The day had finally arrived. After months watching construction crews work their way towards the house she and her boyfriend rent in Rochester, N.Y., Brenda Ververs called Time Warner Cable to cancel service. She thought it would take five minutes to dispense with a barely-tolerated relationship she has maintained with the cable company for nearly 20 years. Instead, she got a retention offer too good to dismiss out of hand.

The day had finally arrived. After months watching construction crews work their way towards the house she and her boyfriend rent in Rochester, N.Y., Brenda Ververs called Time Warner Cable to cancel service. She thought it would take five minutes to dispense with a barely-tolerated relationship she has maintained with the cable company for nearly 20 years. Instead, she got a retention offer too good to dismiss out of hand.

Greenlight Networks, an East Rochester-based fiber overbuilder has been slowly expanding its footprint into a handful of neighborhoods in Rochester and its suburbs, providing 100/20Mbps service for $50 or 1,000/100Mbps for $250 a month. But only a fraction of area residents have heard of the company and even fewer qualify to sign up for their service.

“When the neighbors first saw their construction crews and we found out it was a company called Greenlight, we thought they were there to install red light traffic enforcement cameras,” Ververs said.

Greenlight uses a similar approach to Google Fiber, informally recruiting “fiberhoods” of potential customers. Once enough interest is shown, the company schedules fiber construction in the neighborhood.

But the process remains largely a mystery to many, because unlike Google, Greenlight does not update its website with neighborhood rankings or a detailed service map.

Time Warner Cable, Greenlight’s chief competitor, is well-aware of its fiber competition but considers it too minor to warrant any attention, at least until customers like Ververs call to cancel service.

Time Warner Cable’s national customer retention centers often confuse Greenlight Networks in Rochester, N.Y. with Greenlight, the larger municipally owned fiber to the home network in Wilson, N.C.

“They thought I was moving to North Carolina and was canceling service to start a new account down there, but they finally found Rochester’s Greenlight Networks in their system and went into a script about how Time Warner Cable was an established company and Greenlight was basically a fly-by-night operation that could fail any day,” said Ververs.

Other customers have told Stop the Cap! Time Warner alternates between recognizing Greenlight as a legitimate competitor worth their respect and one that cannot be trusted with your business. But the customer retention effort eventually ends up in the same place — offering customers drastic rate cuts to stay with the cable company.

Not what competition fans want to see: Greenlight’s “Expansion Plans” web page is blank.

“They asked me why I would consider switching to Greenlight for $50 for 100Mbps broadband-only service when for $69 they will give me 50/5Mbps service, cable television, and phone service for two years,” Ververs said. “They emphasized it was less than $20 more for all three services from Time Warner vs. $50 for Internet-only service from Greenlight. They even promised a free upgrade to 100Mbps when it arrives in Rochester sometime this year.”

Some departing customers are also being offered modem fee waivers and free extras, like premium movie channels and expanded international free long distance calling.

Greenlight does not charge modem or franchise fees or hidden surcharges like regulatory recovery fees.

Behind the scenes, Time Warner Cable is also making an effort to lock up the most likely places a fiber overbuilder would want to expand service – multi-dwelling units that are less expensive to wire than single family homes.

Cable operators aggressively recruit apartment managers and neighborhood associations to sign contracts that include discounted service for every home, apartment or condo in a complex, usually offered as “included in the rent or neighborhood association fee.” Many contracts of this type give the cable company exclusive access to existing wiring, discouraging would-be competitors by requiring them to pay considerably higher construction costs to independently wire multi-dwelling units.

Readers also tell us Time Warner is offering departing customers the service improvement many wish they had all along, including a commitment to check and rewire customer homes for free if service quality is among the reasons a customer plans to cancel service. Some customers are also offered specialized customer service contact numbers normally available only to premium-class Signature Home customers. Still others are being given substantial bill credits or rebates if they agree to stay with the cable company.

Ververs hates Time Warner Cable service and the constant rate increases, but the $69 retention offer, apparently only available to customers in competitive areas, has kept them from making a final decision to switch to Greenlight.

“Greenlight doesn’t offer a video or telephone package — just broadband, and we cannot ignore the fact we used to pay Time Warner $160 and can now get three services and free HBO for almost $100 less than we were paying, less than $20 a month more than we would pay Greenlight, and Time Warner plans to match Greenlight’s 100Mbps speeds this year,” said Ververs.

Downtown Rochester, N.Y.

But broadband-only customers are less impressed with Time Warner’s retention efforts in a community than has yet to see cable broadband speeds increase beyond 50Mbps.

Stop the Cap! reader Joseph Corriea writes his friend just signed up for Greenlight in the Highland Park area of Rochester and Time Warner immediately countered with an offer of Extreme Internet (30/5Mbps) for $39 a month. The deal breaker may have been the modem fee Time Warner didn’t offer to waive. Corriea’s friend left Time Warner for Greenlight and is happy with their flat $50 a month bill with no hidden gotcha fees.

Corriea wonders exactly how much bandwidth Time Warner Cable is withholding from barely competitive markets like Rochester.

The answer is plenty. Frontier Communications continues to lose an already meager broadband market share in areas of western New York wired for cable. The majority of its DSL customers only qualify for slowband speeds of 12Mbps or less and although the company recently claimed to have spent $9 million on upgrades in the area, many wonder where the money went.

“Frontier is a joke, they have always been a joke, and the only people doing business with them don’t know any better,” said Riga resident David Sobcek. “DSL is a dinosaur and although they claim faster speeds are available, it is very hit or miss to qualify for them and when the weather is bad, it’s a miss even if you did qualify. They locked my speed at a fraction of what they were selling and gave me nothing but excuses. Time Warner Cable has a monopoly for 99% of this area.”

Western New York is not on Time Warner Cable’s Maxx upgrade list for 2015, which boosts speeds up to 300Mbps. Google has intentionally avoided fiber projects in the northeastern United States because Verizon (and its limited deployment of FiOS fiber) dominates the region, and Frontier Communications has no plans to upgrade cities like Rochester to fiber to the neighborhood service similar to AT&T U-verse.

For the foreseeable future, that leaves Rochester with David vs. Goliath competition – a multi-billion dollar cable company vs. a fiber upstart. But with Time Warner Cable carrying more customer dissatisfaction baggage than American Airlines, nobody should count Greenlight Networks out, especially when the biggest complaint about Greenlight is why it is taking so long to expand their service area.

Subscribe

Subscribe

Monopsony power is wielded when one very large buyer of a product or service becomes so important to the seller, it can dictate its own terms and win deals that no other competitor can secure for itself.

Monopsony power is wielded when one very large buyer of a product or service becomes so important to the seller, it can dictate its own terms and win deals that no other competitor can secure for itself. The FCC recognized the danger of monopsony market power and in the 1990s set a 30% maximum market share limit on the number of video customers one company could control nationally. That number was set slightly above the national market share held by the largest cable company at the time — first known as TCI, then AT&T Broadband, and today Comcast. Comcast sued the FCC claiming the cap was unconstitutional and won twice – first in 2001 when a federal court dismissed the rule as arbitrary and again in 2009 when it threw out the FCC’s revised effort.

The FCC recognized the danger of monopsony market power and in the 1990s set a 30% maximum market share limit on the number of video customers one company could control nationally. That number was set slightly above the national market share held by the largest cable company at the time — first known as TCI, then AT&T Broadband, and today Comcast. Comcast sued the FCC claiming the cap was unconstitutional and won twice – first in 2001 when a federal court dismissed the rule as arbitrary and again in 2009 when it threw out the FCC’s revised effort. If the Comcast merger deal ultimately fails, the company may have only itself to blame.

If the Comcast merger deal ultimately fails, the company may have only itself to blame. Even Comcast admits cable broadband enjoys a near-monopoly at 25/3Mbps speeds. controlling 89.7% of the market as of December 2013.

Even Comcast admits cable broadband enjoys a near-monopoly at 25/3Mbps speeds. controlling 89.7% of the market as of December 2013. The Federal Communications Commission, over loud objections from America’s largest cable and phone companies, has raised the minimum speed necessary to qualify as “broadband” from 4/1Mbps to 25/3Mbps.

The Federal Communications Commission, over loud objections from America’s largest cable and phone companies, has raised the minimum speed necessary to qualify as “broadband” from 4/1Mbps to 25/3Mbps.

With the new definition in place, Comcast’s monopoly control of broadband service becomes more clear as fewer phone companies are able to meet the minimum speed standard to qualify as broadband competitors. Comcast will now control about 50% of all broadband homes in the country, a percentage that could reach even higher if Comcast revamps Time Warner Cable’s broadband tiers.

With the new definition in place, Comcast’s monopoly control of broadband service becomes more clear as fewer phone companies are able to meet the minimum speed standard to qualify as broadband competitors. Comcast will now control about 50% of all broadband homes in the country, a percentage that could reach even higher if Comcast revamps Time Warner Cable’s broadband tiers. Time Warner Cable plans to reach 75 percent of its customers with Maxx service upgrades offering broadband speed boosts up to 300/20Mbps for the same price it charges for 50Mbps by the end of 2016, assuming a merger with Comcast does not result in the plans being shelved.

Time Warner Cable plans to reach 75 percent of its customers with Maxx service upgrades offering broadband speed boosts up to 300/20Mbps for the same price it charges for 50Mbps by the end of 2016, assuming a merger with Comcast does not result in the plans being shelved.

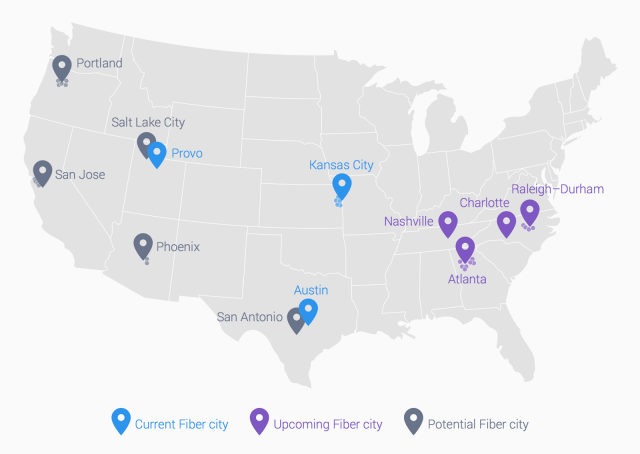

Google has announced it will bring its fiber broadband service to four new cities — Atlanta, Charlotte, N.C., Raleigh-Durham, N.C. and Nashville, Tenn., according to

Google has announced it will bring its fiber broadband service to four new cities — Atlanta, Charlotte, N.C., Raleigh-Durham, N.C. and Nashville, Tenn., according to

Google officials have also been reportedly sensitive to local government red tape and regulation. In Portland, the Journal reports Google has put any fiber expansion on hold there because Oregon tax-assessment rules would value Google’s property based on the value of their intangible assets, such as brand. That would cause Google’s property taxes in Oregon to soar. Until the Oregon state legislature makes it clear such rules would not apply to Google Fiber, there will be no Google Fiber in Portland.

Google officials have also been reportedly sensitive to local government red tape and regulation. In Portland, the Journal reports Google has put any fiber expansion on hold there because Oregon tax-assessment rules would value Google’s property based on the value of their intangible assets, such as brand. That would cause Google’s property taxes in Oregon to soar. Until the Oregon state legislature makes it clear such rules would not apply to Google Fiber, there will be no Google Fiber in Portland.