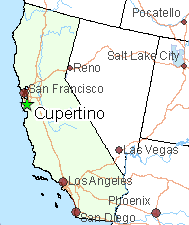

AT&T is rolling out its gigabit fiber service in Cupertino, Calif., but if you want it you will pay $40 a month more than those who live in cities where Google Fiber offers competition.

AT&T is rolling out its gigabit fiber service in Cupertino, Calif., but if you want it you will pay $40 a month more than those who live in cities where Google Fiber offers competition.

AT&T U-verse with GigaPower launched Monday in “select areas,” which traditionally means it won’t be immediately available to most customers. The San Jose Mercury News reports AT&T admitted the service will be available only to a few thousand homes for now in the city and refused to give a percentage of how many of Cupertino’s 20,000 homes would ultimately be able to get the service. AT&T is under no obligation to provide the service and can cherry-pick neighborhoods and skip past government buildings, schools, and hospitals. AT&T won’t give any commitments to the city on its gigabit service.

The company justifies charging $110 a month for the same service it charges $70 for in Austin, Kansas City and North Carolina because it can afford to test higher price points where competitors won’t steal their business.

“We are trying to understand how different markets respond,” Eric Boyer, senior vice president of AT&T U-verse told the Wall Street Journal.

AT&T doesn’t treat the home town of their corporate headquarters much better. In Dallas, Gigapower costs $110, down $10 from its initial price. As Time Warner Cable and Google ponder their own broadband upgrades in North Carolina, AT&T suddenly cut the price of GigaPower on Mar. 17 from $120 to $70 in Winston-Salem and Raleigh-Durham.

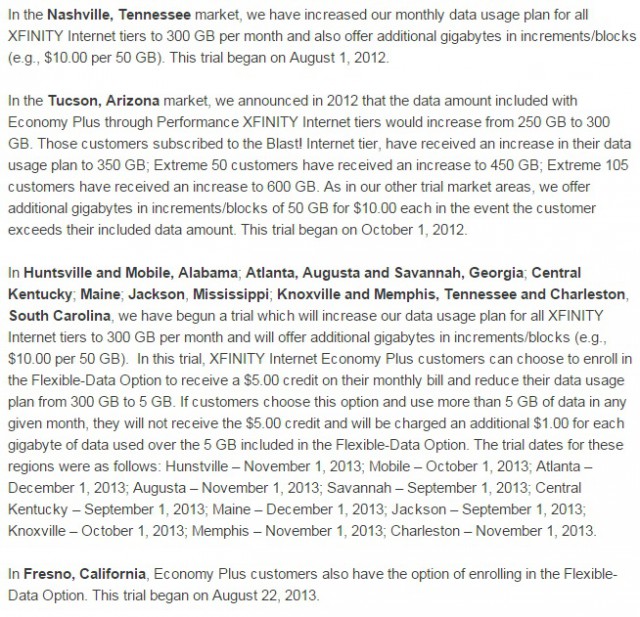

AT&T customers who do not want the company to monitor their browsing activities have to pay $29 more for privacy protection, which opts them out of AT&T’s tracking systems. Despite the high-speed and price, AT&T still insists on usage caps for its most premium broadband offering. Customers can use up to 1TB per month, after which AT&T slaps overlimit fees of $10 for each 50GB customers use over their limit. Its primary competitors, including Google, Time Warner Cable, Verizon and Charter do not have usage caps. Boyer says he knows of no customer that has exceeded the 1,000GB usage cap. But that also brings the question if no customer has exceeded the cap, why have one?

AT&T customers who do not want the company to monitor their browsing activities have to pay $29 more for privacy protection, which opts them out of AT&T’s tracking systems. Despite the high-speed and price, AT&T still insists on usage caps for its most premium broadband offering. Customers can use up to 1TB per month, after which AT&T slaps overlimit fees of $10 for each 50GB customers use over their limit. Its primary competitors, including Google, Time Warner Cable, Verizon and Charter do not have usage caps. Boyer says he knows of no customer that has exceeded the 1,000GB usage cap. But that also brings the question if no customer has exceeded the cap, why have one?

More importantly, Boyer added the company isn’t yet offering services that would be exempt from the cap but might do so in the future. “We are open to a whole host of options,” he said. Critics would likely call that an end run around Net Neutrality.

Competition is the significant driver pushing AT&T and other providers to accelerate broadband upgrades and lower prices for higher speed tiers. In markets where cable operators face DSL competition from the phone companies, speeds are lower and prices are higher. Where an incumbent announces major upgrades like GigaPower or Time Warner Cable Maxx, competitors are forced to respond with upgrades of their own.

That leaves cities served by independent telephone companies like Frontier, CenturyLink, and Windstream at a distinct disadvantage because none of those companies have announced sweeping broadband speed increases and have relied instead on acquired fiber networks (Frontier FiOS and U-verse), limited fiber rollouts (CenturyLink) and incremental speed increases using VDSL and bonded DSL (all three). Frontier claims its customers are not interested in faster broadband speeds.

The northeastern United States has seen only one major market disruptor — Verizon FiOS, and it has shelved future expansion. Dominant cable provider Time Warner Cable has not seen its market share hurt much by limited DSL speeds offered in many areas by Verizon, Frontier, and FairPoint Communications. It continues to offer a maximum of 50/5Mbps broadband in upstate New York, Maine, and Massachusetts.

Subscribe

Subscribe Spanish telephone company Telefónica knows the days of traditional ADSL broadband are numbered, so the company is junking its copper wire network and upgrading customers to fiber broadband at no extra charge.

Spanish telephone company Telefónica knows the days of traditional ADSL broadband are numbered, so the company is junking its copper wire network and upgrading customers to fiber broadband at no extra charge. A Washington state man who just moved into his new home is now being forced to consider selling it to somebody else because Comcast repeatedly misled him about its ability to provide service.

A Washington state man who just moved into his new home is now being forced to consider selling it to somebody else because Comcast repeatedly misled him about its ability to provide service. Four of his options were wireless carriers that don’t provide a strong signal to his home or charge obscenely high prices for usage capped Internet access. ViaSat was on the list promising up to 25Mbps, but ViaSat satellite customers can testify the actual speeds received are much slower, and do not reliably support the VPN access Seth required.

Four of his options were wireless carriers that don’t provide a strong signal to his home or charge obscenely high prices for usage capped Internet access. ViaSat was on the list promising up to 25Mbps, but ViaSat satellite customers can testify the actual speeds received are much slower, and do not reliably support the VPN access Seth required.