Motivated seller?

Perennially rumored-for-sale Cablevision is getting new pressure to sell its cable systems to the highest bidder, thanks to an increasingly impatient Wall Street hoping to cash in on the next wave of cable consolidation.

Bloomberg News reports “time may be running out” for the suburban New York City cable operator, which has achieved its highest valuation in two years. The $4.8 billion enterprise founded 40 years ago by the Dolan dynasty has always fought to stay independent of larger media companies that have snapped up most of America’s cable landscape, but cracks are forming in the hard-as-concrete resistance to leave the cable business.

Many of America’s still-independent cable systems are watching their values increase as Wall Street speculators predict their days are numbered. Charter Communications, now under the influence of Dr. John Malone, is seen as the primary instigator of cable industry consolidation. Malone advocates fewer than five cable operators in the business, which means companies like Bright House, Cox, Mediacom, Cablevision, and even Time Warner Cable may have to go. Those that want to avoid the Malone consolidation treatment are starting to adopt an “eat or be eaten” mentality, opening the door to potential system acquisition wars in the days ahead.

Cablevision has tried to avoid being picked off by the likes of neighboring Comcast or Time Warner Cable by trying (and failing) to go private in 2005 and 2007. Cablevision’s service area formerly extended well into western New York — especially in small communities and rural towns, before selling out to Time Warner Cable and retreating to its home base of Long Island, a few New York City boroughs, and parts of Connecticut and New Jersey.

Cablevision has tried to avoid being picked off by the likes of neighboring Comcast or Time Warner Cable by trying (and failing) to go private in 2005 and 2007. Cablevision’s service area formerly extended well into western New York — especially in small communities and rural towns, before selling out to Time Warner Cable and retreating to its home base of Long Island, a few New York City boroughs, and parts of Connecticut and New Jersey.

Regardless of the nostalgia the Dolan family has had in the cable business, shareholders want maximum value for their Cablevision holdings, and that increasingly means selling the operation. Among the likely buyers: a deep-pocketed Time Warner Cable or Charter Communications, the latter willing to take on considerable debt to finance its acquisitions.

“You never say never,” said Cablevision CEO Jim Dolan in response to questions about a possible sale raised during a recent earnings conference call. But Dolan showed no signs of enthusiasm for a sale either.

Most analysts still expect Cablevision to demand a significant premium to sell. Retiring Time Warner Cable CEO Glenn Britt has steadfastly refused to overspend for acquisitions and the company has a history of dropping out of potential deals once prices rise. But Time Warner Cable’s cable properties are adjacent to Cablevision in New York, making a deal a natural fit. Comcast dominates New Jersey.

Cablevision has recently taken steps that only make a sale more likely, shutting down ancillary businesses like Newsday Westchester, OMGFAST! — a start-up wireless broadband provider in Florida, and selling off Clearview Cinemas, AMC Networks, and reducing holdings in sports programming.

Cablevision has recently taken steps that only make a sale more likely, shutting down ancillary businesses like Newsday Westchester, OMGFAST! — a start-up wireless broadband provider in Florida, and selling off Clearview Cinemas, AMC Networks, and reducing holdings in sports programming.

The biggest downside to a Cablevision buyout remains dealing with Verizon FiOS, which competes in most of Cablevision’s territory. The superior fiber network has forced Cablevision to spend on network infrastructure upgrades and cut prices, yet it is still losing customers to the phone company.

A buyout is unlikely to change much unless a company like Google decides it would like to enter the cable business and build an all-fiber network to compete, for now considered a far-fetched notion by most.

Why the interest in cable consolidation? Malone claims much-larger cable operators can stand toe to toe with programmers during negotiations and get better prices for programming and more leverage to move deals along.

Todd Lowenstein, a Los Angeles-based fund manager at HighMark Capital Management Inc., agrees with that assessment, telling Bloomberg the only ways to combat increasing costs for programming are blackouts or getting bigger.

“We’re at an inflection point,” Lowenstein said in a phone interview with the news service. “We’ve hit the upper limit of consumers’ willingness and ability to pay for cable. To get the upper hand, cable needs to scale up and get bigger — and fast.”

Subscribe

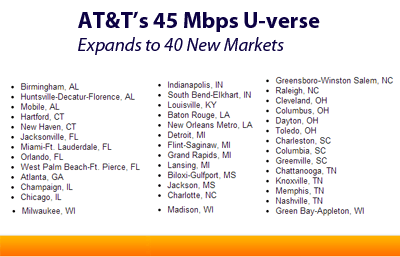

Subscribe AT&T has boosted the maximum available broadband speed for its U-verse Internet offering to 45/6Mbps service in 40 cities across 15 states.

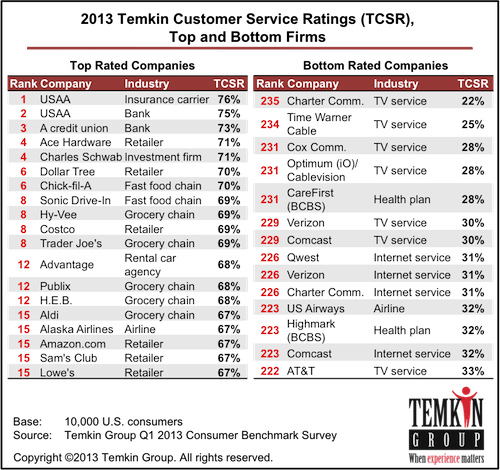

AT&T has boosted the maximum available broadband speed for its U-verse Internet offering to 45/6Mbps service in 40 cities across 15 states. Nine of the ten lowest ranked firms in America are cable and telephone companies, according to a

Nine of the ten lowest ranked firms in America are cable and telephone companies, according to a

Concern about programming costs only goes so far. While Time Warner Cable and Bright House customers continue to go without Showtime and access to CBS programming online (in addition to local station blackouts in New York, Texas and California), the two cable companies have found room in the budget to add two new expensive sports networks to their lineups.

Concern about programming costs only goes so far. While Time Warner Cable and Bright House customers continue to go without Showtime and access to CBS programming online (in addition to local station blackouts in New York, Texas and California), the two cable companies have found room in the budget to add two new expensive sports networks to their lineups. “It’s going to be a popular channel,” said Joe Durkin, Bright House senior director of corporate communications. “It’ll be rich with sports, and we’re happy to bring it to our customers.”

“It’s going to be a popular channel,” said Joe Durkin, Bright House senior director of corporate communications. “It’ll be rich with sports, and we’re happy to bring it to our customers.” Fox also plans to launch another entertainment cable network Sep. 2 with the debut of a companion to the FX network Fox is calling FXX.

Fox also plans to launch another entertainment cable network Sep. 2 with the debut of a companion to the FX network Fox is calling FXX. Waiting for Comcast and Verizon to offer cutting edge broadband to 620,000 Baltimore city residents and businesses appears to be going nowhere, so the city is hiring an Internet consultant to consider whether to sell access to its existing fiber network.

Waiting for Comcast and Verizon to offer cutting edge broadband to 620,000 Baltimore city residents and businesses appears to be going nowhere, so the city is hiring an Internet consultant to consider whether to sell access to its existing fiber network. Like many cities, Baltimore already owns and operates its own fiber ring, built with public funds to support the city’s public safety radio system. Like many municipal institutional fiber networks, Baltimore’s fiber ring is underutilized. Public safety and other institutional users often use just a fraction of available capacity. Despite the fact such networks are often oversized, they are rarely controversial because they do not typically compete with commercial providers and are usually off-limits to the public.

Like many cities, Baltimore already owns and operates its own fiber ring, built with public funds to support the city’s public safety radio system. Like many municipal institutional fiber networks, Baltimore’s fiber ring is underutilized. Public safety and other institutional users often use just a fraction of available capacity. Despite the fact such networks are often oversized, they are rarely controversial because they do not typically compete with commercial providers and are usually off-limits to the public.