Verizon today announced the 100th franchise agreement in the state of Massachusetts for FiOS TV. The Easton Board of Selectmen on Monday granted a cable franchise to Verizon to begin wiring the town of 23,000 with fiber optic service. Residents will receive visits from Verizon employees to explain and market the service, which will compete directly with incumbent cable provider Comcast.

Verizon today announced the 100th franchise agreement in the state of Massachusetts for FiOS TV. The Easton Board of Selectmen on Monday granted a cable franchise to Verizon to begin wiring the town of 23,000 with fiber optic service. Residents will receive visits from Verizon employees to explain and market the service, which will compete directly with incumbent cable provider Comcast.

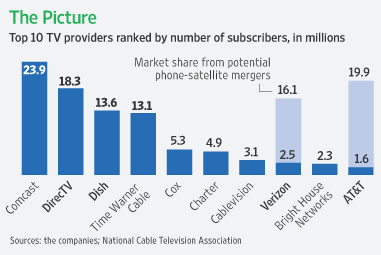

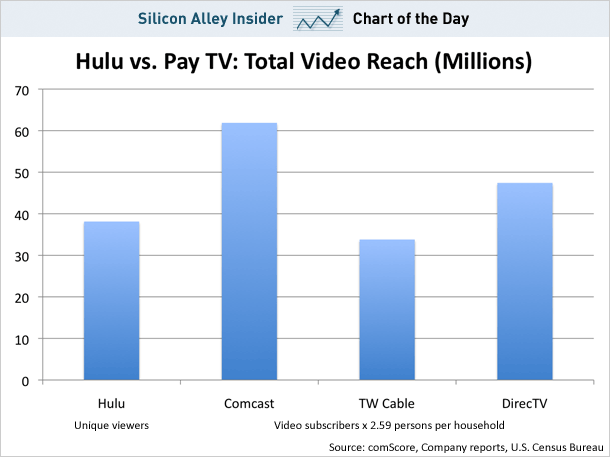

Verizon’s growth in the state has already put them in second place behind Comcast as the largest provider of wired television and broadband service. That position was formerly held by RCN, a cable overbuilder providing service in the Boston area.

Verizon celebrated the 100th franchise agreement by donating $1,000 to the Easton Area Public Library to purchase 100 new books.

“As a result of this new franchise, consumers in Easton will be able to choose their cable provider as easily as they choose their phone company,” said Cupelo. “Competition drives innovation, value and service quality, and it puts the consumer in control.”

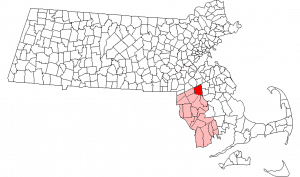

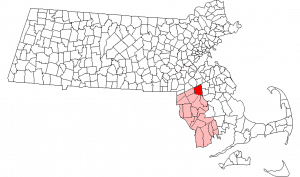

Easton (in dark red), part of Bristol County, Massachusetts

Verizon research indicates 87 percent of Massachusetts residents favor more competition and choice for video services. Independent studies suggest competition in the video market can bring reduced prices, better packages and improved service, although experiences in many communities indicate providers are more apt to compete on services and packaging, and not as much on price.

Verizon’s license agreement with the city of Easton is for 10 years. The agreement contains provisions for the network’s future growth; financial support and capacity for educational and government access channels; cable service to government buildings; and other important benefits to the city, including insurance, indemnification and enforcement protections.

“Verizon will compete aggressively for subscribers in Easton with our FiOS services, which are fueled by our lightning-fast fiber-optic network,” Cupelo said. Verizon soon will begin its door-to-door sales campaign in Easton, explaining the many advantages of FiOS TV to local consumers.

For some local residents, the competition can’t arrive soon enough.

Comcast has alienated many Easton residents by not carrying all of the HD signals from Boston area television stations. Easton, although essentially halfway between Boston and Providence, Rhode Island, has been defined by the Federal Communications Commission as being in the “Providence DMA” (an area of significant influence.) That’s because parts of Bristol County have towns that are considered suburbs of Providence. Easton’s allegiance, in the minds of many who live there, is to Boston, and residents are upset that the majority of HD broadcast stations on Comcast Cable are from Providence.

The town is actually part of a regional effort to redefine their part of Bristol County to be in the “Boston DMA” so they can petition the FCC to make a change.

The Easton Cable Commission has gotten an earful from annoyed residents, who have faced an intransigent Comcast. They have even prepared an FAQ for residents on the matter:

Why can’t I get some Boston based HD channels on Comcast?

This is an important issue to many Easton cable subscribers. We want to take some time to explain the relevant issues just so you understand why most believe Easton residents are not getting the channels they want and the channels that they believe serve them best.

The starting point is the DMA that Easton is in. What is a DMA? Well, that is our problem. DMA is short for Neilsen Media Research Designated Television Market Area. DMA’s are generally split up according to county. Easton is in Bristol County. A good part of Bristol County is actually considered part of suburban Providence. Therefore, Easton, although not a suburb of Providence, is in the Providence DMA. All cable providers must carry the primary channels that serve a DMA. At present, Comcast must carry Providence DMA stations. There is an effort underway to move towns inside of Route 495 into the Boston DMA. We will petition the FCC for this change.

Oakes Ames Memorial Hall and Ames Free Library (North Easton, MA)

But the greater issue here is whether Comcast chose to eliminate Boston channels in High Definition or whether they had no choice. For the most part, this is a Comcast choice. The Town of Easton and our Cable Committee, unfortunately, cannot force Comcast to provide Boston channels in High Definition. Along with the concept of DMA, there is also the concept of “Significantly Viewed” channels in an area. This is another FCC concept which relates to stations not in the local DMA which may be referred to as “distant signals”. A “distant signal” is one that originates outside of a satellite (or cable) subscriber’s local television market, the DMA. In addition to stations in their DMA, satellite (cable) subscribers who receive local-into-local service may, under certain circumstances, receive individual stations from markets outside their DMA that are deemed “significantly viewed” in their community. It is up to the satellite carrier whether or not to offer significantly viewed stations and a subscriber must be subscribing to local-into-local service in his or her DMA to be eligible to receive significantly viewed stations. The determination of whether or not a station is significantly viewed in a community depends on several statutory factors. The FCC has posted the list of stations that are eligible for carriage as significantly viewed signals and the communities in which they are significantly viewed.

The following is the list for Bristol County:

Bristol

WLNE-TV, 6, Providence, RI (formerly WTEV)

WJAR, 10, Providence, RI

WPRI-TV, 12, Providence, RI

+WNAC-TV, 64, Providence, RI

WBZ-TV, 4, Boston, MA

WCVB-TV, 5, Boston, MA (formerly WHDH)

WHDH-TV, 7, Boston, MA (formerly WNAC)

WSBK-TV, 38, Boston, MA

WLVI-TV, 56, Cambridge, MA (formerly WKBG)

So, Comcast has every right to provide the above channels (which include 4,5, and 7) in High Definition. It is their choice not to do so. You may ask why Channel 25 is not on the above list and that is a great question. But the answer is that the determinations for this list were made a long time ago when Channel 25 was owned by religious broadcasters. That is how outdated all of these rules are. It is also the reason that Comcast is forced to black out FOX 25 network programming.

There may be an alternative to Comcast in Easton by the end of the year. We are going through a licensing process with Verizon. They want to offer Fios tv, internet, and phone in Easton by December. It is all of our hopes that Verizon will provide the channels that you are looking for and that competition will benefit all cable tv subscribers in Easton.

For further information please contact the Comcast Customer Care line at 1-800-COMCAST (1-800-266-2278).

In Massachusetts, FiOS TV is available in Abington, Acton, Andover, Arlington, Ashland, Bedford, Bellingham, Belmont, Boxborough, Boxford, Braintree, Burlington, Canton, Danvers, Dedham, Dover, Dunstable, Framingham, Franklin, Georgetown, Grafton, Groton, Hamilton, Hanover, Hingham, Holliston, Hopkinton, Hudson, Hull, Ipswich, Kingston, Lakeville, Lawrence, Leominster, Lexington, Lincoln, Littleton, Lynn, Lynnfield, Malden, Mansfield, Marion, Marlborough, Marblehead, Marshfield, Mattapoisett, Maynard, Medfield, Medway, Melrose, Mendon, Methuen, Middleborough, Middleton, Millbury, Nahant, Natick, Needham, Newton, Norfolk, North Andover, North Reading, Northborough, Norwood, Norwell, Plymouth, Reading, Rochester, Rockland, Rowley, Sherborn, Southborough, Stoneham, Stoughton, Stow, Sudbury, Sutton, Swampscott, Taunton, Tewksbury, Topsfield, Tyngsborough, Wakefield, Walpole, Waltham, Wareham, Wayland, Wellesley, Wenham, West Newbury, Westborough, Weston, Westwood, Wilmington, Winchester, Wrentham and Woburn, and will soon be available in Chelmsford, Easton and North Attleborough.

Subscribe

Subscribe