- Company still losing video customers, but picking up phone customers (on the cheap), and winning with broadband;

- Broadband consumption pricing still CEO’s favorite flavor of Internet billing, but only for other people’s content;

- Broadband speed matters, as Time Warner continues to win over dissatisfied DSL customers;

- ‘If customers love our broadband, we can charge more for it;’

- Verizon/Time Warner’s cooperative marketing agreement starts with discounts but ends with “exclusive product enhancements.”

- The future of Time Warner Cable Wi-Fi.

Time Warner Cable reported unexpectedly strong profits in its first quarter as the company’s broadband services helped stem the losses from departing cable TV customers.

The cable operator told investors it boosted profits 18%, mostly from increasing revenue the company earns selling broadband access to the Internet and convincing customers to add more Time Warner services.

Time Warner Cable said goodbye to 94,000 residential video subscribers last quarter, higher than analysts expected. But that did little damage to earnings because the company picked up an additional 214,000 broadband customers over the same period, most switching from phone company DSL service.

Time Warner Cable’s increasingly aggressive bundled service promotions, particularly on its triple-play offer of cable, broadband, and phone service, even managed to attract 112,000 new landline customers — a significant accomplishment as Americans continue to disconnect traditional phone lines in favor of cell phones. It also helped increase the average revenue earned per subscriber. Time Warner Cable pitches double play promotions as low as $79.00 a month. For just $10 a month more, customers can add a third service, and many do.

Most discounts last for one year, but the operator now often sends letters to customers reaching the end of their promotion offering additional, but lower-value discounts going forward. This has limited bill shock for customers surprised by the company’s regular prices. It also might reduce the urge for customers to shop around for a better deal.

Judging from the company’s financial results, most customers hang on to Time Warner Cable’s broadband regardless of price, if the competition happens to be traditional DSL from the phone company. In fact, as phone and cable companies realize they have sold broadband to virtually every home in their service area that wants it, growth in subscriber numbers going forward largely depends on poaching customers from someone else. Nobody makes that easier than phone companies trying to sell customers DSL with speeds under 10Mbps. According to CEO Glenn Britt, Time Warner Cable picked up more new broadband customers than Verizon and AT&T combined.

Time Warner Cable broadband speeds give headaches to phone companies trying to sell traditional DSL.

While phone companies continue to argue that speeds don’t matter (at least for their DSL product line), Time Warner believes otherwise and apparently so do their new customers. The company reports that almost two-thirds of those dumping DSL said their old service was too slow.

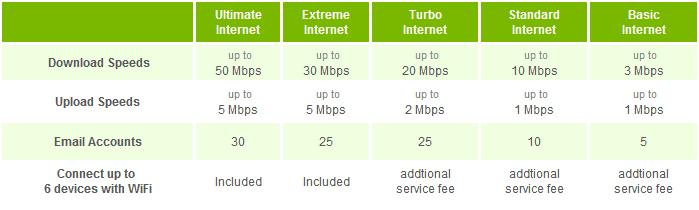

Much of the company’s growth in broadband revenue is also coming from the high end, as customers increasingly gravitate towards faster broadband speed tiers.

Residential DOCSIS 3 (Extreme/Ultimate) customers increased 50% to 218,000, and almost 66% of new broadband customers signed up for either Turbo (20Mbps), Extreme (30Mbps) or Ultimate (50Mbps) service. Together, these customers now make up 20% of Time Warner’s broadband subscribers, up from less than 16% a year earlier.

Customers are willing to pay higher prices for faster service, a point not lost on Britt, who noted that once customers perceive broadband has more and more value, the company can charge more for it over time.

If Britt’s steadfast belief in Internet Overcharging-consumption billing schemes holds true, some customers might find they are charged substantially more if the company decided to discontinue offering unlimited Internet service.

For now, the company plans to continue its experiments in consumption billing through its Internet Essentials program, now testing in South Texas, which limits customers to 5GB of usage per month before overlimit fees kick in. But going forward:

“I think we’ve been pretty clear about this, we do think over time, there will be consumption element to the tiers,” Britt said.

But Britt says he wants to keep unlimited access for customers willing to pay for it.

“We retained our unlimited tier with no cap (I actually don’t like the term cap),” Britt added. “And I think we should always have that. So that this was not in any way coercive, people who wanted to save money, could. People who wanted to keep what they had have kept it, and they still have unlimited. So our plan is to roll that out further across [the country] as the year goes on.”

Britt noted the company’s own streamed video products would not drain customers’ usage allowances. But Netflix and other online streamed video would. Britt adopted the same argument Comcast has used to defend the practice.

“So there’s a set of standards called the IP, Internet Protocol, and those can be used for a wide variety of things in the world,” Britt explains. “There’s also something called the public Internet, which happens to use IP standards. That doesn’t mean those two things are exactly the same. So the application that we have on the iPad is over our closed-circuit network. It’s just a different standard than we’ve used traditionally for our video. But it’s not the public Internet.”

In other developments, the company’s controversial co-marketing agreement with Verizon Wireless has now expanded to four cities: Raleigh, N.C., Cincinnati and Columbus, Ohio, and Kansas City, Mo.

Time Warner Cable executives told investors the early stages of the cooperative marketing agreement will consist of a promotion that includes a $200 gift card when a customer buys both a Verizon Wireless plan and upgrades at least one service on their Time Warner Cable account. But the company plans to gradually reduce discounts and instead offer unspecified “exclusive product enhancements” that will only be available to customers who subscribe to both services.

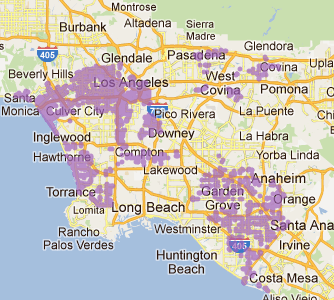

Lastly, expect Time Warner Cable to continue aggressive deployment of its Wi-Fi networks in New York and Los Angeles. The company signaled it intends to construct similar Wi-Fi networks in other cities in serves, but most likely not during 2012.

Subscribe

Subscribe