A year after Frontier Communications assumed control of Verizon’s assets in the Pacific Northwest, customers are fleeing the company’s inherited fiber-to-the-home service FiOS, after announcing a massive (since suspended, except in Indiana) 46 percent rate hike for the television portion of the service. A new $500 installation fee has kept all but the bravest from considering replacing customers who have left for Comcast and various satellite TV providers.

Frontier’s second-quarter financial results revealed the company has lost at least 14,000 out of 112,000 FiOS TV customers in the region (and in the Fort Wayne, Ind. market, where the service is also available.)

Early reaction to the original rate hike announcement started customers shopping for another provider — mostly Comcast, which competes in all three states where Frontier FiOS operates. Even after the rate hike was suspended in some markets, intense marketing activity by Frontier to drive customers towards its partnership with satellite provider DirecTV managed to convince at least some of those customers to pull the plug on fiber in return for a free year of satellite TV, although an even larger number presumably switched to the cable competition.

D.A. Davidson, a financial consulting firm, told The Oregonian the message was clear.

“They would love to get rid of the FiOS TV customers,” Donna Jaegers, who follows Frontier, told the newspaper. “They’re programming costs are very high compared to the rates that they charge.”

Jaegers said Frontier Communications completely botched their efforts to transition customers away from FiOS TV towards satellite, because most of those departing headed for the cable competition, attracted by promotional offers and convenient billing.

Many others simply don’t want a satellite dish on their roof, and are confounded about Frontier’s message that satellite TV is somehow better than fiber-to-the-home service.

Frontier admits its FiOS service is now underutilized, but claims it will continue to provide the service where it already exists.

Frontier Claims Its DSL Service is Better Than Cable Broadband

Frontier’s general business plan is to provide DSL service in rural areas where it faces little or no competition, and most of Frontier’s investment has been to upgrade Verizon’s landline network to sustain 1-3Mbps DSL service, for which it routinely charges the same (or more) for standalone broadband service that its cable competitors charge for much faster speeds.

But Frontier Communications CEO Maggie Wilderotter says their DSL service is better than the cable competition.

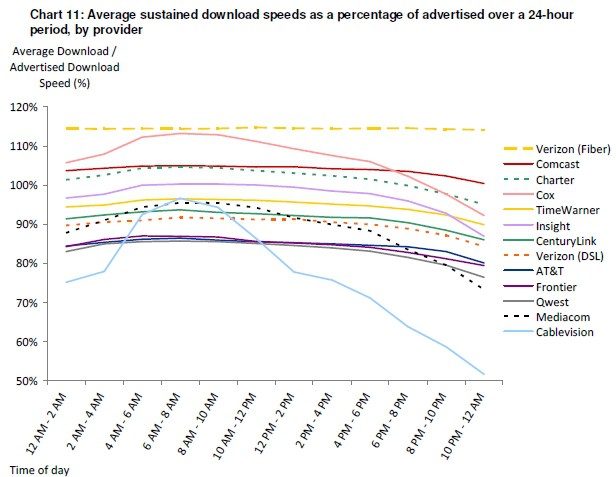

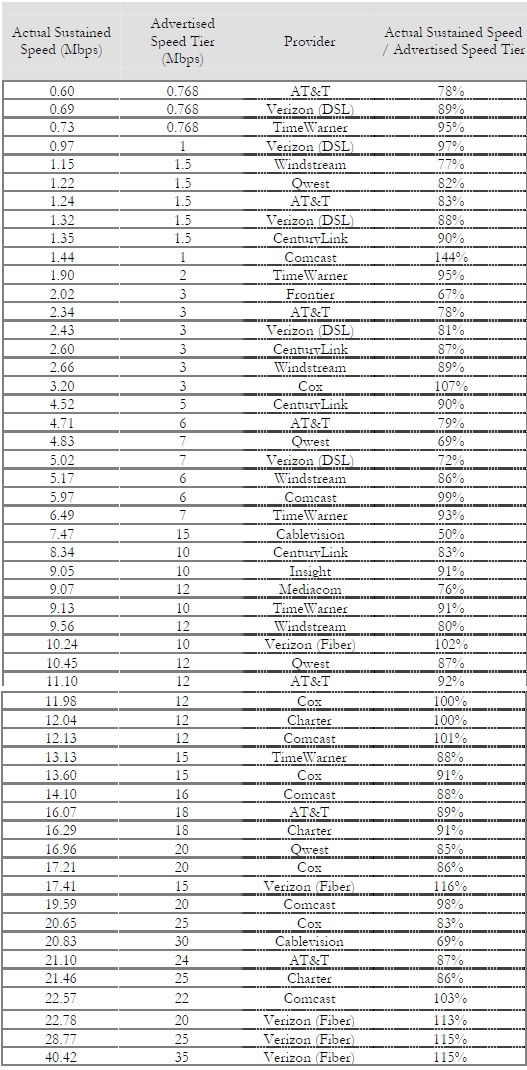

“A key differentiator between our network and cable competition is that you consistently get the speed you pay for,” Wilderotter told investors on a conference call. “There’s no sharing at the local level. High demand for bandwidth-intensive applications like video are putting pressure on all wired networks. To that end, we want to make sure that we have more than enough capacity to satisfy the expectations of our customers. We’re spending capital in all parts of the network with specific emphasis in the middle mile, which will enable us to consistently deliver a quality customer experience for our customers of today and tomorrow.”

Frontier Communications CEO Maggie Wilderotter defends anemic broadband additions during the 2nd quarter of 2011 and tries to convince investors DSL service is better than the cable competition. August 3, 2011. (4 minutes)

You must remain on this page to hear the clip, or you can download the clip and listen later.

Netflix Traffic Represents 25% of Frontier’s Broadband Traffic; Online Video — 50%

Wilderotter admitted Frontier’s broadband network is overcongested in many regions, which she partly blamed for the company’s anemic addition of new broadband customers.

She noted Netflix, which has itself consistently rated Frontier the worst wired broadband provider in the country for being able to deliver consistent, high quality access to their streaming service, represents one-quarter of all capacity usage of Frontier’s broadband network.

“Video is about 50 percent,” Wilderotter added. In an investor conference call, she explained network congestion in more detail:

“In [the second quarter], we had many areas with unacceptable levels of network congestion, which negatively impacted our growth in net high-speed additions.” Wilderotter said. “We believe all of the major congestion issues will be fixed by the end of [the third quarter], and that will enable us to drive higher growth and net broadband activation in [former Verizon service areas.]”

“What we decided to do is to go for fixing the middle mile, which is the [central office] to the […] neighborhood and to expand that capability by 100-fold. And then also, expand from the [central office] out to the Internet and make sure that we have huge capacity to deliver and receive capability to our customers. So when we sell 6 meg, 10 meg, 25 meg, 50 meg, the customer gets what we sell them and that was extremely important for us.”

“So what we did is in the areas where we saw the congestion increase based upon usage increases, and we’ve built new households. We’ve held off on marketing to a lot of those new households until we fixed the congestion problem because we didn’t want to exacerbate what we had already. We’ve shifted capital in terms of the mix of how we’ve spent capital to fix this problem. I’d say we’re probably 75% of the way there in fixing congestion. This quarter is another big quarter for us to get all of the major issues out of the network, which will allow us in the back end of this quarter through the fourth quarter, to really start pushing the penetration levels where we’ve built new households in the areas that have been affected by congestion.”

Frontier Introduces Line Bonded DSL — Two Connections Can Improve DSL Speeds

Frontier Communications also announced the introduction of Frontier Second Connect, a DSL line bonding product that delivers two physical connections to a single household. Line bonding allows for improved broadband speeds.

“Second Connect gives our customers two exclusive connections in one household, and we’re the only provider in every market that can do that,” Wilderotter claimed.

In more urban markets, Frontier’s DSL speeds are woefully behind those available from most cable competitors. Frontier has begun upgrading some of their legacy service areas and retiring older equipment in an effort to improve the quality of service.

“The real initiatives that we have underway are called middle mile, interoffice facilities, as well as some of the more aged equipment that’s in the network,” said Dan McCarthy, Frontier’s chief operating officer. “So as we go through, there’s about 600 projects that are underway today that will improve both the speed and capability.”

“We’ve inherited markets that there has not been upgrades to capacity in these markets for many years and fixes to the networks, plus the elements as the DSLAMs, even the DSLAMs themselves are old,” Wilderotter said. “So we’re replacing network elements in the neighborhood. We’re splitting them and moving customers to other network elements to make sure that they have a good experience.”

Frontier executives answer a question from a Wall Street banker about DSL speeds and congestion problems on Frontier’s broadband network. A detailed technical discussion ensues as the company tells investors it is redirecting some capital to fixing Frontier’s overcongested network. August 3, 2011. (5 minutes)

You must remain on this page to hear the clip, or you can download the clip and listen later.

Frontier Still Losing More than 8% Of Its Landline Customers Every Year

Despite broadband rollouts and incremental improvements, more than eight percent of Frontier’s landline customers disconnect service permanently every year. Frontier called that disconnect rate an improvement over its line losses last year, which exceeded 11 percent in some areas.

“Total line losses improved to an 8.6% year-over-year decline, our lowest level since taking ownership when the pro forma loss rate was 9.7%,” reported Wilderotter. “We also improved [the] loss rate [in former Verizon service areas to] 10.1% compared to 11.4% in Q2 2010.”

Most of Frontier’s departing customers are switching to cable providers and/or cell phone service.

(Update 8-23-2011: We are now told in many areas, Frontier’s Second Connect service is not actually a bonded DSL product, but rather a “dry loop” second DSL line that carries the same speed as your primary line. Presumably, household members can divide up who uses which DSL circuit for Internet access. The charge for Second Connect in ex-Verizon service areas is $14.99 per month plus a second mandatory monthly modem rental fee of $6.99. If the web link does not work, it means the service is not available in your service area.)

Subscribe

Subscribe