Republican Gov. Paul LePage has picked a former telecom industry insider and lobbyist to serve the interests of public utility customers and consumers in Maine.

Republican Gov. Paul LePage has picked a former telecom industry insider and lobbyist to serve the interests of public utility customers and consumers in Maine.

Barry Hobbins is known as an “old school” Democrat, and has been a part of Maine politics for 26 years — since 1972 — most recently as a top political fundraiser. Perceived as unlikely to rock many boats, he was appointed by the Republican governor to replace the current Public Advocate Tim Schneider, who worked on a solar energy bill the governor loathed and vetoed last year.

At the same time the governor is suing the state’s Attorney General for refusing to toe his line on the political positions of his administration, LePage insists Hobbins will serve only the interests of public utility customers and not those held by special interests. The Public Advocate is the public’s representative before the Maine Public Utilities Commission, federal regulators and the state legislature.

“That’s what the public advocate job is: to represent the ratepayer, not to represent a special interest,” LePage told reporters at a recent press conference.

But consumer advocates note Hobbins has already represented several special interests, most notably AT&T, where he served as a lobbyist after temporarily leaving the legislature in 1990. Hobbins is also no stranger to taking lavish gifts from the state’s largest telecom companies, including Time Warner Cable (now Charter Communications). In 2013 and 2015, Hobbins was paid $5,300 and $8,257 respectively to attend industry-sponsored events the cable company called their “winter policy conferences.”

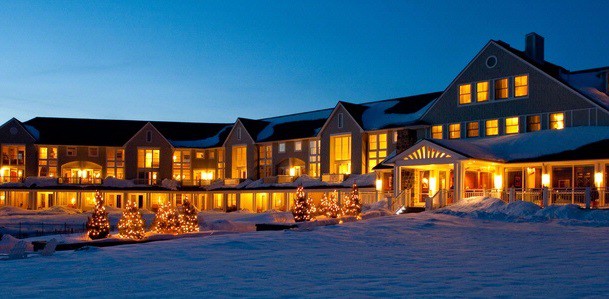

In 2015, Stop the Cap! reported on one of these conferences held at the cushy Cape Elizabeth seaside resort Inn by the Sea, where room rates routinely hit the $500 a night mark. Hobbins was in attendance with about a dozen other legislators, enjoying the complimentary menu which included light noshing options like a herb marinated skirt steak with roasted mushrooms, chimichurri, piquillo aioli, and herbed hand cut steak fries that would cost you or I at least $26, drinks not included.

Hobbins also stayed to enjoy a full menu of lobbyist hobnobbing and “educational” attacks on community broadband, opposition to government oversight of broadband, and efforts to ensure state laws continued to favor incumbent providers:

- Moderator (Session 1): Jadz Janucik, National Cable & Telecommunication Association – The NCTA is the nation’s largest cable industry lobbying group;

- Dave Thomas, Sheppard Mullin Richter & Hampton LLP: A corporate attorney representing cable companies, particularly when they face competitive threats;

- Lisa Schoenthaler, National Cable & Telecommunication Association;

- Moderator (Session 2): Charlie Williams, Time Warner Cable;

- Charles Davidson and Michael Santorelli from the Advanced Communications Law and Policy Institute at New York Law School. Both have received direct compensation from Time Warner Cable for their “research” reports and are very active and frequent defenders of Time Warner Cable’s public policy agenda;

- Joe Gillan, Gillan Associates – an economist working under paid contract with the cable industry;

- Moderator (Session 3): Tom Federle, Federle Law: Chief lobbyist for Time Warner Cable in Maine for over seven years;

- Robin Casey, Enockever LLP: Casey is one of the nation’s pre-eminent cable industry lawyers, called by the Texas Cable Association “the authority on the telecom industry;”

- Mary Ellen Fitzgerald, Critical Insights: A Maine pollster hired by Time Warner Cable to carry out the company’s carefully worded survey on broadband issues;

- Moderator (Session 5): Melinda Poore, senior vice president of governmental relations, Time Warner Cable Maine.

Hobbins claimed his extensive involvement in the telecommunications industry never influenced his legislative work and won’t if he becomes public advocate. But Hobbins has kept extremely close ties with his friends in the cable industry. Tom Federle, Time Warner Cable’s former chief lobbyist also served as former treasurer of a political action committee directly controlled by Hobbins, one that raised more than $30,000 for Maine politicians from Time Warner Cable, AT&T, an industry association, and Federle’s own law firm. That fundraising committee coincidentally disbanded.

Federle promotes his close ties to legislators like Hobbins on his website:

Since 2000, Tom has been an extremely effective advocate and lobbyist for clients before the Maine Legislature. Tom has represented some of Maine’s largest businesses and associations in advancing sound public policy positions. Tom’s work experience both in the private sector and at the highest levels of state government provides him with invaluable perspective and real know-how. Tom puts this to work for his clients to influence the outcome of legislation that impacts his client’s objectives. Tom’s balanced demeanor and tenacity combine to make him a particularly effective advocate before the Maine legislature.

In recent testimony, Federle used his position and influence to blast efforts to improve community-owned broadband services in Maine, telling the legislature: “There are countless examples of government getting into the business of providing broadband, with taxpayers footing the bill, only to end in failure with mountains of debt.”

In April, Maine State Representative Nathan Wadsworth (R-Hiram) introduced a bill to revoke local authority over building internet networks needed by local businesses and residents. The one-time Maine state ALEC chair introduced HP 1040 (also cross filed as LD 1516) to attempt to block efforts to construct public broadband networks and protect incumbent providers. This, despite the fact Maine has ranked 49th out of 50 states in the quality and availability of broadband service.

“This effort joins a national trend of big cable and telephone companies, like Time Warner Cable and FairPoint, leaning heavily on state legislatures to protect themselves from competition,” says Christopher Mitchell, director of the Community Broadband Networks initiative at the Institute for Local Self-Reliance. “Communities do not make these investments when they are well served. If big cable and telephone companies want to preserve market share, they should invest in better services rather than crony capitalist laws.”

Where Hobbins stands on the issue isn’t known.

The nomination will go before a legislative confirmation hearing May 9.

Subscribe

Subscribe

“Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment).”

“Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment).”