Dear Members,

Dear Members,

We have had a very busy winter and spring here at Stop the Cap! and we thought it important to update you on our efforts.

You may have noticed a drop in new content online over the last few months, and we’ve had some inquiries about it. The primary reason for this is the additional time and energy being spent to directly connect with legislators and regulators about the issues we are concerned about. Someone recently asked me why we spend a lot of time and energy writing exposés to an audience that almost certainly already agrees with us. If supporters were the only readers here, they would have a point. Stop the Cap! is followed regularly by legislators, regulators, public policy lobbyists, consumer groups, telecom executives, and members of the media. Our content is regularly cited in books, articles, regulatory filings, and in media reports. That is why we spend a lot of time and energy documenting our positions about data caps, usage billing, Net Neutrality, and the state of broadband in the United States and Canada.

A lengthy piece appearing here can easily take more than eight hours (sometimes longer) to put together from research to final publication. We feel it is critical to make sure this information gets into the hands of those that can help make a difference, whether they visit us on the web or not. So we have made an extra effort to inform, educate, and persuade decision-makers and reporters towards our point of view, helping to counter the well-funded propaganda campaigns of Big Telecom companies that regularly distort the issues and defend the indefensible.

Four issues have gotten most of our attention over the last six months:

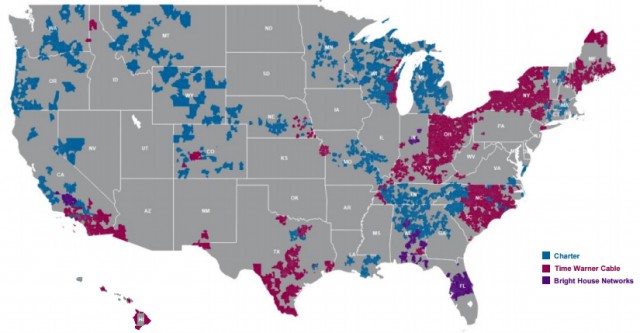

- The Charter/Time Warner Cable/Bright House merger;

- Data cap traps and trials (especially those from Comcast, Blue Ridge, Cox, and Suddenlink);

- Cablevision/Altice merger;

- Frontier’s acquisition of Verizon landlines and that phone company’s upgrade plans for existing customers.

We’ve been successful raising important issues about the scarcity of benefits from telecom company mergers. In short, there are none of significance, unless you happen to be a Wall Street banker, a shareholder, or a company executive. The last thing an already-concentrated marketplace needs is more telecom mergers. We’re also continuing to expose just how nonsensical data caps and usage-based billing is for 21st century broadband providers. Despite claims of “fairness,” data caps are nothing more than cable-TV protectionism and the further exploitation of a broadband duopoly that makes it easy for Wall Street analysts to argue “there is room for broadband rate hikes” in North America. Stop the Cap! will continue to coordinate with other consumer groups to fight this issue, and we’ve successfully convinced at least some at the FCC that the excuses offered for data caps don’t hold water.

Dampier

FCC chairman Tom Wheeler’s broadening of Charter’s voluntary three-year moratorium on data caps to a compulsory term as long as seven years sent a clear message to broadband providers that the jig is up — data caps are a direct threat to the emerging online video marketplace that might finally deliver serious competition to the current bloated and overpriced cable television package.

Wheeler’s actions were directly responsible for Comcast’s sudden generosity in more than tripling the usage allowance it has imposed on several markets across the south and midwest. But we won’t be happy until those compulsory data caps are gone for good.

More than 10,000 Comcast customers have already told the FCC in customer complaints that Comcast’s data caps are egregious and unfair. Considering how unresponsive Comcast has been towards its own customers that despise data caps of any kind, Comcast obviously doesn’t care what their customers think. But they care very much about what the FCC thinks about regulatory issues like data caps and set-top box monopolies. How do we know this? Because Comcast’s chief financial officer this week told the audience attending the JPMorgan Technology, Media and Telecom Broker Conference Comcast always pays attention to regulator headwinds.

“I think it’s our job to make sure we pivot and react accordingly and make sure the company thrives whatever the outcome is on some of the regulatory proposals that are out there,” said Comcast’s Mike Cavanagh. We suspect if Chairman Wheeler goes just one step further and calls on ISPs to permanently ditch data caps and usage billing, many would. We will continue to press him to do exactly that.

Stop the Cap! supports municipal and community-owned broadband providers.

Other companies are also still making bad decisions for their customers. Besides Comcast’s ongoing abusive data cap experiment, Cox’s ongoing data cap trial in Cleveland, Ohio is completely unacceptable and has no justification. The usage allowances provided are also unacceptably stingy. Suddenlink, now owned by Altice, should not even attempt to alienate their customers, particularly as the cable conglomerate seeks new acquisition opportunities in the United States in the future. We find it telling that Altice feels justified retaining usage caps on customers in smaller communities served by Suddenlink while denying they would even think of doing the same in Cablevision territory in suburban New York City. Both Suddenlink and Cablevision have upgraded their networks to deliver faster speed service. What is Altice’s excuse about why it treats its urban and rural customers so differently? It frankly doesn’t have one. We’ll be working to convince Altice it is time for Suddenlink’s data caps to be retired for good.

We will also be turning more attention back on the issue of community broadband, which continues to be the only competitive alternative to the phone and cable companies most Americans will likely ever see. The dollar-a-holler lobbyists are still writing editorials and articles claiming “government-owned networks” are risky and/or a failure, without bothering to disclose the authors have a direct financial relationship to the phone and cable companies that don’t want the competition. We will be pressing state lawmakers to ditch municipal broadband bans and not to enact any new ones.

We will also continue to watch AT&T and Verizon — two large phone companies that continue to seek opportunities to neglect or ditch their wired services either by decommissioning rural landlines or selling parts of their service areas to companies like Frontier. AT&T specializes in bait-n-switch bills in state legislatures that promise “upgrades” in return for further deregulation and permission to switch off rural service in favor of wireless alternatives. That’s great for AT&T, but a potential life-threatening disaster for rural America.

We continue to abide by our mandate: fighting data caps and consumption billing and promoting better broadband, regardless of what company or community supplies it.

As always, thank you so much for your financial support (the donate button that sustains us entirely is to your right) and for your engagement in the fight against unfair broadband pricing and policies. Broadband is not just a nice thing to have. It is an essential utility just as important as clean water, electricity, natural gas, and telephone service.

Phillip M. Dampier

Founder & President, Stop the Cap!

Subscribe

Subscribe America has a new second largest cable conglomerate with 17 million customers and a new name.

America has a new second largest cable conglomerate with 17 million customers and a new name.

![[Image: WSJ.com]](https://stopthecap.com/wp-content/uploads/2016/05/golden-parachute-640x426.jpg)

The Small Swallow the Big

The Small Swallow the Big How to Remake Your Image: Change the Name

How to Remake Your Image: Change the Name As Patrick Drahi’s telecom empire continues to strain under massive debts, a customer exodus in France, and cut throat competition in Europe that has reduced prices of some plans to less than $5 a month, the one thing his parent company Altice can count on is the deep pockets of the American cable subscriber.

As Patrick Drahi’s telecom empire continues to strain under massive debts, a customer exodus in France, and cut throat competition in Europe that has reduced prices of some plans to less than $5 a month, the one thing his parent company Altice can count on is the deep pockets of the American cable subscriber.

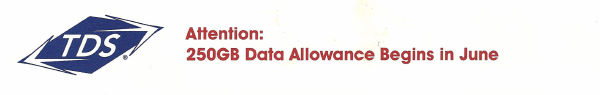

Like some data caps of the past, TDS is giving customers a small break by remaining unlimited during the overnight hours, but for many customers, it won’t be enough to prevent a higher broadband bill.

Like some data caps of the past, TDS is giving customers a small break by remaining unlimited during the overnight hours, but for many customers, it won’t be enough to prevent a higher broadband bill. Soon after recognizing the change in language, Charter’s lawyers

Soon after recognizing the change in language, Charter’s lawyers