The New York State Public Service Commission has invited Stop the Cap! to testify about the impact of Comcast and Time Warner Cable merging on New York State residents.

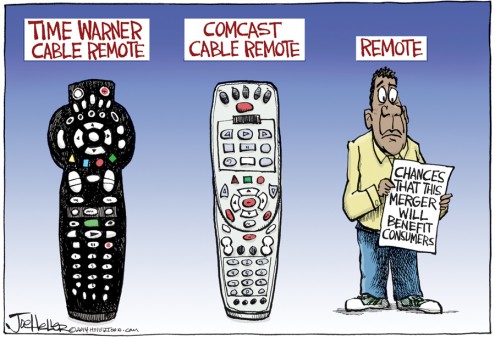

Our testimony will concentrate on an examination of whether the merger is in the best interests of consumers and customers, focusing on issues ranging from usage caps to broadband speeds and pricing and the quality of service provided by both companies. Our remarks will also include a brief overview of the impact of the merger on competition in the state and whether New York would be better served by Comcast or an independent Time Warner Cable.

We will be testifying at the hearing in Buffalo, N.Y., on Monday June 16 starting at 6pm. The public is welcome to attend and will be free to make remarks during the open forum starting at 7:30pm. We urge all New York residents to attend this hearing or others to be held in Albany and New York City. Consumers have significant weight with the New York commissioners and your comments have often derailed the agendas of telecom companies in the state (the Fire Island Verizon Voice Link fiasco, Verizon’s service improvement oversight, stopping Time Warner Cable from cutting off late-paying phone customers on nights and weekends, etc.)

If a sufficient number of residents voice strong concerns about the merger, there is a significant chance New York regulators could place conditions on the merger making it untenable, or could reject it outright, which could torpedo the merger nationwide.

If a sufficient number of residents voice strong concerns about the merger, there is a significant chance New York regulators could place conditions on the merger making it untenable, or could reject it outright, which could torpedo the merger nationwide.

More information from the New York Public Service Commission:

The New York State Public Service Commission will be conducting a series of informational forums and public statement hearings on the petition of Comcast Corporation and Time Warner Cable Inc. allowing Comcast to acquire Time Warner Cable.

The informational forums will consist of presentations by Comcast and other invited parties on the proposed transaction and its likely impact on consumers in New York. The Administrative Law Judge, attending Commissioner and DPS Senior Staff may ask questions of the invited speakers.

Immediately following each informational forum, there will be a public statement hearing at which interested members of the public may offer their views about the Petition in person, before an Administrative Law Judge assigned by the Commission. A verbatim transcript of each hearing will be made for inclusion in the record of the case.

The informational forums and public statement hearings will take place at the following times and places:

Monday, June 16

SUNY Buffalo

Student Union Theater

106 Student Union

Buffalo, NY

We will post driving directions to the forum next week.

Those in or near greater Rochester should contact us and let us know you are attending. We may try to arrange car pooling if there is sufficient interest.

6:00 pm: Informational Forum

7:30 pm: Public Statement Hearing

Wednesday, June 18

SUNY Albany

Performing Arts Center

1400 Washington Avenue

Albany, NY

6:00 pm: Informational Forum

7:30 pm: Public Statement Hearing

Thursday, June 19

NYS DPS Office

90 Church Street

New York, NY

6:00 pm: Informational Forum

7:30 pm: Public Statement Hearing

It is not necessary to be present at the start of the hearing or to make an appointment in advance to speak. Persons interested in speaking will be asked to complete a card requesting time to speak when they arrive at the hearing, and will be called in the order in which the cards are received.

(Cartoon: Heller, Denver Post)

Speakers are not required to provide written copies of their comments.

The public statement hearings will be kept open until everyone wishing to speak has been heard or other reasonable arrangements have been made to include their comments in the record.

Disabled persons requiring special accommodations should contact the Department of Public Service’s Human Resource Management Office at (518) 474-2520 as soon as possible. TDD users may request a sign language interpreter by placing a call through the New York Relay Service at 711 to reach the Department of Public Service’s Human Resource Office at the (518) 474-2520 number. Individuals with difficulty understanding or reading English are encouraged to call the Commission at 1-800-342-3377 for free language assistance services regarding this notice.

Other Ways to Comment

Internet or Mail: Those who cannot attend or prefer not to speak at a public statement hearing may comment electronically to Hon. Kathleen H. Burgess, Secretary, at [email protected] or by mail or delivery to the Secretary at the Public Service Commission, Three Empire State Plaza, Albany, New York 12223-1350. Comments should refer to “Case 14-M-0183, Petition of Comcast Corporation and Time Warner Cable Inc.”

Toll-Free Opinion Line: You may call the Commission’s Opinion Line at 1-800-335-2120. This number is set up to take comments about pending cases from in-state callers, 24 hours a day. Press “1” to leave comments, mentioning the Comcast/Time Warner merger.

All comments provided through these alternative methods should be submitted, or mailed and postmarked, no later than July 31, 2014. All such statements and comments will become part of the record and be reported to the Commission for its consideration.

All submitted comments may be accessed on the Commission’s Web site at www.dps.ny.gov, by searching Case 14-M-0183. Many libraries offer free Internet access.

Subscribe

Subscribe

CenturyLink does not believe it will face much of a competitive threat from AT&T and Verizon’s plans to decommission rural landline service in favor of fixed wireless broadband because the two companies’ offers are too expensive, overly usage-capped and too slow.

CenturyLink does not believe it will face much of a competitive threat from AT&T and Verizon’s plans to decommission rural landline service in favor of fixed wireless broadband because the two companies’ offers are too expensive, overly usage-capped and too slow.

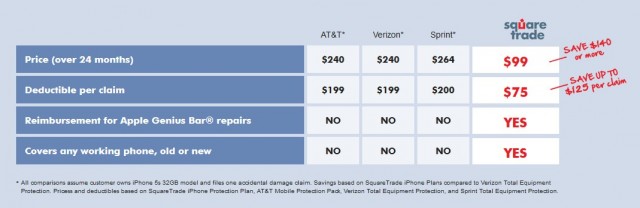

When customers have three or four $600 smartphones on their family plans, purchasing insurance for all of them can prove costly.

When customers have three or four $600 smartphones on their family plans, purchasing insurance for all of them can prove costly.

Squaretrade responds that it doesn’t believe loss/theft protection is a good value for its customers.

Squaretrade responds that it doesn’t believe loss/theft protection is a good value for its customers.

Several long time Rogers executives are out the door, either voluntarily or quietly pushed out.

Several long time Rogers executives are out the door, either voluntarily or quietly pushed out.