Susan Bitter Smith

To say Susan Bitter Smith is beholden to Arizona’s cable industry would be an understatement.

In addition to purportedly representing the citizens of Arizona on regulated utility matters, Bitter Smith is one of the state’s most powerful cable industry lobbyists, earning a salary that consumes 40 percent of the annual budget of the Southwest Cable Communications Association, which represents most cable operators in Arizona, New Mexico, and Nevada.

Despite clear ties to the telecommunications industry Bitter Smith has no intention of ending, in 2012 she ran for the chair of the Arizona Corporation Commission (ACC) — the state body that oversees and regulates phone, cable, and power utilities. Unlike many other states that appoint commissioners, Arizona voters elect them to office. Giving voters a direct election is written into the state constitution, and was designed to limit potential corporate influence and favoritism. Unfortunately for voters, the 2012 election cycle preoccupied by a presidential race and a rare open Senate seat left the mainstream media little time or interest exploring the backgrounds of candidates for the telecom regulator.

Bitter Smith never exactly hid her business relationship with Arizona’s largest cable companies, notably Cox Communications, the cable operator that dominates Phoenix. But she routinely downplayed the obvious conflict of interest, claiming the ACC dealt with regulated utilities, and cable companies were mostly deregulated. The Arizona Republic offered few insights into Bitter Smith’s background, failing to disclose her lobbying connections in their voter recommendations. Instead, the newspaper wrote a single sentence about Bitter Smith’s campaign in its editorial endorsements for the 2012 election: “Bitter Smith enjoys a great reputation as a strong-willed partisan, which seems a difficult fit for the Corporation Commission, at least as compared with the competition.”

Partisanship was exactly what a lot of voters apparently wanted, however, because the vote swung decidedly Republican in large parts of Arizona in the 2012 election. The turnout in Maricopa County, the largest in Arizona, was strongly anti-Obama and voters seemed content voting the party line down the ballot. Incumbents like Democrat Paul Newman did not exactly win an endorsement from the Republic either. The newspaper called him a “fierce and provocative partisan.”

Partisanship was exactly what a lot of voters apparently wanted, however, because the vote swung decidedly Republican in large parts of Arizona in the 2012 election. The turnout in Maricopa County, the largest in Arizona, was strongly anti-Obama and voters seemed content voting the party line down the ballot. Incumbents like Democrat Paul Newman did not exactly win an endorsement from the Republic either. The newspaper called him a “fierce and provocative partisan.”

“It is difficult to fathom work getting done at the commission with a microphone anywhere within Newman’s reach,” the newspaper added. The other Democratic incumbent, Susan Kennedy, was dismissed as an on-the-job trainee by the newspaper.

Broadband Issues Overshadowed by Arizona’s Solar Energy Debate

For most in Arizona, the 2012 election at the ACC was much more about energy issues than high cable bills and dreadful broadband. That year, investment in solar energy was the hot topic and it made the election of business-friendly candidates a high priority for the existing power-generating utilities and their friends at the American Legislative Exchange Council (ALEC). Both could claim a major victory if a state ready-made for solar renewable energy turned its back for the sake of incumbent fossil fuel power generators.

Bitter Smith was never a member of ALEC, not having been a state legislator, but many of her fellow Republicans serving on the ACC were, and some were not shy claiming the Obama Administration’s pro-solar energy policies were “reckless and dangerous.” ALEC and utility companies oppose requirements that mandate the purchase of excess power generated from solar and wind customers at market rates and also want to introduce surcharges for customers relying on solar energy. Their fear: if a large percentage of sun-rich Arizonans installed solar panels, revenue for the investor-owned utilities could plummet.

Bitter Smith was never a member of ALEC, not having been a state legislator, but many of her fellow Republicans serving on the ACC were, and some were not shy claiming the Obama Administration’s pro-solar energy policies were “reckless and dangerous.” ALEC and utility companies oppose requirements that mandate the purchase of excess power generated from solar and wind customers at market rates and also want to introduce surcharges for customers relying on solar energy. Their fear: if a large percentage of sun-rich Arizonans installed solar panels, revenue for the investor-owned utilities could plummet.

Against that backdrop, Bitter Smith’s close relationship with Cox Cable went unnoticed while the media focused their attention on incumbent Republican commissioner Bob Stump – dubbed by some “Trash Burner Bob” for successfully pushing approval of a permit for a 13 megawatt trash burning plant in West Phoenix. Despite a reputation for pollution, Stump sold trash burning as a better renewable energy source for Arizona than solar energy. Waste hauling companies were delighted. The campaign met with less opposition than some expected, in part because anonymous voting guides turned up conflating solar panels as fire hazards that were difficult to extinguish, exposed users to dangerous chemicals, and constituted a hazard to firefighters whose ‘neurons may be blocked‘ when they approached solar panel fires, allegedly caused by electricity inside the panel.

“Trash Burner Bob” Stump

Newcomer Robert Burns also won his election to the ACC that same year. His time at the Commission has also been rocky. This year, he faces an ethics complaint for remaining a registered lobbyist with the Arizona Telecommunications and Information Council, a group funded by the state’s largest telecom companies. After the complaint was filed, Burns claimed it was all a mistake. He later asked the group’s attorney to send a letter to the Arizona Secretary of State’s office requesting his lobbying connection be removed.

Some critics of the Commission have tolerated Burns’ alleged ethical lapse because he has demonstrated some independence from the energy companies he helps oversee.

Burns has argued the Arizona Public Service Company (APS) – a large investor-owned utility – must disclose how much it spent in campaign contributions and lobbying efforts to get its preferred candidates elected to the Corporation Commission. His demand for disclosure comes at the same time his fellow commissioner Stump is being investigated for exchanging text messages with APS officials during the 2014 election. Critics suggest he may have been illegally coordinating the campaigns of two of his closest allies — Tommy Forese and Doug Little. Both won seats on the ACC that year and have maintained a strong alliance with Stump, much to the chagrin of good government bloggers, who frequently refer to all three collectively as “Tommy Little Stump.”

Steve Muratore, editor of the Arizona Eagletarian, calls all three “shameless,” as they tirelessly fight to stop any investigation that could force open APS’ books to reveal what money, if any, was spent to help get both into office.

Utility giant APS will approach the Arizona Corporation Commission to win a 400% rate hike on special fees for solar panel users.

Forese claims the regulator has no business examining APS’ books.

“Commissioners attempting to influence elections in their official capacity through this relationship [as a result of their constitutional authority] would exceed the bounds of their constitutional mandate over public service corporations,” Forese argues.

While the political soap operas play out, in 2013, APA delivered its first Commission-approved blow against solar power, winning permission to apply a surcharge averaging $5 a month for using solar panels to generate electricity. APC successfully argued solar customers cheat other utility ratepayers by not contributing enough to the utility’s fixed costs.

This year, APC is seeking a 400%+ rate increase, proposing a surcharge averaging $21 a month for using solar panels. Customers served by the Salt River Project in Tempe faced even more onerous charges from that utility — a $50 a month fee for using solar panels. The new fees have effectively stopped residential solar power expansion in that utility’s territory, with the approval of ACC commissioners.

Flying Under the Radar

In the context of these other controversies, Bitter Smith’s own apparent conflicts of interest have largely flown under the radar from 2012 until earlier this year. Federal cable deregulation laws limit the Arizona regulator’s oversight of cable companies like Cox, Cable One, and Comcast. That has given Bitter Smith a defense for serving as both a lobbyist and a regulator.  She claims she only lobbies for the cable television and broadband services sold by cable companies like Cox Communications and abstains from consideration of cases such as those involving Cox’s digital phone service, which is still subject to some regulatory scrutiny. Bitter Smith also claims it is easy to tell where the ethical line falls because companies like Cox run different aspects of its business under a variety of affiliated subsidiaries.

She claims she only lobbies for the cable television and broadband services sold by cable companies like Cox Communications and abstains from consideration of cases such as those involving Cox’s digital phone service, which is still subject to some regulatory scrutiny. Bitter Smith also claims it is easy to tell where the ethical line falls because companies like Cox run different aspects of its business under a variety of affiliated subsidiaries.

Arizona Attorney General Mark Brnovich was not impressed with that explanation and last week filed a Petition for Special Action to remove Bitter Smith from office for violating the state’s conflict of interest statute.

“Arizonans deserve fair and impartial regulators,” said Brnovich. “We filed this case to protect the integrity of the Commission and to restore the faith of Arizona voters in the electoral process. Arizona law clearly prohibits a Commissioner from receiving substantial compensation from companies regulated by the Commission.”

On Sept. 2, the Attorney General’s Office (AGO) launched an investigation into Bitter Smith after receiving a formal complaint against her. The AGO investigation found Bitter Smith receives over $150,000 per year for her trade association work, on top of her $79,500 salary as a Commissioner. Arizona State Statute 40-101 prohibits Commissioners from being employed by or holding an official relationship to companies regulated by the Commission. The law also prohibits Commissioners from having a financial interest in regulated companies. Section 40-101 promotes ethics in government and prevents conflicts of interest.

“This isn’t one of these instances where this was maybe somebody skating too close to a line, or maybe somebody that had gone into a grey area. I think the law is very clear on this case,” Brnovich said.

KJZZ in Phoenix began raising questions about Bitter Smith’s apparent conflicts of interest last summer and carried this special report on Aug. 24, 2015. (7:18)

You must remain on this page to hear the clip, or you can download the clip and listen later.

Bitter Smith’s Shadowy and Scrubbed “PR Firm”

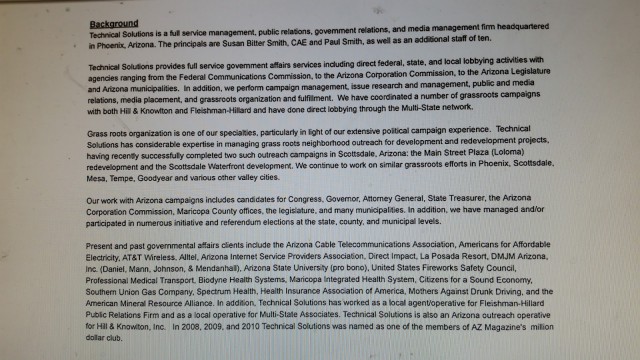

More troubling for Bitter Smith’s case is the “public affairs firm” Technical Solutions, jointly run by Bitter Smith and her husband. A careful scrubbing of the firm’s website “disappeared” the detailed description of the firm’s lobbying services, which counted Bitter Smith’s presence on the Commission a major asset for would-be telecom company clients. Google’s cache resolved that dilemma. Among those taking advantage of Technical Solutions’ services are AT&T, the former wireless company Alltel, and most of the state’s largest cable operators. Bitter Smith also claimed expertise setting up astroturf “grassroots” campaigns advocating her clients’ agendas and interests, but hiding any corporate connection. She also promoted her ability to plant stories with the media for her paying clients.

Scrubbed from the website, but retained by Google’s cache.

Reporters at KJZZ, a public radio station in Phoenix, have spent months following the fine line Bitter Smith has laid as a defense against conflict of interest charges.

Oopsy

Bitter Smith depends on cable and phone companies setting up different entities in name only to manage regulated and unregulated services. That means a cable company could approach the Commission under several different names, one for its phone, one for its television, and one for its broadband business. That distinction allows Bitter Smith to claim she is careful about conflicts of interest:

Bitter Smith said that, because the telecom entities are so separate, it’s OK to vote on telecom matters related to Cox, Suddenlink and other members at the commission. But she still tries not to.

“We thought about that, ‘Well, maybe just from the appearance sake it wouldn’t hurt,’” she said.

Since Bitter Smith took office in 2013, records show the commission has voted at least seven times on matters involving the telephone side of the cable association’s members.

She recused herself four of those times, such as last year when a tariff increase was approved for Cox.

But she didn’t recuse herself on three matters, which she said was accidental, including another tariff increase for Cox approved in 2013.

“Probably should have, just didn’t catch it,” she said.“It was on the consent agenda, I zoomed through.”

She also didn’t recuse herself in May from voting to rescind a $225,000-bond requirement for Mercury Voice & Data, an entity identified in public documents as doing business in Arizona as Suddenlink Communications. She said she missed that one accidentally as well.

“Suddenlink is my member, Mercury Voice & Data is not an entity that I’m familiar with,” Bitter Smith said. “If I had understood, I probably would have, you know, just for optics sake. There’s no legal reason I would need to do that but, had I understood that there was another entity that they now form with a new name, separate entity with a new name, I probably would have.”

[flv]http://www.phillipdampier.com/video/Corporation Commissioner Is Paid Lobbyist For Same Corporations She Regulates 12-3-15.mp4[/flv]

Real News AZ talked with attorney Thomas Ryan about the ethics of serving as a Corporation Commissioner while also employed as a paid lobbyist working for the interests of the companies regulated by that Commission. (7:08)

Ryan

Bitter Smith’s ‘oopsies‘ infuriate government watchdog and Arizona attorney Thomas Ryan, who has tangled with Arizona’s high-powered politicians before… and won.

“This will not go quietly in the night and whoever she retains will no doubt fight it tooth and nail,” Ryan said of Bitter Smith. “But the state of Arizona deserves a Corporation Commission that is not bought and paid for by the very people it’s supposed to regulate, the very industries it’s supposed to regulate.”

Ryan is particularly incensed that Bitter Smith’s apparent ethical lapses are costing Arizonans twice — taxpayers pay her nearly $80,000 salary as a Commissioner and the increasingly expensive cable and phone bills that grow as a result of some of the Commission’s pro-telecom decisions. But at least Bitter Smith is doing well, also collecting her six figure salary from the cable lobbying association she leads.

Pat Quinn, former director of the Residential Utility Consumer Office, or RUCO, which advocates for consumers at the ACC, isn’t moved by Bitter Smith’s fine line and he should know – he’s the former Arizona president of Qwest Communications (today CenturyLink).

Quinn said Bitter Smith’s explanation about the separateness of telecom entities from cable is making a “difference without a distinction.”

“While you may be able to, accounting wise, separate your expenses between what you put in phone and what you put in cable, how do you take out of your mind, ‘Oh, they’re paying me over here and we do good things for them over here, but I’m going to be fair and unbiased when I look at not only Cox on the phone side, but any of the other phone providers,’” Quinn told KJZZ.

How Bitter Smith helped kill rural community broadband in Arizona for the benefit of the state’s biggest cable companies. (6:43)

You must remain on this page to hear the clip, or you can download the clip and listen later.

Killing Community Broadband to Protect Arizona Cable Profits

The clearest cut evidence of Bitter Smith’s lobbying for Arizona cable companies while claiming to represent the public interest as a commissioner came in 2013, when Bitter Smith and Cox Communications lobbyist Susan Anable tried to pressure Galen Updike, a state employee tasked with mapping broadband availability in Arizona and advocating for solutions for the 80 percent of rural communities in the state that remain broadband-challenged to this day.

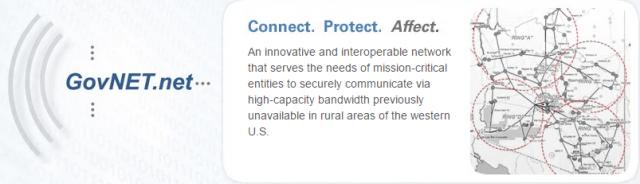

In February, Bitter Smith and Anable allegedly solicited the help of state employees to kill a state contract with GovNet, a firm that had previously received $39 million in federal dollars to bring broadband to rural Arizona.

Updike said Bitter Smith trashed GovNet’s reputation, claiming the provider walked away from earlier projects leaving them incomplete.

“‘There was a better alternative,'” Updike recalls Bitter Smith telling him. “‘You’ve got existing cable companies in the area that are having now to compete against these dollars that come in from the federal government. Can you help us get rid of GovNet’s contract?’ [was the request]. It took my breath away.”

Updike said Bitter Smith maintained a near-constant presence at their meetings, but she had no interest in solving Arizona’s rural broadband problems.

Updike said Bitter Smith maintained a near-constant presence at their meetings, but she had no interest in solving Arizona’s rural broadband problems.

“The only reason for Bitter Smith to be there was to talk about telecommunications policy, broadband policy,” Updike said.

Updike’s efforts to make things better for broadband in rural Arizona met constant headwinds from Bitter Smith and lobbyists for the state’s cable and phone companies.

“All the broadband providers were cherry picking — going after the high easy places to put broadband into where there’s high concentration of population dollars,” Updike said. “And basically the low population areas, the rural areas of the state of Arizona, are sucking wind. They have no possibility for it.”

Efforts to develop the Arizona Strategic Broadband Plan were effectively sabotaged by the cable industry, especially Cox. Bitter Smith immediately objected to the contention the cable industry could collectively offer broadband to 96 percent of the state if it chose. She claimed that was invalid. She also criticized the proposal to begin a comprehensive broadband mapping program claiming it lacked proof it would be any real ongoing benefit to anyone.

Efforts to develop the Arizona Strategic Broadband Plan were effectively sabotaged by the cable industry, especially Cox. Bitter Smith immediately objected to the contention the cable industry could collectively offer broadband to 96 percent of the state if it chose. She claimed that was invalid. She also criticized the proposal to begin a comprehensive broadband mapping program claiming it lacked proof it would be any real ongoing benefit to anyone.

At the center of the lobbying effort backed by Cox was an argument the state should not involve itself in expanding broadband networks. Instead, it should spend its funds promoting the broadband service already available from cable operators to those not yet signed up.

Things got much worse for Updike as Republicans cemented their grip on the Corporation Commission in 2013. Updike continued to voice concerns about Bitter Smith’s conflicts of interest and was eventually taken aside and told to be quiet about the issue.

“I was told to stop poking the bear. The bear was the combination of Cox, CenturyLink and Susan Bitter Smith,” Updike told the radio station.

By May 2013, the broadband planning council’s meetings began to be mysteriously canceled. No strategic broadband plan was ever adopted. That same month, Updike was told he no longer had a job at the Arizona Department of Administration.

Henry Goldberg, and independent consultant who helped draft the never-adopted state broadband plan has little to fear from Bitter Smith, so he was frank with KJZZ.

“To me when you stop discussions of the plan, disband this council, which is supposed to advise the governor on digital policy, there’s something inappropriate going on there. Something like this is critical for the citizens of Arizona.”

Subscribe

Subscribe

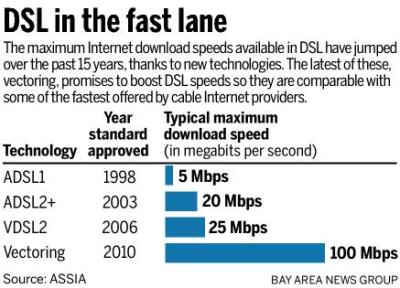

Just a few years earlier, most providers wouldn’t think of offering discounted 10Mbps service, fearing it would cannibalize revenue as customers downgraded to get lower priced service. Increasing demands on bandwidth from online video and multiple in-home users have gradually raised consumer expectations, and their need for speed.

Just a few years earlier, most providers wouldn’t think of offering discounted 10Mbps service, fearing it would cannibalize revenue as customers downgraded to get lower priced service. Increasing demands on bandwidth from online video and multiple in-home users have gradually raised consumer expectations, and their need for speed.

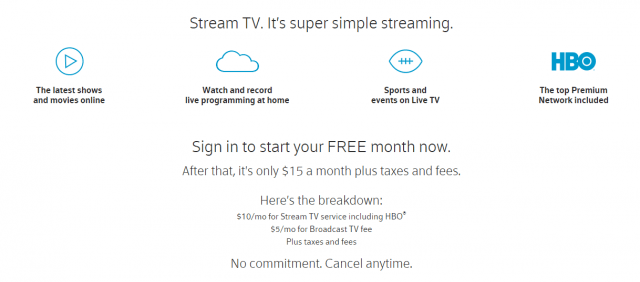

Comcast is inviting controversy launching a new live streaming TV service targeting cord-cutters while exempting it from its own data caps.

Comcast is inviting controversy launching a new live streaming TV service targeting cord-cutters while exempting it from its own data caps.

Comcast claims it is reasonable to exempt Stream TV from its 300GB data cap being tested in a growing number of markets.

Comcast claims it is reasonable to exempt Stream TV from its 300GB data cap being tested in a growing number of markets.

Much of the opposition to municipal broadband comes from Republican politicians on the state and federal level. Most claim municipal providers represent unfair competition to the private sector. The American Legislative Exchange Council (ALEC) considers municipal broadband a significant issue. The corporate-funded group offers state legislators the opportunity to meet with telecom company lobbyists. Legislators are also provided already-written sample legislation restricting municipal broadband developed by ALEC’s telecom company members, including AT&T, Comcast, and Time Warner Cable. In states where Republicans hold the majority in the state legislature, such bills often become law.

Much of the opposition to municipal broadband comes from Republican politicians on the state and federal level. Most claim municipal providers represent unfair competition to the private sector. The American Legislative Exchange Council (ALEC) considers municipal broadband a significant issue. The corporate-funded group offers state legislators the opportunity to meet with telecom company lobbyists. Legislators are also provided already-written sample legislation restricting municipal broadband developed by ALEC’s telecom company members, including AT&T, Comcast, and Time Warner Cable. In states where Republicans hold the majority in the state legislature, such bills often become law.