This is the second part of a two-part series reflecting on Verizon’s 5G millimeter wave wireless home broadband service and how Wall Street complicates its potential. Be sure to read part one, “How a Wall Street Analyst Complicates AT&T and Verizon’s Upgrade and Investment Plans” for the full story.

“Put simply, the cost of building a second network is so high that its builder simply can’t earn a passable return based on the market share available to a second player,” Craig Moffett, an important telecom industry analyst working on behalf of Wall Street investors, argued over Verizon’s fiber to the home project dubbed FiOS. “Virtually every overbuilder, from telephone companies to competitive cable companies to municipalities, has learned this lesson the hard way; almost all such efforts have ended in bankruptcy. Verizon’s own FiOS network was an economic failure; there is no longer any debate about whether FiOS did or didn’t earn its cost of capital. It didn’t, and it wasn’t even close.”

“Put simply, the cost of building a second network is so high that its builder simply can’t earn a passable return based on the market share available to a second player,” Craig Moffett, an important telecom industry analyst working on behalf of Wall Street investors, argued over Verizon’s fiber to the home project dubbed FiOS. “Virtually every overbuilder, from telephone companies to competitive cable companies to municipalities, has learned this lesson the hard way; almost all such efforts have ended in bankruptcy. Verizon’s own FiOS network was an economic failure; there is no longer any debate about whether FiOS did or didn’t earn its cost of capital. It didn’t, and it wasn’t even close.”

Moffett’s philosophy about emerging broadband technology and competition is heavily influenced by his personal and professional belief that broadband competition is bad for business and investors. His distaste for Verizon FiOS, a plan to scrap old copper phone wiring in favor of fiber optics, was well-known across the industry and trade press. But Verizon kept going with the project under the leadership of then-CEO Ivan Seidenberg, who was a telephone man through and through. But by 2010, Seidenberg had decided to retire, and his successor, Lowell McAdam, had a very different perspective about Verizon’s future. McAdam spent almost his entire career from the early 1990s forward in the wireless business. In 2006, McAdam was named the chief operating officer and CEO of Verizon Wireless. When he succeeded Seidenberg in late 2010, Verizon had already announced it was winding down further FiOS expansion. That seemed to suit McAdam just fine, because under his leadership as CEO of Verizon, Verizon Wireless became the dominant focus of the company. Heavy investment in wireless continued, while Verizon’s landline network was allowed to deteriorate.

Moffett told his clients the end of FiOS expansion would be good news for cable companies because they would lose fewer subscribers as a result.

Verizon’s marketing machine carefully lays its business case for 5G home broadband

More than a decade later, Verizon’s decision to embark on another major technology upgrade requiring billions in new spending quickly raised eyebrows on Wall Street. This time, however, Verizon executives attempted to be better prepared to defend their 5G vision from the reflexive investor argument that it was too expensive and extravagant.

Moffett

“First, their fixed wireless broadband business will leverage investments that Verizon argues they will need to make anyway to support their wireless network,” Moffett wrote in a report to his clients, acknowledging Verizon’s claimed reasons for entering the wireless home broadband business. “Second, Verizon argues that it will be cheaper to connect homes wirelessly than it is to connect them with fiber, making it economic to deploy fixed wireless in markets where fiber to the home hasn’t been economically justifiable.”

Most of the expenses cited by Moffett relate to bringing fiber networks into neighborhoods to support the small cell technology Verizon is relying on for its 5G home broadband and mobile services.

Moffett also believes the only attractive market for 5G service will be in more upscale suburban rings around cities, not densely populated urban centers or rural areas. Moffett argues fiber providers are likely already providing service in urban areas and rural areas simply lack enough customers to justify the cost of either a fiber optic network or a small cell network. Ironically, that conclusion means the same suburban ring Moffett rejected 5-10 years ago as economically unsuitable for fiber service is now precisely the area Moffett argues is the only attractive market for fiber service, to bring 5G.

From a short-term results perspective, laying fiber optics is a costly proposition unlikely to return much revenue gain in a few short years. That reality has kept many investor-owned phone companies away from expensive network upgrades. These legacy telephone companies recognize they are going to continue to lose customers to faster technologies like cable, fiber, and perhaps, wireless. But managing an existing low-speed DSL business seems preferable to facing the wrath of investors upset over the prospect of shareholder dividends and share buybacks being curtailed to redirect money into a full-scale upgrade effort, even if it results in better returns and greater revenue a few years down the road.

Verizon is depending on its wireless division’s extremely high profitability to counter the usual objections to major upgrades, and by focusing on how 5G will enhance the wireless experience. It also benefits from media hype surrounding 5G technology, exciting some investors. But Verizon is also downplaying exactly what it will cost to lay fiber optic networks deep into neighborhoods to deliver it.

Moffett investigates Verizon’s first 5G city — Sacramento, Calif., and discovers alarming results

Moffett decided to bypass the traditional cost-benefit analysis of laying mile after mile of optical fiber and decided to test Verizon’s case for wireless 5G home broadband instead.

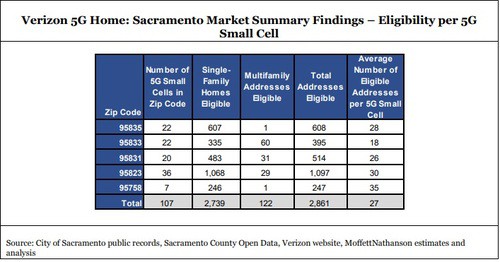

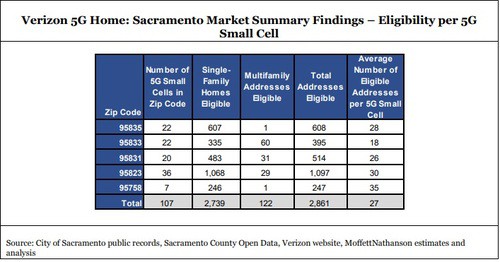

Six months after launch, Moffett investigated Verizon’s 5G millimeter wave network in Sacramento, examining how the service is initially performing. Moffett identified seven zip codes in Sacramento where service was most likely to be available, based on cell tower/small cell records. As of late February, Moffett found Sacramento had 391 Verizon small cells installed, with 273 used for millimeter wave 5G service (the rest are likely designed to bolster Verizon’s 4G LTE network).

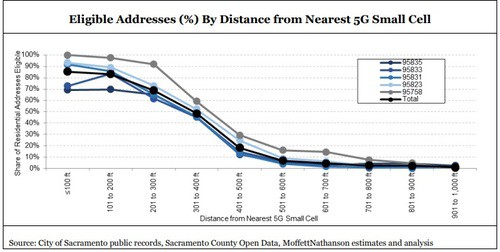

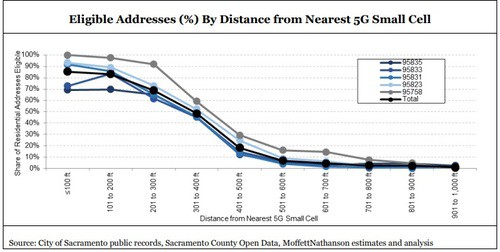

Verizon has admitted small cell technology is vulnerable to distance, so Moffett relied on earlier purported claims of 5G coverage to limit the number of addresses to be sampled. Moffett’s team identified 45,000 out of 70,000 possible addresses, based on if those homes were located within a radius of 0.7 miles of a 5G small cell. Then, Moffett’s team devised a method of hitting Verizon’s 5G availability website with each of those 45,000 addresses to learn which ones Verizon qualified for 5G service.

The results, so far, are underwhelming:

- Only an average of 6% of the queried addresses were actually eligible to receive Verizon’s fixed wireless service. That could mean Verizon has installed 5G small cells, but some are not yet operational in all areas or the network is performing much worse than originally anticipated. Some zip codes did better than others, but not by much. The best offered just an 18% pre-qualified acceptance rate. Apparently Verizon’s qualification website also informs applicants if they already have service, which proved to be a good way of finding out how many addresses actually have signed up. Moffett claims only 3% of eligible customers have decided to subscribe to Verizon’s 5G home broadband service so far.

- Coverage appears to a problem. As Moffett checked addresses further away from each small cell, more and more were deemed ineligible for service. In fact, despite Verizon’s claims that its 5G signal reached customers more than 1,900 feet away, the company’s own website refused to actually sell service to customers that far away. Moffett found subscribers were deemed ineligible for service as little as 400 feet away from a small cell. At that distance, less than 50% of checked addresses could sign up. For those 700 feet or more away, almost no addresses were qualified for service.

With those results, Moffett was able to extrapolate some important numbers about how much Verizon’s infrastructure is being utilized:

- Each small cell serves approximately 27 eligible addresses.

- Verizon’s 5G home broadband has a 0.1% market share in Sacramento.

- Excluding areas where multi-dwelling properties dominate, Verizon has achieved a penetration of roughly one subscribed single-family home per 1.5 5G small cell.

“Our findings in Sacramento — limited coverage, low penetration — preliminary though they may be, suggest that earning an attractive return will be challenging, at best,” Moffett concluded.

Because Verizon has attracted so few subscribers thus far, the total cost per connected home for 5G wireless service could far exceed what it would cost to just lay down fiber to the home service to each customer, which might actually give Verizon more business.

“Our analysis suggests that costs will likely be much higher (that is, cell radii appear smaller) and penetration rates lower than initially expected,” the report explained. “If those patterns are indicative of what is to come in a broader rollout, it would mean a much higher cost per connected home, and therefore much lower returns on capital, than what might have been expected from Verizon’s advance billing.”

If Moffett’s estimate of 27 residences served per small cell was proven true, Verizon would have to deploy well over five million small cells to deliver 5G wireless service across America.

Verizon’s choice of cities to launch its 5G millimeter wave network may be partly designed to test the differences in topology, building density and foliage levels, and there may be dramatic differences between Houston, Sacramento, Indianapolis, and Los Angeles.

Moffett’s overall conclusion is that should Verizon move forward on rolling out 5G wireless home broadband to around 25% of the country, as it planned, reaching those 30 million homes “will take a very, very long time, and it will cost a great deal of money.”

Subscribe

Subscribe Justice Department staffers have told T-Mobile and Sprint that their $26 billion merger is unlikely to win approval as presently structured, according to

Justice Department staffers have told T-Mobile and Sprint that their $26 billion merger is unlikely to win approval as presently structured, according to  Amazon is planning to finance the launch of a new global satellite internet service, powered by a fleet of more than 3,000 low Earth-orbiting satellites that will deliver high-speed internet service to rural underserved and unserved communities, opening up the possibility of millions of potential new Amazon.com customers.

Amazon is planning to finance the launch of a new global satellite internet service, powered by a fleet of more than 3,000 low Earth-orbiting satellites that will deliver high-speed internet service to rural underserved and unserved communities, opening up the possibility of millions of potential new Amazon.com customers.

“Put simply, the cost of building a second network is so high that its builder simply can’t earn a passable return based on the market share available to a second player,” Craig Moffett, an important telecom industry analyst working on behalf of Wall Street investors, argued over Verizon’s fiber to the home project dubbed FiOS. “Virtually every overbuilder, from telephone companies to competitive cable companies to municipalities, has learned this lesson the hard way; almost all such efforts have ended in bankruptcy. Verizon’s own FiOS network was an economic failure; there is no longer any debate about whether FiOS did or didn’t earn its cost of capital. It didn’t, and it wasn’t even close.”

“Put simply, the cost of building a second network is so high that its builder simply can’t earn a passable return based on the market share available to a second player,” Craig Moffett, an important telecom industry analyst working on behalf of Wall Street investors, argued over Verizon’s fiber to the home project dubbed FiOS. “Virtually every overbuilder, from telephone companies to competitive cable companies to municipalities, has learned this lesson the hard way; almost all such efforts have ended in bankruptcy. Verizon’s own FiOS network was an economic failure; there is no longer any debate about whether FiOS did or didn’t earn its cost of capital. It didn’t, and it wasn’t even close.”