Drahi also made headlines last summer by announcing SFR-Numericable was completely scrapping its coaxial cable networks in France (as well as in Cablevision territory in the United States) to move entirely to optical fiber technology, even in the most rural service areas. But the fiber upgrades are not being financed with cash on hand at Altice. Libération reports the $1.78 billion Altice will need to spend on fiber upgrades for France alone will be financed by more bank loans. Drahi hopes to eventually offer bonds to investors to internally finance fiber upgrades.

Pai

WASHINGTON (Reuters) – The head of the U.S. Federal Communications Commission unveiled plans on Tuesday to repeal landmark 2015 rules that prohibited internet service providers from impeding consumer access to web content in a move that promises to recast the digital landscape.

FCC chief Ajit Pai, a Republican appointed by President Donald Trump in January, said the commission will vote at a Dec. 14 meeting on his plan to rescind the so-called Net Neutrality rules championed by Democratic former President Barack Obama that treated internet service providers like public utilities.

The rules barred broadband providers from blocking or slowing down access to content or charging consumers more for certain content. They were intended to ensure a free and open internet, give consumers equal access to web content and prevent broadband service providers from favoring their own content.

The action marks a victory for big internet service providers such as AT&T, Comcast and Verizon Communications that opposed the rules and gives them sweeping powers to decide what web content consumers can get and at what price.

It represents a setback for Google parent Alphabet Inc and Facebook, which had urged Pai not to rescind the rules.

With three Republican and two Democratic commissioners, the move is all but certain to be approved. Trump, a Republican, expressed his opposition to Net Neutrality in 2014 before the regulations were even implemented, calling it a “power grab” by Obama.

Pai said his proposal would prevent state and local governments from creating their own Net Neutrality rules because internet service is “inherently an interstate service.” The preemption is most likely to handcuff Democratic-governed states and localities that could have considered their own plans to protect consumers’ equal access to internet content.

Pai said his proposal would prevent state and local governments from creating their own Net Neutrality rules because internet service is “inherently an interstate service.” The preemption is most likely to handcuff Democratic-governed states and localities that could have considered their own plans to protect consumers’ equal access to internet content.

“The FCC will no longer be in the business of micromanaging business models and preemptively prohibiting services and applications and products that could be pro-competitive,” Pai said in an interview, adding that the Obama administration had sought to pick winners and losers and exercised “heavy-handed” regulation of the internet.

“We should simply set rules of the road that let companies of all kinds in every sector compete and let consumers decide who wins and loses,” Pai added.

Tom Wheeler, who headed the FCC under Obama and advocated for the Net Neutrality rules, called the planned repeal “a shameful sham and sellout. Even for this FCC and its leadership, this proposal raises hypocrisy to new heights.”

AT&T, Comcast and Verizon have said that repealing the rules could lead to billions of dollars in additional broadband investment and eliminate the possibility that a future presidential administration could regulate internet pricing.

‘HEAVY COSTS’

Pelosi: FCC move will hurt consumers and chill competition.

Verizon said it believed the FCC “will reinstate a framework that protects consumers’ access to the open internet, without forcing them to bear the heavy costs from unnecessary regulation.”

The Internet Association, representing major technology firms including Alphabet and Facebook, said Pai’s proposal “represents the end of Net Neutrality as we know it and defies the will of millions of Americans. This proposal undoes nearly two decades of bipartisan agreement on baseline Net Neutrality principles that protect Americans’ ability to access the entire internet.”

Pai’s proposal would require internet service providers to disclose whether they allow blocking or slowing down of consumer web access or permit so-called internet fast lanes to facilitate a practice called paid prioritization of charging for certain content. Such disclosure will make it easier for another agency, the Federal Trade Commission, to act against internet service providers that fail to disclose such conduct to consumers, Pai said.

A U.S. appeals court last year upheld the legality of the Net Neutrality regulations, which were challenged in a lawsuit led by telecommunications industry trade association US Telecom.

The group praised Pai’s decision to remove “antiquated, restrictive regulations” to “pave the way for broadband network investment, expansion and upgrades.”

The FCC’s repeal is certain to draw a legal challenge from advocates of Net Neutrality.

Nancy Pelosi, the top U.S. House of Representatives Democrat, said the FCC move would hurt consumers and chill competition, saying the agency “has launched an all-out assault on the entrepreneurship, innovation and competition at the heart of the internet.”

Republican Senator John Thune said Pai’s plan was an improvement over the Obama rules but that “the only way to create long-term certainty for the internet ecosystem is for Congress to pass a bipartisan law.”

The planned repeal represents the latest example of a legacy achievement of Obama being erased since Trump took office in January. Trump has abandoned international trade deals, the landmark Paris climate accord and environmental protections, taken aim at the Iran nuclear accord and closer relations with Cuba, and sought repeal Obama’s signature healthcare law.

Pai, who has moved quickly to undo numerous regulatory actions since becoming FCC chairman, is pushing a broad deregulatory agenda. Pai said he had not shared his plans on the rollback with the White House in advance or been directed to undo Net Neutrality by White House officials.

The FCC under Obama regulated internet service providers like public utilities under a section of federal law that gave the agency sweeping oversight over the conduct of these companies.

Language in the new proposal would give the FCC significantly less authority to oversee the web. The FCC granted initial approval to Pai’s plan in May, but had left open many key questions including whether to retain any legal requirements limiting internet providers conduct.

His plan also would eliminate the “internet conduct standard,” which gave the FCC far-reaching discretion to prohibit internet service provider practices deemed to violate a list of factors and sought to address future discriminatory conduct.

Reporting by David Shepardson; Editing by Will Dunham

Subscribe

Subscribe

The biggest enemy of Altice in Europe is robust competition, which has allowed dissatisfied customers to switch providers in droves. SFR-Numericable, despite promises of fiber-fast speeds, has endured complaints about slow and uneven speeds and persistent service outages. Drahi’s original business plan was to upgrade broadband speeds and performance to win over France’s remaining DSL customers. That worked for a time, according to the French newspaper Libération,

The biggest enemy of Altice in Europe is robust competition, which has allowed dissatisfied customers to switch providers in droves. SFR-Numericable, despite promises of fiber-fast speeds, has endured complaints about slow and uneven speeds and persistent service outages. Drahi’s original business plan was to upgrade broadband speeds and performance to win over France’s remaining DSL customers. That worked for a time, according to the French newspaper Libération,

Drahi was banking on his ability to manage Altice’s debt and boost revenue by milking U.S. cable customers. Unlike in France, where competition and regulation have kept cable television and broadband prices much lower than in North America, Drahi saw enormous potential from the U.S. telecom market, where Americans routinely pay double or even triple the price many Europeans pay for television and internet access. Drahi sold investors on the prospects of slashing costs, initiating employee cutbacks, and raising prices for acquired U.S. cable companies. Suddenlink customers are particularly captive to cable broadband because the only alternative in many Suddenlink markets is slow speed DSL. Cablevision faces fierce competition from Verizon FiOS, but Verizon has sought to ease revenue-eating promotions that the company has offered in prior years. Both U.S. cable operators have raised prices since Altice acquired them.

Drahi was banking on his ability to manage Altice’s debt and boost revenue by milking U.S. cable customers. Unlike in France, where competition and regulation have kept cable television and broadband prices much lower than in North America, Drahi saw enormous potential from the U.S. telecom market, where Americans routinely pay double or even triple the price many Europeans pay for television and internet access. Drahi sold investors on the prospects of slashing costs, initiating employee cutbacks, and raising prices for acquired U.S. cable companies. Suddenlink customers are particularly captive to cable broadband because the only alternative in many Suddenlink markets is slow speed DSL. Cablevision faces fierce competition from Verizon FiOS, but Verizon has sought to ease revenue-eating promotions that the company has offered in prior years. Both U.S. cable operators have raised prices since Altice acquired them. The Federal Communications Commission has quietly

The Federal Communications Commission has quietly

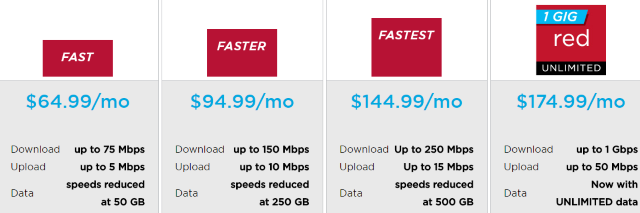

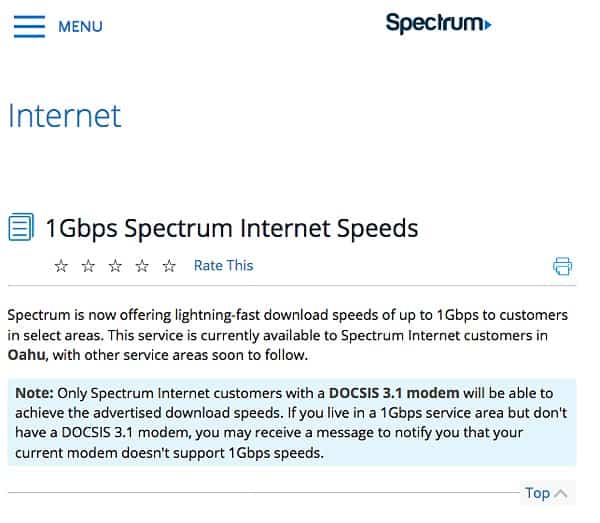

Charter is facing competitive pressure from Google and telephone company competitors upgrading to fiber to the home service. Hawaiian Telcom, for example, now offers

Charter is facing competitive pressure from Google and telephone company competitors upgrading to fiber to the home service. Hawaiian Telcom, for example, now offers  A last-ditch effort last weekend by executives of SoftBank and Deutsche Telekom to overcome their differences in merging Sprint with T-Mobile USA

A last-ditch effort last weekend by executives of SoftBank and Deutsche Telekom to overcome their differences in merging Sprint with T-Mobile USA

But Son’s own failures are also responsible for Sprint’s current plight. Son attempted to cover his losses in Sprint by pursuing a merger with T-Mobile in 2014, but the merger fell apart when it became clear the Obama Administration’s regulators were unlikely to approve the deal. After that deal fell apart, Son has allowed T-Mobile to overtake Sprint’s third place position in the wireless market. While T-Mobile grew from 53 million customers to 70.7 million today, Sprint lost one million customers, dropping to fourth place with around 54 million current customers.

But Son’s own failures are also responsible for Sprint’s current plight. Son attempted to cover his losses in Sprint by pursuing a merger with T-Mobile in 2014, but the merger fell apart when it became clear the Obama Administration’s regulators were unlikely to approve the deal. After that deal fell apart, Son has allowed T-Mobile to overtake Sprint’s third place position in the wireless market. While T-Mobile grew from 53 million customers to 70.7 million today, Sprint lost one million customers, dropping to fourth place with around 54 million current customers. Sprint executives hurried out word on ‘Damage Control’ Monday that Altice USA would partner with Sprint to resell wireless service under the Altice brand. In return for the partnership, Sprint will be able to use Altice’s fiber network in Cablevision’s service area in New York, New Jersey, and Connecticut for its cell towers and future 5G small cells. The deal closely aligns to Comcast and Charter’s deal with Verizon allowing those cable operators to create their own cellular brands powered by Verizon Wireless’ network.

Sprint executives hurried out word on ‘Damage Control’ Monday that Altice USA would partner with Sprint to resell wireless service under the Altice brand. In return for the partnership, Sprint will be able to use Altice’s fiber network in Cablevision’s service area in New York, New Jersey, and Connecticut for its cell towers and future 5G small cells. The deal closely aligns to Comcast and Charter’s deal with Verizon allowing those cable operators to create their own cellular brands powered by Verizon Wireless’ network.

Wall Street’s merger-focused analysts are hungry for a deal now that the Sprint/T-Mobile merger has collapsed. Pivotal Research Group is predicting good things are possible for shareholders of Dish Network, and upgraded the stock to a “buy” recommendation this morning.

Wall Street’s merger-focused analysts are hungry for a deal now that the Sprint/T-Mobile merger has collapsed. Pivotal Research Group is predicting good things are possible for shareholders of Dish Network, and upgraded the stock to a “buy” recommendation this morning. Wlodarczak has also advised clients he believes the deregulation-friendly Trump Administration would not block the creation of a satellite TV monopoly, meaning AT&T should consider pairing its DirecTV service with an acquisition of Dish Networks’ satellite TV business, even if it forgoes Dish’s valuable wireless spectrum.

Wlodarczak has also advised clients he believes the deregulation-friendly Trump Administration would not block the creation of a satellite TV monopoly, meaning AT&T should consider pairing its DirecTV service with an acquisition of Dish Networks’ satellite TV business, even if it forgoes Dish’s valuable wireless spectrum.