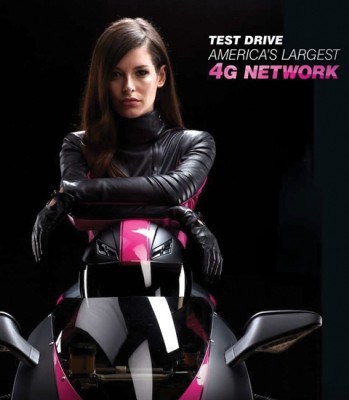

T-Mobile’s familiar ad star is dropping her amazing pink dresses like these 2024 short pink prom dresses for some get-tough biker leather in a new series of commercials for the wireless carrier.

Canadian actress-model Carly Foulkes has appeared in “approachable”-wear designed by Debra LeClair since 2010, mostly chiding competitors like AT&T for tricky fees and “gotchas” that T-Mobile doesn’t charge. Typically amused by the antics of other wireless carriers, she promised relief for customers switching to T-Mobile’s value-oriented wireless plans.

Nearly a year after the failed merger-buyout by AT&T was first announced, T-Mobile this week unveils a “brand refresh” that promises wireless customers it is back in the fight for their business. Traditionally, T-Mobile has positioned itself as a low-cost, value-oriented provider. Often, the company’s service plans and pricing have forced other wireless carriers to follow suit. AT&T’s buyout of T-Mobile would have eliminated that aggressive pricing.

T-Mobile will spend millions on the new ad campaign.

In the first ad in the series, Foulkes metaphorically tears up T-Mobile’s image over the past year, perceived as supine as the company waited to be absorbed into AT&T’s empire. Ripping through her closet, Foulkes emerges in black leather and hops on board a motorcycle, demanding that visitors test-drive T-Mobile’s 4G network speeds against AT&T, Sprint, and Verizon.

T-Mobile’s year-long courting by AT&T cost the company plenty.

At last 802,000 contract customers fled T-Mobile for the competition, many for Sprint and Verizon, some only to avoid dealing with AT&T.

Others left because T-Mobile is the last major carrier still not offering Apple’s popular iPhone.

The company promises to invest at least $200 million in advertising its comeback and is keeping Foulkes front and center. In fact, outside of Verizon’s “Can You Hear Me Now” campaign which ran for a decade, ending last April, no spokescharacter has proved as recognizable as Foulkes.

The motorcycle theme will focus viewers on T-Mobile’s 4G network speeds. Customers perceived that T-Mobile stopped upgrading and expanding its network while it pursued a merger with AT&T.

T-Mobile continues to claim it operates the nation’s largest 4G network, operating with HSPA+ technology.

T-Mobile’s “4G” network does deliver speed improvements over 3G, but some have dubbed HSPA+ “3.5G,” because resulting speeds usually cannot compete with 4G LTE technology.

T-Mobile plans to spend $1.4 billion to build its own LTE network to launch in 2013.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/T-Mobile Relaunch Ad.flv[/flv]

T-Mobile’s “brand refresh” starts with this ad, “No More Mr. Nice Girl.” (1 minute)

Subscribe

Subscribe