Stop the Cap! continues the fight for a better deal for Time Warner Cable customers that could soon end up as Charter Communications customers, if the California Public Utilities Commission (CPUC) approves the merger.

Stop the Cap! continues the fight for a better deal for Time Warner Cable customers that could soon end up as Charter Communications customers, if the California Public Utilities Commission (CPUC) approves the merger.

While the Federal Communications Commission formally approved the deal last week, California has yet to sign off on the transaction, giving consumer advocates like Stop the Cap! an opportunity to recommend the state regulator impose stronger consumer-friendly deal conditions that guarantee customers their share of the anticipated windfall in “deal benefits” that shareholders and executives of the companies involved are likely to receive.

Our California coordinator Matthew Friedman has been educating the CPUC about the true nature of data caps and usage-based billing, and sharing our view that Charter’s promised merger deal benefits are illusory, offering little more than what Time Warner Cable already offers its Maxx-upgraded service areas. In fact, Time Warner’s ongoing commitment to not impose compulsory data caps or usage billing is likely to be canceled by Charter Communications, which has only agreed not to impose such billing schemes on customers for three years.

Even worse, future Charter customers are likely to pay higher broadband bills after Charter imposes its regular prices on Time Warner Cable customers — prices often higher than what Time Warner charges for similar services. Although Time Warner customers have been able to negotiate a better deal for themselves after threatening to cancel, Stop the Cap! anticipates Charter will not be as generous with those customers in the future.

At the minimum, Stop the Cap! is recommending the CPUC either permanently ban compulsory usage caps and usage billing from Charter, or add a competition test that will allow such billing only where consumers can switch to a competitor that offers comparable unlimited broadband service.

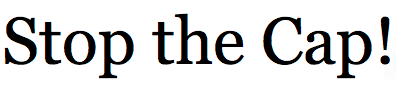

Charter’s broadband “deal”

The loss of [Time Warner’s] commitment [to always offer unlimited broadband options to consumers] could result in the following harms, according to Friedman:

- New Charter’s commitment to provide low cost broadband will become completely voluntary and unenforceable;

- increased broadband pricing resulting in decreased demand for broadband;

- New Charter will be able to circumvent Net Neutrality rules;

- New Charter will be able to engage in a multitude of anticompetitive behaviours, increasing the cost and reducing the attractiveness of competing video content from edge providers, thus lessening the demand for high-speed broadband access to the Internet, and thus running counter to Section 706(a)’s mandate to promote competition in broadband services;

- innovation and investment will potentially decrease significantly;

- network security can be adversely affected; and,

- Californians, especially low-income Californians, may lose access to education opportunities.

We’re not drinking “New Charter’s” Kool-Aid

“Stop the Cap! (and the Office of Ratepayer Advocates as well) has offered a reasonable option of requiring a competition test to sunset the prohibition on data caps and usage based pricing,” wrote Friedman. “This suggestion is based on Charter’s own expert testimony and [the conditions] must be rewritten per these suggestions if it is to fulfill multiple statutory requirements.”

Stop the Cap! also advocates that Time Warner Cable customers that purchased their own cable modems to avoid Time Warner’s modem fees deserve an ongoing bill credit for providing their own equipment, because Charter builds the cost of its modem into the price of broadband service.

“Charter already bakes the price of the modem rental into the monthly cost of the plan,” Friedman noted. “New Charter [should be required] to offer a discount to customers who bring their own modems. Charter currently allows customers to bring their own modems… they just continue to charge those customers for a Charter modem that the customer never uses.”

Although Charter’s pledge to increase broadband speeds for Time Warner customers seems laudatory, in fact Charter’s proposed service offerings also represent a significant rate increase for broadband customers who don’t need or want 60Mbps service. They won’t have much choice after Charter imposes its own plans and pricing, which are now limited to 60 or 100Mbps options for most customers, at prices starting at $60 a month.

“Clearly these TWC customers are materially much worse off under New Charter than TWC,” Friedman told the CPUC. “Equally clear is that Charter’s ‘Simplified Pricing’ (perhaps more accurately described as ‘Fewer Options and Higher Prices’) is far from a public benefit. This massive price increase will affect literally every stand-alone-broadband TWC customer other than the few who qualify for the School Lunch/Senior Assistance plan. While the low-cost School Lunch/Senior Assistance plan is great for the narrowly targeted group of consumers who manage to qualify, roughly doubling the cost of broadband for every other standalone customer more than offsets the combined value of every other ‘benefit’ that the applicants allege will come from this transfer.”

“Clearly these TWC customers are materially much worse off under New Charter than TWC,” Friedman told the CPUC. “Equally clear is that Charter’s ‘Simplified Pricing’ (perhaps more accurately described as ‘Fewer Options and Higher Prices’) is far from a public benefit. This massive price increase will affect literally every stand-alone-broadband TWC customer other than the few who qualify for the School Lunch/Senior Assistance plan. While the low-cost School Lunch/Senior Assistance plan is great for the narrowly targeted group of consumers who manage to qualify, roughly doubling the cost of broadband for every other standalone customer more than offsets the combined value of every other ‘benefit’ that the applicants allege will come from this transfer.”

Stop the Cap! also advocates that the CPUC guarantee Charter customers have a choice about the broadband speeds they need and the amount they have to pay for Internet access.

“New Charter should be required to retain TWC’s pricing and plan structure in perpetuity, for both new and existing TWC customers. TWC customers should retain the ability to switch back and forth between TWC’s cheaper, larger variety of plans,” Friedman wrote. “New Charter should be required to continue TWC’s practice of increasing customer speeds as technology advances with no

accompanying price increase.”

Although Charter’s lobbying efforts promote improved service for Time Warner Cable customers, it is our view that once one examines the full scope and impact of Charter’s proposal, customers will be worse off under Charter than they would be staying with Time Warner Cable.

“TWC stands out in its field for its customer-friendly policies such as providing discounts for those who own their own modems, its public commitment to refuse to impose data caps or

usage based pricing even in the face of pressure from Wall Street to do so, and the creation of its TWC Roku App to allow customers to avoid set-top box rental fees,” argued Friedman. “This transfer, as currently conditioned, creates a net public benefit harm, not a benefit, or even a status quo.”

Subscribe

Subscribe In a decision that relied heavily on trusting Altice’s word, the Federal Communications Commission

In a decision that relied heavily on trusting Altice’s word, the Federal Communications Commission  The FCC called assertions from the Communications Workers of America that Altice intends to secure several hundred million dollars in cost savings from layoffs and salary reductions “speculative.” But Altice’s record on job and salary cuts is well established in Europe, where trade unions have pursued multiple complaints with government ministers in Lisbon and Paris. The leadership of CFE-CGE Orange, the group representing employees in France’s telecom sector,

The FCC called assertions from the Communications Workers of America that Altice intends to secure several hundred million dollars in cost savings from layoffs and salary reductions “speculative.” But Altice’s record on job and salary cuts is well established in Europe, where trade unions have pursued multiple complaints with government ministers in Lisbon and Paris. The leadership of CFE-CGE Orange, the group representing employees in France’s telecom sector,

“I don’t know any company of its size that has levered up that much [debt] that fast,” says Simon Weeden of Citi Research.

“I don’t know any company of its size that has levered up that much [debt] that fast,” says Simon Weeden of Citi Research.

BCE, Inc., the parent company of Bell Canada, has acquired Manitoba Telecom Services, Inc. (MTS), in a deal worth $3.9 billion, further enlarging Canada’s largest telecommunications company.

BCE, Inc., the parent company of Bell Canada, has acquired Manitoba Telecom Services, Inc. (MTS), in a deal worth $3.9 billion, further enlarging Canada’s largest telecommunications company.

A fiber upgrade offering 17 million homes in the United Kingdom broadband speeds up to 200Mbps is proving controversial in parts of York because a local councillor is concerned the project will wreak havoc with the area’s daffodils.

A fiber upgrade offering 17 million homes in the United Kingdom broadband speeds up to 200Mbps is proving controversial in parts of York because a local councillor is concerned the project will wreak havoc with the area’s daffodils.

The Justice Department and FCC Chairman Thomas Wheeler are prepared to accept a massive $55 billion merger between Charter Communications, Time Warner Cable, and Bright House Networks, but at a cost of stringent conditions governing the creation of America’s second largest cable conglomerate.

The Justice Department and FCC Chairman Thomas Wheeler are prepared to accept a massive $55 billion merger between Charter Communications, Time Warner Cable, and Bright House Networks, but at a cost of stringent conditions governing the creation of America’s second largest cable conglomerate.

Gene Kimmelman, chief executive of consumer interest group Public Knowledge,

Gene Kimmelman, chief executive of consumer interest group Public Knowledge,