T

| Organization | Funding Received | Letter Signatory (-ies) |

| Asian Pacific Islander American Public Affairs (APAPA) | The AT&T Foundation gave APAPA $25,000 in 2007. On the APAPA website, AT&T is listed as a top-tier event sponsor with a $50,000 donation in 2009. | Joel Wong, Bay Area Chapter PresidentNorm De Young, VP Outreach and Chair of APAPA’s GovernmentRelations Committee (spoke on behalf of Filipino Progress) |

| CA Small Business Association (CBSA) | AT&T is a corporate sponsor of the Small Business Roundtable (CBRT), the advocacy wing of CBSA, which has received $37,500 from AT&T since 2006. The AT&T Foundation underwrites CBRT’s education fund, tech training and website. Both CBSA and CBRT are active in CPUC proceedings, and CBSA endorses candidates and lobbies public officials.The California Small Business Education Foundation received a 3-year $1.125 million grant from the AT&T foundation. Betty Jo Ticcoli, the letter’s signatory, is its Chair and CSBA is a member.CSBA is a member of the California Utilities Diversity Council (CUDC) along with AT&T and Verizon. | Betty Jo Toccoli |

| California Hispanic Chambers of Commerce (CHCC) | $30,000 from AT&T corporate since 2006, millions more from the Foundation. Black, Hispanic & Asian Chambers are sharing a 1.25-year $287,000 CETF grant. AT&T is a corporate member statewide and of several local Hispanic Chambers. AT&T sponsors CHCC’s annual convention and underwrites local events such as FestivALL, sponsored by the Silicon Valley Hispanic Chamber.Member of CUDC. | Kenneth A. Macias, Chairman of the BoardJoel Ayala, President & CEO |

| City of Firebaugh | $633,000 CETF grant. | Jose Antonio Ramirez, City Manager |

| Cristo Rey High School Sacramento | Received a $25,000 grant from AT&T Foundation in 2009. | Joan Evans, VP for Advancement |

| Fresno-Madera Area Agency on Aging (FMAAA) | $50,000 SBC Foundation Grant in 2002; $20,000 in 2003; AT&T has sponsored FMAAA’s Scamnot.org website since 2005. | Jo Johnson, Executive Director |

| Latino Community Foundation | $25,000 CETF grant. | Aida Alvarez, Chairperson |

| Latino Institute for Corporate Inclusion (LICI) | AT&T is a corporate partner of LICI; LICI’s IRS form 990 shows income of $19,742 in 2008 and it has received $17,500 from AT&T corporate according to AT&T’s 77-M filing with the state, more from the AT&T foundation.Member of CUDC. | Ruben Jauregui, President & CEO |

| Latino Journal | $17,500 from AT&T since 2006; AT&T, Verizon and the CPUC are strategic partners in the Journal-sponsored California Education Summit, which AT&T underwrites.Member of CUDC. | Jose L. Perez |

| Mexican American Opportunity Foundation (MAOF) | $25,000 from AT&T Foundation. | Magda Menendez, Administrator |

| Other Connections Between AT&T and Chong Supporters | ||

| OCA – Organization of Chinese Americans Sacramento | AT&T is a corporate partner of national org and both AT&T and Verizon sponsor Asia Week and other heritage events | Joyce Eng, President |

| Tools of Learning for Children | Big AT&T logo on website. Told the Los Angeles Times, “he’d endorsed [Chong] at the suggestion of executives at AT&T, which has given his group money.” | Murray T Bass, MA, CFP |

| United Way of Butte & Glenn Counties | President Preston Dickinson is former Director of External Affairs for AT&T. | W. Jay Coughlin, Executive Director |

Notes

- 1. CUDC – The California Utilities Diversity Council is a collaboration between the CPUC , the utility companies and other industry participants to promote diversity in the utility industry. AT&T is a gold sponsor of CUDC’s annual convention.

- 2. CETF – CETF is a private non-profit corporation created by the California Public Utilities Commission (CPUC) and funded entirely by AT&T and Verizon. Commissioner Chong is Chair of the CETF Board of Expert Advisors and its Accessibility Committee. CPUC President Michael Peevey is Chairman of the CETF Board of Directors. The CETF board is appointed by the CPUC, AT&T and Verizon.

Sources:

- AT&T Foundation IRS form 990

- The Utility Reform Network

Subscribe

Subscribe

As a result, Verizon lost its case:

As a result, Verizon lost its case:

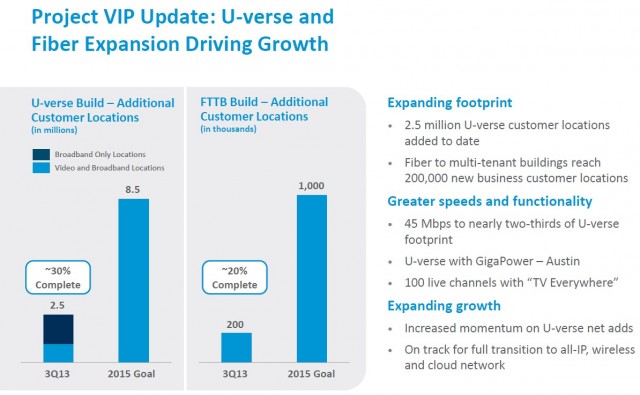

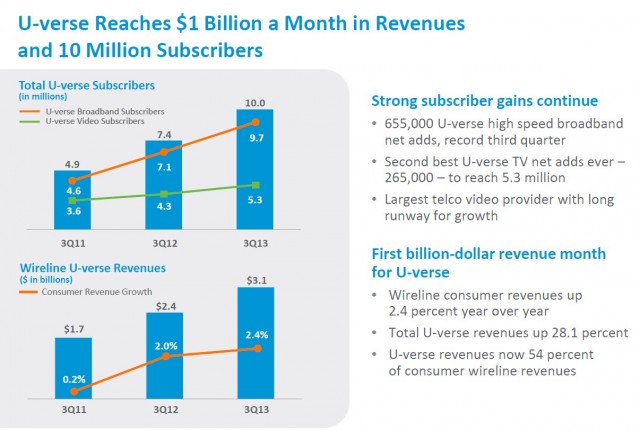

AT&T this month signed up their 10 millionth customer to U-verse High Speed Internet service, surpassing Verizon FiOS as the nation’s biggest telephone company supplier of broadband, television, and telephone service. Coinciding with that success, AT&T is raising prices for U-verse, despite AT&T’s record earnings from the fiber to the neighborhood service, now accounting for $1 billion a month in revenue.

AT&T this month signed up their 10 millionth customer to U-verse High Speed Internet service, surpassing Verizon FiOS as the nation’s biggest telephone company supplier of broadband, television, and telephone service. Coinciding with that success, AT&T is raising prices for U-verse, despite AT&T’s record earnings from the fiber to the neighborhood service, now accounting for $1 billion a month in revenue.

News that there were two potential rivals for Time Warner Cable excited investors, particularly when it was revealed possible suitor Comcast is also separately talking to Charter about a possible joint bid that would split up Time Warner Cable customers while minimizing potential regulatory scrutiny.

News that there were two potential rivals for Time Warner Cable excited investors, particularly when it was revealed possible suitor Comcast is also separately talking to Charter about a possible joint bid that would split up Time Warner Cable customers while minimizing potential regulatory scrutiny.

Ironically, when Malone sold TCI to AT&T, the telephone company would later sell its cable assets to Comcast, run by… and Brian Roberts.

Ironically, when Malone sold TCI to AT&T, the telephone company would later sell its cable assets to Comcast, run by… and Brian Roberts.