Phone companies depending on DSL to keep them in the broadband business are in growing trouble, unless they lack a nearby cable competitor. Subscriber numbers from nine different major phone and cable companies over the summer of 2012 show cable broadband continues to grow as customers cancel DSL service from their local phone company. But for rural customers, DSL often remains the only option. That leaves rural providers like Frontier, Windstream, and CenturyLink in better standing than larger companies like AT&T and Verizon.

Phone Companies

- AT&T‘s U-verse service is the only thing keeping AT&T broadband numbers on the rise. AT&T added 553,000 new U-verse customers during the summer and now serves 6.5 million customers on its fiber-to-the-neighborhood network. AT&T continues to lose DSL customers, primarily to local cable competitors.

- CenturyLink, Inc. has been upgrading its DSL service in several areas to better compete with cable broadband, and is also deploying a fiber-to-the-neighborhood service in select cities. The network upgrades are helping, bringing the company 18,000 new broadband customers. CenturyLink currently serves 5.76 million Internet customers nationwide.

- Frontier Communications has lost broadband customers in its larger service areas, mostly to cable, but those losses have been offset by its DSL expansion in rural areas that have never had broadband before. But the company only managed to add just under 6,000 new broadband customers during the last quarter, serving 1.78 million customers across the country.

- Verizon Communications: Verizon was willing to turn away potential DSL customers for the first time, as it discontinued selling DSL to those who don’t want Verizon landline service. That, and pervasive cable competition, meant Verizon only picked up 2,000 new DSL customers this quarter — the worst showing in four years. Verizon FiOS’ recent price hikes also cost the company some growth for its fiber to the home service, but still earning a respectable 134,000 new customers (5.1 million total). Time Warner Cable, Cablevision, and Comcast have all managed to win back FiOS customers with attractive discount offers.

- Windstream Corp. faces cable competition in a number of its semi-rural service areas, and its DSL service has not been able to keep up with the growing speeds available to cable broadband subscribers. For the first time, Windstream reported it lost more customers than it added, losing 2,200 DSL subscribers. Windstream still has 1.36 million customers signed up for its broadband service.

Cablevision has won back some of its former customers who went with Verizon FiOS but do not like the recent rate hikes.

Cable Companies

- Cablevision, which serves mostly suburban New York City, New Jersey, and Connecticut added 25,000 new high speed customers, many coming back to the cable company from Verizon. Cablevision serves a relatively small geographic area, but a densely populated one. Nearly 3 million broadband customers have remained loyal to the cable company.

- Charter Cable picked up 37,000 new broadband customers, a number fleeing phone company DSL for Charter’s higher speed broadband services. Charter serves 3.8 million broadband customers.

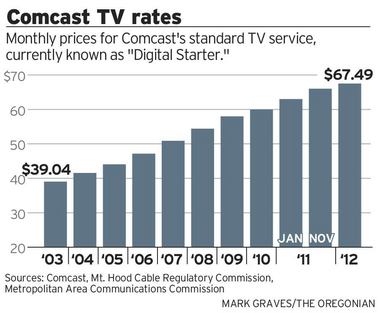

- Comcast added 156,000 new customers to its roster of 18.7 million Internet customers, again mostly from former DSL customers.

- Time Warner Cable expanded with 59,000 new high speed customers, primarily from DSL disconnects. Time Warner provides service for 10.8 million broadband customers.

Subscribe

Subscribe